Life can surprise you. A job loss, car fix, or doctor bill can hit hard. That is why How To Build An Emergency Fund matters. It is cash you keep safe for bad days. No need to borrow or stress. How To Build An Emergency Fund starts small. Even $10 a week adds up. Many young workers and families start with zero. They feel lost at first. But simple steps help. In 2025 prices will go up fast. A fund gives peace. You sleep better. Feel strong. This guide shows easy ways. You can do it too.An emergency fund is your own safety net. Experts say to keep 3 to 6 months of costs. Start with $500 or one month. Build slow. It is liquid cash. Easy to grab. Not in stocks. In a bank or safe spot. Good for all. Gig workers love it. Pay can stop suddenly. Families need it for kids. One bill can break a month. Stats show 40% have less than $400 saved. Many live to pay. But you can change that. Start today.

Why You Need an Emergency Fund Now

Know How To Build An Emergency Fund to Stay Safe. Bad things happen to all. Job gone. Health cost. Home fix. Without cash you use cards. Debt grows fast. The fund stops that. It is money peace. Folks with fund stress less. One study says 60% calmer. You choose to fix, not panic. In 2025 costs will rise. Rent food gas up. The fund covers the gap. Gig pay is not steady. Fund fills low weeks. Young folks start work. No big save yet. Fund builds habit. Good for life. Start small. Feel win fast.Many say it is the first money goal. Before fun trips or big buys. It protects dreams. No, sell stuff cheap in bad times. Reddit users say life is less hard with funds. One wrote: “Six months fund makes me brave to change jobs.” True words. You feel free.

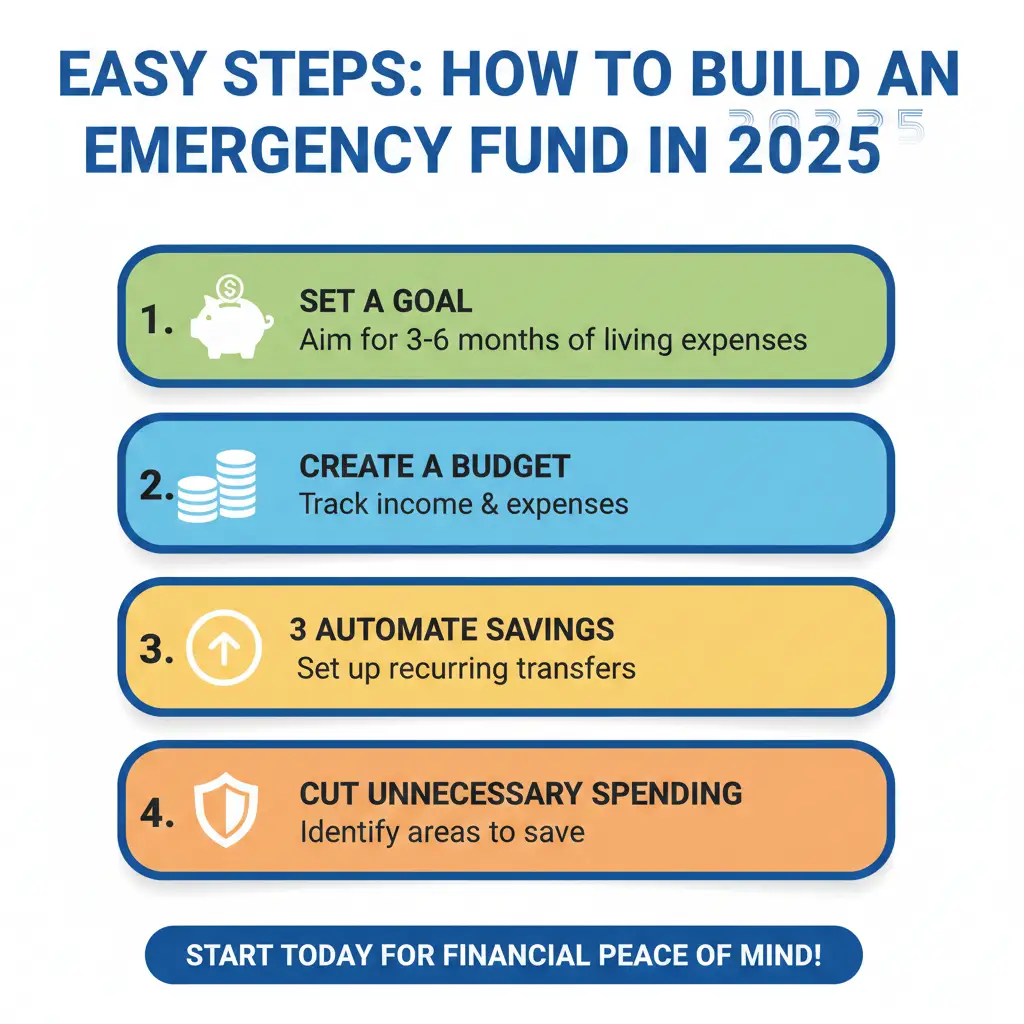

Step by Step: How To Build An Emergency Fund

Here is how to build an emergency Fund in an easy way. Follow these steps.

