Scott Bessent brings a wealth of experience to the table. He serves as the US Treasury Secretary. Bessent has spent decades in finance. He knows how to make money grow. His Bessent sovereign wealth fund proposal reflects that skill. It fits into President Trump’s vision for a prosperous America. Trump wants to make the country self-reliant. The proposal suggests using national assets to invest. These assets include land, minerals, and other resources. By doing this, the US could fund important projects. Think new roads, better airports, and advanced medical research. But challenges exist. Debt levels are high. In May 2025, Bessent announced a pause. The focus shifted to reducing debt first. This careful approach shows leaders think ahead. It reassures citizens that changes come with planning.

You might wonder why this matters now. Global economies face pressures. Trade wars, inflation, and tech shifts demand action. Other countries use sovereign funds successfully. The US could benefit too. This guide covers the proposal’s details. We include backgrounds, achievements, and examples. Statistics and references add depth. Read on to see the full picture.

Understanding Sovereign Wealth Funds: The Basics

Sovereign wealth funds act as national savings tools. Governments create them to manage extra money. They invest in stocks, bonds, real estate, and more. The returns help fund public needs. These funds provide stability during tough times.

Many nations rely on them. Norway’s Government Pension Fund Global is a prime example. It started in the 1990s with oil revenues. Today, it holds over $1.5 trillion. The fund invests globally. It earns about 6% annually on average. This money supports pensions and infrastructure. Citizens enjoy lower taxes because of it.

Singapore has Temasek Holdings. It focuses on long-term growth. The fund owns stakes in major companies. It has grown to $300 billion. Singapore uses profits for education and health.

US sovereign wealth fund proposal draws inspiration from these. But the US lacks oil surpluses like Norway. Instead, it has vast public assets. These include federal lands and mineral rights. The proposal aims to monetize them safely.

Why do funds work? They diversify income. Nations avoid depending on one source. During oil price drops, funds keep economies steady.

Key benefits include:

- Economic growth: Investments create jobs.

- Debt reduction: Profits pay off loans.

- Future security: Saves for generations.

Risks exist, too. Poor investments can lose money. Strict rules prevent that. Transparency builds trust.

In the US context, state-level funds show promise. Alaska’s Permanent Fund pays dividends to residents. In 2023, each person got $1,312. Texas uses its funds for schools. These examples prove the concept.

Bessent’s plan adapts this to the national level. It could make the US a leader in public asset management. Bessent Says Trump Paused Sovereign Wealth Fund to Focus on Debt1

The Man Behind the Proposal

Scott Bessent emerges as a key figure in US finance. Born in 1962, he grew up in South Carolina. He attended Yale University, earning a degree in 1984. There, he studied history and economics.

Bessent’s career took off at Soros Fund Management. He joined in 1991 as a portfolio manager. He helped navigate major market events. In 1992, he contributed to the famous British pound trade. That earned billions for the fund.

In 2015, Bessent founded Key Square Group. It’s a macro hedge fund. It focuses on global economic trends. The firm manages billions. Bessent’s strategies emphasize risk management.

His achievements impress. Forbes lists him among the top investors. He has testified before Congress on economic issues. Bessent advocates for free markets with safeguards.

Trump nominated him for Treasury Secretary in late 2024. The Senate confirmed him quickly. Bessent shares Trump’s views on trade. He pushes for fair deals with China and others.

In his role, Bessent handles budgets, taxes, and debt. The Treasury Secretary Bessent SWF initiative highlights his innovation. He sees untapped potential in US assets.

Bessent speaks often. In a 2025 interview, he said, “We must think big to stay ahead.” His insights reassure markets.

Outside work, Bessent supports education. He donates to Yale. His net worth exceeds $100 million, per estimates. This background makes his proposal credible. Bessent knows how to build wealth.

The Core of Bessant submits proposal on sovereign wealth fund to Trump

Bessent delivered his plan in spring 2025. It responded to Trump’s directive. The president wanted ideas on creating a fund.

The proposal outlines steps. First, identify assets. The US owns 640 million acres of land. This includes national parks and forests. Not all would sell. Some could lease for mining or energy.

Second, set funding mechanisms. Tariffs on imports provide cash. Trump imposed high tariffs on steel and tech. These could feed the fund.

Third, define investments. Focus on safe, high-return options. Examples: US Treasuries, blue-chip stocks, infrastructure bonds.

Fourth, establish governance. An independent board oversees. Rules prevent corruption. Annual reports ensure transparency.

