Have you ever swiped your card for a simple coffee, only to feel a wave of regret wash over you? Maybe you saw pretty new shoes, and your heart went “Yay!” You bought them, but then you looked at your bank and felt “Oh no! Did I mess up all my savings?”

Lots and lots of grown-ups feel the same way. You have a job, you pay for your house and food, and you still have some money left. But when you buy something just for fun, a little voice inside says, “You should not have done that!” That guilty feeling is super common.

This story will tell you why that voice shows up. We will talk about things you learned when you were little, things friends and TV say about money, and how your brain works.

Best of all, we will give you easy steps to feel happy when you spend money the right way. You can still save, pay bills, AND enjoy little treats without feeling sad after.

You deserve to smile when you buy something you love! Let’s unpack it together and turn that inner critic into a cheerleader.

Why Do I Feel Guilty Spending Money: Unpacking the Emotional Layers

Why do I feel guilty spending money often boils down to a mix of hidden emotions and learned habits. It’s not about being “bad with money”, it’s about how our brains and backgrounds wire us to see spending as a threat. You worked hard for many years. Now you have a good job and money left after you pay for food, house, and bills. Yay!

But when you want to buy something fun (like a toy, a pretty shirt, or ice cream), you feel nervous and guilty again.

You think, “I have enough… so why do I still feel bad?” Lots of grown-ups feel the same way. It’s okay!. Let’s break it down into key reasons, starting with the psychological roots.

The Psychology Behind Financial Guilt: Your Brain’s Built-In Alarm Systema

At its core, money guilt is your brain’s way of protecting you from perceived danger. A long, long time ago, people had to hunt and find food every day. If they used too much, they might not eat tomorrow. Our brains still remember that old rule!

Today we have jobs and money in the bank, but our brains still say, “Be careful! Don’t spend!” A big study found that 4 out of every 10 grown-ups feel worried and scared about money at the same time, even when they only buy little things.

Meet Sarah. She is 32 and has a good job. When she was little, her mom had to save every penny. Now Sarah can buy whatever she wants, but when she sees yummy cheese that costs $5, she stops and feels nervous. Her brain whispers, “What if you need that money later?”

Smart helpers say this is called a “scarcity brain.” It keeps thinking there is never enough. That worry can make it hard to sleep and hard to think happy thoughts.

It’s not your fault, it’s just an old brain trick!

But it’s not just fear. Guilt after buying often ties to self-judgment. You might label a purchase as “frivolous,” even if it brings joy, like a hobby supply or a weekend getaway. This moral framing turns money into a scorecard: Save = good person; Spend = irresponsible. In reality, balanced spending fuels happiness and productivity, which in turn boosts your earning power. A NerdWallet survey revealed that 52% of Americans frequently feel guilty about their spending habits, linking it directly to lower life satisfaction.

To spot this in action, watch for patterns. Do you rationalize every treat with “I earned it” but still feel uneasy? Or avoid checking your statements altogether? These are classic signs of personal finance psychology at work. The good news? Awareness is the first step to rewiring it.

How Upbringing Shapes Your Spending Habits and Triggers Regret

When you were little, did your mom or dad say, “Money doesn’t grow on trees!” or “We can’t buy that”? Did they worry out loud about bills at dinner? Those words went deep into your heart. Now, even when you have your own money, buying something just for fun feels wrong or selfish.

Meet Mike. He is 38 and has a good job. When he was a kid, his family never went on vacation. They said it was “wasting money.” Now Mike saves every extra dollar. He finally bought a fishing trip he had always wanted, but right after, he felt super guilty. He said, “I feel like I let my dad down.”

A big study says almost 7 out of 10 grown-ups carry money worries from when they were little. Some families teach that saving is the only good thing, and spending on fun is bad.

Girls hear it even more! People say, “Don’t buy pretty lotion or books, that’s too fancy!” But they let boys buy toys or games without saying anything.

If you ever had big bills on your card when you were young, that scary feeling sticks, too.

It’s not your fault. It’s just old words and old worries still talking in your head! Past mistakes create a fear loop: One impulse buy revives old shame. But remember, you’re not that person anymore. You’ve built a steady income and smart habits. Acknowledging this shift honors your growth.

