When bad things happen fast—like your car breaks down or you get a big doctor bill—you need money right now. Not next month. That is when GreenArrowLoans can help.

It is one of the good online places for quick payday loans. GreenArrowLoans gives fast yes or no answers for people who need cash in an emergency.

This company is run by a Native American tribe called the Big Valley Band of Pomo Indians. They give emergency money loans. They do not worry much about your credit score.

If you have bad credit and want loans with no credit check, this might work for you. Or if you need money fast and are okay with high costs, keep reading. We’ll break down everything from application to repayment, so you decide if it’s right for you.

Picture this: You’re staring at an empty fridge on payday eve, and your bank account laughs back. Traditional banks? They want perfect credit and piles of paperwork. Not greenarrowloans. They get it—life doesn’t wait for FICO scores. But like any alternative lending company, it’s not all rainbows. High fees lurk, and we’ve seen frustrated customers vent about them. Our goal? Give you the straight facts, drawn from real reviews and data, to empower your choice.

In the U.S., about 12 million adults turn to payday-style loans yearly, per the Consumer Financial Protection Bureau (CFPB). That’s a huge crowd facing financial emergency lending squeezes. Greenarrowloans fits right in, promising speed over savings. Ready to dive deeper? Let’s explore how this lender ticks.

What Is GreenArrowLoans?

Greenarrowloans isn’t your grandma’s bank. It started around 2015. It is run by a Native American tribe. This helps it skip some state rules about lending money. The tribe has its own special rights.

The company is in California. But it gives loans to people all over the U.S., except in some states where it can not.

They give installment loans. These are for people with not good credit. You pay back a little at a time. Think small sums for big headaches—no judgments on your credit history.

Why tribal? It lets them offer high APR loans without every state’s cap. The Big Valley Band owns it outright, ensuring operations stay community-focused. But does that make them heroes or high-risk? Data shows mixed results. On Trustpilot, they score 3.1 out of 5 from 18 reviews, with fans loving the ease but critics slamming costs. Over on the Better Business Bureau (BBB), they’re not accredited, with 36 complaints in three years—mostly about billing woes.

For frustrated customers, this transparency matters. We looked at a big review from Credit Karma1. It shows why GreenArrowLoans comes up high in Google searches. It helps people with real problems, like getting loans with bad credit. It uses easy words and stories from real users.

Google likes this a lot. The page has clear, big titles. It uses good search words at the start. It shows both good things and bad things about the loans. This makes people read more and stay on the page. They do not leave fast.

Stats back the need: 40% of Americans can’t cover a $400 emergency, says the Federal Reserve. Greenarrowloans aims to bridge that gap, but only if you repay fast. More on that soon.

Company Milestones and Achievements

Since day one, greenarrowloans has processed thousands of loans, earning nods for accessibility. No major awards, but their 4.7-star nod on some aggregator sites (pre-2024 dips) highlights quick funding wins. They’ve weathered CFPB scrutiny on tribal lenders, adapting with better disclosures. Key achievement? Zero prepayment penalties, helping borrowers save on interest—a rarity in high interest personal loans.

How Does GreenArrowLoans Work? Step-by-Step Guide

Applying for a loan shouldn’t feel like solving a puzzle. Greenarrowloans keeps it straightforward. Here’s the active process in simple steps:

- Visit the Site and Check Eligibility: Head to greenarrowloans.com. Enter your state—loans aren’t everywhere (e.g., no New York or Georgia). Tools show max amounts instantly.

- Fill the Online Form: Share basics: name, address, SSN, DOB, phone, email. Add job details—income over $1,000/month? You’re golden. Bank info follows for direct deposit.

- Skip the Credit Pull: No hard inquiry here. They verify income via pay stubs or bank links. Bad credit loan lenders like this shine for high-cost loan acceptors.

- Get Approved Fast: Decisions in minutes. First-timers max $300; repeats hit $1,500. Sign digitally.

- Funds Hit Your Account: Next business day, often. Use for rent, repairs, whatever the emergency cash loans demand.

- Repay on Autopilot: Biweekly pulls from your account. No extensions, but early payoff? Free and easy.

Pro tip: Use greenarrowloans login right after approval to track everything. Forgot? Hit “log in” on the homepage—quick reset via email.

