Investing in mutual funds builds wealth over time. Many people seek the best performing mutual funds for last 10 years to guide their choices. These funds show strong growth from 2015 to 2025. They help with retirement or saving goals. In this guide, we look at top funds in key markets like the US and Pakistan. We base this on real data from trusted sources. You get facts on returns, risks, and tips to pick funds.

Mutual funds pool money from many investors. Fund managers buy stocks, bonds, or other assets. Over the last decade, tech stocks have driven high returns in the US. In Pakistan, equity and money market funds beat bank deposits amid inflation. We focus on Tier 1 countries like the US and Tier 2 markets like Pakistan. This matches the needs of long-term investors, financial advisors, DIY savers, emerging market fans, and analysts.

Why Look at 10-Year Performance?

A 10-year view shows how funds handle ups and downs. It includes events like the 2020 crash and tech booms. Historical mutual fund returns reveal consistency. Short-term gains can mislead, but long-term data spot consistent performer mutual funds. Advisors use this for portfolio construction & recommendations.

Consider annualized returns. This average growth per year. For example, a fund with 2a 0% annualized return doubles money every few years. But past results don’t promise future gains. Always check current trends. MUFAP Industry Stats1

Key Factors in Mutual Fund Performance

Several elements affect returns:

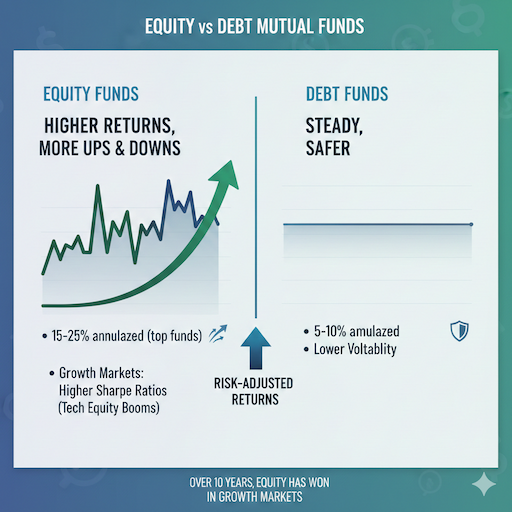

- Fund Category: Equity vs debt mutual funds differ. Equity funds risk more but reward more. Debt funds stay stable.

- Expense Ratio: Low costs mean more money grows. Aim for under 1%.

- Risk-Adjusted Returns: Measures gain per risk unit. Use the Sharpe ratio for this.

- Diversification: Spread investments to cut risk.

- Market Conditions: Tech surges helped US funds. In Pakistan, policy changes boosted equity.

Data from sites like MarketWatch and YCharts shows tech funds led the pack. MarketWatch Top 25 Mutual Funds2

Top Performing Mutual Funds in the US

The US market offers many options. We pull from advisor views and rankings. Focus on top equity mutual funds last 10 years.

High-Return Tech and Growth Funds

Tech dominated the decade. Funds in science and technology posted over 20% annualized returns.

- Fidelity Advisor Semiconductors Fund A (FELAX). This fund invests in chip makers. It gave a 29.30% annualized return from 2015 to 2025. Total growth: 1206%. Expense ratio: 0.94%. Great for growth seekers. It survived market dips by picking strong firms.

- Fidelity Select Semiconductors Portfolio (FSELX) Similar focus, with 26.00% annualized. Total return: 908%. Low expense at 0.62%. Assets under management: $28 billion. Ideal for long-term individual investors.

- Rydex Electronics Fund Investor (RYSIX) Electronics sector fund. 23.87% annualized. It beat many peers in tech rallies.

Other standouts include Fidelity Advisor Technology Fund A (FADTX) at 23.40% and Fidelity Select Technology Portfolio (FSPTX) at 22.41%. These show mutual fund performance 10-year in tech.

Large-Cap and Blend Funds

For balance, try large-cap funds. They mix growth and value.

- Fidelity Blue Chip Growth (FBGRX): 19.14% over 10 years. Focuses on big firms like Apple.

- Fidelity Growth Company Fund (FDGRX): 20.23%. Strong in tech.

- Vanguard 500 Index Fund (VFIAX): 14.41%. Tracks S&P 500 for steady gains.

These have low fees and suit DIY investors & savers.

Value and Dividend Funds

Value funds buy undervalued stocks. Dodge & Cox Stock Fund (DODGX): 12.04%. It includes international picks.

For dividends, Schwab US Dividend Equity ETF (SCHD) offers reliable income.

Bond and Balanced Funds

Though equity led, bonds provide safety. No top bond funds hit equity levels, but Vanguard Total Bond Market ETF (BND) gives stable returns of around 3-5% annualized.

Mutual fund categories (growth, value, balanced) matter. Growth funds shone, but balanced ones like T. Rowe Price Global Allocation (RPGAX) mix for less risk.

