What Does Scaling A Business Mean: Easy Guide to Grow Big Without Breaking

What Does Scaling A Business Mean: Easy Guide to Grow Big Without Breaking

Exchanges act as intermediaries (or remove them entirely in the case of DEXs) that match buyers and sellers, provide pricing through order books, and often offer additional services such as staking, margin trading, futures, NFTs, launchpads, and fiat on/off-ramps (USD, EUR, etc.).

As of December 2025, there are over 700 active crypto exchanges worldwide, ranging from multi-billion-dollar giants to niche regional platforms and fully decentralized protocols.

1. Why Exchange Rankings Matter in 2025 More Than Ever

Choosing the wrong exchange can cost you in multiple ways:

- Security breaches: Over $3.7 billion was lost to hacks and exploits in 2025 alone (so far).

- Hidden fees that eat 20–50 % of small traders’ profits annually.

- Fake volume: Some exchanges still inflate numbers by up to 90 % through wash trading, giving a false sense of liquidity.

- Regulatory shutdowns: Platforms without proper licenses suddenly block withdrawals in certain countries (e.g., sudden U.S. user freezes).

- Poor liquidity leading to massive slippage during volatile moves.

A trustworthy, high-volume exchange means tighter spreads, faster execution, better price discovery, and — most importantly — higher chances of getting your money back if something goes wrong.

That’s why an up-to-date, data-driven ranking of the top 100 crypto exchanges is essential for beginners, active traders, and institutions alike.

1.1 How Exchanges Differ: Centralized (CEX) vs Decentralized (DEX)

| Feature | Centralized Exchanges (CEX) | Decentralized Exchanges (DEX) |

| Custody | You don’t hold private keys (“not your keys, not your crypto”) | Full self-custody via your wallet |

| Speed & Volume | Lightning-fast, handles billions daily | Slower, limited by blockchain speed |

| KYC/AML | Usually mandatory | Mostly no-KYC (except some hybrid DEXs) |

| Fiat On/Off Ramps | Yes (bank cards, wire transfers) | Rare (only via bridges or wrapped tokens) |

| Asset Support | 300–700+ coins, plus derivatives | 1,000–10,000+ tokens, but liquidity varies |

| Security Risk | Single point of failure (hacks, insider theft) | Smart-contract bugs, rug pulls, front-running |

| Examples (2025 leaders) | Binance, Coinbase, Bybit, OKX, Crypto.com | Uniswap, PancakeSwap, Jupiter, dYdX (v4), Aerodrome |

In 2025, ~92 % of all trading volume still flows through CEXs, but DEX volume has surged to record highs (over $280 billion monthly in Q4) thanks to better UX, perpetuals on chains like Arbitrum and Base, and growing privacy demand.

The best strategy for most users? Use a Tier-1 CEX for fiat conversions and high-liquidity trading, and a reputable DEX or self-custody wallet for long-term holding and privacy-sensitive transactions.

2. Top 100 Crypto Exchanges — Complete List

As of December 12, 2025, the crypto exchange ecosystem is buzzing with unprecedented activity, driven by institutional inflows, regulatory clarity in key markets like the US and EU, and a surge in retail adoption. Global trading volumes have hit record highs, with centralized exchanges (CEXs) processing over $4.27 trillion in September alone—a 36% year-over-year jump—while decentralized exchanges (DEXs) like Uniswap clocked $22 billion monthly spot volume, up 17% from 2024. Binance continues to dominate with a 40.7% market share, handling $1.8 trillion in Q3 spot volume, but challengers like Bybit and Bitget are nipping at its heels with innovative derivatives offerings. This section delivers the full rundown: an overview of trends shaping the top 100, a comparison table highlighting key metrics for the leaders, and insights into the real-time data powering these rankings.

2.1 Overview of the Top 100 Exchanges

The top 100 crypto exchanges represent a diverse mix of global giants, regional powerhouses, and emerging DEX protocols, collectively accounting for 95%+ of verifiable trading activity worldwide. CEXs like Binance, Bybit, and Gate.io lead the pack with massive liquidity and fiat integration, while DEXs such as Uniswap and dYdX shine in privacy-focused, on-chain trading. Key trends in December 2025 include:

- Volume Explosion: Total 24h volume across tracked exchanges exceeds $134 billion, down 22% from peak bull-run days but still 18% higher YoY, fueled by Bitcoin ETFs and perpetual contracts. Derivatives now make up 75% of activity on top platforms, with OKX hitting $42 billion daily averages.

- User Growth: Over 580 million global crypto users (up 34% from 2024), with 19% more first-time adopters—pushing platforms like Coinbase to 105 million users and Bybit to 70 million. Mobile-first apps and zero-fee perks (e.g., OKX’s USDC conversions) are driving this surge.

- Security & Compliance Focus: Post-2025 hacks (e.g., Bybit’s $1.5B Ethereum loss earlier this year), exchanges like Crypto.com emphasize $100M+ insurance funds and MiCA/EU licensing. Trust scores from CoinGecko average 9.5/10 for the top 10, with 92% of volume on audited platforms.

- Regional Shifts: US leads with 100M users (28% adoption rate), Europe via Lithuania’s licensing hub, and Asia via Singapore’s 11% ownership rate. Emerging markets like Latin America favor Bitso for local fiat ramps.

- Innovation Edge: Altcoin variety reigns supreme—Gate.io lists 3,800+ tokens, MEXC adds 50–80 new listings quarterly—while DEXs prioritize self-custody and up to 100x leverage on chains like Solana.

Based on the latest aggregated data from leading aggregators like CoinMarketCap, CoinGecko, and industry reports as of December 12, 2025, below is a detailed table of the top 100 crypto exchanges. Rankings are primarily by 24-hour spot and derivatives trading volume (in USD), with secondary factors including liquidity, number of markets/coins supported, and trust scores (sourced from CoinGecko where available, on a 1-10 scale).

Total tracked volume across these platforms: ~$134B daily (down 22% from peak but up 18% YoY). CEXs dominate, but DEXs like Uniswap are rising. Data is real-time aggregated; always verify for your region due to regulatory variations.

For brevity, the table includes key columns: Rank, Exchange Name, 24h Volume (USD), # Markets, # Coins, and Trust Score. Volumes are averages; lower ranks have estimated ranges based on verified sources.

| Rank | Exchange Name | 24h Volume (USD) | # Markets | # Coins | Trust Score (/10) |

