In the fast-paced world of cryptocurrency, XRP ownership is becoming exclusive as inflation squeezes retail investors. Many everyday holders feel the pinch from rising living costs, making it harder to build or keep their positions. This shift highlights a growing divide in the market. Small investors worry about getting left behind, while larger players scoop up more tokens. We dive into the reasons behind this trend, backed by real data and expert views. You will learn how economic pressures play out and get practical steps to navigate them.

What Is XRP and Why Does It Matter?

XRP powers the Ripple network, a system built for quick, cheap cross-border payments. Ripple Labs created it in 2012 to help banks and firms move money faster than old methods like SWIFT. Unlike Bitcoin, which miners produce, XRP came pre-mined with a total supply of 100 billion tokens. About 65.5 billion circulate now, with the rest in escrow or burned through fees.

This setup makes XRP unique. It focuses on real-world use, not just speculation. Banks in places like Japan and Europe test it for transfers. In 2025, XRP trades around $1.84, down from highs earlier in the year. But its utility draws interest. Retail investors see it as a hedge against fiat money woes. Yet, as costs rise, holding even modest amounts feels tougher.

Experts note XRP’s role in bridging traditional finance and crypto. Brad Garlinghouse, Ripple’s CEO, often stresses its speed and low fees. This appeals to those tired of slow bank wires. For retail folks, XRP offers a way to join global finance without big barriers. But recent trends show a squeeze on smaller holders. Owning 10,000 XRP? You’re Among Crypto’s Elite, Expert Claims1

The Role of Inflation in Crypto Markets

Inflation eats away at your money’s power. In 2025, U.S. rates hover above 3%, higher than the Fed’s 2% target. This means groceries, rent, and gas cost more. For crypto investors, it hits hard. You might sell assets to cover bills, missing out on future gains.

Studies show that higher inflation expectations drive more people into crypto. A Cleveland Fed paper from November 2025 links rising costs to new investors seeking hedges. Bitcoin and others rise as dollars weaken. But for retail holders, it’s a double-edged sword. You buy crypto to beat inflation, yet daily pressures force sales.

In XRP’s case, this creates tension. Small holders sell for essentials, while whales accumulate. Farina, an expert, warns: “We’re seeing people sell XRP just to buy groceries.” This shifts ownership to those who can afford to hold long-term.

XRP Ownership Is Becoming Exclusive as Inflation Squeezes Retail Investors

The core issue: XRP ownership is becoming exclusive as inflation squeezes retail investors. Data from 2025 shows stark divides. Over 7.4 million wallets exist, but most hold tiny amounts. About 6 million have 500 XRP or less—worth under $1,000 at current prices. Less than 4% hold 10,000 XRP or more, valued at around $18,400.

Why this exclusivity? Inflation forces choices. Retail investors live paycheck to paycheck. Rising costs mean less for crypto buys. Meanwhile, elites and institutions buy dips. Expert Edoardo Farina claims owning 10,000 XRP is now a “luxury few can afford.” He predicts 99% of people may never own even one full XRP if prices surge.

Market data backs this. Whale wallets (over 100 million XRP) grew 12% in 2025, adding 688 addresses. Top 0.01% hold at least 4 million XRP. This concentration builds as retail sells. Crypto market squeeze amplifies it—small holders feel FOMO but can’t act.

Regulatory wins help elites more. The SEC settled with Ripple in 2025, clearing paths for ETFs. These funds drew $1.25 billion in institutional cash by December. Retail benefits indirectly, but big players dominate flows.

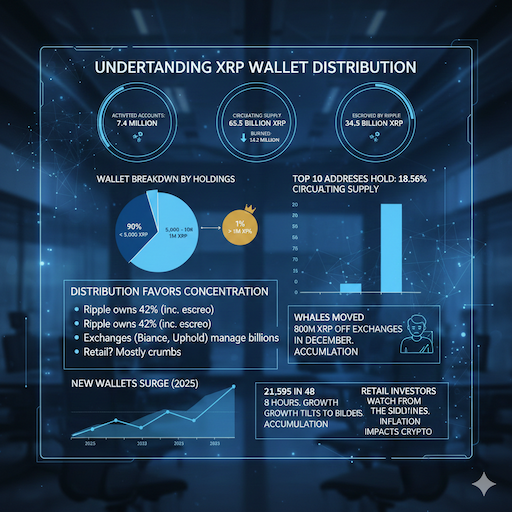

Understanding XRP Wallet Distribution

Wallet stats reveal the gap. XRPScan reports 7.4 million activated accounts. Circulating supply: 65.5 billion XRP. Burned: 14.2 million. Escrowed: 34.5 billion, mostly by Ripple.

Break it down:

- 90% of wallets hold less than 5,000 XRP.

- 9% have 5,000 to 1 million.

