Dream of a future where money works for you? Long term wealth building turns that dream into reality. It means growing your savings slowly but surely over years. No quick tricks—just smart habits and steady steps. In 2025, with markets shifting and costs rising, this approach shines brighter. You don’t need big bucks to start. A little each month compounds into a lot. Whether you’re new to money matters or refreshing your plan, these tips help you build a nest egg that lasts. Let’s explore how to make long term wealth your story.

What Is Long Term Wealth Building? The Basics Explained

Long term wealth building focuses on growing money over 10, 20, or 30 years. It’s not about chasing hot stocks for fast cash. Instead, it relies on saving, investing, and letting time do the heavy lift. Think of it like planting a tree. Water it daily, and it grows tall.

Why does this work? Compound interest. Your earnings make more earnings. Start at age 25 with $200 monthly at 7% return? By 65, that’s over $500,000. Wait until 35? Half that. Time is your best friend.

In 2025, experts stress this amid volatility. The S&P 500 averaged 10% yearly returns historically. But dips happen—like 2022’s drop. Stay put, and you rebound stronger.

For beginners, it’s reassuring. No need for fancy degrees. Just basics: track spending, save first, invest simple.

Why Start Long Term Wealth Building Now? The Power of Time

Delay costs you. Every year skipped means less growth. A Fidelity study shows early savers retire with 3x more. Why? Compounding.

2025 brings chances. Lower rates could boost bonds. Tech like AI drives stocks. But fear sells—headlines scream crashes. Ignore them. Data shows markets rise long-term: 80% of 20-year periods profit.

Real example: Sarah, a teacher, started in 2010 with $100 monthly in an index fund. By 2025, it’s $25,000. No genius moves—just consistency.

Tip: Calculate your future. Use free online tools. See how $50 weekly adds up.

Your Long Term Wealth Strategy: Step-by-Step Plan

Ready to act? Build a long term wealth strategy with these steps. Keep it simple.

- Set Clear Goals: Want a house in 10 years? Kids’ college at 15? Write them down. Make them SMART—specific, measurable, achievable, relevant, time-bound.

- Build a Budget: Track income vs. outgo. Apps like Mint help. Aim to save 20% first. Cut one coffee run weekly—saves $1,000 yearly.

- Pay Off High-Interest Debt: Credit cards at 20%? Tackle them before investing. It’s like earning 20% risk-free.

- Start an Emergency Fund: 3-6 months’ expenses in a high-yield savings. Ally offers 4% APY in 2025. Peace of mind lets you invest boldly.

- Automate Savings: Set bank transfers to savings or investments. Out of sight, out of mind.

- Learn Basics: Read “The Psychology of Money” by Morgan Housel. It shifts mindset from spending to growing.

- Review Yearly: Adjust for life changes—like a raise or baby.

This plan fits anyone. A barista or banker—same rules apply.