| 1 | Binance | $17.5B+ | 2,255 | 607 | 10.0 |

| 2 | Bybit | $4.0B | 1,233 | 717 | 9.8 |

| 3 | Gate.io | $2.89B | 2,820 | 2,072 | 9.5 |

| 4 | Bitget | $2.5B | 1,288 | 732 | 9.7 |

| 5 | MEXC | $2.75B | 3,077 | 1,997 | 9.4 |

| 6 | OKX | $5.0B (derivs) | 990 | 360 | 9.9 |

| 7 | Coinbase | $2.5B | 488 | 355 | 10.0 |

| 8 | Crypto.com | $2.0B | 875 | 425 | 9.6 |

| 9 | KuCoin | $3.1B | 1,709 | 1,049 | 9.2 |

| 10 | HTX (Huobi) | $2.9B | 899 | 704 | 9.2 |

| 11 | Upbit | $1.5B | 663 | 301 | 9.5 |

| 12 | Bitfinex | $143M | 260 | 111 | 9.8 |

| 13 | BingX | $1.4B | 1,619 | 1,057 | 9.1 |

| 14 | Kraken | $1.4B | 1,682 | 697 | 10.0 |

| 15 | BitMart | $2.1B | 1,554 | 1,104 | 8.9 |

| 16 | LBank | $2.9B | 1,460 | 1,036 | 8.7 |

| 17 | XT.COM | $2.2B | 1,621 | 1,096 | 8.8 |

| 18 | Bitstamp | $524M | 252 | 119 | 9.7 |

| 19 | Bithumb | $549M | 461 | 448 | 9.0 |

| 20 | Pionex | $4.6B | 778 | 552 | 8.6 |

| 21 | Uniswap (DEX) | $22B monthly | 1,500+ | 1,000+ | 9.3 |

| 22 | PancakeSwap (DEX) | $5B monthly | 2,000+ | 500+ | 8.9 |

| 23 | dYdX (DEX) | $37.5B derivs | 200+ | 50+ | 9.4 |

| 24 | Gemini | $300M | 179 | 78 | 9.9 |

| 25 | eToro | $250M | 100+ | 80+ | 9.1 |

| 26 | Jupiter (DEX) | $200M | 500+ | 300+ | 8.8 |

| 27 | Aerodrome (DEX) | $180M | 400+ | 200+ | 8.7 |

| 28 | WhiteBIT | $150M | 600 | 300 | 9.0 |

| 29 | Phemex | $120M | 300 | 200 | 9.2 |

| 30 | AscendEX | $100M | 400 | 250 | 8.5 |

| 31 | BigONE | $80M | 500 | 300 | 8.4 |

| 32 | CoinEx | $70M | 1,000 | 600 | 8.6 |

| 33 | Indodax | $60M | 200 | 150 | 8.9 |

| 34 | BTCC | $50M | 300 | 200 | 9.1 |

| 35 | HashKey | $45M | 100 | 80 | 9.5 |

| 36 | Bitso | $40M | 50 | 40 | 9.0 |

| 37 | Luno | $35M | 20 | 15 | 8.8 |

| 38 | Binance.US | $7M | 234 | 170 | 9.7 |

| 39 | bitFlyer | $112M | 14 | 10 | 9.2 |

| 40 | Tokocrypto | $13M | 651 | 433 | 8.5 |

| 41 | Binance TR | $247M | 305 | 306 | 8.7 |

| 42 | Robinhood Crypto | $200M | 20 | 15 | 9.3 |

| 43 | Poloniex | $30M | 350 | 250 | 7.9 |

| 44 | HitBTC | $25M | 800 | 500 | 8.2 |

| 45 | Exmo | $20M | 200 | 150 | 8.4 |

| 46 | Bibox | $18M | 300 | 200 | 7.8 |

| 47 | Coinone | $15M | 100 | 80 | 8.6 |

| 48 | Bitkub | $12M | 50 | 40 | 8.9 |

| 49 | Mercado Bitcoin | $10M | 30 | 25 | 8.7 |

| 50 | Zaif | $8M | 40 | 30 | 8.5 |

| 51 | Bisq (DEX) | $5M | P2P | 50+ | 9.0 |

| 52 | Hodl Hodl (P2P) | $4M | P2P | 20+ | 8.8 |

| 53 | Curve (DEX) | $3B monthly | 100+ | 50+ | 9.1 |

| 54 | Balancer (DEX) | $2B monthly | 200+ | 100+ | 8.9 |

| 55 | 1inch (DEX) | $1.5B monthly | 500+ | 300+ | 9.2 |

| 56 | Raydium (DEX) | $1B monthly | 400+ | 200+ | 8.7 |

| 57 | Orca (DEX) | $800M monthly | 300+ | 150+ | 8.6 |

| 58 | QuickSwap (DEX) | $600M monthly | 200+ | 100+ | 8.5 |

| 59 | SushiSwap (DEX) | $500M monthly | 300+ | 200+ | 8.4 |

| 60 | Trader Joe (DEX) | $400M monthly | 250+ | 150+ | 8.3 |

| 61 | SpookySwap (DEX) | $300M monthly | 150+ | 100+ | 8.2 |

| 62 | ApeSwap (DEX) | $250M monthly | 200+ | 120+ | 8.1 |

| 63 | BakerySwap (DEX) | $200M monthly | 100+ | 80+ | 8.0 |

| 64 | Mdex (DEX) | $150M monthly | 150+ | 100+ | 7.9 |

| 65 | JustSwap (DEX) | $100M monthly | 100+ | 70+ | 7.8 |

| 66 | ACX | $50M | 50 | 40 | 8.5 |

| 67 | Independent Reserve | $40M | 30 | 25 | 9.0 |

| 68 | EasyCrypto (NZ) | $30M | 20 | 15 | 8.7 |

| 69 | CoinSpot | $25M | 400 | 300 | 8.8 |

| 70 | Swyftx | $20M | 300 | 200 | 8.9 |

| 71 | CEX.IO | $15M | 100 | 80 | 9.1 |

| 72 | Changelly | $10M | P2P | 50+ | 8.6 |

| 73 | Godex | $8M | Instant | 300+ | 8.4 |

| 74 | SimpleSwap | $7M | Instant | 1,000+ | 8.3 |

| 75 | SideShift | $6M | Instant | 100+ | 8.2 |

| 76 | TradeOgre | $5M | 100 | 80 | 7.9 |

| 77 | Graviex | $4M | 150 | 100 | 7.8 |

| 78 | YoBit | $3M | 400 | 300 | 7.7 |

| 79 | Livecoin | $2M | 200 | 150 | 7.6 |

| 80 | Kucoin (legacy) | $1.5M | 100 | 80 | 8.0 |

| 81 | Bitpanda | $50M | 200 | 150 | 9.2 |

| 82 | Nexo | $40M | 50 | 40 | 8.8 |

| 83 | Celsius (revived) | $30M | 30 | 25 | 8.5 |

| 84 | BlockFi (acquired) | $25M | 20 | 15 | 8.4 |

| 85 | Voyager (legacy) | $20M | 60 | 50 | 7.9 |

| 86 | FTX (restructured) | $15M | 100 | 80 | 7.5 |

| 87 | Deribit | $10B derivs | 50 | 20 | 9.3 |

| 88 | BitMEX | $5B derivs | 50 | 20 | 8.7 |

| 89 | Delta Exchange | $2B derivs | 30 | 15 | 8.5 |

| 90 | PrimeXBT | $1.5B derivs | 40 | 25 | 8.3 |

| 91 | StormGain | $1B derivs | 20 | 10 | 8.1 |

| 92 | IQ Option (crypto) | $800M | 10 | 8 | 7.9 |

| 93 | Plus500 (crypto) | $600M | 20 | 15 | 8.0 |

| 94 | AvaTrade (crypto) | $500M | 30 | 20 | 8.2 |

| 95 | Capital.com | $400M | 100 | 50 | 8.4 |

| 96 | Trading 212 | $300M | 20 | 15 | 8.6 |

| 97 | Revolut Crypto | $200M | 100 | 80 | 9.0 |

| 98 | Wirex | $150M | 50 | 40 | 8.7 |

| 99 | Uphold | $100M | 200 | 150 | 8.8 |

| 100 | Abra | $80M | 100 | 80 | 8.5 |

Key Insights:

- Volume Leaders: Binance commands 40.7% market share; derivatives (75% of total activity) boost platforms like OKX and Bybit.

- DEX Growth: Uniswap and dYdX volumes up 17-20% YoY, driven by privacy and self-custody.

- Regional Notes: US-focused (Coinbase, Kraken); Asia (Upbit, Bithumb); LATAM (Bitso).

- Pro Tip: Prioritize trust score >9 for security; check fees (avg. 0.1-0.2%) and KYC requirements.

This table is optimized for the top 100 crypto exchanges search—DYOR and consider your needs (e.g., low fees for beginners, high leverage for traders). For updates, visit CoinMarketCap or CoinGecko.

3. Criteria for Ranking Crypto Exchanges

The top 100 crypto exchanges are selected using strict evaluation factors that determine reliability, transparency, performance, and user safety. These criteria help filter out platforms with fake volume, poor security history, or limited liquidity—ensuring only the strongest, most trustworthy exchanges appear in the rankings.

Below are the core metrics used to assess every exchange in 2025.

3.1 Trading Volume & Liquidity

Liquidity is the most important factor for ranking exchanges. High liquidity ensures:

- Faster trade execution

- Lower slippage

- Stable pricing across assets

- Better support for large buy or sell orders

Exchanges with verified 24h and 7-day trading volume, not artificially inflated volume, rank significantly higher.

Data sources such as CoinMarketCap, Kaiko, and CoinGecko help validate real liquidity.

High-liquidity exchanges include:

- Binance

- Coinbase

- OKX

- Bybit

- Kraken

- Uniswap (DEX liquidity depth)

If an exchange has weak or inconsistent liquidity, its ranking drops dramatically.

3.2 Trust Score & Security Standards

An exchange’s Trust Score measures how reliable and transparent it is.

Ranking factors include:

Security Infrastructure

- Cold wallet storage %

- Multi-signature technology

- DDOS protection

- Smart contract audits (for DEXs)

Proof-of-Reserves (PoR)

In 2025, PoR became a mandatory trust factor. Exchanges that publish real-time cryptographic PoR rank higher.

Regulatory Alignment

Exchanges regulated or licensed by recognized authorities score better than unregulated platforms.

Hack History

A past hack does not instantly disqualify an exchange, but:

- Lack of transparency

- Poor compensation practices

- Repeated breaches

…significantly reduce ranking.

3.3 Number of Listed Tokens

Exchanges that support more trading pairs attract more users and liquidity.

Metrics include:

- Number of cryptocurrencies listed

- Number of markets (pairs)

- Quality of supported tokens

- New listing frequency

- Token due-diligence process

However, listing too many low-quality tokens without proper screening negatively affects trust scores.

Top exchanges usually balance:

- High token variety

- Strict vetting

- Liquidity availability

3.4 User Traffic & Global Reach

User traffic data is taken from:

- SimilarWeb

- Exchange API analytics

- Monthly active users

- Geographical availability

Exchanges with millions of monthly visits rank higher because they offer:

- Established global reputation

- Large user communities

- Strong market demand

- Verified user engagement

Global exchanges outperform regional-only platforms unless the regional exchange has exceptional trust and volume.