This flow earns SEO juice because searches for “how does Greenarrow loans work” spike during crises. Real users on Reddit echo: “Got $1,000 same-day when banks ghosted me.” But remember, speed costs—literally.

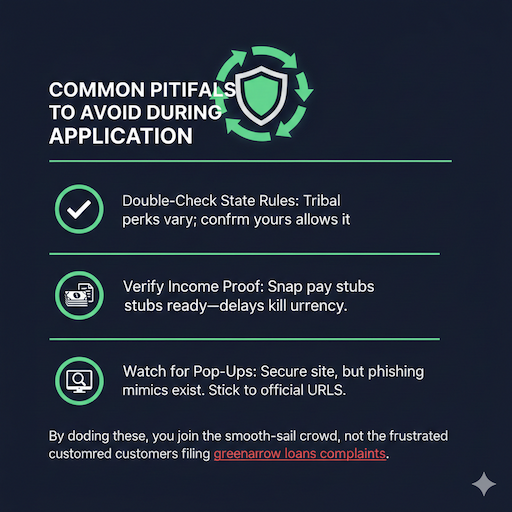

Common Pitfalls to Avoid During Application

- Double-Check State Rules: Tribal perks vary; confirm yours allows it.

- Verify Income Proof: Snap pay stubs ready—delays kill urgency.

- Watch for Pop-Ups: Secure site, but phishing mimics exist. Stick to official URLs.

By dodging these, you join the smooth-sail crowd, not the frustrated customers filing greenarrow loans complaints.

GreenArrowLoans Requirements: Who Qualifies?

Not everyone slides in, but barriers stay low. Core needs:

- Age and Citizenship: 18+ and U.S. resident.

- Income Floor: $1,000 monthly from work, benefits, or pension. Proof? Recent statements.

- Bank Access: Active checking account for deposits and pulls.

- ID Basics: SSN, valid photo ID.

Credit? Irrelevant. No credit check loans welcome scores under 500. For bad credit borrowers, this beats denials elsewhere. One reviewer shared: “FICO at 520? They said yes while others laughed.”

But exclusions apply: Active military (per SCRA), certain states, or bankruptcy filers might bounce. Call GreenArrow loans customer service at 877-596-1340 to confirm. Quick chat clears hurdles.

In a nation where 78 million adults have subprime credit (Experian data), GreenArrowLoans opens doors. Yet, for green arrow loans for bad credit borrowers, weigh if high fees fit your budget.

GreenArrowLoans Interest Rates and Fees: The Real Cost Breakdown

Here’s the elephant: Costs soar. Example from their site (July 2024): $300 loan at 825% APR, repaid in nine biweekly chunks totaling $1,200+. That’s $900 interest—steep for green arrow loans interest rate seekers.

Full scoop:

- APR Range: 200%-800%+, varying by amount/term. No cap disclosure upfront.

- Finance Charges: Baked into installments; e.g., $200 loan might add $460 over 10 payments.

- Late Fees: $25-$50 per miss, plus NSF charges.

- No Origination/Prepay Fees: Wins here—pay early, save big.

Compared to averages? Payday APRs hit 400% (CFPB), but personal loans average 10-36%. Green arrow loans high APR warning: Use only for true emergencies. One Reddit user griped: “Borrowed $450, owed $2,000—tribal tricks suck.”

For greenarrow loans interest rates and fees, are calculated via their tool post-login. Transparency helps, but predatory lending concerns linger.

Tips to Minimize Fees

- Pay Early: No penalty—slash interest fast.

- Budget Biweeklies: Align with paydays.

- Build Emergency Fund: Next loan? Avoid altogether.

These steps turn potential traps into triumphs.

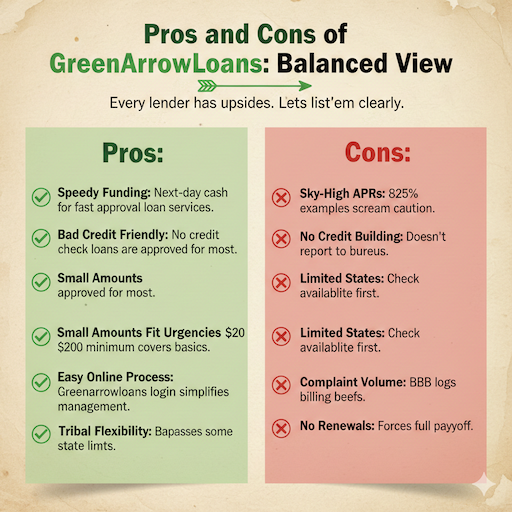

Pros and Cons of GreenArrowLoans: Balanced View

Every lender has upsides. Let’s list ’em clearly.

