HMRC warns that savings over £3 501 may incur tax – this headline has caught the eye of many UK savers lately. It points to a key fact: if your total savings sit around or above this amount and earn decent interest, you might owe tax on what the account grows. Higher interest rates in recent years mean more people now face this issue. Banks report your interest straight to HMRC, so the tax office spots when earnings go over your tax-free limit.

This does not mean all savings over £3,501 get taxed. It means the interest from those savings could push you past your Personal Savings Allowance (PSA). For example, at current average rates around 4%, £3,501 might earn over £140 a year – but real totals often add up across multiple accounts. Many savers get surprise letters or tax code changes because their combined interest tops the allowance.

This guide explains the rules clearly. You’ll learn your tax-free limits, why HMRC sends warnings, and simple steps to keep more of your money. Whether you save for retirement, emergencies, or family, these tips help you stay ahead.

Understanding the Personal Savings Allowance (PSA)

The PSA lets you earn interest tax-free up to set amounts. It depends on your tax band:

- Basic rate taxpayers (income up to £50,270): £1,000 tax-free interest.

- Higher rate taxpayers (income £50,271 to £125,140): £500 tax-free interest.

- Additional rate taxpayers (income over £125,140): £0 tax-free interest.

These rules apply for the 2025/26 tax year. Interest over your PSA gets taxed at your normal income tax rate – 20%, 40%, or 45%.

Many people hear about 3500 savings hmrc because articles use rough maths. At 5% interest, you’d need about £20,000 in savings to earn £1,000 (the basic rate PSA). But at lower rates or for higher rate taxpayers, smaller pots like £10,000-£20,000 can trigger tax. The £3,501 figure seems like a typo or old example, but it highlights that even modest savings can add up.

Add the Starting Rate for Savings if your other income stays low. You get up to £5,000 interest at 0% tax if non-savings income falls below £17,570 (Personal Allowance £12,570 plus £5,000 band). This helps retirees or low earners.

Interest counts from all non-ISA accounts: easy access, fixed rate, notice accounts, and bonds.

How Does HMRC Know My Savings Interest?

You might wonder: how does hmrc know my savings interest? Banks and building societies report it automatically each year. They send details to HMRC after the tax year ends (5 April). This includes interest from every account, even small ones.

HMRC matches this data to your record using your National Insurance number. They calculate if you owe tax. No need for most people to report it themselves – it’s done for you.

If you exceed your PSA and have a job or pension, HMRC often adjusts your tax code. This collects tax through PAYE, spreading it over the year. Retirees or self-employed might get a bill or need Self Assessment.

This system catches most cases, but contact HMRC if you think they’ve missed something or got it wrong.

HMRC Savings Account Tax Warning: What Triggers It?

An hmrc savings account tax warning or hmrc savings account warning letter arrives when HMRC spots interest over your PSA. These letters explain possible tax due and next steps1.

Triggers include:

- Total interest across accounts exceeding your PSA.

- A shift to a higher tax band (e.g., from pay rise or pension start).

- Past year data showing higher interest, prompting a tax code change.

In 2025, more warnings go out as rates stay decent despite base rate cuts to 3.75%. HMRC uses prior year figures to estimate current tax.

Ignore a letter and you risk penalties or extra interest on unpaid tax. Act fast – check your Personal Tax Account online.

Do I Have to Notify HMRC of Savings Interest?

Most times, no – do i have to notify hmrc of savings interest? Banks do it for you. But check your situation:

- If self-employed or with complex income: Report via Self Assessment.

- If interest over £10,000: Likely need Self Assessment anyway.

- If no automatic collection (no PAYE): HMRC might send a Simple Assessment bill.

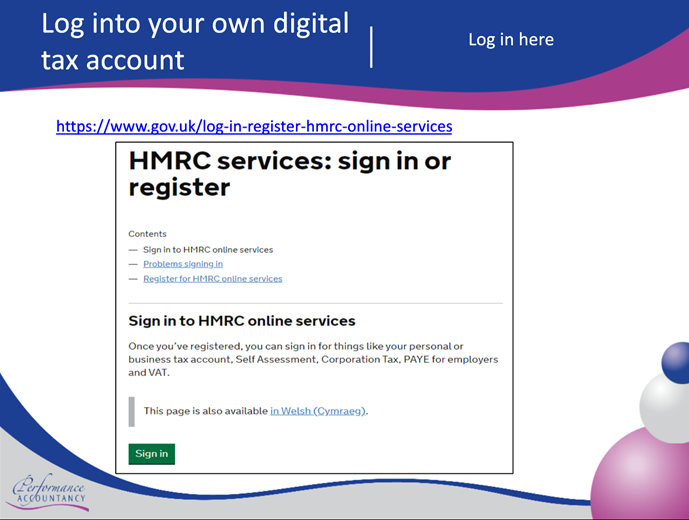

Log into your HMRC Personal Tax Account to view reported interest and check calculations.