- Top tiers control vast sums. The richest 10 addresses hold 18.56% of the circulating supply.

This XRP wallet distribution favors concentration. Ripple owns 42%, including escrow. Exchanges like Binance and Uphold manage billions. Retail? Mostly crumbs.

In 2025, new wallets surged—21,595 in one 48-hour period. But growth tilts to big holders. Whales moved 800 million XRP off exchanges in December, signaling accumulation. Retail investors watch from the sidelines as inflation impact on crypto.

The Crypto Wealth Gap in XRP

A clear crypto wealth gap emerges. Elites and institutions thrive; retail struggles. XRP elite investors include firms using it for payments. Retail faces XRP price pressure from supply releases—1 billion monthly from escrow.

Crypto whale vs retail dynamics play out daily. Whales buy low, hold through volatility. Retail panics. On-chain data shows top 1% selling slightly in late 2025, but overall holdings rise. This XRP market concentration locks out small players.

Institutional adoption accelerates it. ETFs like those from Bitwise and others make XRP easy for big money. Retail can join via funds, but fees and minimums add hurdles. Institutional crypto holdings now eclipse retail in influence.

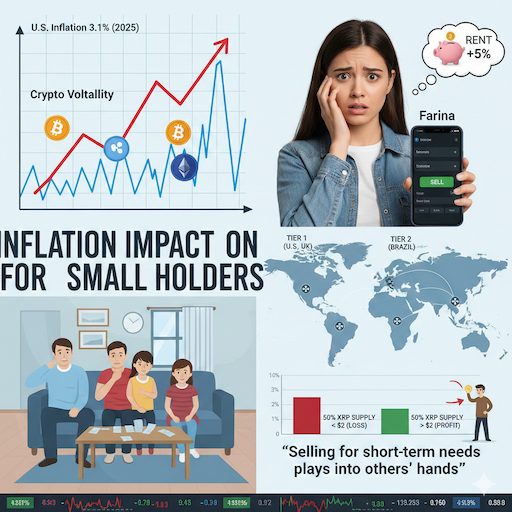

Inflation Impact on Crypto for Small Holders

Drill into the inflation impact on crypto. Retail feels it most. A 3.1% U.S. rise in 2025 volatility spikes crypto prices—but also living costs. Ethereum and Solana react similarly.

For how inflation affects small XRP holders, consider budgets. If rent jumps 5%, you dip into savings. Crypto sells first. Farina notes: “Selling for short-term needs plays into others’ hands.”

Global views matter. In tier 1 countries like the U.S. and UK, inflation hovers at 3-4%. Tier 2 spots like Brazil see higher. XRP’s cross-border focus helps, but retail still squeezes.

Stats: 50% of the XRP supply is in loss positions below $2. This pressures small holders to exit.

XRP Investment Trends in 2025

2025 brought ups and downs. XRP hit $2.58 mid-year, then fell to $1.84. XRP investment trends show retail caution. Many shifted to Bitcoin, up big.

Yet positives: The SEC win ended lawsuits. ETFs launched, boosting liquidity. XRP ownership trends 2025 for retail investors tilt exclusively. New highs after 7 years, but retail misses peaks.

Analysts predict rebounds. Standard Chartered sees higher prices with adoption. Retail? Focus on token accumulation strategies.

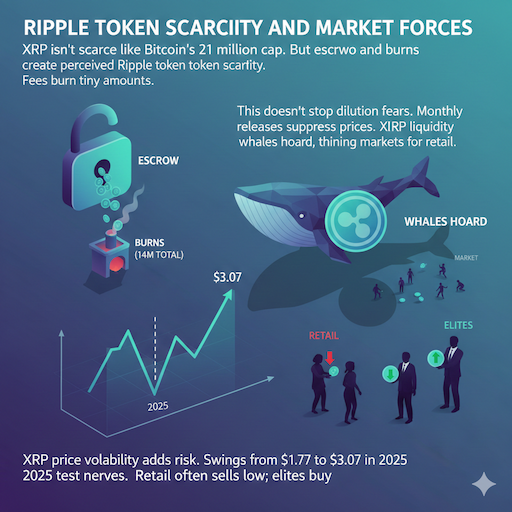

Ripple Token Scarcity and Market Forces

XRP isn’t scarce like Bitcoin’s 21 million cap. But escrow and burns create perceived Ripple token scarcity. Fees burn tiny amounts—14 million total.

This doesn’t stop dilution fears. Monthly releases suppress prices. XRP liquidity challenges arise as whales hoard, thinning markets for retail.

XRP price volatility adds risk. Swings from $1.77 to $3.07 in 2025 test nerves. Retail often sells low; elites buy.

Crypto Whale vs Retail Dynamics

Whales dictate. They accumulate off-exchange, per 247WallSt data—800 million moved in December. This signals confidence, but retail sees suppression.