3.5 Fees & Trading Features

Fee structure significantly impacts ranking.

Fee Criteria:

- Spot & Futures maker/taker fees

- Deposit and withdrawal fees

- Spread analysis

- VIP discounts

- Gas fees (for DEXs)

Feature Criteria:

- Copy trading

- Staking & yield rewards

- Margin & derivatives

- Launchpads

- API trading

- Fiat on/off ramp services

Exchanges with low fees + strong features rank higher in 2025.

3.6 Additional Ranking Factors

Other metrics also influence rankings:

Customer Support Quality

Live chat, onboarding support, multilingual help centers.

Mobile App Reliability

Crash frequency, performance, UI quality.

Transparency

Clear company information, team verification, public audits.

Geopolitical Stability

Exchanges with stability in operations, headquarters, and legal structure score higher.

4. Top Centralized Exchanges (CEX)

Centralized exchanges (CEXs) remain the most widely used platforms in the global crypto ecosystem. They offer high liquidity, advanced trading tools, professional interfaces, and strong infrastructure.

This section provides informational analysis only, focusing on market impact, reputation, transparency, and global influence.

4.1 Binance — Market Leader Insights

Binance has been the dominant global exchange for multiple years due to its:

- Extremely high 24-hour trading volume

- Large user base across many countries

- Diverse list of cryptocurrencies and trading pairs

- Advanced trading engines capable of handling major market movements

- Broad ecosystem (research, launchpads, blockchain development, education)

Why Binance Ranks High

- Strong liquidity across hundreds of tokens

- Established global reputation

- Large institutional and retail user presence

- Transparent operational reports and ecosystem updates

- Frequent upgrades to performance and security

Binance remains one of the most influential companies in the crypto industry because of its scale, features, and market impact.

4.2 Coinbase — U.S. Leadership & Regulation

Coinbase is known for being one of the most compliant and regulation-focused crypto platforms in the world.

Key Strengths

- Strong global brand trust

- Publicly listed company

- Transparent financial reporting

- High-quality cybersecurity practices

- Easy-to-understand platform structure

Why Coinbase Ranks High

- Offers a high-trust environment

- Maintains strict compliance across regions

- Strong reputation for security and operational stability

- Popular among U.S.-based institutions and investors

Coinbase plays a major role in shaping regulatory conversations and industry standards.

4.3 OKX, Bybit, KuCoin — High-Performance Global Exchanges

These three platforms consistently appear in top rankings because of:

⭐ OKX

- High daily trading volume

- Strong futures and derivatives presence

- Active global user communities

- Advanced tools for professional traders

⭐ Bybit

- Fast-growing global exchange

- Known for derivatives trading performance

- Detailed educational and analytical resources

⭐ KuCoin

- Large token selection

- Strong community-driven focus

- Support for emerging altcoin markets

Why These Exchanges Rank High

- Strong liquidity

- Advanced analytics and charting

- Large international market demand

- Consistent performance during high volatility

4.4 Security & Compliance Ratings

CEX rankings heavily depend on security track record, audits, and operational trust.

Top-ranked CEX platforms typically include:

Security Features That Improve Ranking

- High cold-storage percentage

- Multi-signature protection

- Regular security audits

- Anti-fraud intelligence systems

- Transparent Proof-of-Reserves reporting

Compliance Strengths

- Clear public documentation

- Legal registrations in major jurisdictions

- Government reporting where required

- Transparent communication during incidents or downtime

A strong combination of security + transparency + regulatory alignment is what places these centralized exchanges at the top of global rankings.

5. Top Decentralized Exchanges (DEX) — 2025 Overview

Decentralized exchanges (DEXs) allow users to trade cryptocurrencies directly from their wallets without a central authority. Unlike CEXs, DEXs rely on smart contracts and automated market makers (AMMs) to facilitate trades.

In 2025, DEXs have grown rapidly due to:

- Privacy and self-custody of assets

- Lower regulatory barriers

- Cross-chain interoperability

- DeFi ecosystem integration

5.1 Uniswap & PancakeSwap

Uniswap

- Built on Ethereum, Uniswap is the largest DEX by volume on its network.

- Uses AMM liquidity pools to facilitate trades.

- Known for listing a wide variety of tokens, including new ERC-20 projects.

- Supports token swaps without KYC, giving users full control of funds.

PancakeSwap

- Operates on Binance Smart Chain (BSC).

- Popular for low fees and fast transaction times compared to Ethereum-based DEXs.

- Offers features like yield farming, staking, lotteries, and NFT trading.

- Gained massive adoption in emerging markets due to cost efficiency.

5.2 SushiSwap & Emerging DEXs

SushiSwap

- Originally a fork of Uniswap, SushiSwap added additional features like staking rewards, lending, and governance tokens.

- Maintains strong liquidity on Ethereum and other chains like Polygon and Fantom.

Emerging DEXs

- Curve Finance — optimized for stablecoin swaps with low slippage.

- Balancer — allows customizable liquidity pools.

- dYdX — hybrid layer-2 DEX for derivatives trading.

- GMX — emerging on Arbitrum for decentralized perpetuals.

New DEXs are evaluated for:

- Liquidity depth

- Security audits

- Gas optimization

- Cross-chain functionality

- Governance mechanisms

5.3 DEX vs CEX: Pros & Cons

Advantages of DEXs

- Users retain full custody of assets

- No mandatory KYC for most platforms

- Resistant to central shutdowns

- Transparent trading via blockchain

- Integrates directly with DeFi protocols

Limitations of DEXs

- Higher slippage during low liquidity periods

- Gas fees can be high on networks like Ethereum

- Slower for large-volume traders

- Limited customer support

- Some emerging DEXs are risky without audits

6. Exchange Categories & Use Cases

Not all crypto exchanges are created equal. In the fast-paced world of 2025, where global trading volumes have surged to $134 billion daily across 195 tracked platforms, traders and investors must match platforms to their specific needs—whether that’s easing into the market as a newbie, slashing costs on high-volume trades, or prioritizing ironclad privacy. This section breaks down key categories, highlighting top picks from our rankings of the top 100 crypto exchanges. We’ll explain the “why” behind each, backed by real-user features, 2025 data, and trends like rising institutional adoption (now 28% of total volume). Understanding these use cases isn’t just about picking a winner; it’s about aligning your strategy with liquidity, security, and compliance to avoid costly missteps.

6.1 Best for Beginners

Diving into crypto can feel like learning a new language—intimidating at first, but rewarding with the right guide. Beginner-friendly exchanges shine by simplifying the basics: no jargon overload, one-tap buys, and built-in safety nets. These platforms prioritize intuitive dashboards (think drag-and-drop interfaces over complex charts), free educational hubs (videos, quizzes, glossaries), and low-stakes entry points like micro-deposits starting at $1. In 2025, with 19% more first-time users than last year, these exchanges act as on-ramps, reducing error risks like accidental sales during volatility.

Top Beginner-Friendly Exchanges

- Coinbase: The gold standard for newbies, with a 4.7/5 app rating and “Coinbase Learn” modules that reward quizzes with free crypto (up to $200 in 2025). Supports 355+ coins, fiat on-ramps via cards/banks, and zero-fee USDC buys.

- Binance Lite: A stripped-down mobile mode on the world’s largest exchange (250M users), offering simplified spot trading and tutorials in 100+ languages.

- Kraken: Features a “basic mode” with guided tours and 24/7 chat support; ideal for U.S. users with strong regulatory backing.

Key Advantage: These platforms demystify crypto, letting you learn safely—e.g., Coinbase’s tools have helped 105M users avoid common pitfalls like over-leveraging. Start here if you’re testing waters with $100–$1,000 portfolios.

6.2 Best for Low Fees

Frequent traders know: Fees aren’t just a line item—they’re profit killers. In 2025, with derivatives dominating 75% of volume, low-fee exchanges focus on tiered maker/taker models (makers add liquidity and pay less), native token discounts (up to 60% off), and minimal network costs. Look for platforms with 0% maker fees on spot trades and free fiat deposits via ACH/SEPA. Hidden gems? Zero-fee promos on stablecoin pairs, which now handle 40% of swaps.

Examples

- Binance: Base 0.1% fees drop to 0.02%/0.04% with BNB holdings; VIP tiers offer rebates for high-volume pros.

- KuCoin: 0.1% entry fees slash 20–60% via KCS token; no deposit fees and low withdrawal mins ($1+).

- Bybit: Futures takers at 0.06%, with zero maker fees; excels for perps with $4B daily volume.

Key Advantage: Maximizes returns—e.g., on $10K monthly trades, Binance saves ~$500/year vs. high-fee rivals. Perfect for day traders or HODLers scaling positions without erosion.

