Saving money feels tough when every dollar counts. If you’re living on a low income, bills pile up fast, and there’s often nothing left for tomorrow. But here’s the good news: You can start building a safety net right now. In this guide, we’ll dive deep into how to save money on a low income with real steps that work. We’ll draw from everyday folks sharing their wins on forums like Reddit and expert advice from trusted sources. No fancy tricks—just solid plans to help you stretch your cash further. Whether you’re hunting for how to save money on a low income budget tips or ways to boost your pot quickly, these ideas fit real life.

Think about this: In 2025, nearly one in four U.S. households lives paycheck to paycheck. That’s 24% of people just like you, making ends meet but dreaming of a little extra. The average emergency fund sits at only $600 for most Americans. Yet, stories from people earning under $30,000 a year show it’s possible to tuck away 10% each month. One Reddit user shared, “I was making 30k… it was rough… but I always put that 10% away.” You can too. Let’s break it down step by step, starting with the basics.

Why Saving on a Low Income Matters More Than Ever

Life throws curveballs—car repairs, medical bills, or unexpected rent hikes. Without savings, one bump can derail everything. For those on a low income, the personal savings rate hovers around 4.5% as of mid-2025. That’s slim, but it’s a start. Building even a small buffer brings peace of mind. Experts at Bank of America stress that saving isn’t about leftovers; it’s about planning it in like any bill.

Consider Maria, a single mom in Texas earning $25,000 yearly. She juggled childcare and groceries but started by logging every coffee run. Within six months, she saved $800 for emergencies. Her secret? Simple tracking and small swaps. If you’re nodding along, you’re in good company. Over 75% of low-income earners say they want to save more but don’t know where to begin. This article changes that. We’ll cover how to budget and save money on a low income, from daily habits to long-term goals.

Mastering How to Save Money on a Low Income

You don’t need a big salary to save. The key is smart habits. Top advice from real people boils down to three pillars: track your cash, cut what you can, and add a bit more income. Let’s explore each.

Step 1: Track Every Penny to See the Big Picture

First things first—know where your money goes. Many on low incomes leak cash on small stuff like snacks or apps. Start by grabbing a notebook or free app like Mint. Log everything for one month: rent, food, gas, even that $2 soda.

Why does this work? One Reddit thread user nailed it: “Track every dollar, where does it go? Then what expenses can you reasonably cut?” In practice, folks find 20-30% of spending hides in “misc.” For example, if you spend $50 weekly on takeout, that’s $200 a month—enough for a solid savings boost.

Pro Tip: Use the 50/30/20 rule. Put 50% toward needs (rent, food), 30% on wants (fun), and 20% to savings or debt. Adjust for your low income by starting at 5% savings if 20% feels steep. Tools like Excel spreadsheets make this easy—no cost, just your time.

If you’re in the UK searching how to save money on a low income uk, check free resources from MoneyHelper for tailored trackers. They report that tracking alone helps 60% of users cut unnecessary spends right away.

Step 2: Build a Bulletproof Budget

A budget isn’t a cage—it’s your roadmap. Create one that fits how to save money on a low income budget. List income first (wages, benefits). Then, subtract fixed costs: rent (aim under 30% of pay), utilities, phone.

Subtract variables next: groceries ($300/month average for one person), transport. What’s left? That’s your savings seed. Bank of America advises treating savings as a “must-pay” bill. Set it aside day one.

Here’s a simple starter budget for $2,000 monthly income:

| Category | Amount | Tips to Trim |

| Rent/Housing | $800 | Roommates or public transport to cut moves. |

| Food/Groceries | $300 | Bulk buys, meal prep—save $50/week. |

| Utilities/Phone | $150 | Shop deals, bundle services. |

| Transport | $100 | Bike/walk, carpool. |

| Debt/Loans | $200 | Pay minimums first. |

| Savings | $100 | Automate a high-yield account. |

| Fun/Misc | $350 | Limit to $50/week. |

Total: $2,000. Tweak as needed. This setup leaves wiggle room while prioritizing how to save money on a very low income.

For how to save money on a low income budget tips, try the envelope system: Cash in envelopes for categories. When it’s gone, stop spending. One Quora user shared how this halted impulse buys, saving $150 monthly.

Step 3: Cut Costs Without Feeling Deprived

Slash smart, not hard. Focus on big wins first. Housing eats 35% of low-income budgets—shop for cheaper spots or roommates. Food? Cook in bulk. Reddit users swear by thrift shops for clothes (save 70% vs. new) and library events for free fun.

Daily Hacks for Tips on How to Save Money on a Low Income:

- Meal Prep Sundays: Batch-cook rice, beans, veggies. Cuts grocery bills by 25%.

- Cancel Unused Subs: Audit Netflix, gym—average save $20/month.

