Many folks dream of financial freedom but feel stuck with a tight budget. If you earn less than you’d like, know this: You can still grow your money over time. How to build wealth with low income starts with smart choices, not big paychecks. Experts agree—it’s about habits like saving first and investing wisely. In 2025, with rising costs, these steps help even more. Whether you’re a young adult just starting out or a family juggling bills, small actions add up. Let’s break it down into easy plans you can follow today.

Why Building Wealth Feels Tough But Isn’t Impossible for Low Earners

Wealth isn’t just for high rollers. It’s about net worth—your assets minus debts. For low-income folks, the path looks steep, but stats show it’s doable. The top 10% hold 67% of U.S. wealth, while the bottom 50% have just 2.5%. Yet, consistent savers close the gap. A Forbes report notes that habits, not salary, drive results. Even $50 a month invested grows big with time.

Think of it like planting seeds. Start early, water often, and watch it sprout. Low earners face hurdles like debt or surprise bills, but tools like apps and free advice make it easier. This guide draws from pros at CPA firms and life insurers. They stress patience over quick wins. No get-rich schemes here—just real steps for wealth building low income earners.

For background, financial planning has roots in old wisdom. Benjamin Franklin said, “A penny saved is a penny earned.” Today, that means tracking every dollar. Careers in finance, like CPAs, build on this. They help everyday people turn modest checks into secure futures. Achievements? Millions retire comfy by following basics. Ready to join them?

Step 1: Make a Simple Financial Plan to Guide Your Money

First things first: Know where you stand. A financial plan maps your income, bills, debts, and dreams. It’s your roadmap for financial planning for low income life.

Here’s how to start:

- List It Out: Grab paper or an app. Note monthly take-home pay. Add up rent, food, transport—your needs.

- Spot Goals: Short-term? Build a $1,000 emergency fund. Long-term? Save for a house down payment. Set dates, like “three months for the fund.”

- Track Assets: What do you own? A car? Savings? Subtract debts like loans.

- Get Help if Needed: Free tools from banks or apps like Mint work great. For more, chat with a fiduciary advisor—they put your needs first.

Why this works for beginners: It cuts overwhelm. One CPA tip: Review yearly. Adjust for raises or life changes. Example: A teacher earning $40K planned for retirement. In five years, she had $10K saved—small wins built confidence.

Stats back it: Families with plans save 20% more. Link this to wealth building for beginners by keeping goals tiny at first.

Step 2: Master Budgeting to Free Up Cash on a Tight Salary

Budgeting isn’t fun, but it’s your wealth gatekeeper. It shows where money leaks and plugs them. For budgeting for low income families, keep it simple.

Use the 50/30/20 rule:

- 50% Needs: Rent, groceries, bills. Cut here? Shop sales or carpool.

- 30% Wants: Fun stuff like coffee runs. Trim to 20% if tight.

- 20% Savings/Debt: Pay yourself first—auto-transfer to savings.

Tips to make it stick:

- Track Daily: Apps like YNAB (You Need A Budget) link to your bank. See spending in real time.

- Cut Sneaky Costs: Pack lunch saves $200 a month. Cancel unused subs.

- Family Buy-In: Share the plan. Kids learn by helping track.

Real story: A single mom on $30K yearly budgeted strictly. She found $150 extra monthly for debt. In two years, she paid off cards—huge relief.

This ties to how to save money with a low salary. Pros say: Budgets help 85% of users feel in control. No fancy math—just honest looks at cash flow.

For more on basics, check 7 strategies from CPA experts1.

Step 3: Build Saving Habits That Work Even on Small Paychecks

Saving feels hard when bills eat your check. But saving on small income is key—it’s your safety net and seed money.

Start small:

- Emergency Fund First: Aim for $1,000 quick. Then 3-6 months’ expenses in a high-yield account (4-5% interest in 2025).

- Automate It: Set paycheck deductions. Out of sight, out of mind.

- Windfall Wins: Tax refund? Bonus? Straight to savings. No splurges.

Why high-yield? Post-Fed hikes, they beat regular banks. Example: $100 monthly at 4% grows to $1,300 in a year—extra from interest.

For low earners, low income saving plan means consistency. Stats: Savers build 15% more wealth over 10 years. Quote from a planner: “Save like it hurts; spend like it doesn’t.”

Link to side hustles later, but saving builds the base.

Step 4: Tackle Debt to Stop the Wealth Drain

Debt is like a ball and chain—it slows you down. High-interest types, like cards at 20%, eat future gains. Money management for low earners starts here.

Prioritize smart:

- Avalanche Method: Pay high-interest first. Saves most money.

- Snowball Method: smallest debts first for quick wins and motivation.

- Negotiate: Call lenders for lower rates. Many cut 1-2%.

