In Canada, especially in Ontario, people want to buy special shares from companies before everyone else can. These are called private placements. The companies do not have to make a big, long public report called a prospectus.

But there are rules to keep regular people safe from big money risks. Only certain people are allowed to buy these special shares. These people are called accredited investors.

Back in January 2021, a smart group called the Capital Markets Modernization Taskforce talked about new ideas. They wanted to let more knowledgeable people join these deals, but still keep everyone protected. This started some important changes to the rules.

The main rules come from something called NI 45-106. There are two big ways to qualify as an accredited investor in Ontario today: One way is by having a lot of money or a high income. The other way is by knowing a lot about investments – this is called the self-certified investor option.

This simple guide explains what these words mean right now. You will learn how to tell if you fit the rules, what makes them different, and why they are important for people who want to invest in private deals in Canada. Ontario Securities Commission – Local Changes to NI 45-106 Prospectus Exemptions1

What Is an Accredited Investor in Canada?

An accredited investor is someone who can buy certain investments without the full protections of a prospectus. Regulators think these people have enough money or knowledge to handle risks.

The main rules come from National Instrument 45-106 (NI 45-106 accredited investor). This applies across Canada, including Ontario. The definition has stayed mostly the same since before 2021.

Here are the main ways an individual qualifies as an accredited investor criteria Ontario:

- Financial thresholds accredited investor: You have more than $200,000 in yearly income alone (or $300,000 with a spouse), or net assets over $5 million, or financial assets (like cash and stocks) over $1 million.

- You work as a registered advisor or dealer.

- You own a company that meets big institution standards.

- You are a trust or fund managed by pros.

These rules focus on wealth. Rich people can take more risks without extra help.

For companies or funds, there are other categories like banks or big investment funds.

Why Do These Rules Exist?

Ontario securities exemptions, like the accredited one, help companies raise money fast in the exempt market. In 2019, most private money came from accredited investors. But some smart people with good jobs or education could not join because they did not hit the money marks.

That is where the accredited investor definition Ontario Canada January 2021 story starts.

The January 2021 Taskforce Recommendations

In February 2020, Ontario set up the Capital Markets Modernization Ontario Task Force. They looked at how to make markets stronger and help companies grow.

On January 22, 2021, they gave their final report. One big idea (Recommendation 23) was to grow the accredited investor group. They said add people who show strong knowledge through tests, degrees, or jobs – even if they are not super rich.

Why? Many people have skills from school or work to understand risks. The U.S. did something like this in 2020. The Taskforce wanted Ontario to stay competitive.

This ties right to the accredited investor definition changes January 2021. The ideas aimed to open doors for more exempt market investors Canada while keeping safety.

The Ontario Securities Commission (OSC) listened. They made a new path called the self-certified investor exemption. Ontario Securities Commission – Self-Certified Investor Prospectus Exemption (2022, updated2)

The Self-Certified Investor Exemption in Ontario

The OSC did not change the main NI 45-106 accredited investor definition right away. Instead, they made a short-term rule: Ontario Instrument 45-507 (started October 2022, extended to 2025, then continued with Ontario Instrument 45-510).

This lets a self-certified investor Ontario buy private securities under OSC prospectus exemptions.

It is different from the classic accredited vs self-certified investor. Accredited is mostly about money. Self-certified is about knowledge.

How to Qualify as a Self-Certified Investor

You must meet at least one of these to show financial and educational qualification:

- Hold pro titles like CFA, CPA, or CFP.

- Have an MBA or a finance-focused degree.

- Pass tests like the Canadian Securities Course or Series 7.

- Work as a lawyer in securities deals.

- Have a lot of experience in the company’s field.

You sign a form saying you meet one of these (Confirmation of Qualifying Criteria).

You also sign an investor risk acknowledgment form. This makes sure you get the risks, like possible total loss or hard-to-sell shares.

There is a $30,000 limit per year across all such deals. Companies using this must be based in Canada (head office), not funds, and file reports. This helps private placement investor Ontario who are smart but not wealthy.

Accredited Investor vs. Self-Certified Investor: Key Differences

| Aspect | Accredited Investor | Self-Certified Investor |

| Main Focus | Wealth (financial thresholds accredited investor) | Knowledge and experience |

| Income/Assets Needed | Yes (high levels) | No |

| Qualifications | Some pro registrations | Degrees, exams, designations, experience |

| Investment Limit | None | $30,000 per year |

| Risk Form Needed | Sometimes (for some types) | Always |

| Who Can Use | Anyone meeting the criteria | Individuals in Ontario (or designates) |

Many pros, like lawyers or compliance officers, use self-certified. It fits their skills in securities law Ontario. Stikeman Elliott LLP – OSC Expands Accredited Investor Exemption (20223)

How to Qualify as an Accredited Investor Definition Ontario Canada January 2021?