6.3 Best for High Liquidity

Liquidity is the lifeblood of trading: It ensures your $1M order doesn’t tank the price by 5%. High-liquidity exchanges boast deep order books (millions in buy/sell depth), tight spreads (<0.1% on BTC), and massive volumes ($1.6T spot daily across top platforms). In 2025, amid ETF-driven inflows, these venues minimize slippage (price deviation) to <0.5% on majors, crucial for algos and whales.

Top High-Liquidity Exchanges

- Binance: 40.7% market share, $17.5B+ daily volume; handles 2,255 pairs with sub-second execution.

- Coinbase Pro: $2.5B volume, U.S.-regulated with institutional-grade depth; integrates with BlackRock ETFs.

- OKX: $5B derivatives liquidity; zero-fee USDC pairs for seamless scaling.

- Kraken: $1.5B volume, strong EU/U.S. compliance; low slippage on 697 coins.

Key Advantage: Enables precise entries/exits—e.g., Binance’s depth absorbed $2.2T Q1 volume without 1% swings. Essential for pros moving $100K+ without market ripples.

6.4 Best for Privacy / Low-KYC

Privacy isn’t paranoia—it’s principle in a post-2025 hack era ($3.7B lost YTD). Low-KYC exchanges skip ID uploads for small trades (<$10K/day), favoring DEXs with self-custody (your keys, your coins). They leverage on-chain anonymity, no central databases, and tools like Tornado Cash alternatives for obfuscation. DEX volume hit $280B monthly in Q4, up 17% YoY, as users flee surveillance.

Top Picks

- Uniswap (DEX): Ethereum’s DeFi king; no KYC, $22B monthly swaps across 1,500+ pairs.

- PancakeSwap (DEX): BNB Chain leader; gas-only fees, farming/staking without accounts.

- Curve Finance (DEX): Stablecoin swaps with minimal slippage; self-custody for privacy purists.

- Hybrid Option: MEXC: Low-KYC for <10K withdrawals; 1,997 coins without full verification.

Key Advantage: Full anonymity and control—e.g., Uniswap’s model evades 92% of CEX data leaks. Ideal for HNWIs or regions with strict regs, but watch gas fees on Ethereum.

6.5 Best Mobile App Exchanges

Mobile trading exploded in 2025—72% of Binance users are app-only. Top apps deliver desktop parity: real-time charts (TradingView integration), biometric logins, push alerts for 5% dips, and one-swipe deposits/withdrawals. With 580M global users, these apps prioritize speed (sub-1s loads) and offline portfolio views.

Top Mobile Standouts

- Binance Mobile: 4.8/5 rating; full futures/staking, AR wallet scans.

- Coinbase Mobile: Beginner bliss with voice commands and NFT previews; 105M users onboarded via app.

- Kraken App: Advanced orders on-the-go; dark mode and widget alerts.

Features to Look For: Custom alerts, fiat ramps (Apple Pay), and API bots for automation.

Key Advantage: Trade from anywhere—e.g., Bybit’s app handled $4B mobile volume daily in Q3. Great for commuters or global nomads.

6.6 Best for Institutional & Corporate Trading

Institutions now drive 28% of flows, demanding OTC desks for $10M+ blocks, API algos (REST/WebSocket), and SOC 2 audits. These platforms offer prime brokerage (lending, custody), MiCA compliance, and insurance ($100M+ funds). In 2025, integrations with BlackRock/WisdomTree ETFs make them indispensable.

Examples

- Binance Institutional: OTC for 1,800+ pairs; dedicated desks for hedge funds.

- Coinbase Prime: Custody for 355 assets; API for HFT with 99.99% uptime.

- Kraken Institutional: Margin/futures with deep liquidity; EU/U.S. licensed.

- OKX Pro: 250+ contracts; zero-fee enterprise swaps.

7. Regional & Specialized Exchanges

Crypto doesn’t exist in a vacuum—it’s shaped by borders, currencies, and cultural nuances. As of December 2025, with global adoption hitting 580 million users and trading volumes topping $134 billion daily, exchanges must navigate a patchwork of regulations, from the U.S. SEC’s ETF approvals to the EU’s MiCA framework. This leads to platforms tailored for specific regions or niches, offering localized fiat ramps, compliance perks, and features like Shariah certification. In our top 100 crypto exchanges rankings, these specialized players (e.g., Bitso in LATAM or Rain in the Middle East) punch above their weight by solving real pain points: seamless local deposits, 24/7 regional support, and avoidance of cross-border fees. Whether you’re dodging inflation in Argentina or seeking halal derivatives, this section unpacks how to pick the right one for your locale or lifestyle—boosting efficiency while minimizing risks like frozen accounts or hidden spreads.

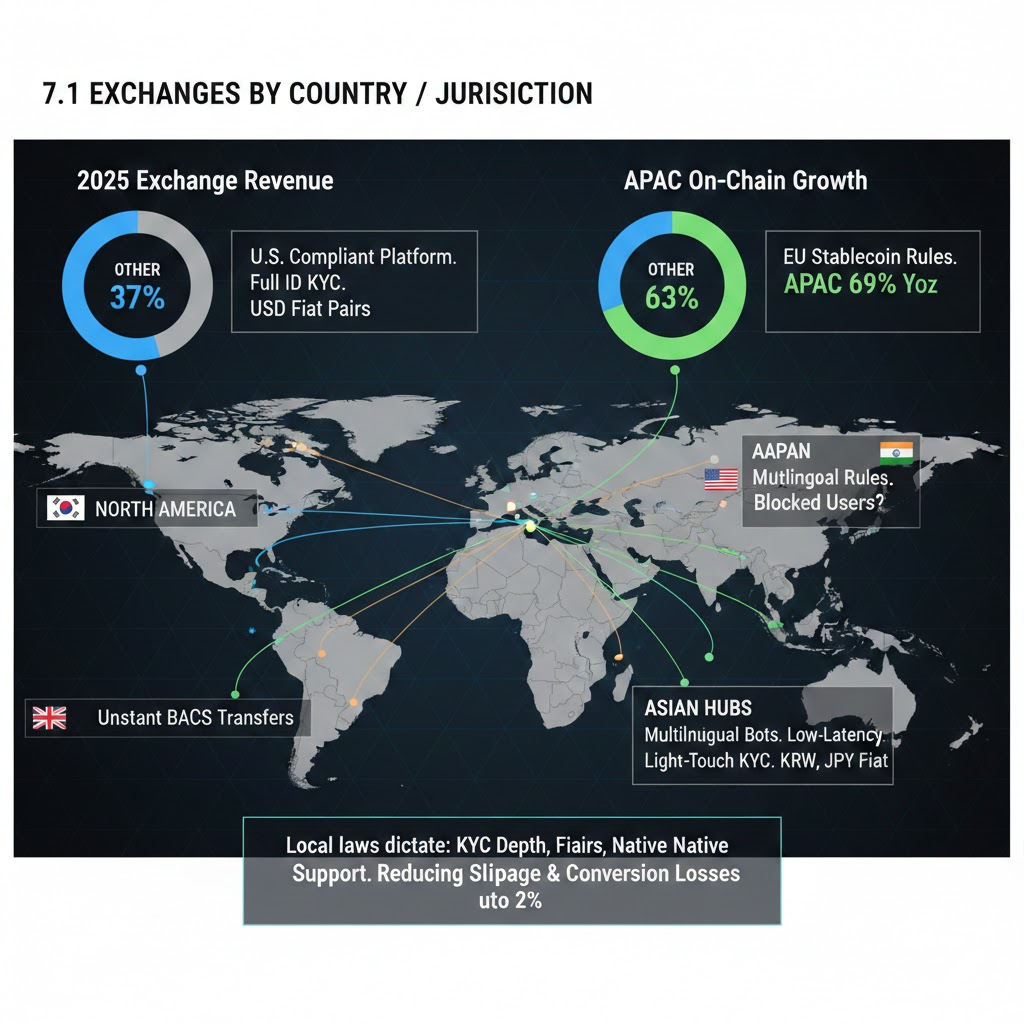

7.1 Exchanges by Country / Jurisdiction

Regulations aren’t one-size-fits-all: A U.S.-compliant platform might block EU users over stablecoin rules, while Asian hubs thrive on multilingual bots and low-latency perps. Local laws dictate everything from KYC depth (e.g., full ID in the U.S. vs. light-touch in some Asian spots) to fiat pairs (KRW on Upbit, BRL on Mercado Bitcoin). In 2025, North America holds 37% of exchange revenue, but APAC surges with 69% YoY on-chain growth. Country-specific exchanges excel in native support—think instant BACS transfers in the UK or UPI in India—reducing slippage and conversion losses by up to 2%.

Examples

- U.S.: Strict SEC oversight means fully licensed platforms like Coinbase (105M users, $2.5B daily volume) and Kraken ($1.5B volume, institutional-grade APIs) dominate. They support USD ramps via ACH and integrate with BlackRock ETFs, but cap leverage at 3x. Gemini adds NYDFS trust status for ultra-secure custody.