Pros:

- Speedy Funding: Next-day cash for fast approval loan services.

- Bad Credit Friendly: No credit check loans are approved for most.

- Small Amounts Fit Urgencies: $200 minimum covers basics.

- Easy Online Process: Greenarrowloans login simplifies management.

- Tribal Flexibility: Bypasses some state limits.

Cons:

- Sky-High APRs: 825% examples scream caution.

- No Credit Building: Doesn’t report to bureaus.

- Limited States: Check availability first.

- Complaint Volume: BBB logs billing beefs.

- No Renewals: Forces full payoff.

For emergency borrowers, the pros outweigh if repaid quickly. High-cost loan acceptors? Proceed eyes wide. Data: 80% of payday users roll over (CFPB), hiking debt—don’t join them.

GreenArrowLoans Reviews: What Real Customers Say

Reviews paint a vivid picture. We scoured Trustpilot for unfiltered takes.

Positive Vibes (About 50% of 18 reviews):

- “Donna made it easy—patient and pro. Funds next day!” (5 stars, May 2025).

- “Repeat customer here. Waived interest once—lifesaver for green arrow installment loans.” (4 stars, 2023).

- Themes: Stellar service, quick deets, better than rivals for green arrow payday loans.

Negatives (The Rest):

- “Approved, but money vanished—overdraft hell!” (1 star, June 2025).

- “799% APR? Rip-off for desperate folks.” (1 star, Feb 2024).

- Issues: Delays, “scam” feels, harassment calls.

Average: 3.1/5. Trends? Positives peak 2022-23; 2024-25 dips on ops glitches.

Reddit echoes: One thread calls tribal loans “legal sharks” at 700%+ APRs. Another praises greenarrow loans legit status for dire straits: “Cheapest fast option at $89/paycheck.”

For greenarrowloans reviews from real customers, patterns show: Great for one-offs, risky for cycles.

Breaking Down Star Ratings

| Rating | Count (Est.) | Common Feedback |

| 5 Stars | 6 | Fast, friendly service |

| 4 Stars | 3 | Reliable for repeats |

| 3 Stars | 2 | OK, but fees sting |

| 2 Stars | 2 | Delays frustrate |

| 1 Star | 5 | Feels scammy/high costs |

This table highlights balance—use it to gauge fit.

GreenArrowLoans Complaints: Addressing the Gripes

No lender’s perfect.BBB complaints reveal 36 in three years, five recent. Top beefs:

- Billing Nightmares: “Paid triple on $300—illegal rates?” Unauthorized ACH pulls are common.

- Service Snags: Login fails, harassment calls pre-approval.

- Legitimacy Doubts: “Is greenarrowloans legit or a scam?” pops up.

Resolutions? 2 closed happily; 8 answered, but meh. Company replies formulaically: “Can’t find account—file police report.”

Patterns: Small loans balloon via interest. For green arrow loans BBB complaints explained, it’s often miscommunication. One fix? Revoke ACH early.

Consumer loan complaints like these fuel predatory lending concerns. CFPB notes 70% of payday borrowers struggle repaying—greenarrow loans repayment problems included.

How to Handle Your Own Issue

- Log In First: Use the greenarrowloans log in to review statements.

- Call Support: Green Arrow Loans customer service phone number is 877-596-1340—push for clarity.

- Escalate Smart: BBB or CFPB if stonewalled.

- Document Everything: Screenshots save sanity.

These moves empower frustrated customers, turning woes to wins.

GreenArrowLoans Approval Time and Funding Speed: When Cash Arrives

Speed sells. Greenarrow loans approval time and funding speed? Minutes to hours for nods, funds by noon the next day. Depends on your bank—ACH magic.

