Money can be hard to watch. The 50 30 20 Budgeting rule makes it simple. You split your pay after tax. Half goes to must haves. Three in ten to fun things. Two in ten to save or pay debts. This 50 30 20 Budgeting helps you live well now and plan for later. No need for big lists. Just three parts. Young workers like it. It cuts stress. You see where cash goes fast. Start with your pay check. Take out tax. Then split. Many say it builds good ways. Feel in charge of cash.The rule came from a book. Elizabeth Warren wrote it. She is a smart money pro. The book is All Your Worth. It came out long ago. But it still helps now. In 2025 folks will use it more. Apps make it easy. Like calc tools. It fits most pays. If you make it low or high. Change if needed. But the base is the same. Split to live, save and enjoy. Warren said it for all folks. Not just rich. Simple to do. No hard math.

What is the 50 30 20 Budgeting Rule?

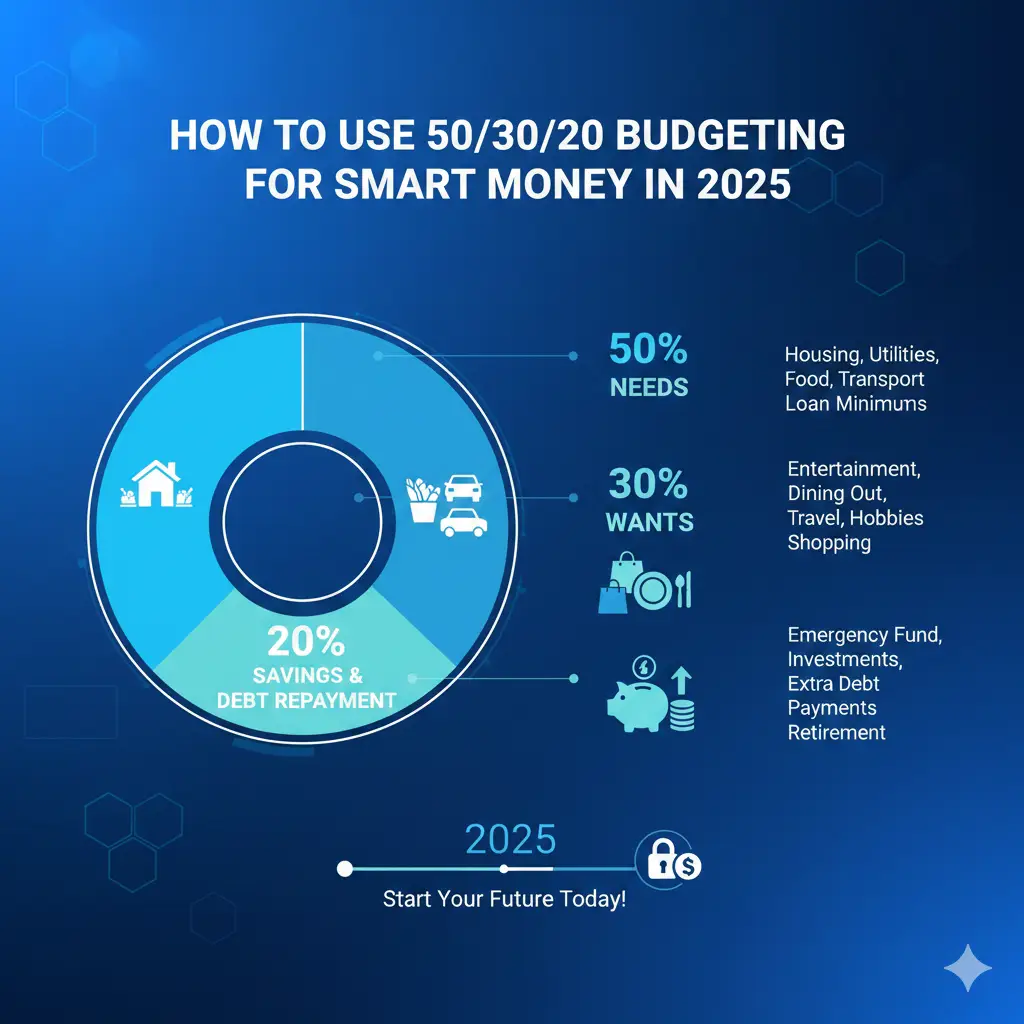

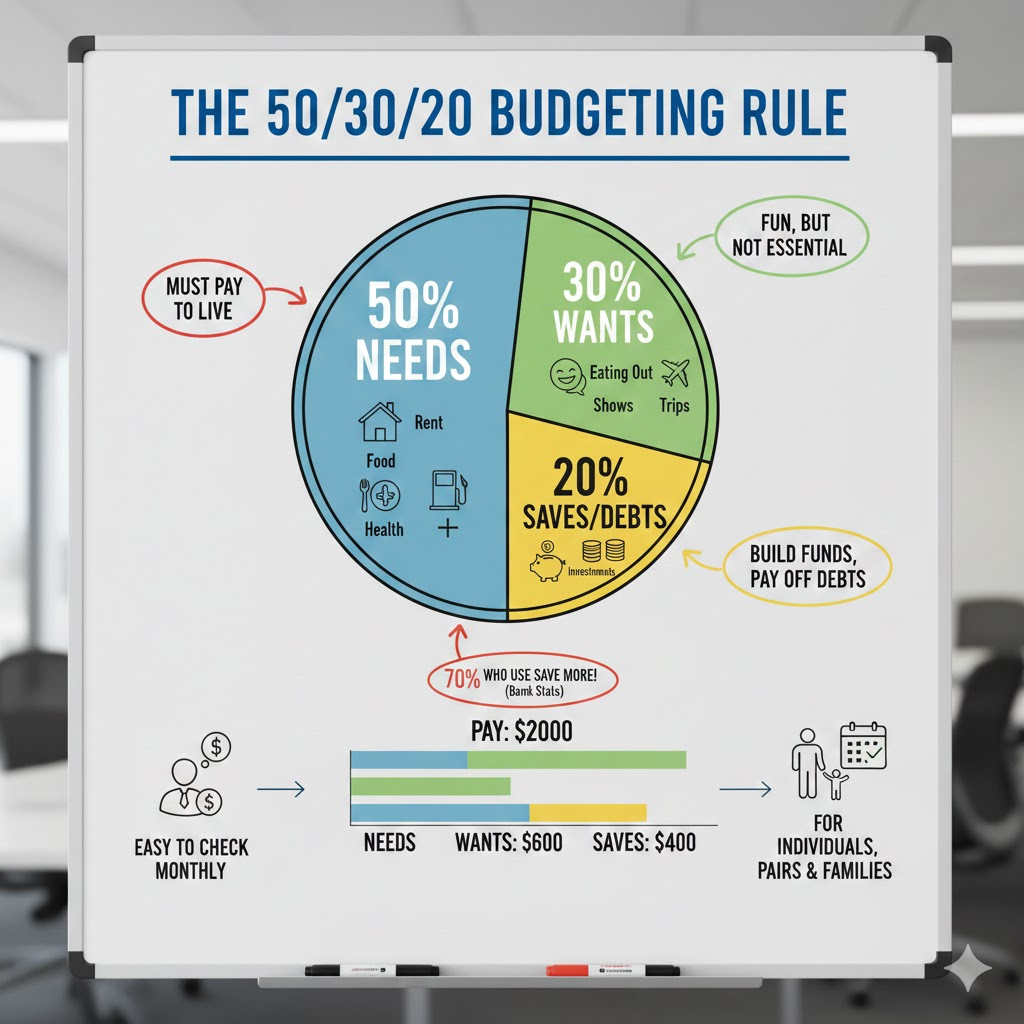

The 50 30 20 Budgeting rule splits your take home pay. First 50% for needs. That is rent food gas health. Things you must pay to live. Keep it half or less. If more cuts costs. Like finding a cheap home. Next 30% for wants. Fun like eating out shows trips. Things you like but not necessarily. Last 20% for saves. Or pay extra on debts. Build funds for bad days. Or put it in the bank for old age. This rule keeps balance. You do not skip fun. But you save too. Easy to check each month. Add up buys. See if it fits. If not, change next time. Many start with paper. Then use an app. It works for one person or pair. Kids can learn it too. Simple words help all know.Folks say it is real. Not too hard. Stats show 70% who use save more. From bank sites. It cuts waste. See you? Cut them. Needs low? Good job. In 2025 costs will go up. But rule helps plan. For example if pay is 2000. Needs 1000. I want 600. Saves 400. Put saves first, some say. To make sure. Rule from Warren book. She teaches at school. Big name in money. Rule now in many banks. Like tips pages. Good for new jobs. Or after school1.

