The world of investing often sees big clashes between market hype and caution. One big story right now is how investor michael burry bets against nvidia stock despite solid fundamentals. Michael Burry, the man known from “The Big Short” movie for spotting the 2008 housing crash early, has taken a bearish stance on Nvidia. He bought put options that profit if the stock falls.

This move surprises many because Nvidia shows amazing growth. The company leads in AI chips, with record sales and huge demand from big tech firms. Yet Burry sees risks like an AI stock bubble and overvaluation. In this article, we break down his bet, Nvidia’s strong points, and what it could mean for retail investors like you.

Who Is Michael Burry?

Michael Burry is a famous legendary investor short position expert. He runs Scion Asset Management and became a star for shorting the housing market before the 2008 crisis. His story inspired the book and film “The Big Short,” where Christian Bale played him. ‘Big Short’ investor Michael Burry says Nvidia’s memo was ‘disappointin1g’

Burry has a medical background—he studied medicine at Vanderbilt University and trained as a neurologist. But he switched to investing full-time. He likes contrarian investing strategies, going against the crowd when he spots overpriced assets.

Some key wins:

- Predicted and profited from the subprime mortgage crash.

- Made smart bets on water rights and farmland during tough times.

- Warned about passive investing risks in 2019.

Burry often shares ideas on social media or his Substack. His views grab attention from retail investors & individual traders who look for signals in high-profile investor moves.

Michael Burry’s Recent Bet: Shorting Nvidia

In late 2025, filings showed Burry’s fund held put options on Nvidia worth hundreds of millions in notional value. These Michael Burry Nvidia short positions let him profit if the stock drops.

He also wrote on his Substack “Cassandra Unchained” about worries. Burry compares today’s AI boom to the dot-com bubble of the 1990s-2000s. Back then, Cisco sold lots of gear but crashed when spending stopped.

Burry points to:

- Big tech companies are spending trillions on AI data centers.

- Possible quick obsolescence of chips as new ones come out fast.

- Accounting tricks, like stretching depreciation periods to make profits look better now.

He called Nvidia’s response to his points “disappointing” and full of “straw men.” This public back-and-forth highlights his Michael Burry investment thesis on overvaluation. Michael Burry Is Betting Against Nvidia Stock. Should You Follow the ‘Big Short’ Star and Sell NVDA Now2?

Why Burry Sees an AI Bubble

Burry warns of an AI industry overvaluation. He says demand looks huge, but much comes from circular deals—companies funding each other.

Key concerns:

- Nvidia fundamentals vs market hype: Sales boom, but valuations soar too high.

- Rapid chip upgrades could make old ones outdated fast.

- Hyperscalers (like Microsoft, Amazon) are extending chip life for books, risking big write-downs later.

Burry draws parallels to past bubbles where supply exploded, but demand didn’t last.

Nvidia’s Solid Fundamentals: Why Many Stay Bullish

Despite Burry’s bet, Nvidia posts strong numbers. As of late 2025:

- Record revenue: Over $57 billion in one quarter, mostly from data centers.

- Huge growth: Revenue up over 60% year-over-year.

- Market cap: Around $4-5 trillion, one of the top companies worldwide.

- Demand: Chips sold out, with big orders from tech giants for AI training.

Nvidia dominates AI GPUs. Its CUDA software creates a moat—hard for others to switch.

Analysts often rate it “Strong Buy.” Many see continued growth as AI spreads to more industries.

Key Nvidia Statistics (Late 2025)

- Quarterly revenue: $57 billion (Q3 fiscal 2026)

- Data center revenue: $51 billion+

- Expected next quarter: $65 billion

- Gross margins: Over 73%

These show real strength in Nvidia financial analysis.

Investor Michael Burry Bets Against Nvidia Stock Despite Solid Fundamentals: The Debate

Investor michael burry bets against nvidia stock despite solid fundamentals creating big talk. On one side, Burry’s contrarian market bets warn of a tech stock correction.

Retail traders watch for market sentiment Nvidia shifts. Some see his move as a sign to question hype.

Value investors dig into Nvidia stock valuation—is the high P/E justified long-term?

