When you look for safe spots to keep your extra cash, the money market mutual fund vs money market deposit account debate often comes up. Many people mix them up because the names sound alike. But they work in different ways. One acts like a savings spot at a bank. The other is more like an investment. In this guide, we break it down simply. We help you see which one might suit your needs better. If you want to park cash safely and earn some interest, keep reading.

What Is a Money Market Deposit Account?

A money market deposit account is a type of savings account you open at a bank or credit union. It pays higher interest than a regular savings account. You can write checks or use a debit card with it sometimes. Banks offer these to attract people who want better returns on their cash without much risk.

Think of it as a mix between a checking and savings account. You get easy access to your money. But it earns more interest. Federal rules once limited withdrawals to six per month. Now, many banks lift that limit. Still, check with your bank.

Why do people choose this? It’s great for emergency funds or short-term goals like buying a car. Your money stays safe. The bank invests it in short-term, low-risk things like government bonds. But you don’t worry about that. The bank handles it.

Key Features of Money Market Deposit Accounts

- Interest Rates: Often higher than standard savings. Right now, top ones offer over 4% APY.

- Access: Debit cards, checks, and online transfers make it easy to use.

- Minimums: Some need $100 or more to open. Others have no minimum.

- Fees: Many have no monthly fees if you keep a certain balance.

Banks like Ally or Quontic offer good examples. They give high rates and no fees. This makes them popular for everyday savers.

What Is a Money Market Mutual Fund?

A money market mutual fund is an investment. You buy shares through a brokerage or fund company. It invests in short-term, safe securities like Treasury bills or corporate debt. The goal is to keep the share price at $1. You earn dividends from the interest those investments make.

It’s not a bank account. It’s a fund. Brokerages like Fidelity or Schwab sell them. They suit people with investment accounts who want to hold cash safely.

These funds aim for stability. But they can fluctuate a bit. In rare cases, the value dips below $1. This happened in 2008 with one fund during the financial crisis.

Key Features of Money Market Mutual Funds

- Yields: Can be higher than bank accounts in good markets. But they vary.

- Access: Sell shares to get cash. It might take a day or two.

- Minimums: Often none, but check the fund.

- Fees: Small annual fees, like 0.5% or less.

People use these in brokerage accounts. It’s a way to earn cash while waiting to invest in stocks. Bankrate’s breakdown of MMAs vs MMFs1

Money Market Mutual Fund vs Money Market Deposit Account: Core Differences

The money market mutual fund vs money market deposit account choice boils down to safety, access, and returns. One is a bank product. The other is an investment. Let’s compare them head-to-head.

Safety and Insurance

Safety matters most for savers. Money market deposit accounts come with FDIC insurance. This covers up to $250,000 if the bank fails. Credit unions use NCUA for the same protection. Your principal stays safe.

Money market mutual funds lack FDIC coverage. They have SIPC protection through brokerages. This guards against brokerage failure, up to $500,000. But it doesn’t cover market losses. In tough times, you could lose a bit. Though it’s rare, like in 2008.

For risk-averse people, the deposit account wins. It’s truly low-risk.

Returns and Yields

Both earn more than regular savings. But how they pay differs.

Money market deposit accounts offer a fixed APY. It’s set by the bank. Top rates hit 4-5% now. It compounds daily or monthly.

Money market mutual funds pay yields based on their holdings. These can beat bank rates sometimes. But they fluctuate with markets. In low-rate times, they might lag.

Check current rates. For example, some funds yield 4.5%, while accounts top at 4.25%. It changes with Fed rates.

Liquidity and Access

You need quick cash sometimes. Both are liquid, but not the same.

Money market deposit accounts let you write checks or use ATMs. Transfers happen fast. Some have limits, but many don’t know.

Money market mutual funds require selling shares. Cash hits your account in 1-2 days. Good for brokerage cash, but slower for daily needs.

If you need money today, go with the deposit account.