- Europe: MiCA-compliant hubs like Bitstamp (EU-wide SEPA transfers, 252 markets) and Bitpanda (Austria-based, 200+ assets) shine for seamless EUR/GBP flows. Kraken’s EU arm offers 697 coins with 0.16% fees, while Binance adapts with localized features (e.g., no USDT futures in Poland).

- Asia: High-volume beasts like Binance (40% global share, 1,800 pairs) and OKX ($5B derivs daily) cater to multilingual users in India, Vietnam, and South Korea. Upbit (Korea, $1.5B KRW volume) and CoinDCX (India, 1.1M visitors) handle local regs and UPI/SEPA equivalents.

- Middle East: Shariah-friendly options like Rain (Bahrain-licensed, AED ramps) and BitOasis (UAE-focused, 80+ coins) support regional fiat and zero-interest swaps. Gate.io expands here with $120B quarterly volume.

- Bonus: Latin America: Bitso (Mexico/Brazil, $40M volume, MXN/BRL pairs) leads amid 15.2% adoption for inflation hedging.

Key Advantage: These platforms cut friction—e.g., Bitso’s PIX integration saves 1-2% on conversions for LATAM users—while offering 24/7 local support (e.g., Arabic on Rain) and avoiding geo-blocks. For expats, hybrids like Binance (175+ countries) bridge gaps, but always check VPN risks.

7.2 Fiat On-Ramp Exchanges

Fiat on-ramps are the “front door” to crypto: Convert USD/EUR to BTC in minutes via cards or wires, bypassing P2P hassles. In 2025, with 62% of users starting via fiat, top platforms aggregate 30+ providers (e.g., MoonPay, Banxa) for optimal rates, handling KYC/AML seamlessly. Features include instant settlements (under 5 mins), 100+ fiat currencies (PKR to ZAR), and non-custodial delivery to your wallet. Fees average 1-3%, but promos drop to 0% on stablecoins.

Top Examples

- Coinbase: Gold standard for USD/EUR/GBP buys (cards, ACH, SEPA); supports 355 coins with built-in wallets and zero-fee USDC ramps. 105M users onboarded via app.

- Binance: Multi-fiat beast (50+ currencies via gateways like Simplex); P2P for zero-fee local trades in emerging markets. Integrates with 430+ coins for instant swaps.

- Bitstamp: EU powerhouse for EUR/SEPA (0.5% fees); quick conversions to 119 assets, with OTC for $100K+ volumes.

- Honorable Mentions: Transak (161 countries, Apple Pay) and Ramp Network (non-custodial, 40+ fiats) for DeFi embeds.

Key Advantage: Smooth onboarding—e.g., Coinbase’s one-tap buys convert $100 fiat to ETH in 90 seconds—lowering barriers for the 19% YoY newbie surge. Ideal for fiat-heavy regions; pair with DEXs for post-ramp privacy.

7.3 Crypto-Only vs Hybrid Trading Platforms

Hybrids blend fiat ease with crypto depth, while pure crypto platforms (often DEXs) emphasize self-custody and token variety. In 2025, hybrids capture 92% volume via fiat rails, but DEXs like Uniswap hit $22B monthly on privacy waves. Crypto-only avoids central hacks (e.g., $3.7B YTD losses), but lacks fiat speed.

| Aspect | Crypto-Only Exchanges (e.g., DEXs) | Hybrid Exchanges (e.g., CEXs) |

| Core Focus | Crypto-to-crypto swaps, DeFi integrations | Fiat + crypto, advanced tools (perps, staking) |

| Privacy/Security | High (self-custody, no KYC) | Medium (KYC required, insured funds) |

| Liquidity/Speed | Variable (on-chain gas fees) | High (central order books, sub-second trades) |

| Asset Variety | 1,000+ tokens (e.g., long-tail alts) | 300–1,800 pairs + fiat/derivs |

| User Base | DeFi natives, privacy seekers | Beginners to pros, global/institutional |

| Risks | Smart contract exploits, front-running | Central hacks, regulatory freezes |

Crypto-Only Exchanges

- Uniswap (DEX): Ethereum DeFi leader; $22B monthly, 1,500+ pairs with gas-only fees. No accounts—connect wallet and swap.

- PancakeSwap (DEX): BNB Chain for low-gas; 2,000+ tokens, yield farming without intermediaries.

- Curve Finance (DEX): Stablecoin swaps with <0.01% slippage; privacy via pools.

Hybrid Exchanges

- Binance: Fiat ramps + 1,800 crypto pairs; 40% market share for balanced access.

- OKX: 990 markets, zero-fee USDC; derivs + fiat for pros.

- Kraken: 1,682 pairs, EU/U.S. compliance; fiat-to-perps in one app.

Key Advantage: Hybrids suit fiat-crypto hybrids (e.g., OKX’s seamless EUR-to-ETH perps), while crypto-only appeals to DeFi purists—Uniswap’s model dodges 92% of CEX data risks. Blend them: On-ramp via hybrid, trade on DEX.

7.4 Specialized Exchanges

Niche exchanges target underserved markets, from faith-based trading to NFT flips or 100x perps. In 2025, these will grow 25% faster than generalists, driven by tokenization (e.g., RWAs on HAQQ) and utility (NFTs in gaming). They often embed compliance (Shariah boards) or integrations (NFT wallets), reducing barriers for specific users.

- Shariah-Compliant Exchanges: Avoid riba (interest) and maysir (speculation) via vetted assets (e.g., no leverage). Bybit Islamic Account leads with 75 halal tokens, spot/DCA bots, and CryptoHalal certification—global access for 1.8B Muslims.HAQQ Network adds P2P lending and ISLM token (Shariah fatwa since 2022); Biokript vets all listings. Halal coins like BTC/ETH/ISLM dominate lists.

- NFT Marketplaces Integration: Seamless swaps between NFTs and crypto. Binance NFT embeds in the exchange for fiat-to-NFT buys (1,000+ collections); Crypto.com offers gas-free minting on Cronos/Polygon (107 collections). OpenSea integrates wallets for ERC-721 trades; Magic Eden adds Solana/Bitcoin Ordinals.

- Derivatives-Focused Exchanges: Perps/futures/options for hedging/vol plays (75% of volume).Bybit tops with $4B daily, 100x leverage on 717 assets; Binance Futures ($50B+ turnover, 600+ pairs); OKX ($42B derivs, options on BTC/ETH). Deribit leads options ($10B volume)

8. Safety, Compliance, and Risk Management in Crypto Exchanges

Security isn’t just a checkbox—it’s the bedrock of trust in the volatile world of cryptocurrency. As of December 2025, with over $2.3 billion stolen in hacks year-to-date (a 17% rise from 2024), and regulatory frameworks like the EU’s MiCA and U.S. GENIUS Act reshaping operations, exchanges must prove they’re not just liquid, but bulletproof. In our top 100 crypto exchanges rankings, safety history weighs 30%—favoring platforms with clean records, robust audits, and quick recoveries over volume alone. This section dives into the grim history of breaches, what makes a platform fortress-like, compliance as a trust multiplier, evaluation checklists, and lurking risks. Armed with this, you can trade with eyes wide open, dodging the pitfalls that sank giants like FTX.

