In today’s fast-paced financial world, many people watch the markets closely. One big trend stands out: investors withdraw from equity funds due to Fed uncertainty. This happens when folks pull their money out of stock-based funds because they worry about what the Federal Reserve might do next with interest rates. The Fed, as the U.S. central bank, sets rules that affect how much it costs to borrow money. When its plans are unclear, it shakes up the stock market1.

This pullback is not new, but in 2025, it hit hard. Data shows billions of dollars moving out of equity funds. For example, early in the year, U.S. equity funds saw $5.05 billion in outflows in just one week. This shift comes from fears over inflation, tariffs, and rate changes. Retail investors, who are everyday people saving for retirement, feel this the most. They move cash to safer spots like money market funds.

Financial advisors see this too. They help clients adjust plans amid the noise. Institutional investors, like big pension funds, also rethink strategies. Even market analysts track these flows to predict trends. If you invest in stocks, this matters. It can change how your money grows. In this article, we break it down simply. We look at why it happens, what data shows, and how to respond. By the end, you will feel more confident about your choices.

The year 2025 brought twists. The Fed cut rates three times late in the year, bringing the federal funds rate to 3.50%-3.75%. But doubts linger about 2026. Will rates drop more? Or stay put due to strong jobs and sticky prices? This Fed interest rate uncertainty drives caution. Investors fear higher rates could slow growth, hurting stocks. Others worry low rates might spark inflation again.

Global events add fuel. Trade tariffs from policy changes spiked uncertainty2. In April 2025, economic policy uncertainty hit high levels, mostly from trade worries. This makes people pull back. They seek safety over risk. Understanding this helps you stay ahead.

Background on the Federal Reserve and Its Role in Markets

The Federal Reserve, often called the Fed, acts as the guardian of the U.S. economy. It started in 1913 to stop bank panics. Today, it has two main jobs: keep prices stable and aim for full employment. To do this, it uses tools like setting interest rates.

The key rate is the federal funds rate. Banks lend money to each other overnight at this rate. When the Fed raises it, borrowing costs more. This slows spending and cools inflation. Lower rates make loans cheap, boosting growth. But changes ripple through markets.

Equity funds hold stocks from companies. When rates rise, firms pay more to borrow. Profits might drop, and stock prices fall. Investors then show investor risk aversion. They avoid risky assets like stocks.

History shows patterns. In 2008, the Fed cut rates to near zero during the crisis. Stocks crashed first but recovered. In 2018, rate hikes sparked volatility. The S&P 500 dropped 20%. Fast forward to 2022-2023: The Fed hiked rates fast to fight inflation. Equity funds saw big outflows.

In 2025, the story continues. After hikes in prior years, the Fed paused, then cut. But mixed signals create doubt. Officials debate inflation risks. This Federal Reserve monetary policy uncertainty affects everyone.

Retail investors react quickly. They check apps and news. If headlines scream “Fed uncertainty,” they sell. Advisors calm them, but fear wins sometimes.

Institutional players use data. They track fund flow trends. When outflows hit, it signals broader worry.

To grasp this, think of the economy as a car. The Fed is the driver. If it brakes suddenly (rate hikes), passengers (investors) get scared. Uncertainty is like fog on the road. No one knows what’s ahead.

Key past events:

- 1970s Stagflation: High inflation, slow growth. The Fed raised rates sharply. Stocks suffered.

- Dot-com Bubble (2000): Fed hikes popped the bubble. Outflows followed.

- COVID-19 (2020): Rates to zero. Inflows surged, then uncertainty in recovery phases led to pulls.

In 2025, similar vibes. Tariffs and elections add layers. Investors watch Fed meetings like sports games.

Fed Actions in 2025: A Timeline of Decisions and Market Reactions

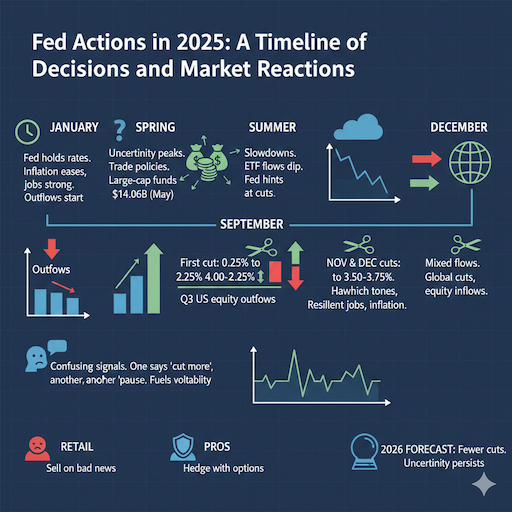

2025 started with caution. The Fed held rates steady early on. Inflation eased, but jobs stayed strong. In January, minutes showed worries about prices and tariffs. This sparked initial outflows.

By spring, uncertainty peaked. Trade policies drove economic policy uncertainty up. Large-cap funds lost $14.06 billion in May. Mid-caps and small-caps also bled cash.

Summer brought slowdowns. Flows into equity ETFs dipped as tariffs loomed. The Fed hinted at cuts.

In September, the first cut: 0.25% to 4.00%-4.25%. Markets cheered briefly. But Q3 saw consistent outflows from U.S. equity in September.

Fall cuts followed. November and December brought two more, to 3.50%-3.75%. Yet, hawkish tones lingered. Officials noted resilient jobs and inflation.

December flows are mixed. Early weeks saw outflows, then inflows ahead of the final meeting. Global equity funds got big inflows mid-month.

