Your age shapes your money choices more than you think. Smart investment strategies by age help you take the right amount of risk at the right time. When you are young, you have decades to recover from dips. Later, you want steady income without big losses. This guide breaks it down simply so anyone can follow – whether you are 22 or 621.

Why Age Matters More Than the Latest Hot Stock

Time is your biggest advantage or biggest risk. A 25-year-old who loses 30 % in a market crash still has 40 years to grow it back. A 65-year-old does not. That is why every expert – from Vanguard to Warren Buffett – says your age investment strategy should change as the years pass.

Recent studies show people who follow investment strategies by age end up with 20-40 % more money at retirement than those who don’t adjust. The secret? Match risk to your timeline.

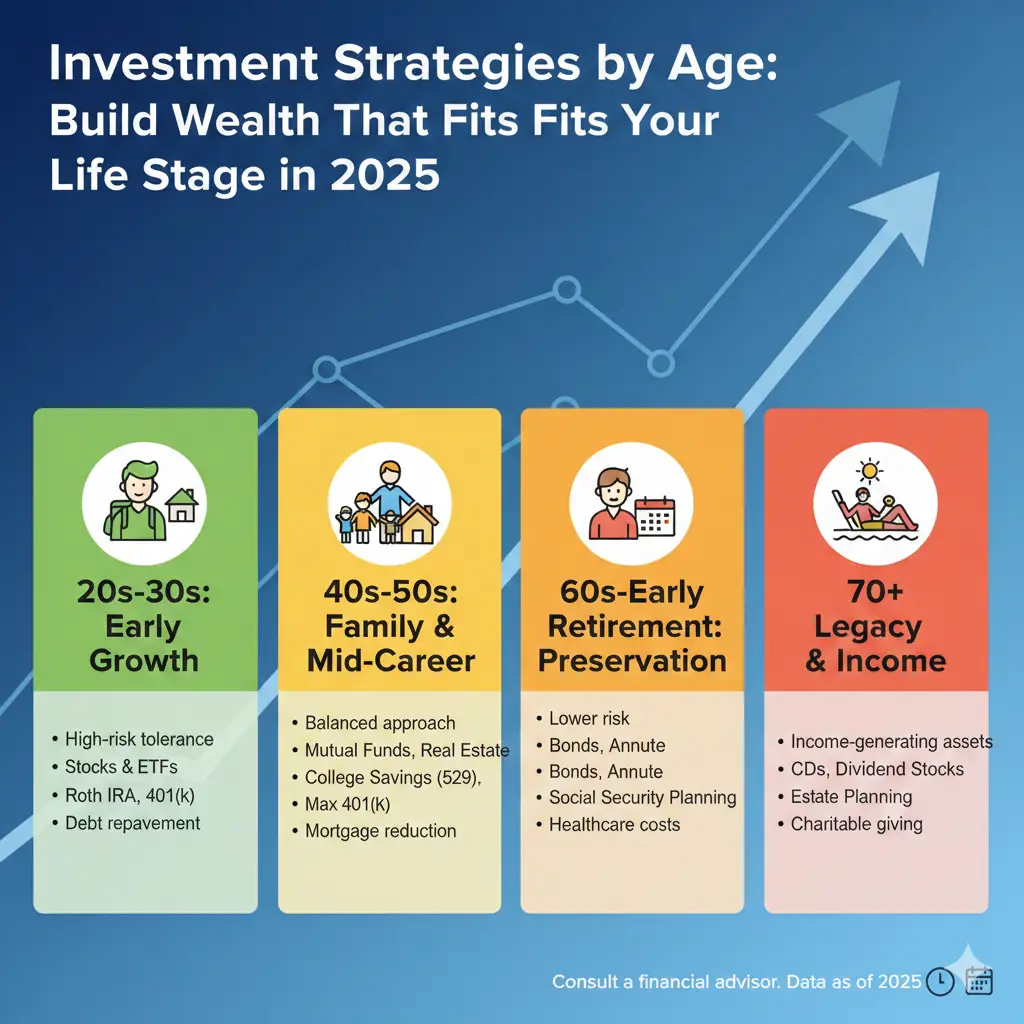

Investment Strategies by Age: The Complete 2025 Roadmap

Your 20s – Go Bold and Build Habits Early

Most people in their 20s have little money but lots of time. This is the best moment to be aggressive.

Key goals

- Start the compounding magic

- Learn investing without fear

- Build an emergency fund first (3-6 months of expenses)

Best moves

- Put 90-100 % in stocks or stock ETFs

- Use dollar-cost averaging (DCA) – invest the same amount every month no matter the price

- Max out Roth IRA or Roth 401(k) – your money grows tax-free forever

- Add a small slice (5-10 %) to crypto if you understand the risk

Example portfolio at age 25

90 % Global stock index funds

10 % Individual growth stocks or Bitcoin/ETH (only what you can lose)

One 25-year-old who started with $200 a month in an S&P 500 fund in 2000 turned it into over $450,000 by age 50 – even after the 2008 crash.

Your 30s – Keep Growing but Add Protection

Income usually rises, but so do bills – wedding, house, kids. Stay aggressive but smarter.

Key goals

- Keep high stock exposure

- Start real estate or side income

- Protect growing wealth with insurance

Recommended mix

80 % stocks (still heavy growth)

15 % bonds or real estate

5 % cash or crypto

401k investment strategies by age 30-39

Choose target-date funds or keep 80/20 stocks/bonds yourself. Raise contributions when you get a raise.