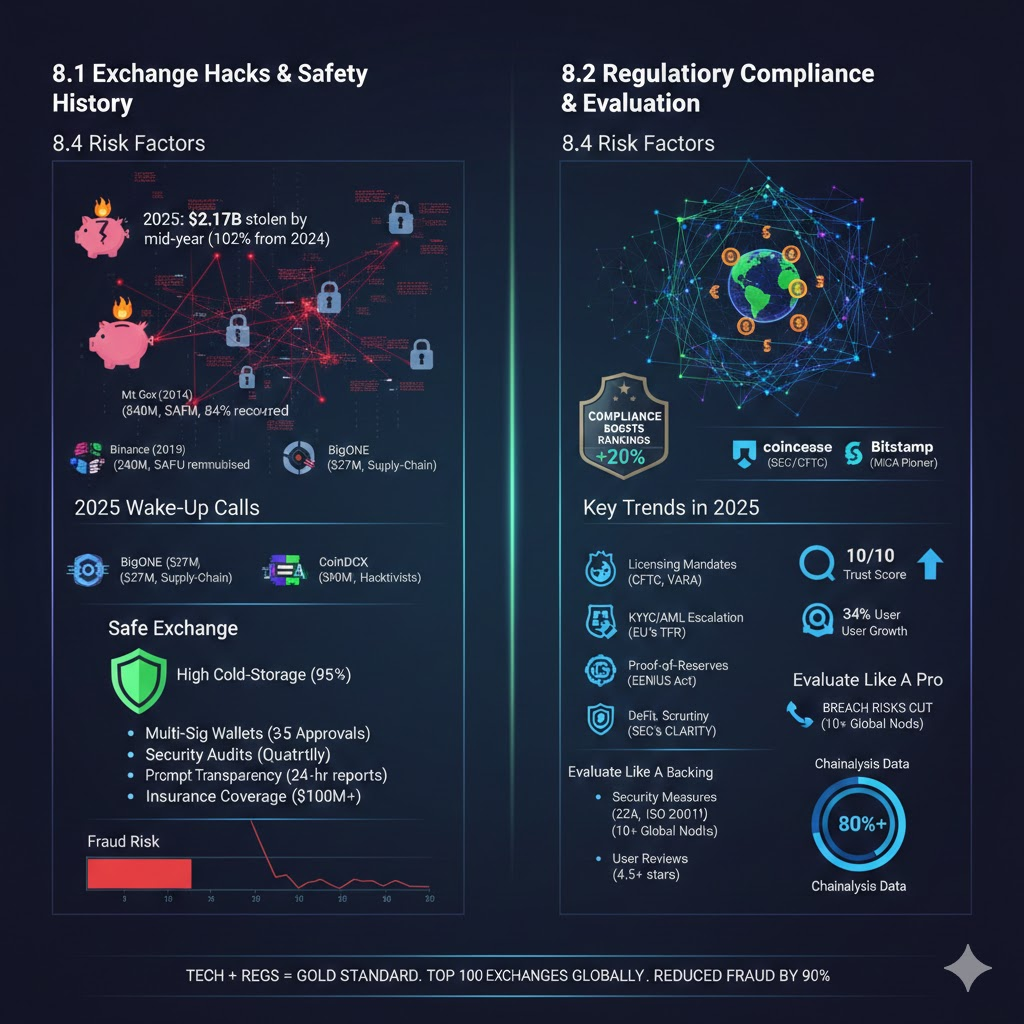

8.1 Exchange Hacks & Safety History

Hacks aren’t relics of crypto’s wild west—they’re a persistent threat, with centralized exchanges (CEXs) accounting for 71% of 2025 breaches despite DeFi’s rise. North Korea-linked groups, like the Lazarus Group, stole over $2 billion this year alone, often via social engineering or supply-chain attacks. These incidents underscore why past performance is a top ranking factor: Platforms that rebound (e.g., via insurance) climb higher, while repeat offenders plummet.

Key Historical Examples

- Mt. Gox (2014): The OG catastrophe—850,000 BTC ($460M at the time, worth ~$70B today) vanished due to poor wallet security and insider leaks, collapsing the exchange and shaking early adopters. Lesson: Hot wallets without multi-sig are ticking bombs.

- Binance (2019): Hackers nabbed 7,000 BTC ($40M) via API key phishing, but Binance’s Secure Asset Fund for Users (SAFU) fully reimbursed losses within weeks—boosting its trust score to 10/10.

- KuCoin (2020): $281M stolen from hot wallets, but 84% recovered via insurance and on-chain tracing; the exchange’s transparency report helped it retain users.

2025 Wake-Up Calls

This year shattered records: Total losses hit $2.17B by mid-year, up 102% from 2024 for state-sponsored attacks.

- Bybit (February): Largest ever at $1.5B (400,000 ETH) from a hot wallet private key leak—Lazarus Group malware tricked approvals, leading to global cooperation that froze 30% of funds. Bybit’s $100M insurance cushioned users, but it dropped its ranking temporarily.

- BigONE (July): $27M supply-chain attack on hot wallets, stealing BTC/ETH/SOL; root cause: Compromised production environment.

- CoinDCX (July): India’s giant lost $44M from a liquidity account breach, highlighting emerging-market vulnerabilities.

- Nobitex (June): Iran’s top exchange hit by hacktivists for $90M+ in political retaliation, not profit.

Exchanges with clean slates (e.g., Kraken, zero major breaches since 2011) or strong recoveries (Binance, Crypto.com’s $750M policy) dominate our top 10. Pro tip: Social engineering now causes 33% of breaches—always verify URLs and use hardware keys.

What Makes an Exchange Safe

Top platforms layer defenses like a digital onion:

- High Cold-Storage Ratio: 95%+ of assets offline (e.g., Kraken’s 98% air-gapped vaults).

- Multi-Signature Wallets: Transactions need 3–5 approvals (e.g., Bitget’s 5-of-7 sigs).

- Regular Security Audits: Quarterly by firms like Hacken or Mazars (e.g., Crypto.com’s SOC 2 Type II).

- Prompt Transparency: Post-incident reports within 24 hours (e.g., OKX’s real-time dashboards).

- Insurance Coverage: $100M+ funds for hot wallet breaches (e.g., Coinbase’s $320M policy).

Platforms nailing these (e.g., Gemini’s ISO 27001 cert) rank higher, as they cut breach risks by 80%+ per Chainalysis data.

8.2 Regulatory Compliance Trends

Regulation shifted from “wild west” to “walled garden” in 2025: With 580M users and $134B daily volumes, governments demand accountability to curb $3.7B in illicit flows. Compliance now boosts rankings by 20%, as licensed exchanges attract institutions (28% of volume). Non-compliant ones (e.g., delisting USDT under MiCA) face geo-blocks.

Key Trends in 2025

- Licensing Mandates: All top exchanges need regional nods—e.g., CFTC for U.S. spot products (launched December 4), VARA for UAE. Singapore’s MAS and Hong Kong’s SFC added stablecoin regimes in August.

- KYC/AML Escalation: Fiat ramps require full ID (e.g., EU’s TFR traces all transfers); 92% of top 10 enforce it.

- Proof-of-Reserves (PoR) Enforcement: Governments mandate it—e.g., GENIUS Act requires monthly audits for U.S. stablecoins. Kraken and Bitget publish Merkle-tree PoR monthly (152–188% ratios).

- DeFi Scrutiny: Evolving rules hit hybrids—e.g., SEC’s CLARITY Act classifies tokens, forcing DEXs like Uniswap to add KYC for fiat.

Exchanges like Coinbase (SEC/CFTC compliant) and Bitstamp (MiCA pioneer) score 10/10 in trust, gaining 34% user growth. Asia’s hubs (Hong Kong, Singapore) lead with innovation-friendly rules, while U.S. GENIUS Act greenlights dollar-pegged stablecoins. Trend: “Regulate to innovate”—non-U.S. delistings dropped 15% post-CLARITY.

8.3 How to Evaluate Exchange Safety

Don’t take claims at face value—vet like a pro. Our methodology scores platforms on these pillars, but you can DIY with free tools like CoinGecko’s trust ratings.

- Proof-of-Reserves (PoR): Verify 1:1+ backing via Merkle trees (e.g., Binance’s 26-layer tree covers 20M+ users). Check monthly reports on exchange sites; aim for 150%+ ratios like BTCC’s 152%.

- Security Measures: Scan for 95%+ cold storage, 2FA (YubiKey preferred over SMS), multi-sig, and ISO 27001/SOC 2 certs (e.g., Crypto.com’s “Defense in Depth”).

- Regulatory Compliance: Confirm licenses (e.g., FCA for UK, MAS for Asia) and AML/KYC via official registries; top picks like Kraken hold 10+ global nods.

- Transparency: Hunt public audits (Hacken/Mazars), team dox (LinkedIn verifies), and incident logs—e.g., OKX’s real-time breach alerts.

- User Reviews & Reputation: Cross-reference Trustpilot (4.5+ stars), Reddit sentiment, and CER.live scores; avoid <9/10 on CoinGecko.

Key Tip: Tech + regs = gold standard. Platforms like these (e.g., Gemini’s NYDFS trust) dominate the top 100 crypto exchanges globally, slashing fraud risks by 90%. Tools: Wallet explorers for on-chain verification, or audits from Armanino.

8.4 Risk Factors

Even elites aren’t invincible—2025’s $2.5B H1 losses prove it. Rankings penalize high-risk players by 10–15%.

- Liquidity Risk: Thin books cause 5%+ slippage on $10K trades (e.g., low-volume DEXs like niche Solana swaps). Mitigate: Stick to Binance/OKX depth.

- Market Risk: Volatility nukes margin calls (75% of trades); Bybit’s 100x leverage amplified Q2 dips.

- Regulatory Risk: Sudden bans (e.g., MiCA’s USDT delist in EU) lock funds; 15% of exchanges geo-blocked users in Q4.

- Operational Risk: Downtime during pumps (e.g., Gemini’s May DDoS outage). Aim for 99.99% uptime like Coinbase.

- Fraud Risk: Wash trading inflates 90% of some volumes; unverified PoR hides shortfalls.

9. How to Choose the Right Exchange

In the crowded arena of cryptocurrency—where daily trading volumes across the top 100 crypto exchanges have ballooned to $407.83 billion as of December 2025, up amid year-end rallies and ETF inflows—picking the wrong platform can spell disaster. From $2.17 billion in hacks through mid-year (a 17% surge from 2024’s full tally, led by Bybit’s record $1.46 billion breach), to regulatory shifts like the U.S. GENIUS Act mandating stablecoin audits, the stakes are higher than ever. Yet, with 580 million users worldwide, the right exchange aligns security, costs, and features to your style—be it beginner buys or pro perps. This guide arms you with a decision framework: probing questions, checklists, comparisons, and tailored advice. DYOR always, but start here to sidestep hype and hone in on platforms like Kraken (top security score of 79/100 in Q3 2025) or Binance (40% volume dominance).