Bessent emphasized monetization. “We’re going to monetize the asset side of the U.S. balance sheet for the American people,” he told reporters. This means turning idle assets into active investments.

The plan estimates the initial size at $100 billion. It could grow to trillions. Like Norway, it would invest 60% in stocks, 35% in bonds, and 5% in real estate.

Bessent Trump economic proposal ties to broader goals. It supports manufacturing revival. Fund money could build factories. Trump Signs Executive Order to Create Sovereign Wealth Fund2

Experts praise the creativity. But they note challenges. Congress must approve sales. Legal hurdles exist.

This proposal sparks economic policy debate White House. It pushes boundaries.

Trump’s Executive Order: The Starting Point

President Trump signed the executive order on February 3, 2025. It directed action. Treasury and Commerce departments led the effort.

The order requires a plan in 90 days. It covers funding, structure, and strategies. Trump said, “We’re going to create a lot of wealth for the fund. And I think it’s about time that this country had a sovereign wealth fund.”

Bessent and Howard Lutnick collaborated. Lutnick, Commerce Secretary, brings business acumen. He founded Cantor Fitzgerald.

The Trump executive order sovereign wealth fund mentioned potential uses. Fund “great national endeavors.” Examples: Highways, airports, manufacturing, and medical research.

Trump hinted at buying TikTok. “We might put that in the sovereign wealth fund,” he said. This addresses security concerns.

Reuters covered the signing extensively. They noted controversies. Funding needs Congress for big changes. The order reassures. It shows commitment to innovation.

Pushback from the White House and Pauses

Progress hit snags. In May 2025, Bessent announced a pause. “The Trump administration has paused plans to create a sovereign wealth fund to prioritize paying down debt,” he said.

Why? US debt exceeds $35 trillion. Interest payments eat budgets. Focusing there first makes sense.

CBS News reported internal pushback. White House rejected some parts. Spokesperson Kush Desai stated, “No final decisions have been made.”

Trump administration pushback on sovereign wealth fund stems from caution. Debates focus on funding. Tariffs alone may not suffice.

Legal issues arise. Executive orders can’t fund everything. Congress holds the purse strings. Bessent remains optimistic. He works on revisions. This pause helps. It allows better planning.

How Would a US Sovereign Wealth Fund Work in Practice?

Imagine the fund as a giant piggy bank. The government deposits money. Managers invest it.

Step-by-step:

- Collect funds: From tariffs, asset leases, and surpluses.

- Build structure: Create a corporation-like entity.

- Invest strategically: Diversify across assets.

- Distribute returns: Pay debt, fund projects.

How would a US sovereign wealth fund work daily? A board meets quarterly. They review performance. Adjust as needed.

Like Norway, avoid risky bets. Focus on steady growth. In the US, it could buy stakes in tech firms. Or fund green energy. Simulations show potential. If invested at 5% return, $100 billion grows to $128 billion in five years. This model reassures. It’s proven elsewhere.

Potential Impacts on National Debt and Economy

Debt burdens the US. Annual interest hits $1 trillion. The fund offers relief.

Impact of US sovereign wealth fund on national debt: Use profits to pay principal. Reduce borrowing needs.

Estimates: 4% annual return on $500 billion fund yields $20 billion. Apply to debt.

Broader effects:

- Boost growth: Investments create jobs.

- Lower taxes: Less need for revenue.

- Stabilize markets: Diversified income.

Critics say risks outweigh. Market crashes could hurt. But history shows funds succeed. Norway weathered the 2008 crisis well. Bessent’s plan includes buffers. Limit risky assets to 20%. This strategy helps US debt and deficit management.

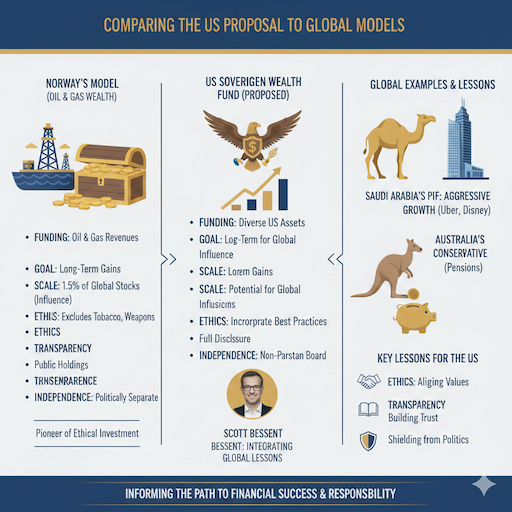

Comparing the US Proposal to Global Models

Comparison of US sovereign wealth fund vs Norway fund: Norway funds from oil. US from assets. Both aim for long-term gains.

