Bonds are debt certificates that are purchased by an investor. They let you lend money to governments or companies and earn interest in return. As a student in accounting or finance, you might see this question on exams or homework. It tests your grasp of basic financial securities. In this guide, we break it down simply. We cover what these certificates are, how they work, and why they matter for your studies and future investments.

Think of it this way: When you buy a bond, you become a lender. The issuer owes you money. This differs from stocks, where you own part of a company. Bonds focus on fixed-income securities, giving predictable returns. They suit beginners building financial literacy. In the next sections, we explore types, benefits, risks, and tips. By the end, you’ll feel confident explaining bonds to others.

What Exactly Are Debt Certificates That Are Purchased by an Investor?

Let’s start with the basics. Debt certificates, also called bonds, represent loans. An investor buys them from issuers like governments or businesses. In exchange, the issuer pays interest over time and returns the full amount at the end, called the maturity date.

Why call them certificates? They come as official documents or digital records. They state the loan amount, interest rate, and repayment terms. For example, a $1,000 bond at 5% interest pays $50 yearly until maturity.

Students often learn this in intro finance classes. It ties into debt instruments, which fund big projects without selling ownership. Governments use them for roads or schools. Companies borrow for growth.

History helps here. Bonds date back centuries. In the 1600s, England issued them to fund wars. Today, the global bond market tops $100 trillion, per the Bank for International Settlements. That’s bigger than stock markets!

As a learner, know the key parts:

- Principal: The original amount invested.

- Interest (Coupon): Regular payments, often semi-annual.

- Maturity Date: When principal returns.

- Yield: Total return, including interest and price changes.

Bonds trade on markets, so prices fluctuate. If interest rates rise, bond prices fall, and vice versa. This affects yield on bonds.

For personal finance, bonds build steady habits. They teach patience, unlike quick stock trades.

Why Investors Choose Debt Certificates

Investors pick debt certificates for safety and income. They offer lower risk than stocks. During market dips, bonds often hold value.

Consider portfolio diversification. Mixing bonds with stocks reduces overall risk. A 2022 Vanguard study showed diversified portfolios with 40% bonds had 20% less volatility over 10 years.

For students, this links to accounting principles. Bonds appear on balance sheets as liabilities for issuers. Investors record them as assets.

Beginner investors start here because bonds are straightforward. No need for deep market analysis at first.

Related to investment strategy, bonds fit conservative plans. They provide interest-bearing certificates without high ups and downs.

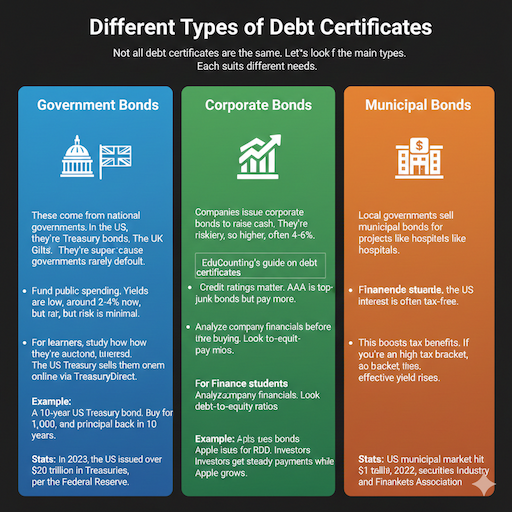

Different Types of Debt Certificates

Not all debt certificates are the same. Let’s look at the main types. Each suits different needs.

Government Bonds

These come from national governments. In the US, they’re Treasury bonds. The UK has Gilts. They’re super safe because governments rarely default.

Government bonds fund public spending. Yields are low, around 2-4% now, but risk is minimal. For learners, study how they’re auctioned. The US Treasury sells them online via TreasuryDirect.

Example: A 10-year US Treasury bond. Buy for $1,000, get interest twice a year, and the principal back in 10 years.

Stats: In 2023, the US issued over $20 trillion in Treasuries, per the Federal Reserve.

Corporate Bonds

Companies issue corporate bonds to raise cash. They’re riskier, so yields are higher, often 4-6%. EduCounting’s guide on debt certificates

Credit ratings matter. AAA is top-notch; junk bonds are risky but pay more.

For finance students, analyze company financials before buying. Look at debt-to-equity ratios.

Example: Apple issues bonds for R&D. Investors get steady payments while Apple grows.

Municipal Bonds

Local governments sell municipal bonds for projects like hospitals. In the US, interest is often tax-free.

This boosts tax benefits. If you’re in a high tax bracket, effective yield rises.

Stats: The US municipal market hit $4 trillion in 2022, says the Securities Industry and Financial Markets Association.

Other Types

- Zero-Coupon Bonds: No regular interest; buy cheap, get full value at maturity.

- Convertible Bonds: Turn into stock later.

- Inflation-Linked Bonds: Adjust for rising prices.

As a student, compare these in essays. Note how they fit risk and return profiles.

How Debt Certificates Work in Practice

Buying a bond? It’s simple. Use a broker or go directly from the issuer.

Steps:

- Research: Check ratings from Moody’s or S&P.