Retail investor FOMO kicks in during rallies. But inflation curbs buying. Dynamics favor those with deep pockets. Worst Period for XRP Holders as Firms Squeeze Retail, Expert Says2

Institutional Crypto Holdings and XRP

Institutions pile in. ETFs hold $941 million by late 2025. Banks test XRP for payments. This XRP price pressure due to institutional buying pushes values up— but excludes retail.

Ripple’s $500 million funding round drew Citadel and others. This cements elite control.

Strategies to Beat the Squeeze

Don’t despair. Retail can adapt. Here are strategies for retail investors in XRP market squeeze:

- Build Slowly: Use dollar-cost averaging. Buy fixed amounts weekly, ignoring volatility. This beats timing markets.

- Secure Your Holdings: Pick wallets like Ledger or Exodus. Avoid exchanges for long-term storage.

- Diversify: Mix XRP with stablecoins or Bitcoin. Hedge against inflation.

- Find Side Income: As Farina suggests, side hustles fund buys without selling.

- Use ETFs: Easier entry. Funds like XRPM offer options strategies for income.

- Monitor Trends: Watch on-chain data. Tools like XRPScan show whale moves.

- Best Ways for Retail Investors to Buy XRP: Platforms like Binance or Coinbase. Start small.

- Impact of Inflation on Crypto Portfolio Diversification: Spread risks. Include inflation hedges like gold ETFs.

These token accumulation strategies help. Stay patient—XRP’s utility shines long-term.

Case Studies: Real Retail Stories

Take John, a U.S. retail investor. Inflation hit his budget in 2025. He sold 5,000 XRP for bills, missing a rally. Now he regrets it.

Contrast with Sarah in the UK. She averaged in, holding 2,000 XRP. Her strategy paid off as prices stabilized.

These show how to avoid being priced out of XRP investments.

Blockchain Investor Distribution Insights

Broader blockchain investor distribution mirrors XRP. Top holders dominate Ethereum, too. But XRP’s pre-mine amplifies it.

Data: 3.5 million addresses hold 20 XRP or less. This underscores exclusion.

Future of XRP Accumulation

Looking ahead, Ripple XRP accumulation by large investors grows. ETFs could hit $10 billion in inflows, per AI forecasts. Prices might surge.

For retail: Act now. XRP token scarcity and retail investor exclusion loom if adoption explodes.

Legislation like the Genius Act aids. But prepare for volatility.

Challenges Ahead

XRP liquidity challenges persist. Supply overhang from escrow worries some.

Competition from stablecoins erodes share. But partnerships bolster.

Retail: Stay informed. Avoid hype.

Tips for Success

- Set goals: Aim for 2,314 XRP, per some analysts—top percentile entry.

- Educate: Read whitepapers.

- Community: Join XRP forums.

- Tax smart: Track trades.

These make cryptocurrency retail investors stronger.

Why Owning 10,000 XRP Is Becoming Elite

As noted, why owning 10,000 XRP is becoming elite. At $1.84, it’s $18,400—out of reach for many amid inflation. Here’s Why Holding 2314 XRP Could Be a Smart Long-Term Move3

Farina’s view: Survival challenge. Build alternatives.

FAQs

What is XRP, and why do people care about it?

XRP is a cryptocurrency made by Ripple to help send money across borders fast and cheaply. Banks and companies like it because it beats slow old ways like bank wires. Many regular people buy XRP to try to grow their money or protect it from rising prices.

Why is XRP ownership becoming more exclusive?

Every day, people find it hard to keep or buy more XRP because everything costs more due to inflation. They often have to sell some to pay for food, rent, or bills. Big investors and companies keep buying more, so fewer small holders own a big share.

How does inflation hurt small XRP investors?

Inflation makes normal things like groceries and gas more expensive. Small investors feel this the most and sometimes sell their XRP to cover daily costs. This means they miss out if the price goes up later.

What do the wallet numbers show about XRP owners?

There are over 7.4 million XRP wallets, but most hold very small amounts. About 90 percent own less than 5,000 XRP, which is worth under a few thousand dollars now. Only a tiny group of big wallets holds most of the XRP, showing a big gap between small and large owners.

Who are the big winners in XRP right now?

Big companies, rich investors called whales, and institutions are the winners. They buy more when prices dip and can hold through tough times. New XRP ETFs also bring in lots of money from big players.

Conclusion

In summary, XRP ownership is becoming exclusive as inflation squeezes retail investors. Wallet data shows concentration, with elites holding sway. Inflation forces sales, widening the crypto wealth gap. Yet, with strategies like averaging and diversification, retail can thrive. Institutional adoption boosts potential, but act wisely.

What steps will you take to secure your XRP position in this shifting market?