When someone close to you passes away, dealing with their finances can feel overwhelming. The question of what happens to bank account when someone dies without a will UK comes up often for families. In the UK, if a person dies without a will, they die “intestate.” The law steps in with rules called intestacy rules. These decide who gets the money and who handles the estate.

Banks freeze sole accounts right away to keep the money safe. No one can take funds out until the right person gets legal power. This protects the estate for the true heirs. Joint accounts work differently—they go straight to the surviving owner. This guide explains the steps clearly. It helps bereaved relatives and those managing the estate.

Understanding Intestacy in the UK

When there is no will, intestacy rules apply. These come from old laws updated over time. They set a clear order for who inherits.

Here is a simple breakdown:

- Married or civil partner with no children: The spouse gets everything.

- Married or civil partner with children: The spouse gets personal items, the first £322,000, and half of the rest. Children split the other half (at age 18 or when married).

- No spouse but children: Children share everything equally.

- No spouse or children: Parents inherit, then siblings, and so on.

Unmarried partners get nothing under these rules, even if they lived together for years. Step-children or foster children also miss out.

If someone dies without a will what happens to their money?1 It forms part of the estate. Debts and taxes come out first. Then it goes to heirs per the rules.

What Happens to Sole Bank Accounts

Sole accounts belong only to the deceased. Banks freeze them as soon as they learn of the death.

Follow these steps:

- Notify the bank: Send a death certificate. Use the Death Notification Service for many banks like Barclays, HSBC, Lloyds, and NatWest.

- The account freezes: No withdrawals or payments happen, except specials like funerals.

- Get legal authority: Apply for letter of administration without will uk. This lets the administrator access funds.

- Close or transfer: Show the grant to the bank. They release money after debts.

Can next of kin withdraw money from deceased bank account? No, not without the grant. Next of kin means closest relative, but it gives no automatic right to funds. Taking money without power is illegal.

Some banks release small amounts without a grant. Limits vary—often £5,000 to £50,000. Check with the bank.

Joint Bank Accounts After Death

Joint accounts pass easily.

- The money goes fully to the surviving owner.

- No need for probate or letters.

- Show the death certificate. The bank updates the account to the survivor’s name.

This happens fast and without tax issues for the transfer. The value counts for inheritance tax on the estate.

If the account is “tenants in common” (rare), the share goes into the estate.

Paying for the Funeral from the Deceased’s Account

Funerals cost a lot, and families need quick help.

Can you use a deceased persons bank account to pay for their funeral? Yes, often.

- Take the death certificate and funeral invoice to the bank.

- Many pay the funeral director directly, even from frozen accounts.

- This is a key exception. It covers the main bill, not extras like wakes.

Banks like Lloyds, NatWest, HSBC, and Barclays allow this. It eases pressure right after loss.

If the estate lacks money, check for government help like Funeral Expenses Payment.

Applying for Letters of Administration

Without a will, you need letters of administration.

Who is the next of kin when someone dies without a will? Usually the spouse first, then children, parents, or siblings.

Steps to apply:

- Check if needed: Not for tiny estates or all joint assets.

- Gather papers: Death certificate, details of assets/debts.

- Fill forms: Use GOV.UK for PA1A form.

- Pay fee: Around £300 if estate over £5,000.

- Wait: Takes weeks to months.

The grant lets you handle banks, sell property, and share the estate.

How does closing bank account after death no will work?

Follow these steps:

- Send death certificate to the bank (use Death Notification Service for many banks).

- Bank freezes the account.

- Apply for letters of administration.

- Show the grant to the bank.

- Bank closes the account and releases funds to the estate (often via cheque or executor account).

What happens to bank account when someone dies without a will UK?

The person dies “intestate.” Intestacy rules decide who gets the money.

- Sole accounts (only in the deceased’s name) freeze right away. No one can take money out until someone gets legal power called letter of administration without will uk.

- Joint accounts pass straight to the surviving owner. They show the death certificate, and the bank updates the account. Banks protect the money until the right person steps in.

If someone dies without a will what happens to their money?