- Shop Sales: Use apps like Flipp for deals. One family saved $400 yearly on basics.

- Energy Savers: Unplug devices, LED bulbs—trim $10-20 off utilities.

- Transport Tweaks: Bus passes or biking. In the UK, how to save money fast on a low income uk often means Oyster card top-ups for discounts.

These add up fast. Bankrate notes small changes like these net $100-300 monthly for tight budgets.

Boost Your Income: The Fast Track to More Savings

Cutting alone goes so far. To really ramp up, earn extra. Side gigs fit how to save money fast on a low income. Drive for Uber (earn $200/weekend), walk dogs on Rover ($15/hour), or sell crafts on Etsy.

Reddit consensus: “The best way to save money is to make more money.” One user went from $22k to adding $500/month via gigs, building a $2,000 fund in four months.

Quick Gig Ideas:

- Delivery Apps: DoorDash—flexible hours, $10-20/hour.

- Freelance Skills: Write on Upwork if you’re good with words ($20/article).

- Sell Stuff: Garage sale or Facebook Marketplace—turn clutter to cash.

- Tutoring: Online via platforms like VIPKid ($14-22/hour).

For how to save money fast on a low income without cutting more, focus here. Aim for $100 extra weekly— that’s $400/month toward goals.

In the UK, check Universal Credit top-ups or part-time retail for steady boosts1.

Automate Your Way to Effortless Savings

Don’t rely on willpower. Set it and forget it. Banks let you auto-transfer 5-10% of paychecks to savings. High-yield accounts now offer 4-5% interest—better than 0.01%.

NerdWallet lists automation as top for 2025. One tip: Round up purchases (coffee $3.50? Save $0.50). Apps like Acorns do this, growing pots quietly.

For how to save money fast on a low income calculator, try free online tools. Input income/expenses; it spits out savings projections. Example: $2,000 income, 10% auto-save = $2,400 yearly, plus interest.

Set Goals That Stick: From Emergency Funds to Dream Buys

Dream big, start small. Short-term: $1,000 emergency fund (3 months’ expenses for many). Long-term: Retirement or a car.

Bank of America pushes “if/then” plans: “If rent spikes, then cut dining.” This beats surprises.

Goal Ladder:

- Month 1: Save $50—treat as non-negotiable.

- Month 3: Hit $200 for basics like tires.

- Year 1: $1,200 buffer.

For how to save money for a house on a low income, use the 50/30/20 twist: Funnel that 20% to a dedicated account. In the US, FHA loans need just 3.5% down—about $10,500 for a $300k home. Save $200/month? You’re there in four years. UK folks, Lifetime ISAs offer 25% bonuses of up to £4,000 yearly.

Stats show low-income savers for homes average $5,000 down via consistent micro-saves.

Tools and Apps: Your Free Allies

No need for paid help. Freebies abound:

- YNAB (You Need A Budget): Teaches zero-based budgeting—every dollar assigned.

- Goodbudget: Digital envelopes for how to budget and save money on a low income.

- PocketGuard: Tracks bills, flags overspends.

For how to save money fast on a low income pdf, download free guides from NerdWallet—printable planners with checklists.

Employer perks? Max 401(k) matches—free money. HSAs for health saves too.

Real Stories: Inspiration from the Trenches

Let’s hear from others. On Reddit’s personal finance forum, a user earning $22k shared: “There’s only so many pennies you can save when you only earn a handful… but gigs changed that.” They added dog-walking, saving $300/month.

Another from Quora: “I cut coffee runs and meal-prepped—went from zero to $500 saved in three months.” (Community threads like this one overflow with such gems.)

Bank of America’s Better Money Habits site features a teacher who automated $25/paycheck, hitting $1,000 fast2.

These aren’t outliers. With discipline, you join them.