Tools: Free calculators online show payoff dates. Example: $5K card debt at 18%? Pay $150 extra monthly—gone in 3 years, saves $1K interest.

Stats: Debt-free folks invest 30% more. For how to build wealth when you live paycheck to paycheck, clear this hurdle first. One win: A gig worker paid off $8K student loans by budgeting extras. Freedom followed.

Smart Ways to Start Investing with Low Income in 2025

Now, the exciting part: How to invest with low income in 2025. You don’t need thousands. Small, steady puts money to work against inflation (around 2-3% now).

Basics for low income investment tips:

- Retirement Accounts: 401(k) with employer match—free money! Or IRA: Contribute $7K yearly (2025 limit).

- Low-Cost Options: ETFs via apps like Vanguard. Fees under 0.1%. Diversify: Stocks for growth, bonds for safety.

- Start Tiny: $5 weekly in a robo-advisor like Betterment. They auto-pick for you.

- Tax Smarts: Roth IRA grows tax-free. Long-term holds cut gains tax to 0-15%.

Example: Invest $50 monthly in an S & P 500 ETF. At 7% average return, it’s $100K in 30 years. Stats: Early investors (20s) end with 3x more by 65.

For beginners, the best investments for low earners are index funds—broad, cheap, steady. Avoid crypto hype; stick to proven paths.

Tie to how to start investing with little money. Pros warn: Diversify to sleep easy.

Dive deeper with Pacific Life’s income-to-wealth guide2.

Boost Your Income: Side Gigs and Skills for Extra Cash Flow

Earning more speeds things up. Building wealth on a low income often means multiple streams.

Ideas:

- Gig Economy: Drive for Uber ($200-500/month part-time).

- Freelance: Write or design on Upwork if skilled.

- Sell Stuff: eBay old clothes or Etsy crafts.

- Upskill Free: Coursera courses for better jobs.

Stats: Side hustles add $500 average monthly for 40% of Americans. A barista learned coding online—doubled pay in a year.

This creates room for passive income for low salary, like dividend stocks later.

Dodge Lifestyle Creep and Build Lasting Money Habits

As income ticks up, don’t inflate spending. Money habits for wealth keep you grounded.

Tips:

- Pause Purchases: Wait 48 hours on wants.

- Review Monthly: Celebrate savings, not stuff.

- Educate Yourself: Books like “Rich Dad Poor Dad” shift mindsets.

For wealth tips for students and young adults, start in your 20s—compounding magic. How to start building wealth in your early 20s? Save 10% auto.

Protect Your Gains: Insurance and Long-Term Planning

Don’t let one bump wipe progress. Long-term wealth strategies include shields.

Essentials:

- Health/Life Insurance: Cheap term policies cover basics.

- Estate Basics: Free will templates pass assets smoothly.

- Generational Focus: Save for kids’ education via 529 plans.

Example: A family used life insurance for their protection—peace of mind cheap.

Stats: Insured households recover 50% faster from setbacks.

Simple Ways to Build Wealth: Daily Routines That Add Up

Tie it together with simple ways to build wealth:

- Morning: Check budget app.

- Weekly: Transfer savings.

- Monthly: Review investments.

For step-by-step wealth building, track net worth quarterly—upward trend motivates.

Realistic Paths for Paycheck-to-Paycheck Life

If every cent counts, how to build wealth when you live paycheck to paycheck? Micro-saves: Round up purchases. Community aid: Food banks free cash for funds.

One story: A nurse saved $20 weekly from coffee skips—$1K emergency fund in a year.