Institutional players monitor for volatility risks.

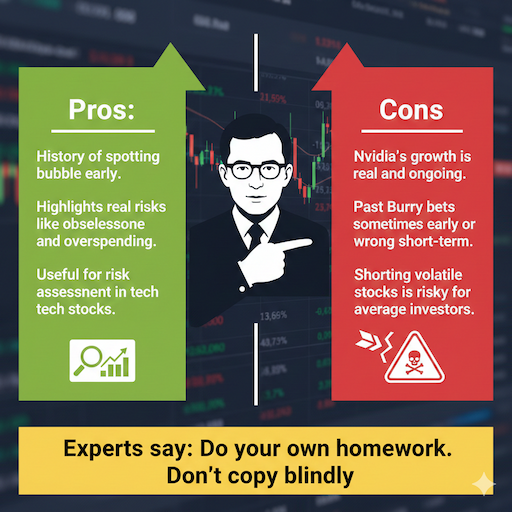

Pros and Cons of Following Burry’s Bet

Pros:

- History of spotting bubbles early.

- Highlights real risks like obsolescence and overspending.

- Useful for risk assessment in tech stocks.

Cons:

- Nvidia’s growth is real and ongoing.

- Past Burry bets sometimes early or wrong short-term.

- Shorting volatile stocks is risky for average investors.

Experts say: Do your own homework. Don’t copy blindly.

Contrarian Investing in 2025: Lessons from Burry

Contrarian investment strategies of Michael Burry in 2025 focus on value over hype. He looks for mismatches between price and true worth.

Tips for you:

- Study fundamentals deeply.

- Watch for bubble signs: Massive capex, high valuations.

- Diversify—don’t bet everything on one stock.

- Consider both sides in debates like Nvidia price target vs fundamentals.

Many ask: Should investors follow Michael Burry in shorting Nvidia? It depends on your risk level and view. Famed Investor Michael Burry Bets Against Nvidia 3

Related Topics in Tech Investing

Other ideas tied to this:

- Short selling tech stocks: dangers and rewards.

- Stock market speculation in AI.

- Big Short investor 2025 updates.

- Warnings from high-profile investors predicting tech stock correction.

Burry’s Substack offers Substack investment insights on these.

What Retail Investors Think

Retail investors reaction to Michael Burry shorting Nvidia mixes excitement and caution. Forums buzz with talks on whether it’s time to sell or hold.

Many like the narrative of a hero vs. a giant. But remember: Markets can stay “irrational” longer than you can stay solvent.

FAQs

Who is Michael Burry?

Michael Burry is a famous investor known from the movie “The Big Short.” He spotted the 2008 housing crash early and made a lot of money by betting against it. Now he runs his own fund and likes to go against what most people think.

Why is Michael Burry betting against Nvidia stock?

Burry thinks Nvidia and the whole AI market might be in a big bubble, like the dot-com crash long ago. He worries that chips get old too fast, companies spend too much, and some money tricks make profits look better than they are. He bought special options that make money if Nvidia’s stock price goes down.

Does Nvidia have strong fundamentals?

Yes, Nvidia is doing very well right now. It makes tons of money from selling AI chips, with sales jumping over 60% in a year. Big tech companies keep buying a lot, and Nvidia leads the market with its special software.

What are put options that Burry bought?

Put options are like bets that a stock will fall in price. If the price drops, Burry can make money from these options. His fund bought puts worth hundreds of millions on Nvidia stock.

Is the AI boom a bubble according to Burry?

Burry says yes, it looks like a bubble. He sees companies spending trillions on AI, but thinks the demand might not last forever. He compares it to past times when everyone got too excited and prices crashed later.

Conclusion

In the end, investor michael burry bets against nvidia stock despite solid fundamentals spotlights the clash between strong growth and bubble fears. Nvidia shines with record sales and AI leadership. Yet Burry’s points on overvaluation, quick obsolescence, and accounting raise valid questions.

For retail and value investors, this serves as a reminder to balance hype with deep analysis. Michael Burry shorting Nvidia and AI stock bubble concerns may or may not come true soon. Stay informed, assess risks, and stick to your plan.