You are 30 years old. You have a good job and some money saved. You want to be comfy and happy when you stop working in 30 years. You don’t have enough cash yet for a big house down payment.

Now you have two big choices:

- Put your money in the stock market and let it grow quietly by itself (like a magic garden that keeps getting bigger).

- Try to buy a house someday so you can collect rent checks every month.

People have argued about this forever: stocks or a house, which one makes you richer in the long run?

Stocks grow faster, and you rarely have to touch them. A real house feels safe because you can touch it, and it can pay you rent, but it also gives you lots of work.

This simple guide is made for busy people like you who want things to be easy and flexible. We will look at real numbers, super easy examples, and the best plan so you can grow a big pile of money without stress.

Why Compare Long-Term Returns: Stocks vs Real Estate Investment Now?

Everyone talks about how to make money. But for normal people like you (not super rich yet), there are really only two big choices that work great over many years: stocks or a house.

These two are very different:

- Stocks grow with new ideas and big companies all over the world (like Apple and Amazon).

- A house grows slowly because people always need a place to live, but it stays in one spot.

Since the 1970s, the world has changed a lot. We went from making things in factories to making apps and computers. Stocks love that fast change. Houses do not change as fast.

Most people reading this do not have millions of dollars. You want your money to be free to move if you get a new job or have a baby. Stocks let you sell in one second. A house can take months to sell.

A new survey in 2024 asked Americans: “What is the best way to get rich slowly and safely?” 37% said “buy a house.” But almost all money experts now say “buy stocks” instead.

Stocks can drop fast when things go bad (like in 2008), but then they come back even higher. Houses fall less, but they also grow much more slowly.

In this guide, we will only use real numbers from trusted places (like the S&P 500 for stocks and the Case-Shiller list for houses), so you know it’s true. No fluff, just insights to fuel your decisions.

Historical Performance: Unpacking Long-Term Returns, Stocks vs Real Estate Investment

To grasp long-term returns, stocks vs real estate investment, we must look back. History isn’t a crystal ball, but it reveals patterns. Over the past 30 years (1995–2025), stocks have consistently edged out property in raw growth.

Take this snapshot: If you invested $10,000 in the S&P 500 in 1995, it would balloon to over $200,000 by 2025, thanks to an average annual return of about 10.4% (including dividends). That’s compounding returns at work; your earnings generate more earnings. Flip to real estate: The same amount, funneled into a median U.S. home, might yield $50,000–$60,000 today, based on 5.5% average annual appreciation per the Case-Shiller index. Solid? Yes. Spectacular? Not quite.

But numbers tell only part of the story. Historical returns stocks vs real estate vary by era. During the 2000s housing boom, property surged 8–10% yearly in hot spots like California. Stocks? They flatlined post-dot-com bust. Fast-forward to 2010–2020: Equities roared back with 13% averages, while homes chugged at 5–6%.

Here’s a quick table for clarity:

| Period | Stocks (S&P 500 Annual Avg.) | Real Estate (U.S. Homes Annual Avg.) | Key Notes |

| 1995–2025 | 10.4% | 5.5% | Stocks win on total return; RE stable. |

| 2000–2010 | 1.4% (incl. dividends) | 4.2% | RE edges during bust; stocks recover later. |

| 2010–2025 | 12.8% | 6.1% | Tech boom boosts equities. |

| Inflation-Adj. (Long-Term Avg.) | 7.7% | 3.5% | Both hedge against inflation, but stocks grow more. |

Sources: S&P Dow Jones Indices and Federal Housing Finance Agency.

Why the gap? Stocks benefit from equity market growth, companies reinvest profits into R&D, and expand globally. Real estate relies on real estate appreciation vs stock growth, driven by supply shortages and population shifts. Yet, property drags with costs: Think 1–2% yearly for taxes, 1% for upkeep, and vacancy risks eating into gains. Which Has Performed Better Historically: Stock Market or Real Estate1?

