Many people make Common Budgeting Mistakes that lead to stress and less savings. These slip-ups happen to new budgeters or busy families alike. But spotting them early helps you fix your plan fast. You start with small changes to track cash better. This builds good money habits over time. Feel calm as you see your goals come true. Simple steps turn errors into wins.

What Are Common Budgeting Mistakes?

Common Budgeting Mistakes often start with not knowing your full money picture. You might guess at spending instead of tracking real numbers. This leads to surprises like big bills at the end. Beginners skip this and feel lost quick. Experts say write down every buy for a week first. See where cash goes without guesswork. In the US, a 2023 survey by the National Foundation for Credit Counseling found 65% of adults skip tracking, causing overspending. This hurts savings goals like a trip or home down payment.Another big one is setting goals that feel too far off. You aim to save $10,000 but forget why or how. This drops drive when life gets busy. Tie goals to real needs, like three months of rent in a fund. Families in the UK face this with rising costs; a MoneyHelper report shows 40% quit budgets from vague aims. Make goals small and fun, like $50 for a family movie night. Review them weekly to stay on path.Budgeting errors pop up when you ignore odd costs too. Think car fixes or holiday gifts that hit once a year. Spread them over months to avoid shocks. Couples often miss this when sharing bills. One partner pays rent, the other food, but gifts add up. Use a shared sheet to list all. This keeps peace and cash steady.Financial planning mistakes include no room for joy. You cut all fun to save, then splurge and feel bad. Add a small pot for treats like coffee or parks. This makes budgets stick. In Canada, Scotia Bank notes rigid plans fail 70% of users. Balance needs with wants for long wins.Money management mistakes like no reviews hurt most. Life changes: new job, baby, or raise. Update your plan monthly. Skip this and old numbers mislead. Tools like free apps help spot shifts fast.These budgeting pitfalls affect young adults most. A college grad with loans might not be tracking expenses right. Log daily to learn patterns. Over time, you spot waste like unused subs.In short, Common Budgeting Mistakes come from rush or no plan. But awareness fixes them. Start today for less worry.

Why Do Common Budgeting Mistakes Happen?

Common Budgeting Mistakes stem from busy lives and no clear start. New to money plans? You pick a method that feels hard, like complex apps. Give up fast when it drags. Try paper lists first for ease. A Prasad CPA blog says 50% fail from wrong tools. Match method to your style: quick notes for goers, apps for tech fans.Irregular cash flow trips many. Gig workers or part-timers guess pay wrong. Average last months for a true base. This avoids shortfalls. In the UK, TSB finds variable income causes 45% of budgeting blunders. Plan for low weeks with buffers.Life events blindside too. Weddings, moves, or health scares add costs. Build in flex spots. Santa Monica College notes young couples skip this, leading to debt. Talk early about shared goals.Personal finance mistakes grow from no emergency cash. One fixed bill wipes savings. Aim for $1,000 first, then grow. US stats show 28% have none, per Bankrate. Start small: $20 weekly.Forgetting reviews lets errors build. Monthly check: What worked? Tweak for next. This keeps plans fresh.Common money mistakes include all-or-nothing views. Miss one day, quit all. Forgive slips and restart. Habits form in 21 days, say pros.These roots show mistakes in budgeting are normal. Learn from them to grow strong.

