Girl Scout Juniors, get ready to become money pros! The junior budget maker badge requirements pdf is your ticket to fun ways to learn about cash. This badge helps girls ages 9 to 11 grasp how to plan with money. It fits right into the Girl Scouts Junior badge lineup from Girl Scouts of the USA. Think simple games with play money and jars for saving. Leaders and parents, you’ll love the easy steps to guide your troop.

Why does this matter? Money skills start young. Studies show kids form money habits by age seven. One report says one in five kids can’t make a basic budget. But with this badge, your girls will shine. They learn to split money into spend, save, and share. No more impulse buys on candy! Instead, they plan for big dreams like a troop trip.

This guide pulls from official sources. It breaks down every step. You’ll find tips, examples, and links to junior budget maker badge PDF downloads. Ready to earn that patch? Let’s dive in. By the end, you’ll know how to earn Girl Scout badges like a boss.

What Is the Junior Budget Maker Badge?

The Junior Budget Maker Badge is a key part of the financial literacy badge series. It launched in 2022 but ties back to the 2011 Girl’s Guide. It replaced the old Business Owner badge. This makes it the go-to for Year 1 money lessons in the Junior level.

Girls tackle five big steps. Each one builds skills like spotting needs vs wants activities. They use play money for real-life practice. The goal? Create a budget that fits goals. When done, girls can save for wants and needs smartly.

Leaders, this badge links to the Cookie Program. Sell cookies? Plan proceeds with the troop. It’s hands-on fun. No fancy tools needed—just paper, jars, and imagination.

From the official booklet, budgets are plans for money use over time. They meet goals like buying a bike or donating to a cause. This badge teaches that. It empowers young girls with money management for young girls basics.

Stats back it up. A Global Financial Literacy survey found 33% of adults worldwide lack money know-how. Early start changes that. For girls, it’s huge. Women face pay gaps and family breaks in work. Learning now closes those gaps later.

Girl Scouts rocks this. Their program builds entrepreneurial minds. One study shows girls in financial programs feel more confident. They set goals and stick to them. This badge does just that.

Why Earn the Junior Budget Maker Badge? Boosting Financial Smarts Early

Earning the budgeting badge requirements isn’t just about a patch. It’s life skills. For Girl Scouts Juniors, it’s the start of saving and spending skills. Imagine planning a zoo trip with troop funds. Or saving allowance for new sneakers. These lessons stick.

Why now? Kids ages 9-11 face peer pressure. Friends have cool gadgets. Ads push “must-haves.” Without tools, it’s easy to overspend. But with this badge, girls learn balance. They practice spend-save-share jars. One jar for fun buys, one for future dreams, one for helping others.

Benefits are clear. Research from the University of Cambridge says money views form by age seven. Start at nine? Even better. A PISA study found 20% of kids can’t budget basics. Girl Scouts fixes that. Their financial program helps girls earn, save, and give back.

For girls especially, it’s empowering. Women often handle family budgets but lag in confidence. One survey shows 74% of teens doubt their money skills—girls more so. Early education flips that. It teaches negotiation, like asking for fair cookie sale shares.

Impact? Big. A Greenlight study says financially savvy kids avoid debt traps. They build wealth young. Girl Scouts data shows participants lead more. They pitch ideas, track goals. One alum said, “This badge made me see money as a tool, not a toy.”

Parents and leaders, guide with ease. Activities fit troop meetings. Use free junior badge workbook ideas. Tie to holidays—budget for gifts. Or community service—share jar donations.

Stats wow: FDIC’s Money Smart program boosts scores by 20% in grades 4-5. Girl Scouts mirrors that. Girls who earn this feel ready for real money. No more “buyer’s remorse” tears.

In short, this badge sparks financial education for children. It reassures girls: You got this! Leaders, watch confidence bloom.

Junior Budget Maker Badge Requirements PDF: Step-by-Step Guide

Grab your junior budget maker badge requirements pdf for details. Official from Girl Scouts, it lists five steps. Each has choices—pick one that fits your troop. We’ll break them down with tips and examples. Keep it simple: Use play money, index cards, jars.

Step 1: Investigate Why You Want What You Want

First, girls spot needs vs wants. Needs keep us safe—like food or shoes. Wants are fun extras—like glitter stickers. Ads and friends sway us. This step uncovers why.

Choices—do one:

- Analyze What You Own: List five items on cards. Line up from most to least needed. Ask: What made me want it? Do I use it? Will I next year? Share with a buddy. Example: Backpack (need for school) vs. toy (want for play). Discuss ads’ tricks.