Norway’s fund owns 1.5% of global stocks. The US could do similar scale. Saudi Arabia’s Public Investment Fund invests in Uber, Disney. Aggressive style. Australia’s Future Fund saves for pensions. Conservative approach.

Lessons for the US:

- Ethics: Norway avoids tobacco, weapons.

- Transparency: Publish holdings.

- Independence: Keep politics out.

Bessent studies these. His plan incorporates best practices.

This comparison educates. Shows paths to success.

The Broader Context of US Economic Policy Under Trump

Trump’s policies emphasize America First. Tariffs protect jobs. Deregulation spurs business. The fund fits. It’s a US economic policy under Trump tool. White House economic advisors like Kevin Hassett support. They see it as innovation.

Debates occur. Economic policy debate White House weighs pros, cons.

Goals: Reduce trade deficits, boost manufacturing. The fund could finance reshoring. Bring factories home. This approach reassures businesses. Predictable policies help. Sovereign Wealth Fund: Trump Administration White House Pushes Back3

Strategies for Government Asset Monetization

Government asset monetization turns idle resources into cash.

US examples: Sell airwave spectrum. Earned billions.

Bessent proposes more. Lease federal lands for solar farms.

Steps:

- Inventory assets: Map all holdings.

- Value them: Use experts.

- Monetize safely: Avoid fire sales.

This creates a national investment fund.

Benefits: Immediate cash, long-term royalties.

Risks: Environmental concerns. Balance needed.

Effective Federal Debt Reduction Strategy

Federal debt reduction strategy combines cuts, growth.

Fund adds layer. Invest to generate payoff funds.

Other tactics: Cut spending, raise efficiency.

Trump prioritizes this. Pause reflects that.

US debt and deficit management improve with tools like this.

Statistics: Debt-to-GDP ratio at 130%. The fund could lower it by 10% in a decade.

Reassuring for the future.

Designing a Strong Sovereign Fund Governance Model

Sovereign fund governance model ensures fairness.

Key elements:

- Board selection: Experts, not politicians.

- Rules: No self-dealing.

- Audits: Yearly checks.

Norway’s model: The Central Bank manages. The government sets guidelines.

The US could copy. Add congressional oversight.

This builds trust.

Advancing Public Asset Management

Public asset management optimizes government holdings. Fund professionalizes it. Instead of neglect, active care. Federal investment vehicle for efficiency. Helps taxpayers.

The Timeline for the Trump Sovereign Wealth Fund Proposal

Timeline for trump sovereign wealth fund proposal:

- November 2024: Bessent nominated.

- February 2025: Executive order signed.

- May 2025: Proposal submitted.

- May 2025: Pause announced.

- Ongoing: Debates continue.

Future: Possible legislation in 2026.

Stay updated.

Reasons White House Rejected Parts of the SWF Proposal

Reasons white house rejected parts of SWF proposal:

- Funding gaps.

- Debt priorities.

- Legal barriers.

They seek improvements.

Shows a thorough review.

FAQs

What is the main goal?

The main goal is to build more wealth over time. This wealth helps pay for big projects and also reduces debt faster. It creates a stronger plan for both growth and getting out of debt.

Why was it paused?

The plan was paused to put full focus on paying off debt first. Debt can cost a lot in interest, so clearing it saves money right away. Once debt is lower, it becomes easier and safer to build wealth again.

How is it funded?

It gets funded mostly from extra assets that are sold or used. Tariffs on some imports also bring in money to help pay for it. This mix keeps the funding steady without needing to borrow more.

What are the risks?

The biggest risk is losing money if the markets go down. Investments can drop in value during bad economic times. This could slow down wealth building or make it harder to reach goals.

What are the benefits?

The benefits include stronger economic stability for the future. Less debt means more money stays with you instead of going to interest. Over time, it leads to more freedom, growth, and a safer financial life.

Conclusion

In wrapping up, the idea when Bessent submits proposal on sovereign wealth fund to Trump marks a pivotal step. It promises to harness US assets for lasting prosperity. Though paused to address debt, it holds potential for funding infrastructure, research, and more. This could strengthen the economy for Tier 1 and Tier 2 countries’ audiences who seek data-driven insights. Leaders like Bessent offer expert guidance. The plan reassures with its focus on careful growth. What do you think—could a sovereign wealth fund transform America’s financial future?