Past of the 50 30 20 Rule

Elizabeth Warren made the rule. She wrote a book with a girl. All Your Worth in 2005. It teaches money ways. Rule is the core part. Split to live well. She say needs under half. To stay safe. Warren was a teaching pro. Then in gov. Help folks with debts. Rules help avoid bad cash spots. Like too much. Now in 2025 apps use it. Like calc on the web. Folks share on the net. How it changes life. One stat 40% less stress with rules. From money sites. It grows big. Banks push it. Simple for all. No need for pro help. Just do a split.Warren wins big. Books sell lots. She fights for fair money. Rule part of that. Help poor folks too. If low pay changes percentages. Like 60 20 20. But the base is the same. The past shows it lasts long. Still good now2.

How to Start 50 30 20 Budgeting Step by Step

Start 50 30 20 Budgeting with pay. Find take home. After tax. Use a pay slip. Or calc online. Next list needs. Rent bills, food, car. Add up. See if 50% or less. If more cut. I like eating less. But eating out is what I want. Then list wants. A fun shop shows a gym. Keep 30%. Last saves. Put it in the bank or pay debt. Use auto send. From the bank. Each pay day. Track with an app or paper. Check the end month. See if it fits. Change if no. Like if I need to move home. Or side jobs for more pay.Steps: 1. Get a pay number. 2. Times 0.5 for needs. 3. Times 0.3 for wants. 4. Times 0.2 for saves. 5. List buys in groups. 6. Add each week. 73. Fix at month end. Easy. Do it once a week. Feel good fast.

Good Things About 50 30 20 Budgeting

The 50 30 20 Budgeting has wins. Simple to learn. No big work. Just three parts. Helps save auto. 20% adds up. Like for bad days fund. Balances life. Fun in 30%. I don’t feel bad. Good for new folks. No hard tools. Stats say users save 15% more. From bank checks. Cuts stress. Know cash safe. Works for most pays. Change if needed. Like high rent spots. Do 60 30 10. But the rule base is good.More wins. Teaches groups. Needs vs wants. Kids learn. Families use. In 2025 apps help track. Free ones too.

Bad Things About 50 30 20 Budgeting

Some bad in 50 30 20 Budgeting. If high costs. Needs over 50%. Like big city rent. Hard to fit. Then change the rules. Or cut big. Not for all. If no steady pay. Like gig work. Hard to split. I need more track. Some say too loose. I want it to be 30% big. Can waste. If no check. Not deep. No small groups. Like types of food. But for a start, good. Stats say 20% of folks change it. To fit life.

FAQs on 50 30 20 Budgeting

What is the 50 30 20 Budgeting rule?

The 50 30 20 Budgeting rule splits pay. 50% need home food. 30% want fun. 20% saves or debts. Easy way to plan. From the Warren book. Helps balance now and later. Good for new money folks. Track simple. Change if needed.

How to use 50 30 20 Budgeting for low pay?

For low pay 50 30 20 Budgeting change percent. Like 60 needs if costs are high. Cut wants to 20. Saves 20. Find cheap ways. I like cooking at home. Side jobs have more cash. Apps help see cuts. Start small. Build up.

What are the wins of 50 30 20 Budgeting?

Wins of 50 30 20 Budgeting simple. Learn fast. Saves auto. Balances fun and safety. Cuts stress. Users save more. Good start point. Fits most.

What is bad about 50 30 20 Budgeting?

Bad of 50 30 20 Budgeting if costs are high. Needs over half. Hard fit. Not for no steady pay. Too loose sometimes. Waste in wants. Change to fit. Still a good base.

How to track with 50 30 20 Budgeting?

Track 50 30 20 Budgeting with an app. Like pull buys. Sort groups. Or a paper list. Add it day by day. Check the week. Fix over. Use calc for splits. Easy steps.

Is 50 30 20 Budgeting good for families?

Yes 50 30 20 Budgeting for families. Split house costs. Teach kids. Balance fun saves. If big costs change. Apps share views. Good plan.

Conclusion

To close 50 30 20 Budgeting is a smart simple way. Splits pay for needs and wants saves. Warren helps all. Stats show more saves and less stress. Start today with calc. See change.What part of 50 30 20 Budgeting is hard for you? Tell us!

References

- NerdWallet Calc: Tool to split pay. https://www.nerdwallet.com/finance/learn/nerdwallet-budget-calculator – Fits small homes modest pay save goals. ↩︎

- UNFCU Site: Facts on rule parts wins. https://www.unfcu.org/financial-wellness/50-30-20-rule/ – Good for new pros want easy plan. ↩︎

- Investopedia: Past and how. https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp – For folks learning money base. ↩︎