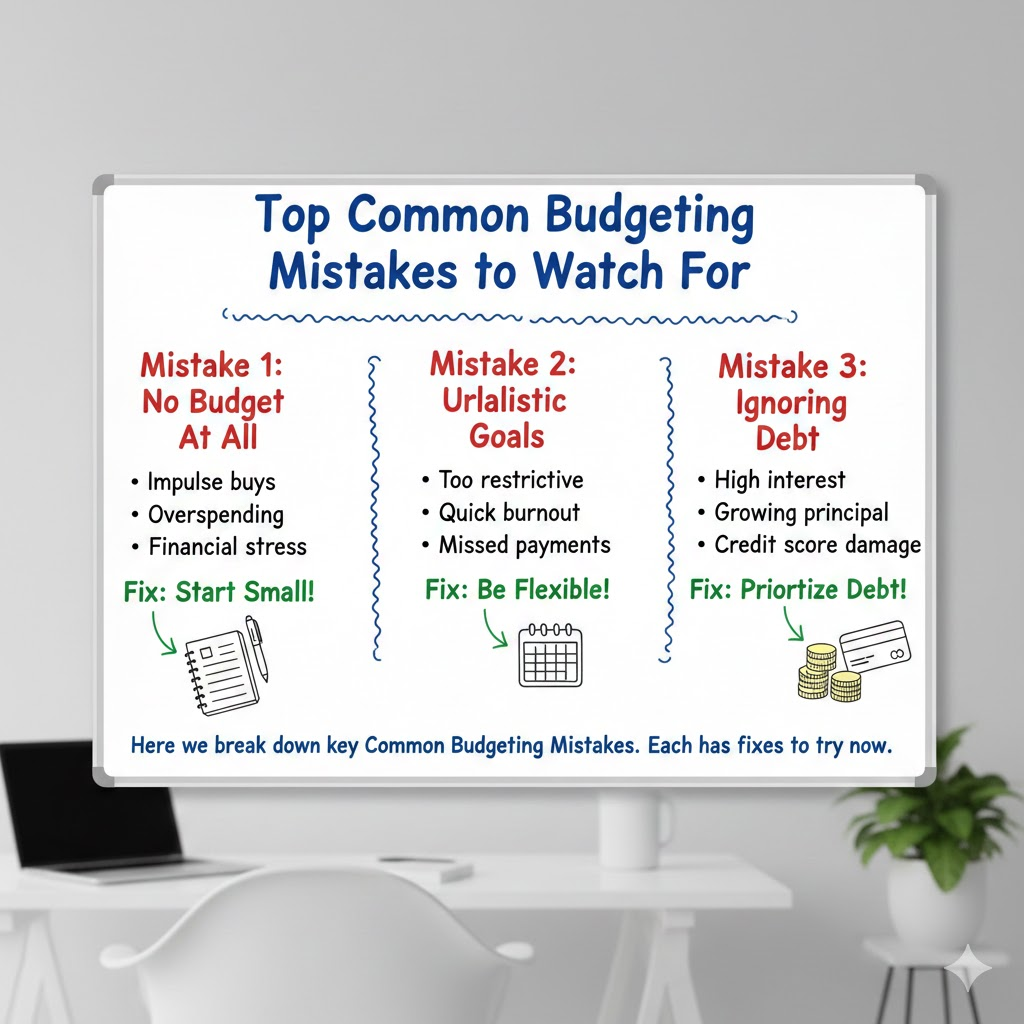

Top Common Budgeting Mistakes to Watch For

Here we break down key Common Budgeting Mistakes. Each has fixes to try now.

- Mistake 1: Not tracking daily spends. Small buys like snacks add up to $200 monthly. You forget them in plans. Fix: Log in a phone note each day. Group into food, fun, bills. Review weekly to cut waste. Apps like Mint auto-sort for free. This habit saves a lot over time.

- Mistake 2: Ignoring irregular costs. Yearly fees like insurance hit hard if lumped. Spread into monthly pots. List all once: gifts, fixes, taxes. Add $50 to an “odd” fund. Scotia Bank tips this for seasonal bills like heat. Avoid loan needs.

- Mistake 3: Setting unrealistic goals. Aim too high, like no eats out ever. Burn out quick. Start real: Cut dining twice weekly. Track wins to build pride. Tie to why, like debt pay for freedom. Prasad notes vague goals drop 60% adherence.

- Mistake 4: Skipping emergency funds. No buffer means credit for tires. Save 3-6 months’ needs in a side account. Start $25 paychecks. US pros say this cuts stress 80%. Auto-transfer to grow easily.

- Mistake 5: No fun money slot. Rigid cuts lead to binges. Add 5% for joys like movies. This keeps joy in plans. Families thrive with shared treat pots.

- Mistake 6: Forgetting reviews. Plans stale without checks. Monthly sit: Adjust for raises or hikes. Couples review together for team buy-in. This spots debt management errors early.

- Mistake 7: One-size-fits-all methods. Apps work for some, paper for others. Test three, pick best. College notes beginners fail from mismatch.These most Common Budgeting Mistakes hit all. Fix one weekly for change.

How to Avoid Common Budgeting Mistakes

Spot a budgeting error? Act fast with these steps. First, track true numbers. Use bank logs for last months. See real flows, not hopes. This base’s plans are solid.Second, set smart goals. Make them SMART: Specific, Measurable, Achievable, Relevant, Time-bound. Like “Save $100 for fun by June.” Write and post them.Third, build buffers. For odds and shocks, save ahead. Tools like equal pay bills help utilities. In Canada, this event peaks.Fourth, add flex. 50/30/20 rule: 50% needs, 30% wants, 20% saves. Adjust for tight cash.Fifth, review often. Weekly peeks, monthly deep dives. Apps alert overs.Sixth, learn from slips. Journal what went wrong, how to tweak. Share with a buddy for tips.Seventh, use free aids. Sites offer sheets.Scotiabank budgeting mistakes guide has tools for starters.These steps dodge financial discipline problems. Feel steady soon1.