Want to check if you fit the classic way? Follow these steps how to qualify as an accredited investor in Ontario:

- Look at your income: Over $200,000 alone or $300,000 with spouse for the last two years? Expect the same next year?

- Check assets: Financial assets (cash, stocks, bonds) over $1 million? Or total net assets over $5 million?

- See if you have pro status: Registered advisor? Or family trust?

- Get proof ready: Bank statements, tax returns.

- Sign forms if needed: For some accredited types, use Form 45-106F9.

Talk to a securities lawyer or advisor for help. Rules are strict for regulatory compliance capital markets.

Steps to Become Self-Certified

- Pick your qualifying item (like a passed exam).

- Fill the Confirmation form.

- Read and sign the Risk Acknowledgement.

- Give forms to the issuer.

- Stay under $30,000 yearly limit.

Simple, but honest signing is key.

Benefits for Investors and Issuers

For investors:

- More chances in exempt offerings Ontario.

- Join private placement regulations deals.

For issuers and exempt market dealers (EMDs):

- Bigger pool of buyers.

- Easier capital raise.

- Fits the capital markets modernization taskforce accredited investor report.

Data from these pilots helps future rules.

Current Status and Future Changes

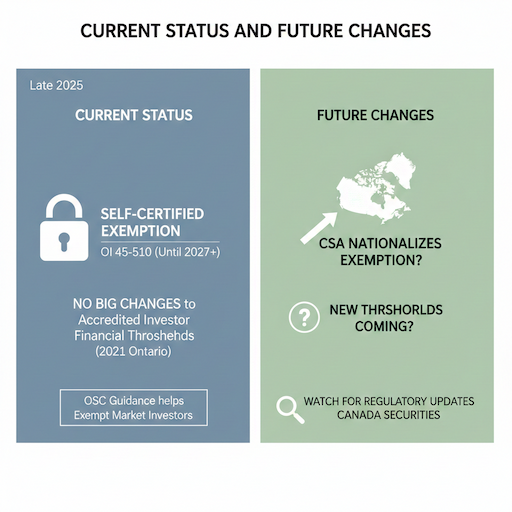

As of late 2025, the self-certified exemption continues under OI 45-510 (until 2027 or longer). CSA talks about making it national.

No big changes to the core accredited investor financial thresholds 2021 Ontario yet. But OSC guidance helps OSC guidance on exempt market investors.

Watch for updates on regulatory updates Canada securities.

FAQs

What changed with the accredited investor definition in Ontario, Canada January 2021?

In January 2021, a special group called the Taskforce suggested adding a new way to qualify based on knowledge and skills instead of just money. The Ontario Securities Commission did not change the main accredited investor definition. Instead, they created a separate new rule called the self-certified investor exemption for people who know a lot about investments.

Can anyone become a self-certified investor?

No, not just anyone can become a self-certified investor. You must have real proof, like special degrees, licenses, exams, or work experience in finance or investments. If you say you qualify, but it is not true, you can get in big trouble with the rules.

Is there a difference between accredited and self-certified?

Yes, there is a clear difference between the two. Accredited investors usually qualify by having a lot of money or a high income. Self-certified investors qualify by showing they have real knowledge and understanding of investments, even if they do not have as much money.

How much can I invest as self-certified?

As a self-certified investor, you can invest up to $30,000 in total each year. This limit is there to help keep things safe because you do not have the same money tests as accredited investors. After that amount, you might need to use other rules or qualify differently.

Do I need a lawyer to qualify?

You do not always need a lawyer to become self-certified, but it is a good idea to get help. Securities lawyers or other pros can make sure your forms are correct, and you follow all the rules. This helps stop mistakes and keeps everything legal and safe for you.

Conclusion

The accredited investor definition Ontario Canada January 2021 marks a key moment. The Taskforce’s ideas led to the self-certified investor option. This opens doors for knowledgeable people to join private placements safely.

Classic wealth rules stay strong under NI 45-106. The new path adds choice based on skills.

Whether you are a lawyer checking investor eligibility criteria, a dealer doing private placements, or an investor wanting more options, these rules help grow markets while protecting people.