Minimum Balances and Fees

Money market deposit accounts might need $100-$1,000 to open. Keep a balance to avoid fees. Many online banks skip fees.

Money market mutual funds often have low or no minimums. But watch expense ratios. These eat into returns.

Risk Levels

Money market deposit accounts have almost no risk. FDIC backs them.

Money market mutual funds are low-risk but not zero-risk. Market changes can affect value. New rules help, but history shows risks.

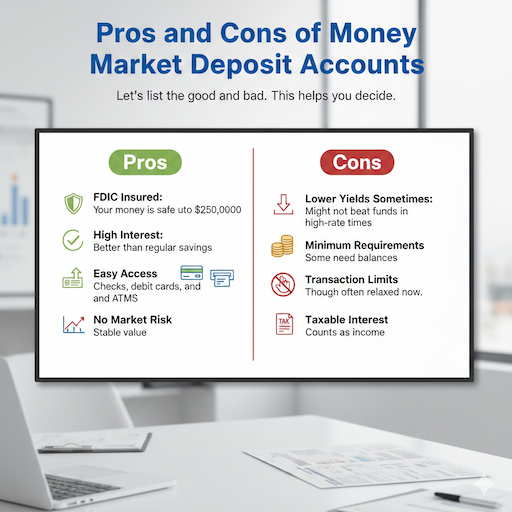

Pros and Cons of Money Market Deposit Accounts

Let’s list the good and bad. This helps you decide.

Pros

- FDIC Insured: Your money is safe up to $250,000.

- High Interest: Better than regular savings.

- Easy Access: Checks, debit cards, and ATMs.

- No Market Risk: Stable value.

Cons

- Lower Yields Sometimes: Might not beat funds in high-rate times.

- Minimum Requirements: Some need balances.

- Transaction Limits: Though often relaxed now.

- Taxable Interest: Counts as income.

Pros and Cons of Money Market Mutual Funds

Now, the fund side.

Pros

- Potential Higher Yields: Can outperform bank accounts.

- Flexibility in Investments: Part of a brokerage portfolio.

- Low Minimums: Easy to start.

- Tax Options: Some are tax-exempt.

Cons

- No FDIC Insurance: Risk of loss.

- Market Fluctuations: Value can dip.

- Slower Access: Takes time to cash out.

- Fees: Expense ratios reduce returns.

When to Choose a Money Market Deposit Account

Pick this if safety tops your list. It’s ideal for emergency fund options. Keep 3-6 months of expenses here. The FDIC cover gives peace of mind.

Also good for short-term goals. Save for a vacation or home repair. Access is quick. No worry about markets.

Novice savers like this. It’s simple. No investing knowledge needed.

When to Choose a Money Market Mutual Fund

Go for this if you have a brokerage account. It’s a cash equivalent investment. Hold money here while picking stocks.

If you want higher yields and accept tiny risk, it’s fine. Good for intermediate investors.

But not for emergencies. The delay in access hurts.

Money Market Mutual Fund vs Money Market Deposit Account for Emergency Funds

For an emergency fund, the deposit account shines. Why? Instant access and insurance.

Funds work if your emergency cash is in a brokerage. But most experts say keep emergencies in banks.

Think about your needs. If you fear job loss, go insured. CNBC’s comparison of accounts and funds2

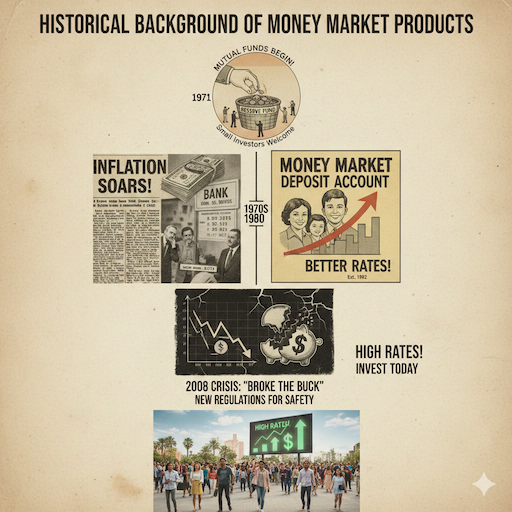

Historical Background of Money Market Products

These products started in the 1970s. High inflation made regular savings lose value. Banks created money market deposit accounts in 1982. They offered better rates.

