You open your bank app and see red numbers. Rent is due. Groceries cost more this week. And that credit card bill? It keeps growing. If you’re earning low wages, low income debt repayment can feel like climbing a mountain with no shoes.

But here’s the truth: how to pay off debt fast on a low income is not about magic or luck. It’s about debt management tips that real people use every day. You don’t need a high salary. You need a clear debt repayment plan, discipline, and the right tools.

Over 60% of households earning under $40,000 per year carry debt, according to recent financial surveys. Many think they’re trapped forever. They’re wrong. With financial freedom on low income as your goal, every dollar saved and every extra dollar earned moves you forward.

This guide gives you how to pay off debt fast on a low income in simple, actionable steps. We’ll cover the budget for debt payoff, pay off debt quickly methods, fast debt reduction secrets, and managing debt with small income like a pro.

Let’s begin.

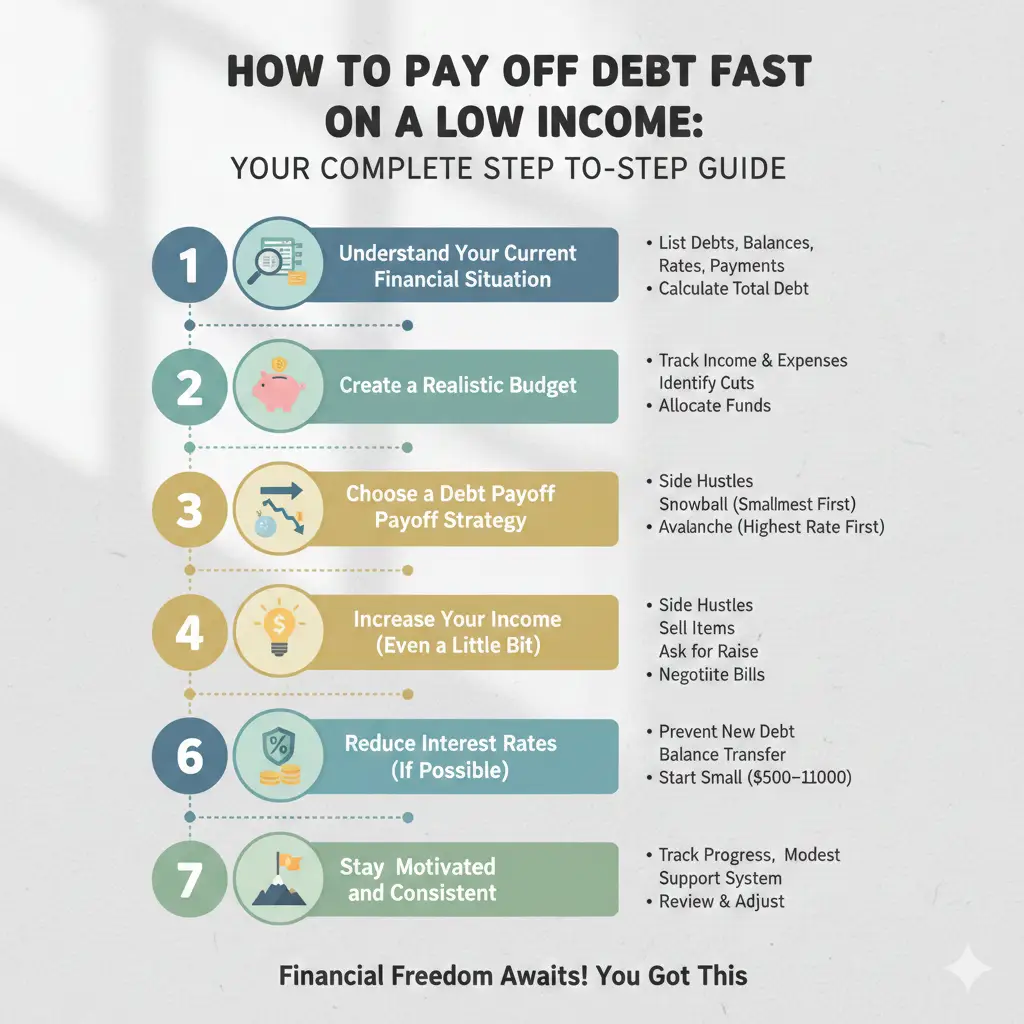

Step 1: Face Your Debt — The First Move in 5 Minutes a Day

You can’t fix what you don’t see. Start by listing every debt. This is the foundation of how to pay off credit card debt fast on a low income.

