You can absolutely learn how to build wealth from nothing. In fact, 67.7 % of millionaires today are self-made – they started with little or no money and followed simple, repeatable steps. This guide shows you the exact roadmap that works in 2025, whether you are 25 or 60, earning a modest paycheck, or just getting started. No inheritance, no lottery win, and no risky schemes required.

Why Most People Succeed at Building Wealth from Nothing

Real success stories prove it works. Oprah Winfrey grew up poor and became a billionaire. Howard Schultz (Starbucks) was raised in public housing. In 2024, the Forbes 400 list showed 70 % of billionaires built their fortune themselves. The secret? They focused on income, discipline, and time – not luck.

You can do the same. Here is the proven 10-step plan.

Step 1: Change Your Money Mindset First

Rich people think differently. Start believing that creating wealth from nothing is normal. Read one simple book a month (try “Rich Dad Poor Dad” or “The Millionaire Next Door”). Spend 15 minutes a day learning. Free YouTube channels and blogs teach everything you need.

Step 2: Get Control of Your Money Today

Write down every dollar you earn and spend for 30 days. Most people discover they waste $200–500 a month on small things. Use a free app like Mint or a simple notebook. Knowing where your money goes is the first real step in how to build wealth from nothing.

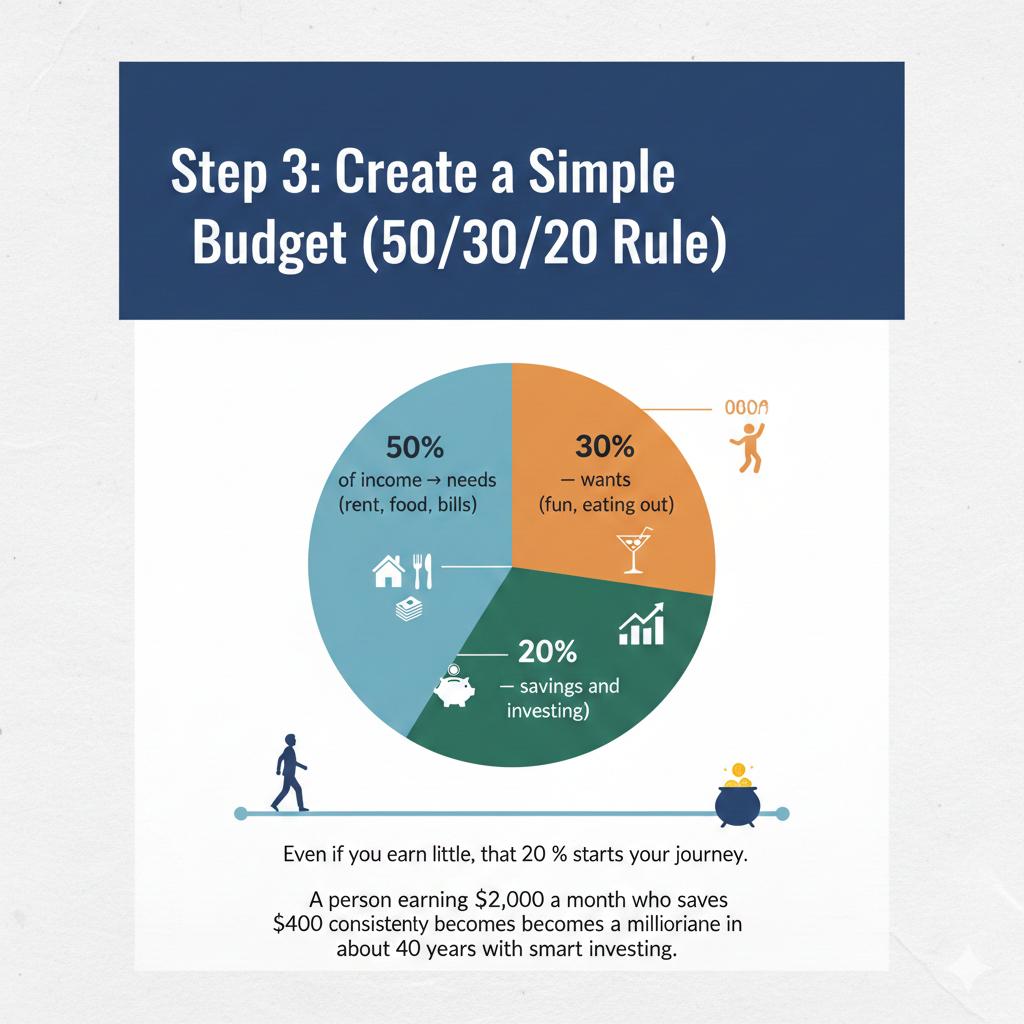

Step 3: Create a Simple Budget (50/30/20 Rule)

- 50 % of income → needs (rent, food, bills)

- 30 % → wants (fun, eating out)

- 20 % → savings and investing

Even if you earn little, that 20 % starts your journey. A person earning $2,000 a month who saves $400 consistently becomes a millionaire in about 40 years with smart investing.