The Consequences of Common Budgeting Mistakes

Common Budgeting Mistakes cost more than cash. Stress builds from bill chases. Sleep loses worry. Relationships strain over fights.Debt grows fast. No fund means high-rate loans. Interest eats future pay. A 2024 CFPB report says unchecked spending leads to 20% more debt yearly.Savings stall. No goals mean no progress. Miss home buys or retire peace.Habits weaken. Quitting fails to drop trust in self. But restarts build grit Health dips too. Worry links to ills, per Mayo Clinic. Good plans ease that.Work suffers. Money thoughts distract. Focus sharpens with control.Fix early to skip these hits. Wins follow.

Tips for Fixing Budgeting Blunders

Try these for budgeting tips after slips. Start fresh monthly. Forgive past, plan now.Use visuals. Charts show spends. Free online makers help.Seek community. Forums share fixes. Reddit’s r/personalfinance has stories.Educate slow. Read one tip daily. Books like “Total Money Makeover” guide.Pair with apps. YNAB teaches every dollar a job.Celebrate small. Hit a week? Treat free, like walks.Track mood. Happy budgets stick better.These heal saving money pitfalls. Grow from errors.

Common Budgeting Mistakes for Beginners

New to this? Mistakes beginners make when budgeting include over-detail. Too many lines are confusing. Keep five groups: home, food, move, fun, save.Under-save too. Think $5 is enough? Bump to 10%. Builds quick.Ignore subs. Netflix hides $15 monthly. Audit yearly No why. Goals without fire fade. Link to dreams.These snag starters. Simple fixes free you.

FAQs About Common Budgeting Mistakes

What are the Most Common Budgeting Mistakes People Make?

Most Common Budgeting Mistakes start with no tracking. You miss small spends that add up. Then come vague goals that drop drive. Irregular costs surprise too. No emergency cash leaves you open. Rigid plans without fun lead to quits.

How do I avoid common budgeting errors?

To dodge common budgeting errors, track real numbers first. Log buys for two weeks. Set goals you can hit, like $20 weekly saves. Add pots for odds like gifts. Build a $500 fund slowly. Include joy slots to stay in. Review weekly for tweaks. Test tools till one fits. Learn from slips without guilt. Share plans with a pal. Free guides help starters. Habits form easily over time. Peace follows smart steps.

Why do budgets fail from financial planning mistakes?

Financial planning mistakes kill budgets by mismatch. Unreal aims burn out fast. No buffers hit shocks. Forgets fun sparks binges. Skips reviews let drifts grow. Variable pay guesses wrong. Debt ignores snowballs. Fix with real data bases. SMART goals guide. Flex for life. Fun keeps joy. Check often. Average incomes are true. Pay high debts first. These turns fail to flow. Strength builds.

What are top budgeting mistakes to avoid for young adults?

For youth, top budgeting mistakes to avoid are loan overuses and no funds. Cards tempt easy buys. Track to stop. Ignore shared costs with roommates. List all upfront. Vague career saves fail. Aim job-tied goals. Subs pile quiet. Audit monthly. No insurance gaps risks. Shop cheap covers. These snag grads. Simple logs and small saves free you. The future brightens.

How can couples fix common pitfalls in monthly budgeting?

Couples mend common pitfalls in monthly budgeting by team talks. Share full pictures early. List joint bills clear. Set shared goals like trips. Add personal pots for peace. Track together weekly. Flex for dates or gifts. Review changes like raises. Apps sync for both. Forgive joint slips. This builds trust. Harmony grows from open plans.

Conclusion: Sidestep Common Budgeting Mistakes for Lasting Wins

Common Budgeting Mistakes like no tracks or rigid cuts trip man2y, but fixes bring freedom. Spot them, tweak plans, and watch savings rise. Use tips for steady habits. You deserve calm cash flow. What one mistake will you fix this week?

References

- Santa Monica College: Arakelian Budgeting Notes PDF – Educational resource with examples for young adults and couples on debt, insurance, and pre-marriage planning. ↩︎

- Scotiabank: Common Budgeting Mistakes and How to Avoid Them – Practical advice for Canadian families and beginners on tracking, irregular costs, and emergency funds. ↩︎