Paying Tax on Savings When Retired

Retirees often ask about paying tax on savings when retired. Many rely on pensions and savings, so interest can push income up.

Good news: You still get the full PSA based on your tax band. Low pension income might qualify for the Starting Rate for Savings too.

HMRC collects via tax code on your state or private pension if possible. Otherwise, a bill arrives.

Many retirees get warnings as fixed pensions plus rising interest tip them over allowances.

How Does HMRC Collect Tax on Savings Interest?

HMRC has clear ways to collect:

- PAYE adjustment: Common for workers or pensioners. Tax code changes deduct extra from pay or pension.

- Simple Assessment: HMRC sends a bill with the amount due.

- Self Assessment: If you already file or have high interest.

- Direct payment: Rare, but possible if other methods fail.

Pay by 31 January after the tax year, or spread via PAYE.

How to Avoid Paying Tax on Savings

Want to know how to avoid paying tax on savings? Here are proven, legal steps:

- Use Cash ISAs: Up to £20,000 per year tax-free. Interest doesn’t count toward PSA.

- Split with a partner: Each gets their own PSA. Joint accounts split 50/50 unless you tell HMRC otherwise.

- Choose Premium Bonds: Prizes tax-free, no interest.

- Give to family: Lower earners or children (watch £100 parent gift rule for kids).

- Pension contributions: Reduce taxable income, possibly drop tax band.

- Track totals: Move money to ISAs before interest builds.

For example, max ISAs first, then use PSA on regular savings.

Shop best rates – top easy access around 4.5%, but fixed deals vary.

What to Do If You Receive an HMRC Warning Letter

Stay calm. Follow these steps:

- Log into your Personal Tax Account: Check reported interest.

- Compare with your records: Add up statements from all banks.

- Spot errors: Contact the bank or HMRC.

- Pay if owed: Via PAYE, bill, or Self Assessment.

- Plan ahead: Move to ISAs to cut future tax.

Seek free advice from HMRC helpline or TaxAid if needed.

Special Rules for Different Savers

- Joint accounts: Interest splits equally for tax.

- Children’s savings: Parent’s gift rule – over £100 interest per parent per child counts toward parent’s PSA.

- Non-taxpayers: Register for gross interest (no tax deducted).

- Offshore accounts: Still report if UK resident.

Recent Changes and Outlook for 2025/26

Allowances have frozen since 2016, so more people pay as rates rose. Base rate now 3.75%, but good savings deals linger.

HMRC improves data matching, so fewer escape notices.

FAQs About HMRC Savings Tax Warnings

What does “hmrc warns that savings over £3 501 may incur tax” actually mean?

It is a simplified way some articles describe the risk of owing tax on savings interest. There is no automatic tax just because you have more than £3,501 in savings2. Tax only applies to the interest you earn if it exceeds your Personal Savings Allowance (£1,000 for basic-rate taxpayers, £500 for higher-rate, £0 for additional-rate).

Why do some headlines mention £3,501 specifically?

The figure is an approximate example. At older interest rates, a pot around that size could generate interest that starts to exceed part of the allowance for some people. It is not an official HMRC threshold.

How does HMRC know my savings interest?

Banks and building societies automatically report the interest you earn to HMRC every year. HMRC matches this information to your tax record using your National Insurance number.

Do I have to notify HMRC of savings interest myself?

In most cases, no. The bank reports it for you. You only need to report it yourself if you are required to complete a Self Assessment tax return (for example, if you are self-employed or have very high interest).

What is an hmrc savings account warning letter?

It is a letter or nudge from HMRC telling you that, based on the interest reported to them, you may owe tax because you have exceeded your Personal Savings Allowance. It explains what to do next.

Conclusion

In conclusion, hmrc warns that savings over £3 501 may incur tax to highlight growing interest pushing savers over allowances. Understand your PSA, track interest, and use ISAs to protect earnings. Stay proactive with your HMRC account for peace of mind3. Have you checked your savings interest lately – what steps will you take next?

References

- HMRC Savings Account Warning: What You Need To Know – Explains warnings, thresholds, and actions for individual savers unaware of rules or with multiple accounts. ↩︎

- HMRC Tax Warning Savings Interest 3500 – Covers how interest builds on modest pots, aimed at taxpayers surprised by tax on non-ISA savings. ↩︎

- HMRC Savings Tax Warning – Details PSA for 2025/26, collection methods, and tips for retirees or those needing Self Assessment. ↩︎