Many in their 30s love dollar-cost averaging into index funds while putting bonuses into a house down-payment or rental property.

Your 40s – Balance Growth and Safety

This decade decides if you retire rich or just okay. You still have 20+ years, so don’t go too safe yet.

Key goals

- Max retirement accounts ($23,500 limit in 2025 for 401k)

- Diversify beyond company stock

- Pay off high-interest debt

Typical portfolio

70 % stocks

25 % bonds/real estate

5 % cash/alternatives

Reddit users on investment strategies by age reddit threads often say their 40s were when they finally “got serious” and saw balances jump.

Age 50-59 – Shift Toward Protection

You are close enough to retirement that a big crash could hurt. Start moving money to safer spots each year.

Key goals

- Build a 2-3 year cash cushion

- Lock in gains

- Plan required minimum distributions (RMDs) later

Smart allocation

50-60 % stocks

30-40 % bonds/dividend funds

10 % cash or annuities

Many people use the Rule of 110: subtract your age from 110 to get your stock percentage. Age 55 → 55 % stocks.

Age 60+ – Focus on Income and Preservation

Your new job: make money last 30+ years while covering healthcare and fun.

Best retirement investment strategies by age 60+

- 30-50 % stocks (still need growth to fight inflation)

- 40-60 % bonds, CDs, dividend aristocrats

- 5-10 % cash for emergencies

- Consider annuities for guaranteed income

A popular retirement investment strategy by age is the 4 % rule – withdraw 4 % of your nest egg the first year, adjust for inflation after.

Simple Age-Based Portfolio Table (2025 Updated)

| Age Group | Stocks | Bonds | Cash/Other | Example Funds |

| 20-29 | 90-100% | 0-10% | 0-5% | VTI, VXUS, QQQ |

| 30-39 | 80-90% | 10-15% | 5% | VOO + BND |

| 40-49 | 70-80% | 15-25% | 5-10% | SCHD + VNQ |

| 50-59 | 50-70% | 25-40% | 10% | Target 2035 |

| 60+ | 30-50% | 40-60% | 10-20% | Target Income |

Dollar-Cost Averaging: The Strategy That Works at Every Age

No matter your age, dollar-cost averaging removes emotion. You buy more shares when prices are low and fewer when high. Binance Academy calls it one of the simplest ways to build wealth over time. Read their full guide here: Dollar-Cost Averaging Explained.

Quick Tips That Save Thousands

- Automate everything – paycheck to 401k to brokerage

- Rebalance once a year (sell winners, buy losers)

- Never borrow from retirement accounts

- Increase savings rate 1 % each year

- Read one good book – many readers love simple plans like the “5 Steps to Wealth” approach (search it here on Amazon2).

Common Mistakes People Make by Age

20s: Not starting at all

30s: Lifestyle creep eating raises

40s: Too much company stock

50s: Going too safe too soon

60s: Spending principal instead of income

Real-Life Example: Sarah’s Journey

- Age 25: $50/month into Roth IRA → $9,000 total contributed

- Age 45: Balance $180,000 (mostly growth)

- Age 65: Over $1.2 million – all from small, steady moves using investment strategies by age

Your Personalized Investment Strategies by Age Checklist

Print this and check off as you go:

- Emergency fund built

- Maxed Roth or traditional retirement account

- Stock/bond mix matches my age

- Using dollar-cost averaging every paycheck

- Rebalance every 12 months

- Written income plan for retirement years

FAQs: Investment Strategies by Age (2025 Edition)

What are the best investment strategies by age?

The best investment strategies by age focus on time horizon. In your 20s–30s: go almost 100 % stocks. In your 40s: move to 70–80 % stocks. In your 50s: 50–70 %. Age 60+: 30–50 % stocks and more bonds for safety.

How should I adjust my investing by age?

Follow the Rule of 110: subtract your age from 110. The answer is the percentage you should keep in stocks. Example: Age 35 → 75 % stocks, 25 % bonds/cash.

What is a good age investment strategy for beginners in their 20s?

Start with a Roth IRA or 401(k), use dollar-cost averaging, and put 90–100 % into low-cost global stock index funds (like VTI or VXUS). Small, regular investing beats trying to time the market.

What are the smartest 401k investment strategies by age?

- 20s–30s: 100 % stock target-date fund or S&P 500

- 40s: 80/20 stock/bond mix

- 50s: Switch to a target-date fund for your retirement year

- 60s: Move to income-focused or conservative target-date fund

When should I lower risk in my retirement investment strategy by age?

Start lowering stock exposure around age 50–55. By age 60, most people shift to 40–60 % bonds or dividend funds to protect what they’ve built.

Conclusion: Start Today with Investment Strategies by Age

The best investment strategies by age are not about beating the market – they are about staying in the market long enough for time to work its magic. Adjust your risk as birthdays pass, automate everything, and let compounding do the heavy lifting. Whether you are just opening your first brokerage account or getting ready to retire, the right mix for your age puts math on your side.

What age are you right now, and which change will you make this month? Share in the comments – let’s keep each other accountable!

References

- 2024-2025 contribution limits from IRS.gov . ↩︎

- Amazon.com Book Search – “5 Steps to Wealth” style guides: Simple wealth-building books loved by beginners in their 20s-30s starting from zero. ↩︎