Tackling Common Roadblocks

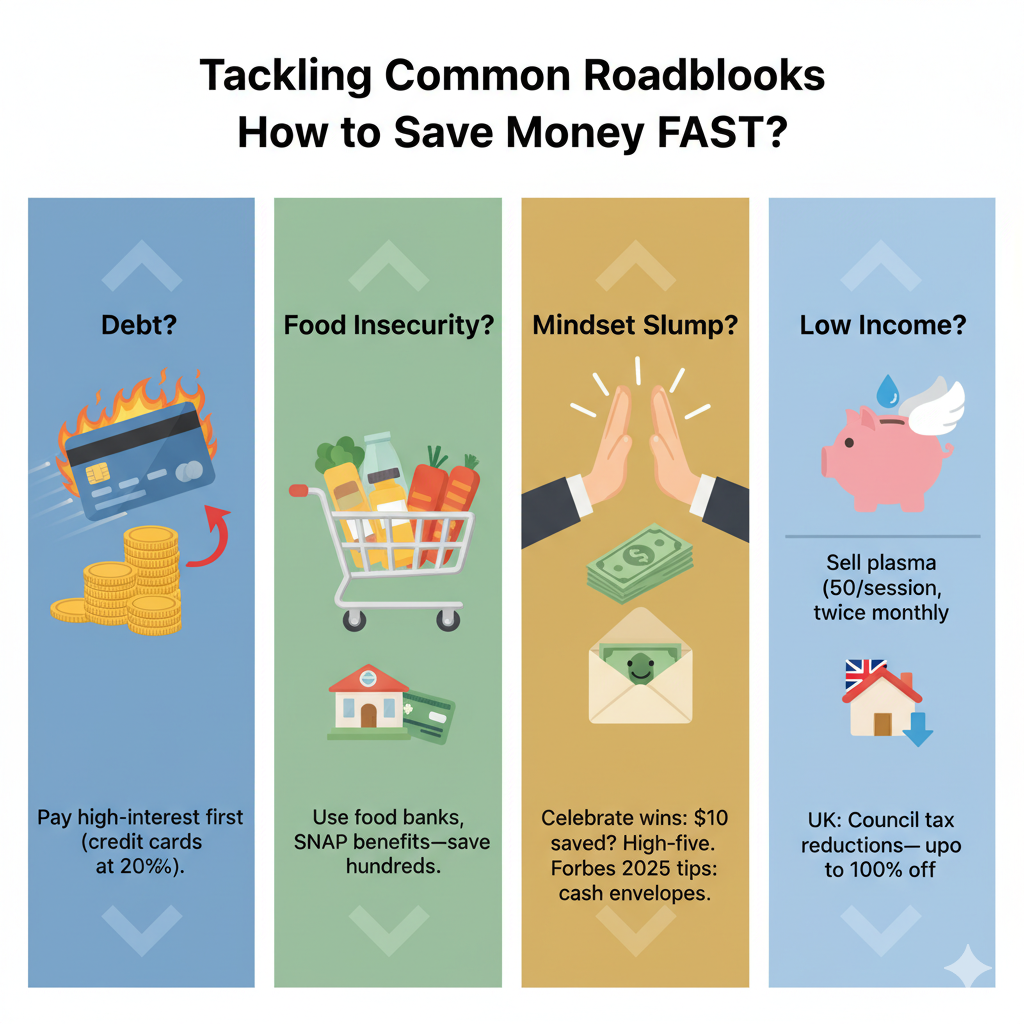

Debt? Pay high-interest first (credit cards at 20%+). Food insecurity? Use food banks, SNAP benefits—save hundreds.

Mindset slump? Celebrate wins: $10 saved? High-five. Forbes 2025 tips include cash envelopes for motivation.

For how to save money fast on a low income?, combine cuts and gigs. One hack3: Sell plasma ($50/session, twice monthly).

In how to save money fast on a low income uk, leverage council tax reductions—up to 100% off for low earners.

Advanced Strategies for 2025

As you grow comfy, level up. CDs lock rates at 4.5% for short terms. Index funds for long-haul (start with $50 via apps like Vanguard).

Tax refunds? Direct to savings. Average $2,800—huge boost.

For how to save money fast on a low income budget, audit yearly: Review apps, negotiate bills (cable down 10-15%).

FAQ: Quick Answers to Your Burning Questions

What’s the easiest way to save money on a low income?

Track spending for a week, then automate 5% transfers. Simple and sets momentum.

Can I save for big goals like a house on how to save money for a house on a low income?

Yes! Aim $100/month in a dedicated account. Use low-down loans; many succeed in 3-5 years.

How about tips on how to save money on a low income for beginners?

Start with no-spend days, bulk cooking, and free community events.

Is there a way to save money fast on a low income calculator?

Try Bankrate’s free tool—plug in numbers for custom plans.

What if my income’s very low—still possible?

A: Absolutely. Micro-saves like $5/week add up; focus on benefits and gigs.

Wrapping Up: Your Path to Financial Wins

You’ve got the tools now to tackle how to save money on a low income. From tracking dimes to gig hustles, small steps build big security. Remember, 25% of Americans feel fully secure with steady saving habits. You’re on that road. Start today: Pick one tip, like logging spends, and watch your confidence grow.

What’s your first move—budget tweak or side hustle? Share in the comments; let’s cheer each other on!

References

- Quora Discussion: How Can You Save Money If You Have a Low Income? – User stories emphasize real-world cuts and mindset shifts. ↩︎

- Bank of America Better Money Habits: Ways to Save Money – Structured expert guides with automation focus. ↩︎

- Reddit r/personalfinance Thread: How Do I Save Money with Low Income? – High engagement from 23+ comments with practical, peer-validated tips. ↩︎