The Role of Modern Life: Debt, Social Media, and Impulse Spending Regret

When you look at Instagram, you see fancy people on planes and beaches. You think, “I want that fun too!” So you buy a little treat, but then you feel bad right after.

Money helpers say: “Buying things just because friends do can make you sad later.” You want to pay off bills or save for when you’re old, but the pictures make you forget.

Everything costs more now, and many grown-ups owe $6,900 on their cards. Every time you swipe, your heart goes “uh-oh!” Almost half of the people say money worries make them feel sick or sad.

Lisa is 29. She got a better job and bought a plane ticket to Bali – her big dream trip! At first, she was super happy. Then she started worrying, “Did I use my safe money?” She could pay for it, but her brain still said “No!”

Prices go up, jobs can be scary, and almost 8 out of 10 people feel nervous about money. Even when you have extra dollars to spend, the guilty voice stops you from enjoying little happy things.

That’s not fair! You work hard. You should be able to smile when you buy something nice.

Common Signs and Stories

Recognizing financial guilt helps you address it head-on. Here are telltale signs, pulled from real experiences of working adults:

- You buy a fun book and feel happy… then you hide the paper like it’s a secret! The happy feeling turns into a worried feeling super fast.

- You walk past your favorite coffee shop and keep going, not because it costs too much, but because you are scared of feeling bad after you buy it.

- After one yummy dinner at a restaurant, you say, “Okay, now I will only eat at home for a whole week!” You try extra hard to save, and it makes you tired.

- At night, you can’t sleep because you keep thinking, “I should not have bought that $50 shirt,” even when you still have plenty of money.

Real stories from the internet: One grown-up bought a fun game for $500. He was so happy… then so guilty! He wrote, “It didn’t hurt my savings plan, but I still feel bad.” Another dad bought toys for his kids, then took them back to the store because he felt guilty. Later, he was sad because his kids didn’t get to smile.

Lots and lots of people feel this way – more than 7 out of 10! If this happens to you, it’s okay. It just means your heart is trying to tell you something. You can write down when the guilty feeling comes. That helps you understand it and feel better.

The Hidden Costs: How Guilt After Buying Affects Your Well-Being and Wallet

Feeling bad about spending makes you tired. That tired feeling takes away the energy you need for your job, your friends, and your family.

Many young grown-ups (6 out of 10) feel worried about money all the time. Older people worry less.

This guilty feeling can make you hide from friends. You say “no” to fun things because you don’t want to spend. Some people save every penny and never have fun. That’s not good either.

Your body feels it too! You can’t sleep, your shoulders hurt, and your tummy feels funny from all the worry.

Sometimes the guilty feeling makes you do silly things:

- You save too much and then suddenly buy everything.

- Or you buy things to feel happy, then feel even worse after.

Smart helpers say money worries can make you think, “I don’t deserve nice things.” That’s not true!

Here’s the happy news: When you learn to spend on things that make you smile (like a trip or a fun class), you feel stronger and smarter. One girl checked what she really loved, started spending on those things, and the guilty voice got quieter and quieter.

You deserve happy things. You really do!

The cost of ignoring it? Stagnation. You’re working hard for security—don’t let guilt steal the rewards.

Eye-Opening Stats: You’re Not Alone in This Money Mindset Struggle

Numbers don’t lie, and they validate your feelings. Here’s a snapshot:

- More than half of grown-ups in America (52 out of 100) feel bad when they spend money. It happens the most to people who have “just enough” money – like you!

- 71 out of 100 people feel sorry right after they buy something, especially when they grab it fast without thinking.

- 43 out of 100 say money worries make their hearts feel sad or tired sometimes.

- 77 out of 100 grown-ups feel nervous about money, and it gets worse when they want to buy a little treat for themselves.

- Even in faraway England, many people feel guilty when they use their savings money.

See? You are not alone! Almost everyone who tries to save and be smart with money feels this guilty feeling. It’s super normal!

