Xiaohongshu, often called xhs.com in its web domain, stands out as a leading Chinese social commerce platform. If you aim to find recent investor and/or funding history of xhs.com, this article breaks it down step by step. We draw from reliable sources to give you clear facts. Founded in 2013, the company mixes social sharing with shopping. It helps users post reviews on fashion, beauty, and travel. By 2025, it will boast over 300 million monthly active users. This growth draws big investors. We focus on its funding path, recent valuations, and key players. This info helps investors, analysts, and business teams spot trends in Chinese tech.

What Is Xiaohongshu?

Xiaohongshu started as a shopping guide for Chinese tourists. Founders Charlwin Mao and Miranda Qu saw a need for real user tips on products abroad. They launched it in June 2013 in Shanghai. At first, it focused on Hong Kong shopping. Soon, it grew into a full lifestyle app. Users share photos, videos, and notes on everything from makeup to trips.

The app’s name means “Little Red Book” in Chinese. Outside China, it goes by RedNote or rednote. It blends Instagram-style posts with e-commerce links. Brands pay to advertise here because users trust the content. In 2025, about 30% of users are male, up from earlier years when most were women born after 1990. Revenue comes mainly from ads, like from cosmetics firms. In 2023, it made $500 million in profit on $3.7 billion in sales. By 2024, quarterly revenue hit $1 billion. Wikipedia Entry on Xiaohongshu1

Xiaohongshu fits the Chinese social commerce platform trend. It competes with apps like Douyin (TikTok in China) but focuses on “grass-planting” – where posts inspire buys. In 2025, it gained U.S. users after TikTok’s shutdown there. Downloads jumped 200% year-over-year. This global push boosts its appeal to investors. Now, let’s dive into its funding story.

Building the Foundation with Seed and Series A Funding

Every big company starts small. Xiaohongshu’s journey shows smart steps in raising cash. In September 2013, it got a seed round of CNY 150,000. This tiny amount helped launch the app and add basic features. It came at a time when Chinese apps were booming.

Next, in August 2014, came the Series A round. It raised CNY 141,000. Again, small sums, but they grew the user base. These early rounds focused on tech tweaks and more users. No big names have led yet, but it set the stage for growth. By 2015, the app had warehouses in Shenzhen and Zhengzhou for better shipping. This tied into its e-commerce side.

These rounds total under $1 million in today’s terms. Yet, they proved the idea worked. Founders used them to hit milestones, like a 2017 shopping festival that made over CNY 100 million in two hours. Early funding built trust for later big deals.

Scaling Up: Series B and C Rounds Bring Big Players

Growth sped up in 2015. The Series B round in June brought $17.5 million. Notable Capital led it. This cash-scaled operation boosted engagement. Users loved sharing real stories, which drew more people.

Then, in March 2016, the Series C round raised $100 million. Tencent led this one. Tencent, a tech giant, saw potential in social media ties. This round valued the company higher and helped expand into fashion and beauty. By now, total funding has hit about $117.5 million. It shifted Xiaohongshu from a niche guide to a broad lifestyle social media app China.

Tencent’s backing was key. It opened doors to more users via WeChat links. Analysts note this as a turning point. The app topped app store charts in shopping categories. TexAu Profile on Xiaohongshu2

Major Milestones: Series D and E Funding Rounds

2018 marked a leap. The Series D round in June raised $300 million. Alibaba Group led it, with Tencent joining again. Valuation hit $3 billion. This cash grew e-commerce tools. Users could now buy straight from posts.

In November 2021, the Series E round added $500 million. Temasek Holdings and Tencent led. Valuation soared to $20 billion. Genesis Capital and GGV Capital also invested. Total funding now neared $917.7 million. This round strengthened finances and scaled features like live streams.

These rounds show strategic picks. Alibaba and Tencent, rivals in China, both backed it. This rare move highlights Xiaohongshu’s unique spot in social media unicorn China.

Recent Shifts: 2023 and 2024 Funding Activities

Post-2021, the focus moved to secondary sales. In 2023, Sequoia China (now HongShan Capital) bought shares at a $14 billion valuation. No new cash raised, but it showed investor faith.