For global flavor (since we’re eyeing Tier 1 and Tier 2 countries like the U.S., UK, India, or Brazil), patterns hold. In India, the BSE Sensex delivered 12% annualized from 2000–2025, versus 7% for urban housing. Brazil’s Bovespa? 9.5% vs. 6% for property. Local twists matter, emerging markets see faster urban real estate pops, but stocks still lead for diversified plays.

One caveat: These are averages. Your mileage varies. A Detroit rental might lose value over 20 years, while a diversified stock fund like Vanguard’s VTI hums along.

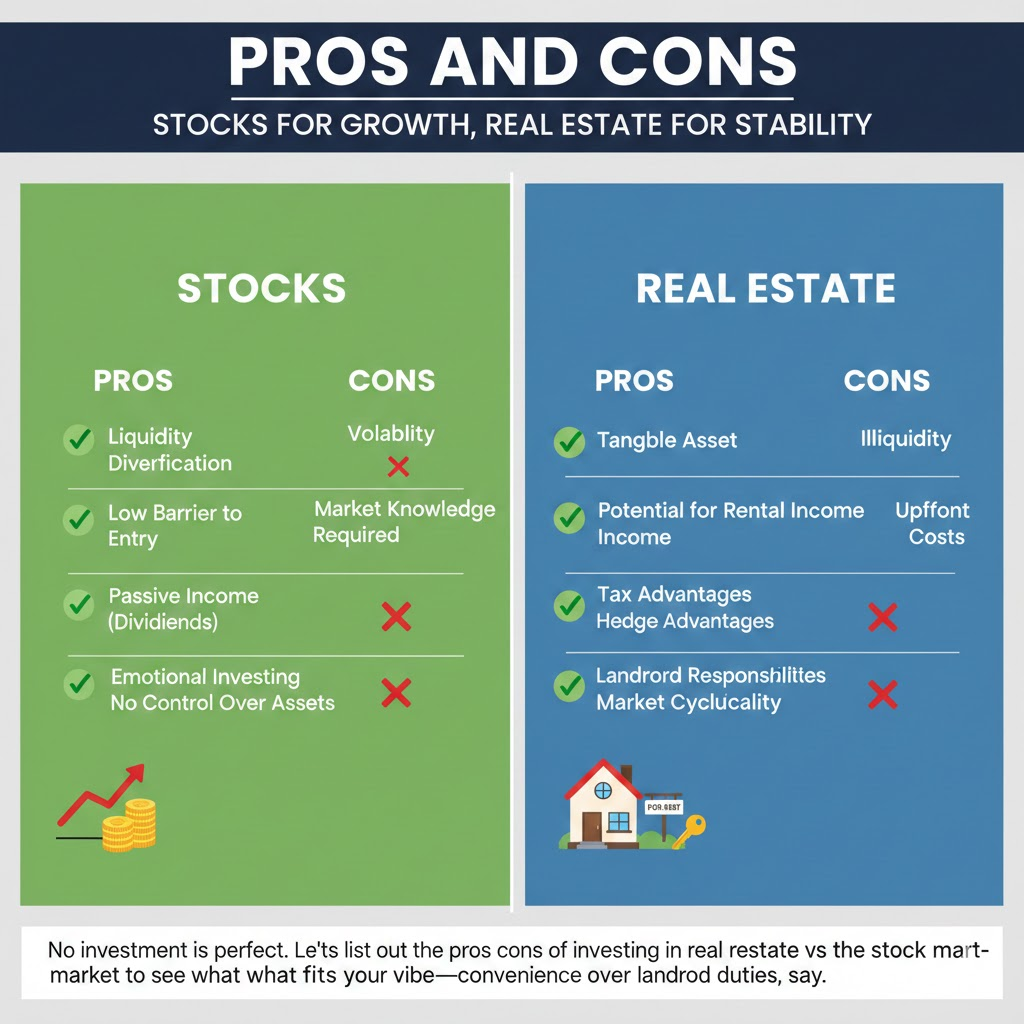

Pros and Cons: Stocks for Growth, Real Estate for Stability

No investment is perfect. Let’s list out the pros and cons of investing in real estate vs the stock market to see what fits your vibe—convenience over landlord duties, say.