These actions show the Fed balancing growth and prices. But the signals are confusing. One official says cut more; another says pause. This fuels stock market volatility.

Investors react in waves. Retail folks sell on bad news. Pros hedge with options.

For 2026, forecasts say fewer cuts. Uncertainty persists.

Why Investors Withdraw from Equity Funds Due to Fed Uncertainty

Many factors drive investors withdraw from equity funds due to Fed uncertainty. First, fear of higher rates. If the Fed hikes or pauses cuts, it squeezes profits. Stocks drop.

Second, macroeconomic uncertainty. Inflation, jobs data, and geopolitics mix in. In 2025, tariffs from Trump policies added risk.

Third, market sentiment turns sour. When uncertainty rises, people prefer cash.

Data backs this. In January 2025, $5.05 billion left U.S. equity funds. Large-caps hit hardest at $4.88 billion.

Retail investor behavior shifts fast. They use apps to sell quickly. Advisors note clients worry about recession concerns.

Interest rate hikes history shows outflows. But even cuts with doubt cause pulls if inflation lingers.

Market liquidity dries up in volatile times. Hard to sell without losses.

Risk-adjusted returns worsen. Stocks seem overpriced.

Experts say: “Uncertainty heightens caution.”

In the UK, similar: £10 billion outflows over six months from budget fears. Global link.

Psychologically, loss aversion plays. People hate losses more than gains.

Media amplifies. Headlines like “Fed Uncertainty Looms” trigger sales.

Investment portfolio shifts happen. From stocks to bonds or cash.

To understand, consider the steps investors take:

- Monitor Fed signals: Watch meetings, minutes.

- Assess personal risk: If near retirement, pull more.

- Diversify: Move to safer assets.

This explains the trend.

Analyzing Equity Fund Outflow Data in 2025

Data tells the story. Equity fund outflows hit records in 2025.

Early year: $5.05 billion weekly outflow in January. Large-caps $4.88B, mid-caps $1.2B.

May: $14.06 from large-caps.

Q3: Consistent outflows in September.

December: Mixed, with outflows early, then $266M from some funds before the final Fed meet.

US equity funds saw capital leave for safer spots. Money market funds gained $56.19 in one week.

Asset under management (AUM) changes: Mutual funds shrank as ETFs grew.

Global: EM funds outflows.

Fund flow trends: After negative S&P weeks, ETF inflows rose 13% in 2025.

Sectors: Industrials out, tech in.

This data from sources like LSEG Lipper, EPFR.

Equity fund outflow data January 2025 set the tone.

Yearly, outflows totaled billions, showing caution.

Impact of Fed Uncertainty on Markets and Investor Portfolios

Fed interest rate uncertainty ripples widely. Stocks swing. Stock market volatility increases. VIX, the fear gauge, spikes.

Portfolios suffer. If heavy in equities, values drop.

Capital outflows reduce liquidity. Prices fall faster.

Investment reallocations: To bonds, which gained $9.14B.

Shifting investments from stocks to money market funds: A Common move for safety.

Economy: Slower growth if investing halts.

For retail: Retirement savings hit. Advisors suggest rebalancing.

Institutional: Hedge with derivatives.

Effect of Fed rate uncertainty on US equity fund inflows: Turns them negative.

Positive side: Opportunities in undervalued stocks.

In 2025, paradox: Strong returns despite risks.

Market liquidity key. Low liquidity amplifies moves.

Global impact: UK outflows from similar uncertainties.

Investor Risk Aversion Strategies During Economic Uncertainty

Face uncertainty head-on. Investor risk aversion strategies during economic uncertainty help3.

- Diversify portfolio: Mix stocks, bonds, cash.

- Build cash reserves: For opportunities.

- Use stop-loss orders: Limit losses.

- Focus on quality stocks: Strong balance sheets.

- Consult advisors: Get personalized advice.

How Fed interest rate decisions influence portfolio allocation: If cuts, add stocks; if hikes, add bonds.

Trends in equity fund withdrawals amid market volatility: Watch weekly data.

Tips:

- Stay informed, but don’t overreact.

- Long-term view: Markets recover.

- Reallocate to tech if resilient.

Reassuring: History shows resilience.

FAQs

What causes investors to withdraw from equity funds due to Fed uncertainty?

Investors get scared when the Fed might change interest rates. They worry that higher rates will make borrowing cost more and hurt company profits. This fear makes them pull money out of stock funds to feel safer.

How do Fed decisions affect my portfolio?

Fed choices change how much it costs to borrow money for companies and people. Lower rates help stocks grow because businesses can expand more easily. Higher rates can slow things down and make stock prices drop for a while.

Should I pull my money now?

No, it is usually better not to pull money out right now. Think long-term because markets go up and down, but grow over many years. Talk to a financial expert to make the best choice for your own situation.

Where does the money go?

When people leave stock funds, they often move the cash to safer places. Many put it in money market funds that pay a little interest and feel very safe. Others buy bonds or just keep them in regular savings accounts.

Is this trend temporary?

Yes, this kind of pulling out money is usually just short-term. Markets have seen this many times before, and they always bounce back. Staying calm and patient often helps you do better in the long run.

Conclusion

To wrap up, investors withdraw from equity funds due to Fed uncertainty shaped 2025 markets. Billions flowed out amid rate doubts, tariffs, and volatility. Yet, smart strategies help navigate. Diversify, stay informed, and focus on quality. The economy shows strength, with cuts providing relief. As we head to 2026, caution pays, but opportunities await.

What steps will you take to protect your investments amid ongoing Fed shifts?