July 2024 saw stake sales to new and old backers. Valuation hit about $17 billion. Investors included DST Global, HongShan, Hillhouse Investment, Boyu Capital, and CITIC Capital. This was a Series F round in some reports, led by DST Global. It added to the Xiaohongshu Series funding story without a full new round.

By late 2024, revenue grew to $4.8 billion, with 3,300 staff. Profitability came in 2023, a big win for a Chinese social media startup funding case.

Find Recent Investor and/or Funding History of xhs.com: 2025 Updates

To find recent investor and/or funding history of xhs.com, look at the 2025 secondary market buzz. No major primary rounds, but valuations surged via trades.

In January 2025, the valuation was $20 billion. By June, it hit $26 billion in trades, per GSR Ventures docs. Xiaohongshu made up 91% of a GSR fund’s assets. This boosted GSR’s returns.

In September 2025, valuation rose 19% to $31 billion. GSR Ventures (Jinshajiang) disclosed this in portfolio updates. Xiaohongshu now accounts for 92% of its fund. This reflects strong demand for the secondary share sale Xiaohongshu.

Profit forecasts hit $3 billion for 2025, up triple from prior years. This aids pre-IPO Chinese tech companies like Xiaohongshu. No new funding rounds, but these valuations signal health.

Key recent investors via stakes: Baillie Gifford, Helios & Partners, Boyu Capital, CITIC Capital, DST Global. Total Xiaohongshu capital raised stays at $918 million from earlier rounds.

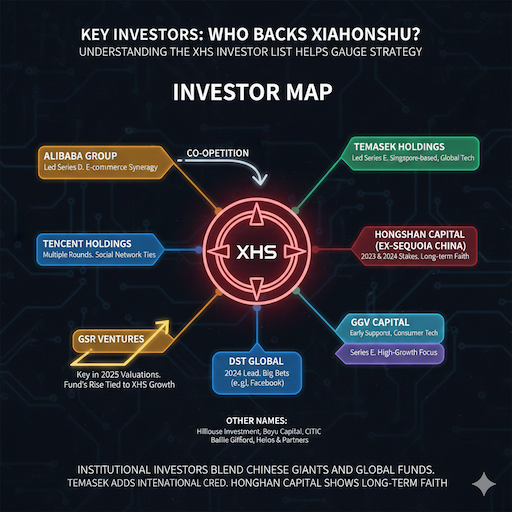

Key Investors: Who Backs Xiaohongshu?

Understanding the XHS investor list helps gauge strategy. Major backers include:

- Alibaba Group: Led Series D. Focuses on e-commerce synergy.

- Tencent Holdings: In multiple rounds. Brings social network ties.

- Temasek Holdings: Led Series E. Singapore-based, eyes global tech.

- HongShan Capital (ex-Sequoia China): 2023 and 2024 stakes.

- DST Global: 2024 lead, known for big bets like Facebook.

- GSR Ventures: Key in 2025 valuations, holds a large stake.

- GGV Capital: Early supporter, focuses on consumer tech.

- Genesis Capital: In Series E, invests in high-growth.

Other names: Hillhouse Investment, Boyu Capital, CITIC Capital, Baillie Gifford, Helios & Partners.

These institutional investors in Xiaohongshu mix Chinese giants and global funds. Tencent Alibaba investment XHS stands out as co-opetition. Temasek investment Chinese startups adds international cred. Sequoia China HongShan Capital XHS shows long-term faith.

For GSR Ventures Xiaohongshu, their fund’s rise ties directly to XHS’ growth.

Valuation Timeline: From Startup to Unicorn

Track the Xiaohongshu valuation 2025 through the years:

- 2018: $3 billion (post-Series D).

- 2021: $20 billion (post-Series E).

- 2023: $14 billion (HongShan buy).

- July 2024: $17 billion (stake sales).

- Jan 2025: $20 billion.

- June 2025: $26 billion (GSR trades).

- Sep 2025: $31 billion (19% jump).

This Xiaohongshu funding and valuation timeline shows steady climbs. Total how much funding has Xiaohongshu raised: $918 million. Xiaohongshu total funding raised so far supports its unicorn status. Bloomberg on Xiaohongshu’s $26 Billion Valuation3

In private market valuation China tech, it nears Baidu’s level. Growth comes from user base and ads, not just funding.