Stocks: The Easy Path to Wealth

Stocks suit people with limited initial capital. Start with $100 via apps like Robinhood. Here’s why they rock for long-term plays:

- Higher Potential Returns: As noted, 10%+ averages crush real estate’s 5–6%. ROI stocks vs real estate tilts here for patient savers.

- Liquidity and Flexibility: Sell shares anytime. Need cash for a wedding? No sweat. Contrast with property maintenance cost headaches.

- Diversification Made Simple: Buy an index fund investing ETF covering 500 companies. Global exposure without passport stamps.

- Low Hassle: No tenants calling at midnight. Passive income through investing via dividends (S&P yields ~1.3% now).

- Tax Perks: Roth IRAs let gains grow tax-free.

Downsides? Risk and volatility in investing. The 2022 bear market shaved 25% off stocks. But history shows recoveries—every 20-year stretch since 1926 yielded positive returns.

Real Estate: Tangible but Demanding

Property appeals if you crave ownership. Leverage a mortgage to control a $300,000 asset with $60,000 down. Pros include:

- Inflation Hedge: Rents and values rise with costs. During 2021–2023 inflation spikes, U.S. homes gained 15% yearly.

- Steady Cash Flow: Rental income vs dividend income—aim for 5–8% yields, often beating stock dividends.

- Leverage Magic: Mortgage leverage in property amplifies gains. A 20% down payment on a doubling asset nets huge profits.

- Tax Breaks: Deduct interest, depreciate buildings, defer gains via 1031 exchanges.

- Emotional Win: That “mine” feeling boosts commitment. Why Do Stock Market Returns Beat Real Estate2?

Cons hit hard for busy pros:

- High Entry Barriers: Down payments, closing costs—$50,000+ minimum.

- Illiquidity: Selling takes months. Liquidity of financial assets? Stocks laugh at that.

- Ongoing Costs: Repairs, vacancies, managers (8–12% fees). Real estate cash flow analysis often reveals thinner nets than expected.

- Local Risks: Bad neighborhoods tank values. No global diversification like investment portfolio diversification.

In short, stocks favor set-and-forget warriors; real estate rewards hands-on hustlers.

Stocks vs Real Estate Investment During Inflation: Who Holds Up?

Inflation erodes cash, so smart investors seek hedges. Enter stocks vs real estate during inflation periods performance. Both protect, but differently.

Real estate shines here. Home prices track CPI closely; 85% of 5-year periods since 1985 beat inflation, per Avison Young data. Rents adjust upward, covering rising expenses. In the 1970s, with stagflation, U.S. properties returned 9% annually, outpacing stocks’ 5.9%.

Stocks? They falter short-term (high rates crimp valuations) but crush long-term. From 2000–2025, inflation-adjusted S&P 500 gains hit 5.1%, vs. real estate’s 3.2%. Why? Companies pass costs to consumers, boosting profits. Sectors like energy and materials thrive.

Inflation hedge investments tip: Blend them. REITs (real estate investment trusts) offer property exposure with stock liquidity, yielding 4.1% dividends in 2024, better than the S&P’s 1.3%.

Example: During 2022’s 9% U.S. inflation, stocks dipped 18%, but homes rose 6%. By 2025, equities recovered 25%+. Lesson? Time in market beats timing it.

Building Your Strategy: Asset Allocation for Lasting Wealth

You’re not picking a winner, you’re crafting a portfolio. Asset allocation is key for long-term investment strategies. Aim for 60–80% stocks early, tapering to 40–60% real estate/REITs as you age.

Tips for people with limited initial capital:

- Start Small in Stocks: Dollar-cost average $200/month into low-fee index funds. Over 30 years at 7% real return? $250,000 from $72,000 invested.

- Dip into Real Estate Indirectly: Buy REITs via apps. No plumbing calls, instant diversification.

- Leverage for Property Wisely: If going direct, target cash-flow positive rentals. Use tools like BiggerPockets for analysis.

- Diversify Globally: Stocks give worldwide reach; pair with international REITs for balance.