Best performing mutual funds for last 10 years

Pakistan’s market grew fast. Mutual funds beat deposits due to inflation. Data from MUFAP and others show strong gains.

Equity Funds Lead Growth

Equity funds are tied to stocks like the KSE-100.

- NBP Stock Fund (NSF): From 2011-2021, 422% total return. Outpaced the market by 151%. Updated to 2025, similar trends hold with recent 3-year returns over 100%.

- ABL Stock Fund: 143% 3-year absolute. High in volatile markets.

- AL Habib Stock Fund: 192% 3-year.

Over 10 years, equity averaged high teens annualized, per industry reports. Best performing mutual funds in India/Pakistan over the last 10 years often hit 15-20% in good years.

Money Market and Income Funds for Stability

Low risk, high liquidity.

- ABL Cash Fund: 22% 3-year annualized.

- NIT Money Market Fund: 22.6%.

- Alfalah GHP Income Fund: 22.4%.

These gave 20%+ recently, beating deposits’ 5-10%.

Shariah Compliant Options

For ethical investing, Meezan Islamic Fund shows consistent growth. 10-year data points to 12-15% annualized.

Pakistan’s funds survived crashes like 2020. Mutual funds that survived market crashes in last 10 years include these, thanks to diversification. YCharts Blog on Best Performing Funds3

Comparing Equity vs Debt Funds

Equity vs debt mutual funds: Equity offers higher returns but more ups and downs. Debt stays steady. Over 10 years, equity has won in growth markets.

- Equity: 15-25% annualized in top funds.

- Debt: 5-10%, but safer.

Use risk-adjusted returns to compare. Tech equity had high Sharpe ratios in booms.

Large-Cap vs Small-Cap Funds

Large-cap and small-cap funds: Large-caps like Vanguard S&P 500 are stable. Small-caps grow faster but risk more.

Top large-cap: Vanguard Large-Cap ETF (VV).

Top small-cap: Vanguard Small-Cap ETF (VB).

In Pakistan, small-caps in equity funds added extra returns.

SIP vs Lump-Sum Investments

SIP vs lump-sum mutual fund performance: SIP (systematic investment plan) averages costs. Over 10 years, it has reduced risk in volatile markets.

Example: Lump-sum in FELAX grew 1200%. SIP might yield slightly less, but with peace.

In Pakistan, SIPs in money market funds built wealth steadily.

How to Choose the Best Funds

Follow these steps:

- Set Goals: For retirement, pick best performing funds for retirement.

- Check Returns: Look at best mutual funds CAGR 10 years.

- Assess Risk: Use mutual funds with best risk-adjusted returns over 10 years.

- Review Fees: Low fund expense ratio matters.

- Diversify: Mix investment portfolio diversification.

- Research: Use tools like Morningstar for mutual fund rankings.

How to choose best performing mutual funds of the last decade: Match to your risk level.

Risks and Considerations

No fund is risk-free. Market crashes hurt equity. Inflation eats debt returns. In Pakistan, policy changes add uncertainty.

High-return mutual funds 10 years often have volatility. Balance with bonds.

Trends in Mutual Fund Performance

Historical mutual fund returns show tech and equity dominance. Consistent performer mutual funds like the Fidelity series stayed top.

In emerging markets, local benchmarks help with local performance benchmarking.

Building a Diversified Portfolio

Mix funds for balance:

- 60% equity for growth.

- 30% debt for stability.

- 10% international.

This aids portfolio construction & recommendations.

For Financial Advisors

Advisors, use fund NAV growth and trend analysis & research. Recommend based on client goals.

For Emerging Market Investors

In Pakistan, focus on top performing mutual funds in Pakistan last 10 years. Use MUFAP data for picks.

FAQs

What are the best-performing mutual funds for the last 10 years?

Tech funds like FELAX (Fidelity Select Semiconductors) are at the top. They gave about 29% average returns each year over the last 10 years. These funds did great because tech companies grew very fast.

How do I evaluate fund evaluation & selection?

Look at how much money the fund made over many years. Check the fees – lower fees mean you keep more money. Also, look at risks, like how much the value goes up and down.

Are top-performing small-cap, mid-cap, and large-cap mutual funds different?

Yes, they are different! Small-cap funds grow faster but can lose money quickly, too. Large-cap funds are safer and steadier, while mid-cap funds are in the middle.

What about high-return mutual funds suitable for retirement planning?

For retirement, pick funds that grow steadily over time. Balanced funds mix stocks and bonds so they are not too risky. They give good returns without big ups and downs.

Do mutual funds with consistent top performance over 10 years exist?

Yes, some funds stay strong year after year. Vanguard index funds are great examples because they copy the whole market. They have low costs and good, steady growth for a long time.

Conclusion

The best performing mutual funds for last 10 years offer lessons in growth and resilience. From US tech giants to Pakistan’s equity stars, these funds built wealth. Remember, diversify and stay informed. Past performance guides, but future markets change.

What fund will you add to your portfolio next?