Money market mutual funds began in 1971. The first was the Reserve Fund. It lets small investors access high-yield securities.

In 2008, the crisis hit funds hard. One broke the buck. Rules changed to make them safer.

Today, both are popular. With rates up, people flock to them.

Current Trends in Money Market Options

Rates are high now due to Fed hikes. Bank money market interest rates average 0.6%, but the top ones hit 5%.

Funds yield around 4-5%. Online banks compete hard.

More people use apps for these. Robo-advisors include funds in portfolios.

Comparing to Other Options

How do they stack against others?

| Question | What It Is | Main Difference | Safety | Extra Features | Best For |

| Money Market Deposit Account vs High-Yield Savings | Both are safe bank accounts | MMA lets you write checks and use a debit card. HYSA usually pays a little more interest. | Both have FDIC insurance up to $250,000 | MMA has checks. HYSA has no checks. | MMA if you want checks. HYSA if you want the highest interest. |

| Money Market Mutual Fund vs Savings Account | A fund is an investment. Savings is a bank account. | The fund can pay more interest. Savings are safer and easier. | Savings has FDIC insurance. The fund has no insurance. | Fund buys safe short-term items. Savings is simple. | Fund if you want more interest and a tiny risk is OK. Savings if you want zero risk. |

| Money Market Fund vs Bank Account | A fund is an investment. A bank account is at a bank. | The fund may pay more and is flexible. A bank account is super safe. | Bank account has FDIC insurance. Fund does not. | The fund is good for investors. A bank is good for everyday safety. | Bank account for total safety. Fund for a bit more money with small risk. |

Statistics and Examples

In 2023, money market funds held $6 trillion. Up from $4 trillion in 2020.

Deposit accounts grew, too. Average APY: 0.6%, top 5%.

Example: Jane saves $10,000. In MMA at 4%, earns $400/year. In MMF at 4.5%, $450, but with risk.

Bob uses MMF in brokerage. Earns while waiting for stock dips. Britannica’s guide on money market differences3

Tips for Choosing Between Them

- Assess risk tolerance.

- Check current rates.

- Consider access needs.

- Look at fees.

- Think about taxes.

Consult advisors if unsure.

FAQs

What is the main difference between a money market fund and a money market account?

A money market account is like a special savings account at a bank or credit union. You put money in, and it is safe with FDIC insurance up to $250,000. A money market fund is an investment that buys very safe short-term things like government notes, but it is not at a bank and has no FDIC insurance.

Are money market mutual funds safe?

Money market mutual funds are very safe for most people. They try hard to keep your money at $1 per share, and they invest in super safe short-term items. But they are not insured by the government, so in very rare bad times, you could lose a tiny bit of money.

Can I lose money in a money market deposit account?

No, you cannot lose money in a money market deposit account if it is FDIC-insured. The government protects your money up to $250,000 per person at each bank. It is one of the safest places to keep cash for a short time.

What’s better for short-term investment options?

It depends on what you want! If you want super safety and easy access, pick a money market deposit account with FDIC insurance. If you want a little more interest and do not mind a tiny risk, a money market fund might be better.

How do low-risk investment vehicles compare?

Both money market funds and money market accounts are very low-risk choices. The account is safer because of FDIC insurance, so you never lose principal. The fund gives a bit higher interest most of the time, but it has a very small chance of losing value in extreme cases.

Conclusion

In the money market mutual fund vs money market deposit account matchup, both help grow cash safely. Deposit accounts offer top safety and access. Funds give potential for higher yields in investments. Choose based on your needs – emergency funds lean to accounts, brokerage cash to funds. This keeps your money working without big risks.

What are you using for your cash reserves right now?