- Role-Play Money and Happiness: Groups act out scenes. Buy an experience (arcade day), a small treat (ice cream), or a gift (charity donation). How does each feel? Tip: Act silly! Laughter helps lessons sink in.

- Do a Survey: Ask five people about trendy items. List and check yours. Did they influence you? Think long-term. Example: Survey school friends on phones. See peer power.

This builds self-awareness. Girls learn influences like TV. Per a Eurobarometer poll, only 21% set long-term goals without it. This step changes that.

Leaders, time it for 20 minutes. Use fun financial literacy exercises. End with shares: “My biggest want surprise?”

Step 2: Practice Spend-Save-Share

Now, split the money three ways. Spend for now needs/wants. Save for later biggies. Share to help others. It’s the badge’s heart.

Choices—do one:

- Make a Plan with Your Troop: List 10 troop wants on paper. An adult helps price them. Get $50 play money. Divide into columns. Example: Zoo trip ($30 saved), crafts ($10 spent), shelter donation ($10 shared). Vote fair.

- Create Spend-Save-Share Jars: Decorate three jars. Imagine $20 for supplies. Divide. Compare with a friend’s plan. Why different? Tip: Use colored paper for labels. Girls love crafts.

- Plan for the Unexpected: List surprise costs on slips (e.g., $5 lunch forget). Earn $10 weekly. Adjust budgets over weeks. Example: Week 1 goal: Save $5 for cleats. Pull “broken headphones $10″—replan!

Unexpected hits teach flexibility. Life throws curves—like flat tires. This preps girls.

According to the FDIC, kids who practice this save 15% more. Tied to Girl Scouts troop activities. During cookies, the plan proceeds this way.

Discuss: “What if share jar funds a park clean-up?” Builds community.

Step 3: Learn How to Decide What to Buy

Avoid buyer’s remorse—that “oops” after buying. Think pros/cons. Research beats regret.

Choices—do one:

- Visit a Store: Pick an item like shoes. Compare three options online/in-store. Note price differences. Why vary? Example: Sneaker A ($20 basic) vs. B ($40 trendy). Informed choice wins.

- Figure Out the Pros and Cons: For a big item (bike), read statements. Sort pro/con. Group agrees? List Sample: “Friends have it” (con—peer pressure). “Makes life easier” (pro).

- Find Out What Other People Think: Research reviews. Interview the owner. Ask: Best model? Downsides? Tip: Use kid-safe sites. Role-play interviews for fun.

This curbs impulse. A Time study says 20% young adults overspend monthly without it. Girls learn value.

Leaders, make it a field trip. Post-cookie sales, review booth buys. “Worth it?”

Step 4: Find Out How Financial Services Help People Save

Banks keep money safe and grow it via interest. Start early—compound magic!

Choices—do one:

- Talk to a Financial Expert: Video chat with a banker. Ask about kid savings plans, borrowing, and interest. Example: “How does a piggy bank compare to a bank?”

- Watch a Video: List questions first. Watch the banking clip. Answer hunt. Tip: Free FDIC videos for kids.

- Use an Interest Calculator: Plug in deposit, years, 0.50% rate. See growth. Add weekly? More wow! Example: $50 at 9 grows to $52.25. Small now, big later.

Interest: The Bank pays for holding money. Teaches patience. Per NFEC, literate kids save twice as much.

Link to junior Girl Scouts badge PDF. Discuss ATMs, deposits. Field trip to the bank?

Step 5: Build a Spend-Save-Share Plan

Tie it together. Plan a real or troop goal.

Choices—do one:

- Make a Plan for Your Cookie Money: Brainstorm needs/wants. Divide into spend/save/share. Track to goals. Example: $100 cookies—$30 spent on crafts, $40 saved trip, $30 shared food bank.

- Plan for Something You Want or Need: Family item budget. Save steps. Tip: Chart progress weekly.

- Budget for Your Future Self: Dream goal (camp). Set timeline, jars. Adjust as needed.

This cements skills. Girls present plans—pitch like pros.

From Girl Scouts, cookie earners lead financially. 37% Gen Z save portions—boost with this.

Celebrate! Badge ceremony with “money” cheers.

Fun Activities to Teach Budgeting to Girl Scout Juniors

Beyond steps, add activities to teach budgeting to Girl Scout Juniors. Keep it playful.