The money joins the estate. Pay debts, funeral costs, and taxes first. Then, share what’s left per intestacy rules:

- Spouse or civil partner gets most (or all if no children).

- Children share if no spouse.

Further relatives (parents, siblings) if no closer family. Unmarried partners get nothing automatically.

Closing Bank Account After Death No Will

Closing bank account after death no will follows these steps:

- Notify with a death certificate.

- Apply for letters if needed.

- Send a grant to the bank.

- Bank closes account and sends cheque or transfers to executor account.

Some banks open special which banks offer executor accounts.2 These hold estate money safely.

If the deceased’s spouse had a sole account, like “my husband died and i am not on his bank account“, it freezes. The surviving spouse applies for letters as top priority.

Common Challenges and Tips

Dealing with this takes time and emotion. Here are tips:

- Act early: Notify banks soon to stop unwanted payments.

- Keep records: Note balances at death for taxes.

- Get help: Use free advice from Citizens Advice or paid solicitors.

- Avoid mistakes: Never use the deceased’s card or login—it’s against the law.

- Plan ahead: This shows why wills matter. They avoid intestacy issues.

Many face delays with probate. Start the process soon.

FAQs

Which banks offer executor accounts?

Many big ones like HSBC, NatWest, and Barclays do. They hold estate money safely.

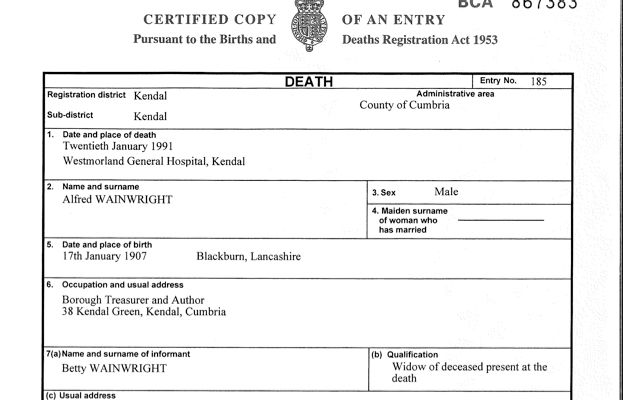

These pictures show examples of key items like death certificates, invoices, grants, and rules charts. Making a will helps avoid these steps for your loved ones.

Can next of kin withdraw money from deceased bank account?

No, not usually. “Next of kin” means closest relative, but it gives no legal right to touch the money.

Withdraw without letters of administration could be illegal. Banks may allow small amounts (often £5,000–£50,000) for urgent needs, but rules vary.

Who is the next of kin when someone dies without a will?

The order matches who can apply for letters of administration:

- Spouse or civil partner.

- Adult children.

- Parents.

- Siblings.

- More distant relatives. This person often handles the estate.

Can you use a deceased persons bank account to pay for their funeral?

Yes, this is a common exception.

Take the death certificate and funeral invoice to the bank. Many pay the funeral director directly, even from a frozen account. This covers the main funeral bill (not extras like flowers or wakes). It helps families quickly.

What is a letter of administration without will uk?

It is the court paper that gives the administrator power to handle the estate. Apply through GOV.UK if the estate is worth more than about £5,000. It proves to banks you can access and share the money.

Conclusion :

In conclusion, what happens to bank account when someone dies without a will UK involves freezing sole accounts, quick transfer for joint ones, and needing letters of administration for access3. The process protects the estate but can take time. Follow steps carefully and seek support. Making a will avoids these issues for your family. Have you thought about your own plans yet?

References

- The Gazette: What happens to a bank account when someone dies – Covers joint accounts, notifications, and exceptions like funerals/IHT. Useful for understanding legal protections and personal representatives’ roles. ↩︎

- Longmores Solicitors: What happens to a bank account when someone dies without a will – Detailed explanation of freezing accounts, joint vs sole, funeral payments, and required documents. Helps estate administrators with procedural details. ↩︎

- Citizens Advice: Dealing with the financial affairs of someone who has died – Practical steps for notifying banks, accessing funds for funerals, and understanding probate/letters of administration. Ideal for bereaved relatives needing immediate guidance. ↩︎