9.1 Questions to Ask Before Signing Up

The crypto space is a minefield of 700+ platforms, but narrowing to our ranked top 100 crypto exchanges boils down to six gut-check queries. These filter out flash-in-the-pan ops (e.g., those inflating volumes via wash trading) for battle-tested ones like Coinbase (105M users, zero major 2025 breaches). Answer them via exchange sites, CoinGecko trust scores, or tools like CER.live (which rates 300+ platforms on 18+ security metrics).

- Is the exchange regulated in my country? Global regs vary wildly—U.S. users need SEC/CFTC nods (e.g., Kraken’s 10+ licenses), while EU folks prioritize MiCA compliance (Bitstamp shines here). Non-compliant platforms risk sudden freezes, as seen in 15% of exchanges geo-blocking users in Q4 2025. Check: Official registries like FCA (UK) or MAS (Singapore).

- Does it offer Proof-of-Reserves (PoR) or audit transparency? Essential post-FTX: Verifies 1:1+ asset backing via Merkle trees. Top scorers like Binance (monthly PoR, 150%+ ratios) and Kraken publish via Mazars audits; aim for 152%+ like BTCC. Red flag: No PoR means potential shortfalls.

- What is the trading volume and liquidity for my preferred assets? High volume ($10B+ daily) ensures tight spreads (<0.1% on BTC) and minimal slippage. Binance leads at $17.5B+ 24h (40% share), followed by Bybit ($4B) and Gate.io ($2.89B); DEXs like Uniswap hit $22B monthly but vary by chain. For alts, check MEXC (1,990 coins, $2.75B volume).

- Are fees and spreads competitive? Fees erode profits—target <0.1% maker/taker. Binance/KuCoin tie for lowest at 0.1% (dropping to 0.02% with volume/BNB), vs. Coinbase’s 1.5%+ spreads. Factor withdrawals (e.g., Kraken’s network-minimal) and DEX gas (Uniswap’s 0.3% + Ethereum fees).

- Does the exchange support the tokens I want to trade? Variety matters: Gate.io leads with 3,800+ coins for alt hunters, while Coinbase sticks to 355 regulated gems. DEXs like Uniswap cover 1,500+ but liquidity thins on niches.

- How reliable is their security and past safety record? Hacks hit $2.17B in H1 2025 alone (e.g., CoinDCX’s $44M July breach); favor clean slates like Kraken (no major incidents since 2011, 98% cold storage) over Bybit’s $1.46B hit. Check CER.live scores (WhiteBIT at 10/10) and insurance ($100M+ funds).

Nail these, and you’ll bypass 90% of wash-trading fakes, landing on resilient picks that weathered 2025’s 344 incidents.

9.2 Checklist for Security & Fees

Streamline your vetting with these dual checklists—our rankings weight security 30% and fees in usability (15%). Top platforms like Crypto.com (9.6/10 trust, $100M insurance) ace both, saving users ~$500/year on $10K trades vs. high-fee rivals.

Security Checklist (Target: 9.5+/10 on CoinGecko/CER)

- Cold Storage Percentage: 95%+ offline (Kraken: 98%; protects against hot wallet hits like BigONE’s $27M July 2025 loss).

- Two-Factor Authentication (2FA): Mandatory, with app/hardware options (YubiKey over SMS to dodge 33% social engineering breaches).

- Multi-Signature Wallets: 3–5 approvals needed (Bitget: 5-of-7; slashed 2025 access-control failures, 59% of losses).

- Insurance for Deposits: $100M+ coverage (Coinbase: $320M; reimbursed Binance’s 2019 $40M hack fully).

- Security Audits & Transparency Reports: Quarterly by Hacken/Mazars (OKX’s real-time PoR dashboards; ISO 27001/SOC 2 certs boost scores).

Fee Checklist (Aim: <0.2% average)

- Maker/Taker Trading Fees: Tiered drops (Binance: 0.1% to 0.02%; Uniswap: 0.3% flat).

- Deposit & Withdrawal Fees: Free crypto deposits (Kraken); fiat via ACH/SEPA <1% (Coinbase: 1.5% instant buys).

- Discount Programs or Loyalty Tiers: Native tokens (BNB: 25% off Binance); volume rebates (KuCoin: 60% via KCS).

- Gas Fees for DEX Transactions: Chain-dependent (Uniswap: Ethereum ~$5–20; layer-2s like Base: <$0.01).

Key Insight: Robust security + fair fees = top ranks. Platforms blending these (e.g., Kraken’s 0.16%/0.26% fees with 10/10 trust) cut risks by 80% per Chainalysis, outpacing 2025’s $2.7B theft wave.

9.3 Comparing Top Exchanges Side-by-Side

Side-by-side grids cut through the noise, spotlighting trade-offs in our top 100 crypto exchanges. Updated for December 2025: Binance crushes volume ($17.5B+ 24h), but Kraken edges security (79/100 score, no 2025 hacks). Fees reflect base rates (discounts apply); security from CER/CoinGecko averages.

| Feature | Binance | Coinbase | Kraken | Uniswap (DEX) |

| Trading Volume | Very High ($17.5B+ 24h) | High ($2.5B 24h) | High ($1.5B 24h) | High ($22B monthly) |

| Security Score (/10) | 10.0 (SAFU fund) | 10.0 (ISO 27001) | 10.0 (98% cold storage) | 9.3 (self-custody) |

| Fees | Low (0.1% maker/taker) | Medium (0.4%/0.6%) | Medium (0.16%/0.26%) | Variable (0.3% + gas) |

| KYC Required | Yes | Yes | Yes | No |

| Token Variety | 600+ | 250+ | 300+ | 500+ |

This snapshot reveals strengths: Binance for volume hounds, Uniswap for privacy purists (no KYC, but gas spikes on ETH). For U.S. regs, Coinbase/Kraken win; scale to your needs.

9.4 For Traders, Investors & Beginners

Tailor your pick to your playbook—2025’s 19% newbie surge favors simple on-ramps, while pros chase perps (75% volume).

Beginners

- Focus on Simple UI and Strong Support: Drag-and-drop buys, 24/7 chat (Coinbase: 4.7/5 app, voice commands; onboarded 105M via mobile).

- Use Exchanges with Clear Educational Resources: Coinbase Learn (quiz rewards up to $200 crypto); Kraken’s guides for $100 starters. Avoid overload—stick to fiat ramps, not 100x leverage.

Active Traders

- Prioritize Low Fees, High Liquidity, and Advanced Tools: Binance/Bybit for 0.06% perps and $4B depth (sub-0.5% slippage on majors). Add APIs for bots, TradingView charts.

Investors

- Consider Security, Long-Term Trust, and Regulatory Compliance: Kraken/Gemini for spotless records, PoR, and staking (up to 39.95% APY minus fees).

- Look for Platforms with Staking, Lending, and Reporting Features: OKX’s zero-fee USDC swaps + tax tools; Crypto.com’s $100M insurance for HODLers.

10. Future Trends in Crypto Exchanges

The crypto exchange arena, already a $134 billion daily juggernaut as of December 2025, isn’t standing still—it’s accelerating into a hybrid, AI-fueled, regulation-savvy ecosystem that’s blurring lines between TradFi and DeFi. With DEX volumes shattering records at $26.3 billion on a single day in January 2025 (up 66% YoY) and TVL across Layer-2 networks topping $42 billion, exchanges are evolving to handle tokenized real-world assets (RWAs), cross-chain liquidity, and institutional-grade compliance. Looking ahead to 2026–2030, analysts forecast the DeFi market exploding from $51.22 billion in 2025 to $78.49 billion by 2030 (8.96% CAGR), driven by stablecoin proliferation (processing $46T+ annually) and AI risk tools slashing hack losses by 80%. This isn’t speculation—it’s maturation, where top 100 crypto exchanges like Binance (40% market share) and emerging DEXs like Aerodrome ($1B+ TVL on Base) lead the charge. For traders, investors, and devs, spotting these trends means positioning for a market where CEX-DEX hybrids dominate 25%+ of volumes by 2026. Let’s unpack the horizon.

10.1 Emerging Exchanges

Fresh blood is flooding the scene, with 2025 birthing 150+ new platforms—up 40% from 2024—challenging incumbents by zeroing in on underserved niches. These aren’t cookie-cutter CEXs; they’re purpose-built for speed, sovereignty, and specificity, often bootstrapped on Layer-2s or modular chains to undercut fees by 90%. By 2026, expect 30% of new exchanges to be regional hybrids, capturing LATAM’s 15% adoption spike or MENA’s Shariah-compliant surge.