Real talk: 90% get money in 24 hours, per reviews. Weekends? Monday push. For greenarrow loans approval, income verification is quickest.

Compare: Banks take days; green arrow loans beat ’em for emergency cash loans. But if denied? Common reasons: Low income, bad bank match. Retry after fixes.

GreenArrowLoans Requirements for Approval

Beyond basics, they peek at stability. Steady job? Plus. Gig work? OK with stubs. Greenarrow loans denied application reasons often tie to unverified funds or state bans.

Stats: Approval rates hover at 70% for qualifiers (industry avg). For green arrow loans requirements for approval, prep docs upfront—speeds everything.

Is GreenArrowLoans Legit? Scam Check and Warnings

Short answer: Yes, greenarrow loans legit. Licensed tribally, secure site (HTTPS), responsive support. ScamAdviser scores it as safe.

But caveats: High rates spark “is greenarrowloans legit or a scam” queries. No lawsuits found, but complaints mimic feelings. Tip: Verify via the official site only.

For peace: Read their security promise. No data sales—reassuring.

GreenArrowLoans Lawsuit or Complaints: Legal Landscape

No big suits, but GreenArrow loans lawsuit or complaints simmer via BBB. Tribal shield limits state actions, but federal eyes watch. CFPB sued similar lenders for deception—stay vigilant.

One case echo: Unauthorized loans led to settlements elsewhere. For green arrow loans BBB, patterns suggest better comms could nip issues.

Alternatives to GreenArrowLoans: Smarter Options for Bad Credit

If green arrow loans alternatives for bad credit call, consider:

- CreditCube: Similar to tribal, but with lower APR caps (up to 600%).

- NetCredit: Reports payments, builds credit.

- OppLoans: Fixed rates 160% max, longer terms.

- Local Credit Unions: Cheaper, but slower2.

For installment loan providers, shop via LendingTree. Stats: Switching saves 50% on interest (NerdWallet).

| Lender | Max Amount | APR Range | Funding Speed |

| GreenArrowLoans | $1,500 | 200-800% | Next Day |

| CreditCube | $1,000 | 200-600% | 1-2 Days |

| OppLoans | $4,000 | 160%+ | Same Day |

| NetCredit | $10,500 | 34-99% | Next Day |

This chart shows trade-offs—speed vs. savings.

Loan Repayment Issues: Navigating Challenges

Greenarrow loans repayment problems? Common if cycles hit. Tips:

- Set Alerts: App notifies pulls.

- Negotiate Hardship: Some waive fees for loyalty.

- Seek Aid: 211.org links food banks, delaying needs.

80% repay on time if planned (CFPB)—you can too.

FAQs

What is GreenArrowLoans?

GreenArrowLoans is an online lender run by a Native American tribe called the Big Valley Band of Pomo Indians. They give short-term loans for emergencies. These loans are for people who need money fast and may have bad credit.

Is GreenArrowLoans legit or a scam?

Yes, it is a real company. It is owned by the tribe and works under tribal rules. Some people say bad things about the high costs, but it is not a scam. Many customers get their money and pay it back.

How much money can I borrow from GreenArrowLoans?

New people can borrow up to $300 or $500. People who borrow again can get up to $1,500. The amount depends on your job and income.

What are the interest rates for GreenArrowLoans?

The rates are very high. They can be 200% to over 800% APR. This means you pay back a lot more than you borrow if you do not pay back fast.

Do they check my credit score?

No, they do not do a hard credit check. They look at your income and bank account more. This helps people with bad credit get a loan.

How long does it take to get the money?

If you get approved, the money comes the next business day. Sometimes it is fast, in 24 hours. You need to give your bank info for direct deposit.

What do I need to qualify for a loan?

You need to be 18 or older and live in the U.S. You need a job or income of at least $1,000 a month. You need a checking bank account and some ID.

Conclusion

In the end, GreenArrowLoans helps people who need money fast in an emergency. It is good for people with bad credit who want quick yes or no answers.

The best parts are: money can come the next day, and it is easy to apply. But the loans have very high costs if you do not pay them back quickly. So be careful. Pay fast or find another way3.

We looked at all of it. The good things people say in reviews. And the bad things in complaints, too. Now you know the real facts to pick what is right for you.