Grab a notebook or open a free app. Write:

- Creditor name

- Total balance

- Interest rate

- Minimum payment

- Due date

Do this today. Seeing it all in one place stops the fear. It turns chaos into a plan.

“The first step to freedom is knowing exactly where you stand.” – Financial Expert

Step 2: Build a Budget for Debt Payoff That Actually Works

A budget isn’t punishment. It’s power. It shows you exactly where your money goes — and where it should go.

How to Create Your Zero-Based Budget

- Add up all income Include paycheck, government benefits, child support, or cash gifts.

- List every expense: Rent, food, phone, transport, debt payments — everything.

- Assign every dollar a job Income minus expenses = zero. Every dollar must work.

- Find the leaks of that daily coffee? $5 × 30 = $150/month. That’s real money for pay off debt quickly.

Use free tools like paper, Google Sheets, or apps. This is living on a budget made simple.

Step 3: Stop the Bleeding — No New Debt

Before you attack old debt, stop adding new.

- Freeze your credit cards (literally — put them in ice).

- Delete saved card info from shopping sites.

- Use cash or debit only.

This one rule is non-negotiable for fast debt reduction.

Step 4: Choose Your Weapon — Snowball Method vs Avalanche Method

You have two proven debt elimination strategies. Pick one and stick to it.

The Snowball Method (Best for Motivation)

| Debt | Balance | Min Payment |

| Store Card | $350 | $25 |

| Credit Card A | $1,200 | $40 |

| Personal Loan | $5,000 | $150 |

How it works:

Pay minimums on everything. Throw all extra cash at the smallest debt ($350). Once gone, roll that $25 + extra to the next.

Why it works: Quick wins build momentum. You feel progress fast.

The Avalanche Method (Saves Most Money)

| Debt | Balance | Interest | Min Payment |

| Payday Loan | $800 | 400% | $200 |

| Credit Card B | $3,000 | 24% | $90 |

| Student Loan | $10,000 | 6% | $120 |

How it works:

Attack the highest interest first. Save thousands long-term.

Which should you choose?

- Pick a snowball if you need wins to stay motivated.

- Pick an avalanche if you want to pay less interest.

Both lead to how to pay off multiple debts fast on a tight budget.

Step 5: Slash Expenses with Money-Saving Strategies

You don’t need to live like a monk. But small cuts add up fast.

21 Cutting Expenses Ideas That Save $500+/Month

- Cook at home 5 nights a week → Save $200

- Cancel streaming (use free library apps) → Save $40

- Switch to generic brands → Save $60

- Use public transit or bike → Save $100

- Buy nothing new for 30 days → Save $150

- Negotiate phone/internet bill → Save $30

- Shop with a list only → Save $80

- Use cash envelopes → Stop overspending

- Refinance high-interest loans → Save $50+

- Sell unused items (clothes, electronics) → Earn $100+

These are frugal living habits that fuel ways to save money to pay off debt on low income.

Step 6: Earn More with Side Income Ideas (Even 5 Hours/Week)

You don’t need a second job. You need the best side hustles to pay off debt quickly.

Top 10 Side Income Ideas for Low-Income Workers

| Hustle | Time/Week | Earnings/Month | Startup Cost |

| Delivery (food/packages) | 10 hrs | $400–$800 | $0 |

| Online surveys/tasks | 5 hrs | $100–$300 | $0 |

| Sell handmade items | 8 hrs | $200–$600 | <$50 |

| Pet sitting/walking | 6 hrs | $300–$500 | $0 |

| Tutoring (online/in-person) | 4 hrs | $200–$400 | $0 |

| Virtual assistant | 10 hrs | $500–$1,000 | $0 |

| Rent out parking space | 0 hrs | $100–$300 | $0 |

| Flip thrift store finds | 5 hrs | $200–$700 | <$100 |

| Babysitting | 8 hrs | $400–$600 | $0 |

| Transcription | 7 hrs | $300–$600 | $0 |

Pick one. Start small. Every $100 speeds how to pay off debt fast on a low income.

Step 7: Use Debt Consolidation the Smart Way

Tired of 5+ payments? Combine them.

Good Debt Consolidation (Do This)

- Non-profit credit counseling agencies

- Lower interest (5–10%)

- One monthly payment

- Free or low fee

Bad Debt Consolidation (Avoid This)

- For-profit companies

- Upfront fees

- High rates

- “Settlement” promises

Learn more from Credit Canada’s expert guide1.