Step 4: Build an Emergency Fund Fast

Save $1,000 first (your mini safety net). Then aim for 3–6 months of living costs. Keep this money in a separate savings account. This fund stops you from going into debt when life surprises you.

Step 5: Pay Off Bad Debt Quickly

List all debts. Pay minimums on everything except the smallest one. Attack that one with everything extra (debt snowball) or attack the highest interest first (debt avalanche). Being debt-free feels like a huge pay raise.

Step 6: Earn More Money – Always

Ask for a raise, learn a high-income skill (coding, copywriting, sales), or start a tiny side hustle. Even an extra $200–500 a month speeds up wealth building dramatically.

Step 7: Start Investing Early – Even Tiny Amounts

Investing is how money works for you. Start with $50 or $100 a month. Choose low-cost index funds or ETFs that follow the whole stock market. Over the last 100 years, the U.S. stock market returned about 10 % per year on average.

See the magic of compounding:

| Age you start | Monthly investment | Value at 65 (7 % return) |

| 25 | $200 | $525,000+ |

| 35 | $200 | $226,000 |

| 45 | $200 | $95,000 |

Starting early beats starting big.

Step 8: Choose Passive Investing (Best for Beginners)

You do not need to pick individual stocks. Buy diversified ETFs that hold thousands of companies worldwide. Many brokers and robo-advisors let you start with $1. Automation removes emotion – you buy every month no matter what the market does1.

How to Build Wealth from Nothing After 60 – It’s Still Possible

Many people worry about age. Good news: how to build wealth from nothing at 60 still works. Save and invest more aggressively (30–50 % of income) because you have less time. Focus on safe dividend stocks and bonds. A 60-year-old who invests $1,000 a month at 7 % can still have $250,000+ in 15 years.

Step 9: Build Passive Income Streams

Once you have some savings, add income that arrives while you sleep:

- Dividend stocks or ETFs

- Rent out a room or parking space

- Create digital products (e-books, courses)

- Peer-to-peer lending or REITs (real estate without owning property)

These turn your money into a money-making machine2.

Step 10: Protect Your Growing Wealth

Get proper health and term life insurance. Write a simple will. Keep learning and adjusting your plan each year.

Real-Life Examples That Inspire

- A teacher in Texas saved $300 a month starting at age 28. By 60 she had over $1.2 million – all from index funds.

- A janitor named Ronald Read quietly invested in blue-chip stocks and left $8 million when he passed away.

- Thousands of everyday people share their journeys on Reddit communities dedicated to how to build wealth from nothing Reddit threads – proof it works today.

Special Tips for Building Generational Wealth

Teach your children or family the same steps. Start small investment accounts for kids. Show them how money grows over time. How to build generational wealth from nothing begins with the habits you model today.

FAQs: How to Build Wealth from Nothing

Can you really learn how to build wealth from nothing in 2025?

Yes! Over 67 % of millionaires today are self-made and started with little or no money. You just need income, discipline, and time.

How long does it take to build wealth from nothing?

It depends on how much you save and invest. Saving $300–500 a month and investing at 7–10 % average return can make you a millionaire in 30–40 years. Starting earlier speeds it up a lot.

How to build wealth from nothing with no money right now?

Start with your very next paycheck. Track every dollar, cut one small expense (like eating out), and save the difference. Even $50 a month is a real beginning.

How to build wealth from nothing at 60 or older?

It’s still possible! Save and invest 30–50 % of your income, choose safe dividend funds or bonds, and you can grow a six-figure nest egg in 10–15 years.

Is there a free how to build wealth from nothing PDF I can download?

Yes, many free guides exist. Vanguard, Fidelity, and some banks offer excellent beginner PDFs. Search “investing for beginners guide PDF” from trusted sites.

How to build generational wealth from nothing?

Follow the same steps, then teach your kids or family. Open small investment accounts for children and let compounding work across generations.

How to build passive income wealth from nothing?

Start by investing in dividend ETFs or index funds. Once you have $10,000–$25,000 saved, the dividends become real passive income that grows every year.

Conclusion: Your Wealth-Building Journey Starts Today

You now know exactly how to build wealth from nothing. It takes no special talent – only consistent action over time. Start with Step 1 today: track your money and save your first $100. Ten years from now you will thank yourself.

Which step will you take first to begin making wealth from nothing?

References

- Investopedia.com – “7 Simple Steps to Build Personal Wealth” – Trusted global source explaining compounding and long-term investing. ↩︎

- Sarwa.co – “How to Build Wealth From Nothing” (2024) – Excellent 10-step framework used by thousands of beginners in the Middle East and beyond. ↩︎