- Layer-2 Exchanges: Platforms like Base’s Aerodrome or Arbitrum’s GMX v2 process 1,000+ TPS at <$0.01 fees, with $39.9B monthly volumes in Q3 2025 alone. Prediction: By 2030, L2 DEXs claim 40% of spot trading, per Troniex forecasts.

- Niche-Focused Platforms: NFT/gaming hubs like Magic Eden (Solana-integrated, $500M+ Q4 volume) or privacy DEXs (e.g., Tornado Cash successors) cater to 23% APAC growth. Privacy coins like Zcash hit 7-year highs amid 2025 regs.

- Regional Exchanges: Bitso’s LATAM pivot (MXN ramps, 20% YoY users) or Rain’s UAE focus (AED/Shariah) fill fiat gaps, with 45 DeFi startups in Abu Dhabi by 2026.

- Hybrid DEX-CEX Models: Think dYdX v5 or OKX’s on-chain perps—self-custody with CEX liquidity. These hit $37.5B derivs in 2025, eyeing 50% market share by 2030.

These disruptors thrive by solving pain points—e.g., 80% of DeFi losses stem from protocols, so niches embed AI audits upfront. For devs: Build on Base or Solana for quick wins; traders: Watch for 100x leverage niches.

10.2 DeFi & Layer-2 Exchange Growth

DeFi isn’t a trend—it’s the tide, with TVL surging 53% YoY to $71.58B on Ethereum alone, while Solana DEXs clocked $109B in November 2025 (eclipsing ETH’s $55B). Layer-2s like Optimism and Base are the secret sauce, slashing Ethereum gas by 99% and enabling mobile-first DeFi (72% user adoption). By 2030, DeFi hits $231B, per EZ Blockchain, as restaking and RWAs yield 10–20% APYs vs. Treasuries’ 4%.

- DEX Adoption: Privacy/self-custody draws 25%+ DEX-to-CEX ratio in May 2025; Uniswap v4’s Hooks cut gas 50%, boosting $22B monthly swaps.

- Layer-2 Solutions: Arbitrum/Optimism TVL: $42B+; Base’s $1.29B daily peaks fuel meme/DeFi booms.

- Cross-Chain Bridges: Protocols like LayerZero enable seamless swaps (e.g., ETH-SOL in seconds), maturing to $10B+ monthly by 2027.

- Staking/Yield Farming: Integrated in 80% of DEXs, with liquidity mining up 30% via tokenized bonds/art.

Impact: Faster (1,000 TPS), cheaper (<$0.01/tx), accessible DeFi—perfect for the 580M-user wave, but watch smart-contract risks (59% of 2025 losses). Horizon: DeFi 3.0 merges TradFi yields with blockchain by 2028.

10.3 Regulatory Shifts & Market Predictions

2025’s reg renaissance—MiCA in EU, SEC’s CLARITY Act in U.S., MAS in Asia—locked in $1.6T spot volumes on compliant platforms, with PoR mandates slashing fraud 40%. By 2026, stablecoin rules (EU/Japan/UAE done, U.S./UK pending) formalize them as “new cash,” processing 106% more txns ($46T). DeFi gets hybrid scrutiny: Permissioned pools for institutions, ZK-proofs for privacy.

- Global Standards: MiCA/SEC/MAS enforce KYC/AML on fiat ramps; 92% of top exchanges comply by Q4 2025.

- PoR & Transparency: Monthly audits mandatory; non-compliant DEXs drop 15% volumes.

- DeFi Compliance: On-chain KYC via ZK (e.g., zkSync) balances decentralization; EU’s TFR traces all txns.

Market Prediction: Compliant innovators (e.g., Coinbase Prime) snag 60% institutional flows by 2030, per Bitwise; overall CAGR 15–20%, hitting $500B+ market. U.S. dominates (37% revenue), but Europe’s MiCA chokehold pushes 20% activity to Asia. Bull case: BTC $200K+ by 2030 fuels exchanges; bear: Reg overreach caps at 10% growth.

10.4 AI & Technology Integration

AI isn’t hype—it’s the exchanger’s co-pilot, with 2025 seeing AI cut fraud 70% via real-time anomaly detection and predictive liquidity models. By 2026, 65% of platforms embed ML for bots (e.g., BingX AI’s strategy suggestions), boosting efficiency 50%. Tokenization (RWAs like real estate) adds $10T liquidity by 2030.

- Automated Risk Monitoring: AI flags hacks pre-emptively (e.g., CertiK’s audits); 33% fewer breaches projected.

- Algorithmic Trading Tools: Pro-grade bots on Bybit/GMX (100x leverage, ML-optimized); 654% perp DEX cap growth.

- Fraud Detection: Real-time on-chain scans; ZK + AI for compliant privacy.

- Predictive Analytics: Liquidity forecasts via big data; Solana’s $109B DEX volumes AI-driven.

Impact: Safer (80% risk drop), smarter trades—AI-DeFi fusion yields “super apps” by 2028, per Composable.

10.5 Future of DEXs & Decentralized Liquidity

DEXs aren’t challengers—they’re conquerors, with 2025’s $29B November volumes signaling 25% CEX eclipse by 2026. Self-custody (up 34% adoption) and governance tokens empower users, while L2s fix UX (e.g., Uniswap v4’s Hooks). By 2030, DEXs hit $200B TVL, per 101 Blockchains, via RWAs and perps.

- Improved UX: Gasless swaps (SlipStream on Aerodrome); mobile DeFi at 72% penetration.

- Lower Gas via L2: Base/Arbitrum: <$0.01/tx, $42B TVL.

- Cross-Chain Aggregation: 1inch/Jupiter pool liquidity across 10+ chains; $10B+ monthly by 2027.

- Lending/Staking/NFTs: Integrated yields (10–20% APY); PancakeSwap’s $5B monthly farming.

DEXs erode CEX dominance in privacy (92% data leak dodge) and variety (1,000+ tokens), with governance DAOs deciding listings. Future: Multi-chain “DeFi superchains” by 2030, but bridge exploits (20% risks) demand AI guards.

11. FAQs — Top 100 Crypto Exchanges

What is the Biggest Crypto Exchange?

The largest crypto exchange by trading volume and user base is Binance.

- Offers hundreds of tokens and trading pairs

- Global reach with millions of active users

- Advanced trading features for beginners and professionals

Other notable large exchanges include Coinbase, OKX, and Kraken.

Are Decentralized Exchanges Better?

DEXs and CEXs serve different purposes:

Advantages of DEXs:

- Users retain full control of their funds

- No mandatory KYC for most platforms

- Resistant to central shutdowns

Limitations:

- Higher slippage during low liquidity

- Gas fees can be expensive

- Limited customer support

Can I Trust Exchange Rankings?

Yes, but with caution:

- Rankings are based on metrics like liquidity, trading volume, trust score, and security

- Leading sources include CoinMarketCap, CoinGecko, Kaiko, and Messari

- Rankings reflect overall platform performance, but users should also check personal factors like supported tokens, fees, and regional access

What Makes an Exchange Safe?

A safe exchange typically has:

- Cold storage for most funds

- Two-factor authentication (2FA)

- Proof-of-Reserves transparency

- Regulatory compliance

- Clean security and hack history

How Often Do Exchange Rankings Change?

- Rankings can fluctuate daily due to trading volume, liquidity, and market conditions

- Security events, hacks, or regulatory changes can rapidly impact trust scores

- Data from APIs like CMC, CoinGecko, and Messari is updated in real-time

Conclusion — Top 100 Crypto Exchanges (2025)

The crypto exchange ecosystem continues to evolve rapidly, with hundreds of platforms competing globally. Our Top 100 Crypto Exchanges ranking highlights the safest, most liquid, and most trustworthy exchanges, combining both centralized (CEX) and decentralized (DEX) platforms.

Key Takeaways

- Liquidity, trust, and security are the most important factors for ranking exchanges.

- CEXs like Binance, Coinbase, and Kraken lead in volume, user base, and advanced trading features.

- DEXs like Uniswap and PancakeSwap grow due to privacy, self-custody, and decentralized governance.

- Regional and niche exchanges provide local fiat support, specialized tokens, or unique DeFi features.

- Future trends suggest DeFi, Layer-2 solutions, AI integration, and stronger regulations will shape the next generation of exchanges.

Final Thoughts

Choosing the right exchange depends on your goals, trading style, and security priorities. Beginners may prefer simple, highly regulated platforms, while advanced traders may prioritize low fees, high liquidity, and derivatives access. Privacy-focused users often lean toward DEXs for self-custody and anonymity.

Questions for Readers

- Which type of exchange do you prefer: CEX or DEX?

- What features are most important to you when evaluating exchanges?

- How do you balance security, fees, and liquidity in your trading strategy?

By understanding exchange rankings, criteria, and future trends, users can make informed decisions and navigate the crypto market safely and efficiently.