Step 8: Master Debt Negotiation Like a Pro

Your creditors want their money. They’ll work with you — if you ask.

Script to Lower Interest or Payments

“Hi, I’m calling because I’m committed to paying this debt, but my income is limited. I can afford $X per month. Can we lower the interest rate or set up a hardship plan?”

Tips:

- Call before you miss a payment.

- Be polite but firm.

- Get agreements in writing.

Many drop rates from 24% to 12% or less. This is powerful credit card debt help.

Step 9: Get Free Help from Credit Counseling

Non-profit agencies are your secret weapon.

They offer:

- Full budget review

- Debt management tips

- Negotiated lower rates

- One affordable payment

- Free education

Find trusted help at Credit Canada or local non-profits.

Step 10: Tap Into Government and Community Support

You may qualify for help you’re not using.

Canada

- Canada Child Benefit

- GST/HST Credit

- Disability Tax Credit

- Provincial rent supplements

USA

- SNAP (food assistance)

- LIHEAP (utility help)

- Local charity funds

Every dollar saved = dollar to debt.

Protect Yourself: Debt Collector Rights and Scam Warnings

Debt collectors cannot:

- Call before 8 AM or after 9 PM

- Harass or threaten you

- Lie about what you owe

- Contact you at work if you say stop

Demand validation in writing within 30 days.

Avoid scams promising to “erase debt” for upfront fees. Read warnings at FTC Consumer Advice2.

Build a Tiny Emergency Fund (Start with $10)

Yes — even on low income.

Goal: $500–$1,000

Method: Save $10–$20 per week

Why: Stops new debt when car breaks or kid gets sick

Real Success Stories: Step by Step Guide to Becoming Debt Free on a Small Income

Maria, 29, Single Mom, $2,100/month

- Debt: $12,000 (cards + medical)

- Actions:

- Cut eating out → Saved $180

- Babysat weekends → Earned $400

- Used snowball method

- Called creditors → 2 rates dropped

- Result: Debt-free in 22 months

Jamal, 34, Factory Worker, $2,800/month

- Debt: $9,500

- Actions:

- Sold old gaming console → $250

- Delivered food 2 nights/week → $600/month

- Used avalanche method

- Consolidated via non-profit

- Result: Paid off in 14 months

You are not alone. This is how to manage debt while earning minimum wage — and win.

Low-Income Budgeting Tips to Eliminate Debt Fast

| Category | Old Spend | New Spend | Saved |

| Food | $600 | $400 | $200 |

| Transport | $250 | $150 | $100 |

| Entertainment | $120 | $30 | $90 |

| Phone | $90 | $45 | $45 |

| Total Saved | $435 |

That’s $435/month to pay off debt quickly.

Stay Motivated: Track, Celebrate, Repeat

- Use a debt payoff chart (color in as you pay).

- Celebrate milestones: $1,000 paid = movie night at home.

- Join free online communities (Reddit r/debtfree).