- Wants vs Needs Game: Cut shopping cards. Sort into jars. Debate: Is a phone a need? (20 mins) Download free from Girl Scouts site.

- Play Money Store: Set up shop with troop items. “Shop” with budgets. Haggle fun!

- Budget Relay: Teams race to “buy” needs under budget. Twist: Unexpected cost slips.

- Share Jar Drive: Collect for charity. Track donations. Feel-good math1.

This fit step-by-step guide for Junior Budget Maker badge. Per Sammy Rabbit, early play boosts retention 30%.

Leaders, adapt for two meetings. First: Steps 1-2. Second: 3-5. Materials: Play coins, jars ($5 total).

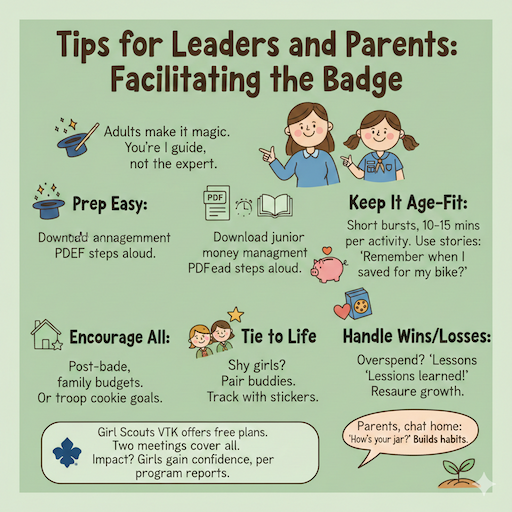

Tips for Leaders and Parents: Facilitating the Badge

Adults make it magic. You’re the guide, not an expert.

- Prep Easy: Download junior money management badge PDF. Read steps aloud.

- Keep It Age-Fit: Short bursts, 10-15 mins per activity. Use stories: “Remember when I saved for my bike?”

- Encourage All: Shy girls? Pair buddies. Track with stickers.

- Tie to Life: Post-badge, family budgets. Or troop cookie goals.

- Handle Wins/Losses: Overspend? “Lessons learned!” Reassure growth.

Girl Scouts VTK offers free plans. Two meetings cover all. Impact? Girls gain confidence, per program reports.

Parents, chat home: “How’s your jar?” Builds habits.

How to Earn the Junior Budget Maker Badge in Girl Scouts: Full Checklist

Quick ref: Badge requirement checklist.

- Investigate wants: Analyze, role-play, or survey. ☐

- Practice spend-save-share: Troop plan, jars, or unexpected. ☐

- Decide buys: Store visit, pros/cons, or reviews. ☐

- Financial services: Expert talk, video, or calculator. ☐

- Build plan: Cookies, personal, or future. ☐

Complete? Sew on that patch! For financial literacy badge for girls ages 9 to 11, it’s gold.

Integrating the Badge with Other Girl Scout Programs

Link to cookies for double fun. Junior Girl Scouts budgeting exercises and activities shine here. Set sales goals, budget proceeds. Use spend-save-share for earnings.

Or pair with Outdoor badges—budget camp gear. Building earning Girl Scout badges easy.

Stats: Cookie sellers earn 2x savings habits, per GSUSA.

Common Challenges and Solutions

Stuck? Girls say, “Math’s hard!” Solution: Visuals—draw budgets.

No money talk at home? Start neutral: “Pretend play.”

Leaders overwhelmed? Use VTK aids. Free!

One challenge: Uneven participation. Rotate roles—leader one week, girl next.

Solutions keep it reassuring. Every girl earns.

Real Stories: Girls Who Earned the Badge

Meet Mia, 10. Her troop surveyed wants. “I learned ads lie!” Now save for a drone.

Leader Sarah: “My shy girl pitched a share plan. Confidence boom!”

These show Girl Scouts Junior badge money management PDF works. Alums say it sparked careers in finance.

Statistics on Financial Literacy: Why It Matters

Dive deeper. 48% average U.S. score on tests—low! But programs like this lift it.

For girls: Pay gap costs $500K lifetime. Early skills negotiate better. PISA: 1/5 kids fail basics. Girl Scouts? 80% feel prepared post-program.

NFEC: Illiterate youth overspend $100/month. The badge prevents that2. EU framework pushes kid education—GS leads. These numbers reassure: Act now, win big.

Resources for Deeper Learning

- Official Junior Budget Maker Badge Booklet PDF for full steps. ↩︎

- Florida Council Activity Guide—cookie ties. ↩︎