- Rebalance Yearly: Sell winners, buy laggards to maintain mix.

Which investment gives better long-term returns: stocks or real estate? Data says stocks, but your risk tolerance rules. Are stocks more profitable than real estate in 20 years? Likely yes, per 90% of rolling 20-year periods since 1970.

Case study: Sarah, a 35-year-old marketer in London. She split $50,000: 70% FTSE 100 ETF, 30% UK REITs. By age 55, projections show $300,000+ at 8% blended return—far beyond all-in property after fees.

Real Estate vs Equities Performance: Lessons from the Pros

Veteran investors swear by data. Warren Buffett favors stocks for their capital gains comparison edge. “The stock market is a device for transferring money from the impatient to the patient,” he quips.

On the flip: Grant Cardone pushes real estate for cash flow from rental property. But even he admits: “Scale requires capital most lack.”

Historical data comparing real estate ROI to stocks? A 2025 Motley Fool analysis shows REITs beating broad stocks over 50 years (9.8% vs. 9.5%), blending the best of both.

For retirement: Long-term investment comparison for retirement planning favors 70/30 stock/REIT tilts. Why? Stock dividends vs rental income long-term outcomes, dividends compound automatically; rents demand effort. Should You Invest in the Stock Market or Real Estate3?

Is real estate a better investment than stocks for beginners? No, if capital’s tight. Start with stocks, graduate to property.

Best investment for long-term wealth building: stocks vs property? A hybrid. Real estate vs the stock market for passive long-term income? REITs win for ease.

Navigating Risks: Volatility, Leverage, and Mindset

Risk-tolerant individuals thrive here. Stocks’ ups and downs? View as sales—buy low. Real estate’s steady climb suits stability seekers, but mortgage leverage in property amplifies losses if values dip.

Mindset shift: Focus on the return on investment difference between real estate and stocks. Net after costs, stocks often net 8–9%; property 4–6%.

Pro tip: Stress-test. What if rates rise 2%? Stocks adjust; properties’ payments spike.

FAQs

What are the average long-term returns for stocks vs real estate?

Over many years, stocks grow about 10% per year (7% after inflation). Real estate grows only 5–6% per year (3–4% after inflation). So stocks make your money grow twice as fast!

How does real estate appreciation vs stock growth play out over 40 years?

Start with $100,000. After 40 years, stocks can turn it into about $4.5 million. The same $100,000 in a house might grow to only $800,000 (and that’s before fixing toilets and paying taxes). Stocks win by a huge amount!

Best for passive income through investing?

Stocks pay you dividends every few months, and you do zero work. Real estate pays rent, but you have to fix things and chase late tenants. The easy winner = REITs (they own hundreds of buildings and just send you money like dividends).

Pros and cons of investing in real estate vs the stock market for diversification?

Real estate is good because it goes up and down at different times than stocks, so your money feels safer. But it’s hard to sell fast, costs a lot of money to buy, and needs lots of care. Stocks are simple, cheap, and you can sell them in one click.

During high inflation, how do stocks vs real estate perform?

When prices go up fast, both can protect your money. Real estate feels safer right away because rent and house prices rise quickly. Stocks may drop a little at first, but then they grow even stronger later, so they win in the long run.

Conclusion

Stocks vs houses: which one grows your money better over a long time?

Stocks win for most people! They grow faster, you can start with just a little money, and you can buy companies all over the world. Houses give you rent money and protect you a little when prices go up, but they need a lot of work and time.

Best easy plan:

- Put 60-70% of your money in stocks or simple index funds.

- Put 20-30% in REITs (these are like stocks that own many buildings).

- Buy a real house only if you really love it.

That way, you get big growth and some safe rent money too!

Remember, wealth builds through consistency, not perfection. Start today—your future self will thank you.

References

- Which Has Performed Better Historically: Stock Market or Real Estate? ↩︎

- Why Do Stock Market Returns Beat Real Estate? ↩︎

- Should You Invest in the Stock Market or Real Estate? – Hartford Funds: Breaks down 30-year returns and diversification tips. ↩︎