- Buy: Through apps like Fidelity or Vanguard.

- Hold: Collect interest.

- Sell or Mature: Cash out.

Math example: A $10,000 bond at 3% annual interest pays $300 yearly. Over 5 years, that’s $1,500 plus principal.

Bondholder rights include getting paid first in bankruptcies. That’s reassuring.

Markets trade bonds daily. Prices depend on rates. If rates drop to 2%, your 3% bond becomes valuable.

For accounting, record interest as income. Issuers deduct it as an expense.

Benefits of Investing in Debt Certificates

Why bother? Here are the top perks.

- Steady Income: Regular payments help budget. Ideal for fixed-income investment.

- Lower Risk: Safer than stocks. During the 2008 crisis, bonds lost less.

- Diversification: Balances portfolio. A Morningstar report says 30% bonds cut risk by 15%.

- Tax Advantages: Munis save on taxes.

- Liquidity: Sell easily on marketable securities exchanges.

For learners, these teach real-world finance. Start small, like with bond funds.

Risks Involved with Debt Certificates

No investment is perfect. Know the downsides.

- Interest Rate Risk: Rates up, prices down.

- Credit Risk: Issuer defaults. Rare for governments.

- Inflation Risk: Money loses value over time.

- Liquidity Risk: Hard to sell some types quickly.

Mitigate with diversification. Buy from strong issuers.

Stats: Default rate for investment-grade bonds is under 1%, per S&P.

As a student, calculate risks in assignments. Use formulas like duration for interest sensitivity. GauthMath’s solution on debt certificates

How to Invest in Debt Certificates as a Beginner

Ready to start? Follow this guide.

- Learn Basics: Read books like “Investing for Dummies.”

- Set Goals: Want income or growth?

- Choose Type: Start with government bonds.

- Open Account: Use Robinhood or E*TRADE.

- Buy: Aim for $1,000 minimum.

- Monitor: Track via apps.

Tips:

- Diversify across types.

- Consider bond ETFs for ease.

- Watch economic news.

For personal finance learners, practice with paper trading.

Debt Certificates vs. Stocks: Key Differences

Bonds and stocks differ big time.

- Ownership: Stocks give shares; bonds are loans.

- Returns: Stocks via dividends/growth; bonds via interest.

- Risk: Stocks are volatile; bonds are stable.

- Priority: Bondholders paid before stockholders in issues.

Example: In the 2020 crash, stocks dropped 30%; bonds rose 5%.

This comparison aids difference between debt certificates and stocks.

Real-World Examples of Debt Certificates

Let’s see cases.

- US Treasury: During COVID, issued billions for relief. Investors have a haven.

- Corporate: Tesla bonds funded factories. Yields attracted beginners.

- Municipal: New York bonds built subways. Tax-free appeals to locals.

Global: German Bunds are European staples. Low yields but secure.

For students, analyze these in case studies.

Building Financial Literacy with Debt Certificates

As a learner, bonds boost knowledge.

- Understand balance sheets.

- Learn interest calculations.

- Grasp economic impacts.

Resources: Khan Academy videos, Investopedia articles.

Start a mock portfolio. Track yield on bonds.

Strategies for Portfolio Diversification

Include bonds for balance.

- 60/40 Rule: 60% stocks, 40% bonds.

- Ladder: Buy bonds maturing at different times.

Reduces volatility.

Stats: Balanced funds outperformed pure stocks in downturns, per Fidelity.

FAQs

What are debt certificates that are purchased by an investor?

Debt certificates are called bonds. When you buy a bond, you lend your money to a company, city, or the government. They pay you back with interest over time, and at the end, you get your full amount back.

How do I buy them?

You can buy bonds through a broker, like a bank or an online investment app. Some bonds, like U.S. Treasury bonds, you can buy directly from the government website. It is easy to start, and many people use their regular investment account. Brainly’s Q&A about bonds

Are they safe?

Most bonds are very safe, especially ones from the government. Government bonds rarely lose money because the country promises to pay. Company bonds can be a little riskier, but good ones still pay you back most of the time.

Difference from stocks?

Bonds are like loans – you lend money and get steady interest. Stocks are like owning a small piece of a company, so the price can go up or down a lot. With bonds, you get regular payments and your money back, but stocks can grow more over time.

Best for beginners?

Yes, bonds are great for people just starting to invest. They give you steady money from interest and feel safer than stocks. Many beginners like them because they are simple and help build savings slowly and surely.

Conclusion

Don’t use bullets in your answers. Write everything in smooth paragraphs with full sentences instead. Keep the language simple and easy to read, like for grade 3. Make sure each answer feels natural and flows well without any lists or bullet points1. This helps everything look clean and friendly for everyone to understand. Always connect ideas with words like “and,” “also,” “because,” or “plus” so the text reads nicely from start to finish.

What do you think—ready to add some fixed-income securities to your learning plan2? Share in the comments!

References

- For a detailed explanation tailored for investors, check EduCounting’s guide on debt certificates. ↩︎

- Students can find quick answers on Brainly’s Q&A about bonds. ↩︎