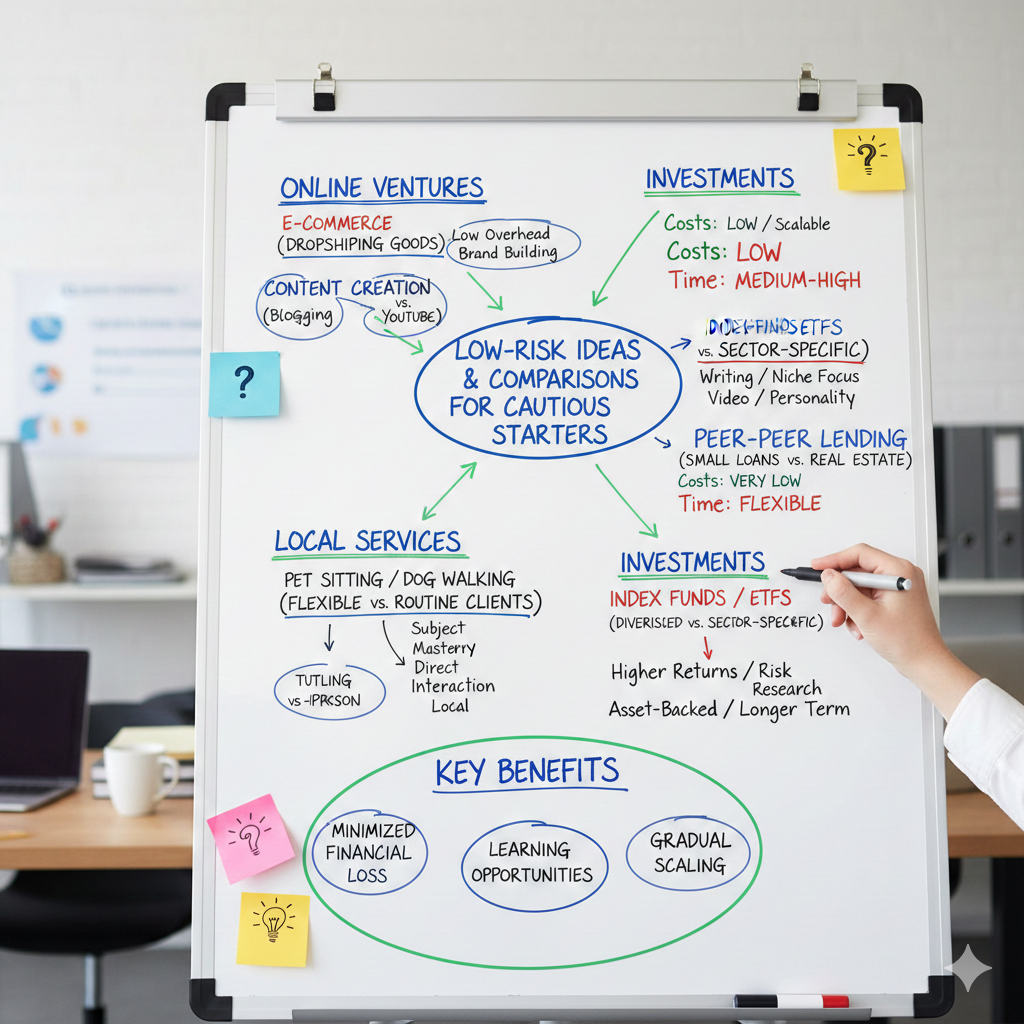

Low-Risk Ideas and Comparisons for Cautious Starters

Low-risk investment ideas for low income earners? CDs at 4%, bonds. Vs. stocks: Safer but slower.

Table:

| Option | Risk | Start Amount | Expected Return |

| High-Yield Savings | Low | $1 | 4-5% |

| Index ETFs | Medium | $50 | 7% avg |

| Roth IRA | Low-Medium | $0 (open free) | Tax-free growth |

Choose based on comfort.

Grow Wealth Slowly: The Power of Patience

Growing wealth slowly beats fast and fails. Compounding: $100 monthly at 7% = $200K in 40 years.

For financial freedom on a low income, focus on the marathon mindset.

Best Habits to Accelerate Your Journey

Best financial habits to build wealth fast? (Safely, that is.)

- Read finance news weekly.

- Network for job tips.

- Avoid impulse buys.

FAQs: How to Build Wealth with Low Income (2025 Edition)

Can I really build wealth if I have a low income?

Yes! How to build wealth with low income is possible through small, consistent habits. Even $25–$50 a month saved and invested can grow into tens or hundreds of thousands over time thanks to compounding.

How much should I save if I earn a small salary?

Start with 1–5% of your pay if that’s all you can manage. The goal is saving on small income — every dollar counts more than zero. Automate it so you never see the money.

What’s the first step when I live paycheck to paycheck?

Build a tiny emergency fund first ($500–$1,000). This stops new debt when surprises hit. This is the foundation of how to build wealth when you live paycheck to paycheck.

I have debt — should I save or pay it off first?

Pay off high-interest debt (above 7–8%) first, then save. Once toxic debt is gone, every extra dollar goes to wealth building low income instead of interest payments.

How do I start investing with little money in 2025?

Open a free brokerage account (Robinhood, Fidelity, Vanguard) and buy low-cost index funds or ETFs. Many let you start with $1. This is the easiest answer to how to start investing with little money.

In Conclusion: Your Path to Wealth Starts Now

Building wealth on low income takes grit, but it’s within reach. From budgeting to investing, these steps—drawn from expert plans—turn modest means into security. Remember how to build wealth with low income: Save first, invest steady, protect smart. In 2025, start today for tomorrow’s freedom. You’ve got this.

What’s one step you’ll take this week?

References

- CPA Practice Advisor: “7 Strategies to Build Wealth No Matter Your Income” (2025). Targets low- to middle-income beginners with actionable, debt-focused tips for long-term stability. ↩︎

- Pacific Life: “4 Ways to Help Turn Income Into Wealth.” Aimed at modest earners seeking diversification and generational planning through simple savings and investment advice. ↩︎