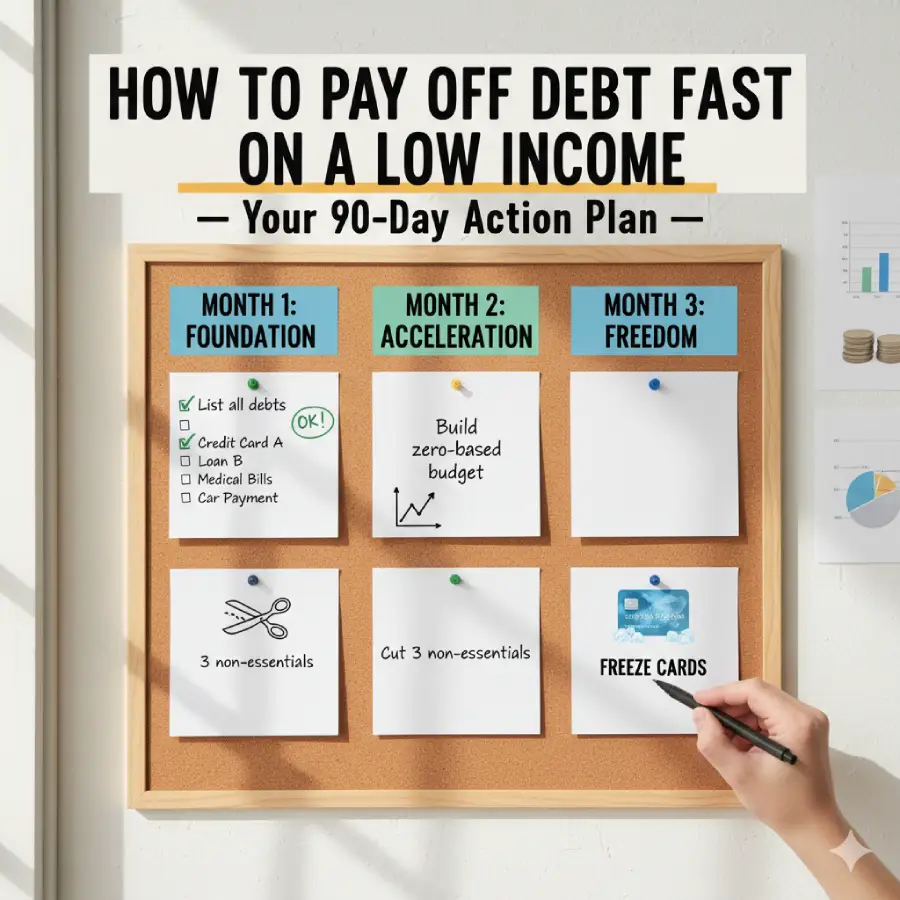

How to Pay Off Debt Fast on a Low Income — Your 90-Day Action Plan

Month 1: Foundation

- List all debts -oke [ ] Build zero-based budget

- Cut 3 non-essentials

- Freeze cards

Month 2: Momentum

- Start side hustle

- Pay off first small debt

- Call 2 creditors

Month 3: Scale

- Contact credit counselor

- Apply for benefits

- Save $100 emergency fund

FAQs: Best Strategies to Get Out of Debt with Limited Income

How can I pay off debt fast when I’m on a low income?

Even with a small paycheck, you can pay off debt fast by combining aggressive budgeting, extra income streams, and smart repayment strategies that squeeze every rupee toward your debt.

What is the fastest way to pay off debt on a low income in 2025?

The fastest proven methods in 2025 are the Debt Snowball or Debt Avalanche while living on a zero-based budget, picking up side hustles, and cutting expenses to the bone so 50–70% of your income attacks the debt.

Can I really pay off Rs. 5 lakh debt fast while earning only Rs. 40,000 per month?

Yes! People earning Rs. 30,000–50,000 per month routinely pay off Rs. 5–10 lakh in 12–24 months by following a strict budget, earning Rs. 10,000–20,000 extra through freelancing or part-time work, and using high-impact debt payoff methods.

Which debts should I pay off first on a low income to see results fastest?

For quickest wins and motivation, pay off the smallest balance first (Debt Snowball). For saving the most money, attack the highest-interest debt first (Debt Avalanche)—both work brilliantly on low income when you stay consistent.

How do I create a realistic budget to pay off debt fast with limited income?

Start with the 50/30/20 rule (modified for debt payoff): put 50–70% toward debt and bare essentials, 20–30% toward needs, and slash wants to almost zero. Track every single rupee using free apps until your debt is gone.

How to Pay Off Debt Fast on a Low Income?

How to pay off debt fast on a low income isn’t about earning more tomorrow. It’s about spending less today, earning a little extra this week, and attacking debt with a proven plan right now. You don’t need perfect conditions. You need consistent action. Start with your budget. Add a side hustle. Pick a snowball or avalanche. Get free help. One year from now, you’ll look back and wonder why you waited.

Conclusion: You Hold the Power to Financial Freedom on Low Income

You’ve got the full roadmap. How to pay off debt fast on a low income is no longer a mystery. It’s a choice. A daily choice to budget, save, earn, and persist.

You don’t need more money to start.

You need courage to begin.

What’s your first step today?

Will you list your debts? Cut one expense? Call a creditor?

Take that step now. Your future self is waiting.

References

- Federal Trade Commission (FTC) “How to Get Out of Debt” Official U.S. consumer protection adviceWhy it ranks: Government authority, scam warnings, legal rights, simple language. ↩︎

- Credit Canada “How to Get Out of Debt on a Low Income (10 Strategies)” Read the full guide hereWhy it ranks: Trusted non-profit, Canada-specific benefits, clear 10-step list, empathetic tone. ↩︎