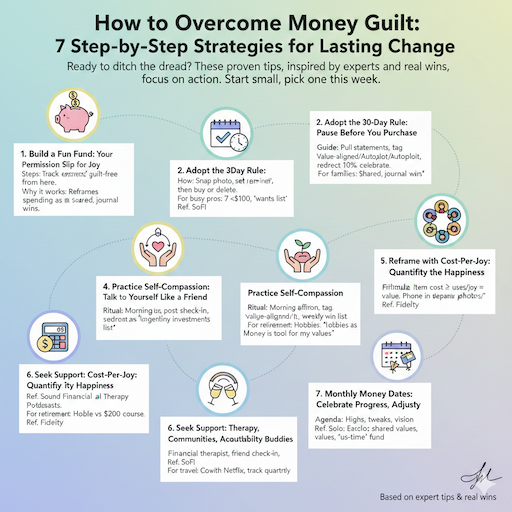

How to Overcome Money Guilt: 7 Step-by-Step Strategies for Lasting Change

Ready to ditch the dread? These proven tips, inspired by experts and real wins, focus on action. Start small, pick one this week.

1. Build a Fun Fund: Your Permission Slip for Joy

First, create a dedicated “blow money” bucket. After bills and savings (aim for 20% of income), allocate 5-10% for guilt-free treats. Reddit FI folks swear by this: One user set $200/month, using it for gadgets without second-guessing.

Steps to Set It Up:

- Track income/expenses for a month using a free app like Mint.

- Auto-transfer $50-100 bi-weekly to a separate account—label it “Joy Jar.”

- Rules: Spend only from here on wants. No regrets allowed.

Why it works: It reframes spending as planned, not sneaky. SoFi recommends this for impulse control, noting it cuts overspending regret by 30% in users. Over time, dipping in feels like a reward, not a risk. Imagine funding that pottery class without the post-buy blues, pure empowerment.

Expand on implementation: For a family of four, adjust to $300/month shared. Track wins in a journal: “Spent $20 on ice cream, family laughed all night. Worth every penny.” This builds evidence against the guilt gremlin. If debt lingers, start tiny at $20/week. Consistency compounds, just like savings.

2. Adopt the 30-Day Rule: Pause Before You Purchase

Impulse is guilt’s best friend. Counter it with a cooling-off period. Wait 30 days on non-essentials over $50. This trick, from SoFi’s playbook, lets wants reveal themselves as needs—or fade.

How to Make It Stick:

- Snap a photo of the item; set a calendar reminder.

- Ask: “Will this spark joy in a month? Align with my values?”

- If yes, buy. If no, delete the pic.

A 35-year-old teacher tried this after regretting a $300 blender. A month later? Still wanted it, for smoothies that fuel her mornings. No guilt after buying. Research backs it: Delays reduce emotional buys by 40%, per behavioral finance studies.

For busy pros, tweak to 7 days for under $100. Pair with a “wants list” spreadsheet, prioritize by joy score (1-10). This turns shopping into a strategy, easing budgeting guilt.

3. Audit Your Values: Spend on What Lights You Up

Mindful spending means aligning dollars with dreams. List top values, health, connection, growth, then categorize last month’s spends.

Inspired byHer First $100K’s approach to ditching money guilt1, Tori Dunlap suggests buckets like “adventure” or “self-care.”

Quick Audit Guide:

- Pull statements; tag each: Value-aligned (e.g., gym membership = health) or autopilot (e.g., daily latte = habit).

- Redirect 10% from non-essentials to values (e.g., swap takeout for a class).

- Celebrate: Toast aligned buys with a note, “This book grew my skills.”

Users report 50% less financial guilt after this, as spending feels purposeful. For retirement-focused folks, frame hobbies as “longevity investments”, golf clubs keep you active into the 70s.

Dive deeper: Interview yourself. “What childhood memory ties to this guilt?” Journal prompts uncover blocks, like “Mom said clothes were vanity.” Reframe: “Clothes boost my confidence at work.” Repeat weekly for mindset magic.

4. Practice Self-Compassion: Talk to Yourself Like a Friend

Guilt thrives on criticism. Flip it with kindness. When regret hits, say: “It’s okay; you’re learning.” This draws from therapy techniques in Sound Financial Therapy’s emotional stress guide.

Daily Ritual:

- Morning affirmation: “I deserve joy from my earnings.”

- Post-spend check-in: “What good did this bring? Lesson if not.”

- Weekly review: List three “wins,” like sticking to the budget.

A Millennial Therapy post shares a client who journaled compassion notes, slashing spending anxiety in three months. For parents, extend to kids: Model guilt-free ice cream runs to break cycles.