- Find your monthly costs. Add rent, food, bills, gas. Say $2000.

- Set goals. First aim $1000. Then one month costs. Later 3-6 months.

- Open a new bank account. Call it an emergency. High interest if you can. Online banks give more.

- Save auto each pay. Send $25 or $50 direct. No see, no spend.

- Cut small things. One coffee out less. One game less. Add that cash.

- Sell old stuff. Phone clothes games. Put it all in the fund.

- Add extra pay. Bonus tax back gift cash. All to fund.

- Track each month. See you grow. Cheer small wins.Do this each week. In one year, a big fund. Start $20 a week. That is $1000 a year. Good start. Many do it. You can too.

Good Places for Your Emergency Savings Account

Pick a safe spot for an emergency savings account. Normal bank ok. But online banks pay more interest. Like 4-5% now. Money grows. Easy move to the main bank fast. No fee. Good name Ally Marcus SoFi. All safe. Up to a big protection limit. Keep in savings not check. No card link. Hard to spend fast. Some split. Part high interest. Part quick cash. Safe and grow.For start, keep in the same bank. Easy see. Later move for more pay. No risk stocks. This cash is for bad days only. Not fun buys.

Emergency Fund Tips to Save Faster

Use emergency fund tips to grow quickly.

- Pay yourself first. Save before bills.

- Use the 50/30/20 rule. 20% to fund till goal.

- Round up buys. The app sends extra to save.

- No weeks. All saved.

- Side small job. All cash to fund.

- Cut one bill. Like cable. Save that money.

- Tell pals goals. They help keep on track.One Reddit user saved $10,000 in two years. Cut, eat out and have fun. Added $100 pay. You can too. Small cuts, big wins1.

How Much to Save in Emergency Fund

Ask how much to save in an emergency fund. Start $500-$1000. Covers small fixes. Then one month costs. Later 3-6 months. If gig work goes 9-12 months. Families with kids aim high. One job home low. Two jobs ok less. Check your life. Big health cost? Save more. Rent high city? More months. The goal feels safe. Not the same for all.Stats say 3 months is a good start. Covers most bad times. Add slow. No rush. Better some than zero.

FAQs About How To Build An Emergency Fund

What is the best way to build an Emergency Fund?

The best way to Build An Emergency Fund is auto save. Open a new account. Send cash each pay. Start $25 a week. Cut small spends. Add extra money. Goal $1000 first. Then more. Keep a safe bank. High interest is good. Many do this. Grow fast.

How To Build An Emergency Fund with Low Pay?

How To Build An Emergency Fund with low pay starts tiny. Save $5-$10 a week. Cut one fun thing. Sell old stuff. Use a round up app. Extra job cash all saved. Slow ok. $500 helps a lot. Build habits. Grow later.

Where is a good emergency savings account?

A good emergency savings account is an online bank. High interest 4-5%. Safe fast cash. Names Ally SoFi Marcus. Or normal bank savings. No card link. Hard spend. Split some quick some high pay. Safe growth.

How fast can I build an emergency fund?

You can build an emergency fund fast with cuts. Save $100 a month. One year $1200. Cut the cable. Add side pay. Sell things. Many reach $5000 in two years. Depends pay and cuts. Start now faster.

Is 3 months emergency fund enough?

Three months of emergency fund is enough for most. Covers job loss fix. Gig work needs more. Family kids aim for 6 months. Check your life. Start 3. Add later. Better than zero.

Can I use an emergency fund for fun?

No use of emergency funds for fun. Only real bad days. Car break doctor job gone. Keep rules. Or funds gone fast. Make new goals for trips. Keep this safe.

Conclusion

Now you know How To Build An Emergency Fund. It is an easy step. Start a small auto save. Cut little things. Watch grow. In 2025 it saves stress. Gives power. Peace mind. Many start zero. Reach big goals. You can too. Open account now. Save the first $10. Feel win.What is your first step for How To Build An Emergency Fund? Tell us2!

References

- Reddit Real Stories: User tips from zero. https://www.reddit.com/r/personalfinance/comments/1jm8vx7/how_do_you_build_up_an_emergency_fund_im_lost/ – Fits gig folks low pay need real ways. ↩︎

- Investopedia Guide: Clear steps and why. https://www.investopedia.com/personal-finance/how-to-build-emergency-fund/ – Good for young workers who want a safe start. ↩︎