Comparing Xiaohongshu to Peers: TikTok and Others

How does it stack vs. rivals? In comparison of Xiaohongshu and TikTok valuation, TikTok’s parent ByteDance hits $220 billion. But Xiaohongshu’s niche in lifestyle beats TikTok’s short videos for shopping trust.

TikTok focuses on fun; Xiaohongshu on real advice. In 2025, Xiaohongshu’s $31 billion tops some like Snap (unprofitable) and nears Pinterest’s earnings.

Other investment history of Chinese social media apps: Weibo or Kuaishou saw similar paths but lower valuations now. Xiaohongshu’s profit edge sets it apart.

For those who invested in Xiaohongshu in 2024 2025, focus on secondary buyers like DST and GSR.

IPO Prospects: Is Xiaohongshu Preparing?

Many ask, is Xiaohongshu preparing for IPO? Signs point yes. 2025 profit forecast of $3 billion boosts chances. It shifted from the U.S. to Hong Kong plans in 2022 due to the rules.

Recent moves: Bought a payment license in 2025 for in-app buys. This closes the loop from content to checkout. Restructuring in December 2025 added “Live” and “Village” units for 300 million daily users.

Analysts see a 2026 IPO likely. Valuation at $31 billion could rise more. For Xiaohongshu private market valuation analysis, secondary trades show demand.

Insights for Investors and Analysts

As the primary audience, investors & venture capitalists value these trends. Secondary market valuations like $26B to $31B via GSR give risk/return clues.

Financial analysts & market researchers track Alibaba, Tencent, Temasek involvement for ecosystem insights.

Corporate strategy/business development teams use this to gauge competitor health.

Secondary audience: Journalists & tech media craft stories on Chinese internet companies. Entrepreneurs & startup founders benchmark against Xiaohongshu shareholders.

Academic / university research studies cross-border investor behavior.

Tips for tracking:

- Check PitchBook or Tracxn for updates.

- Follow X posts on funding buzz.

- Read Bloomberg for valuation news.

Challenges and Future Outlook

Xiaohongshu faces hurdles. In 2025, it got penalized for “negative content” by China’s cyberspace body. Taiwan banned it over fraud concerns. U.S. growth needs content tweaks.

Yet, Outlook shines. AI tools like Diandian search boost engagement. Global expansion post-TikTok ban helps.

For the latest funding round of xhs.com, watch secondary sales. Find recent investors in Xiaohongshu via funds like GSR.

FAQs

What is Xiaohongshu?

Xiaohongshu is a fun Chinese app. People share photos and tips about makeup, clothes, and trips. They also shop right in the app. It has over 300 million users now.

How much money has Xiaohongshu raised?

It raised about $918 million in total. That money came from different rounds long ago. No big new money came in after 2021.

Who are the big investors?

Big names helped a lot:

- Alibaba and Tencent (they are huge Chinese companies)

- Temasek from Singapore

- Funds like DST Global, HongShan, and GSR Ventures, Many others joined in later too.

How much is Xiaohongshu worth now?

In 2018, it was worth $3 billion. By late 2021, it reached $20 billion. In September 2025, it went up to $31 billion.

What were the main money rounds?

Here are the big ones:

- 2013: Very small start-up money

- 2015: $17.5 million

- 2016: $100 million (Tencent helped)

- 2018: $300 million (Alibaba-led)

- 2021: $500 million (the biggest one). After that, people just bought and sold shares.

Will Xiaohongshu go public soon?

Maybe in 2026! It makes a good profit now. It changed some rules so it can sell shares to people.

How is it different from TikTok?

TikTok is about short, funny videos. Xiaohongshu is about real tips for shopping and life. It helps people trust what they buy.

Conclusion

In summary, to find recent investor and/or funding history of xhs.com, note its $918 million total raise across rounds up to Series E in 2021, with 2024-2025 secondary valuations hitting $31 billion. Key backers like Tencent, Alibaba, and GSR drive this. Profits and user growth position it for IPO. This path offers lessons in Xiaohongshu venture capital success.

What do you think – will Xiaohongshu’s IPO change the social media unicorn China landscape? Share your views.