Build a habit: Use phone wallpapers with quotes like “Money is a tool for my values.” Over time, this quiets the inner judge, fostering guilt-free spending.

5. Reframe with Cost-Per-Joy: Quantify the Happiness

Turn abstract guilt into math. Calculate “cost per use” or “joy hours.” That $100 concert? If it sparks 20 happy memories, it’s $5 each, cheaper than therapy!

From Reddit tips: One user crunched a gaming console at $1/hour over the years, a game-changer for impulse spending regret.

Formula Fun:

- Item cost ÷ estimated uses/joy moments = value.

- Compare: $20 coffee vs. $200 course (lifetime skills).

- Track in app: Log post-buy joy on a 1-10 scale.

Fidelity advises this for money mindset shifts, reducing emotional ties. A graphic designer applied it to art supplies: $50 kit yielded endless projects, erasing doubt.

Customize: For travel lovers, factor in intangibles like photos or stories. Share calcs with a buddy for accountability; laughter lightens the load.

6. Seek Support: Therapy, Communities, and Accountability Buddies

You’re not meant to solo this. Dealing with financial guilt as a young professional thrives on connection. Join forums likeHow to get over feeling guilty about spending money on yourself2? or apps like YNAB for peer chats.

Find Your Tribe:

- Book a financial therapist via Psychology Today; sessions unpack trauma.

- Weekly check-in with a friend: “What treat this week?”

- Podcasts like “Her Money” for mindset boosts.

SoFi notes community normalizes feelings, cutting isolation. One pod listener, post-therapy, spent on a spa day guilt-free, crediting talks for clarity.

For couples: Discuss shared values first. “Our fun fund is us-time.” This prevents budgeting guilt from straining bonds.

7. Monthly Money Dates: Celebrate Progress, Adjust Freely

End each month with a ritual: Wine (or tea), statements, and cheers. Review wins, tweak budgets, no judgment.

Date Agenda:

- Highs: “Loved that hike—$30 well spent.”

- Tweaks: “Cut subscriptions; add hobby line.”

- Vision: “Next month: Art class for growth.”

This builds positive associations, per EastRise Credit Union tips. A couple in their 40s turned theirs into date night, blending finance with fun, and guilt vanished.

Scale it: Solo? Cozy up with Netflix. Track quarterly for big-picture peace.

Crafting a Guilt-Free Spending Mindset for Life

These strategies aren’t quick fixes; they’re mindset builders. Consistency fades money guilt, revealing spending as self-fuel. As you practice, notice shifts: Easier swipes, deeper joy, stronger security.

Remember the audience here: You, the steady-income earner eyeing retirement, debt freedom, or that dream home. Your prudence got you here; now, grace lets you thrive. Weave in emotional spending as an ally, treats recharge for the grind.

For deeper dives, exploreSoFi’s guide on why we feel guilty after spending for budget templates3.

FAQs

How do I stop feeling bad when I buy things for myself?

Make a special “Fun Money” jar every month. Put a little money in it just for happy treats. Before you buy something big, wait 30 whole days. If you still love it after 30 days, buy it and smile! Write down how happy it makes you feel. You will see the fun is worth it!

What if I keep buying things fast and then feel sorry?

When you want to buy right now, stop and take five slow breaths. Ask yourself, “Why do I want this today?” Write the answer in a little book. If it keeps happening, talk to a kind helper (like a counselor). They can help find the old worry that makes you feel bad.

Can money guilt hurt my friends or love?

Yes! If one person always says “no” to fun, or one spends more, people get upset. Sit together once a month for a “money date.” Eat ice cream and talk about dreams (like a trip or a new couch). When you both agree, spending feels happy, not scary!

How can I buy fun stuff without feeling bad when I’m young and working?

Use the easy 50-30-20 rule!

- 50% of your money pays bills and food.

- 30% is for fun things you want (games, clothes, trips).

- 20% goes to savings. That 30% is YOUR happy money because you worked hard! Buy a coffee or pretty shoes and say, “I earned this!” You deserve it!

Conclusion

Why do I feel guilty spending money? It’s a cocktail of psychology, past lessons, and modern pressures, but it’s beatable. By understanding roots like scarcity and FOMO, spotting signs early, and applying tools like fun funds and compassion, you reclaim joy. Stats show millions wrestle with this; your story adds to the chorus of change.