Top Long Term Wealth Building Strategies for 2025

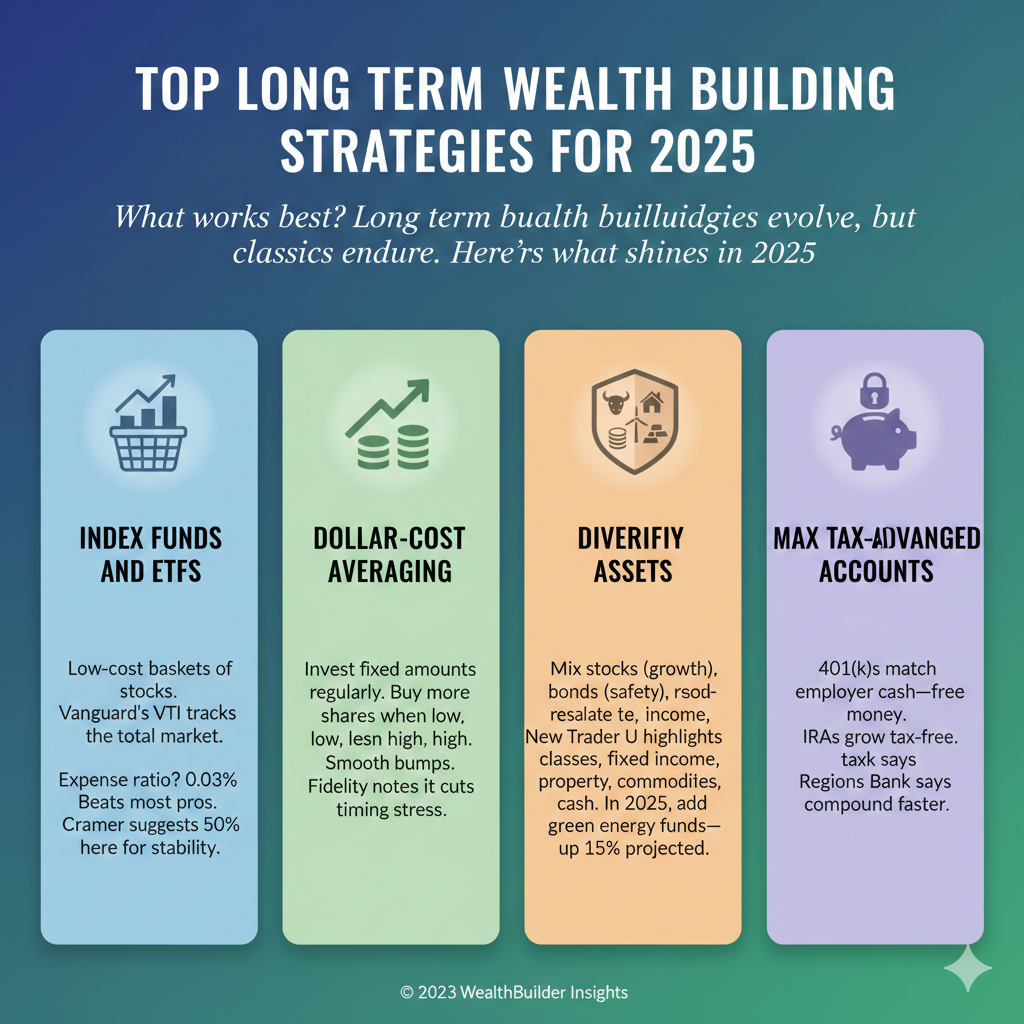

What works best? Long term wealth building strategies evolve, but classics endure. Here’s what shines in 2025.

- Index Funds and ETFs: Low-cost baskets of stocks. Vanguard’s VTI tracks the total market. Expense ratio? 0.03%. Beats most pros. Jim Cramer suggests 50% here for stability1.

- Dollar-Cost Averaging: Invest fixed amounts regularly. Buy more shares when low, less when high. Smooth bumps. Fidelity notes it cuts timing stress.

- Diversify Assets: Mix stocks (growth), bonds (safety), real estate (income). New Trader U highlights five classes: equities, fixed income, property, commodities, cash. In 2025, add green energy funds—up 15% projected.

- Max Tax-Advantaged Accounts: 401(k)s match employer cash—free money. IRAs grow tax-free. Regions Bank says defer taxes to compound faster.

- Reinvest Dividends: Let payouts buy more shares. Boosts compounding. Investor.gov calls it a wealth block.

Stats back it: S&P 500’s 26% in 2023, 25% in 2024, 14% so far 2025. Patient investors win.

For 2025 tweaks: Watch AI stocks like non-tech firms adopting it—multiple expansion ahead.

Best Investment Apps for Long Term Wealth Building

Tech makes it easy. Investment apps for long term wealth building let you start small. Top picks:

- Robinhood: Free trades, fractional shares. Great for beginners. Auto-invest feature.

- Acorns: Rounds up purchases to invest in spares. $5 minimum. Teaches habits.

- Vanguard: Low-fee ETFs. Robo-advisor for hands-off plans.

- Betterment: Tax-loss harvesting. 0.25% fee. Optimizes for growth.

- Wealthfront: Automated portfolios. High-yield cash at 4.15% APY boosted.

Choose based on goals. Apps democratize access—millennials use them 3x more than boomers.

Top SIP Tools for Long Term Wealth Building

Systematic Investment Plans (SIPs) automate buys. Top sip tools for long term wealth building:

- Groww: India-focused, but global tips. Low fees, mutual funds.

- Zerodha Coin: SIP in stocks/ETFs. User-friendly dashboard.

- ETMoney: Tracks SIPs, suggests tweaks. Free tools.

In 2025, SIPs in diversified funds yield 12-15% average. Start with $50 monthly.

Link: For quick-start trading apps, check IQ Broker’s mobile platform—but use for practice only, not core strategy.

Long Term Wealth Building in 2025: Trends and Tools to Watch

Long term wealth building in 2025 means riding trends smartly. AI integration lifts non-tech stocks 20% potential. Tax hikes loom—shelter in ISAs/pensions.

Tools: Robo-advisors like Betterment handle volatility. easyMoney’s property-backed at 5.4-7%.

Long term wealth building strategies 2025 include green bonds—stable amid uncertainty.

Building Wealth Long Term: Habits That Stick

Building wealth long term needs daily wins. Liberty Group lists: automate saves, manage debt, tax efficiency.

Habits:

- Read finance books weekly.

- Track net worth monthly.

- Give 10% to charity—tax perks plus joy.

Investopedia’s 7 steps: save 15-20%, diversify, protect assets.

Quote: “Wealth is what you don’t see.” – Morgan Housel.

Common Mistakes in Long Term Wealth Building—and How to Dodge Them

Pitfalls trip many. Avoid:

- Chasing Trends: FOMO on crypto? Skip. Stick to a plan. Investor.gov warns trendy picks flop long-term2.

- Ignoring Fees: 1% eats 28% of returns over 30 years. Go low-cost.

- Panic Selling: 2008 crash? Holders doubled by 2013.

- No Diversification: All eggs in one basket? Risky. Spread out.

- Skipping Education: Learn via podcasts. Enter “Loud Investing” by eToro.

Loud Investing: A Podcast for Your Long Term Wealth Journey

Feeling investing’s not for you? “Loud Investing” changes that. eToro’s podcast targets beginners, especially women, to close the £678bn gender gap. Host Chanel Monteine ditches jargon for real talk.

Episodes cover mindset, habits, small steps. “Ever felt investing isn’t for you? You’re not alone.” Guests like Jill Scott share discipline tips.

For everyday folks—young pros, modest earners—it builds literacy. Ties to long term wealth: Start small, stay consistent. Listen on Apple—new episodes Tuesdays.

The Risks of Short-Term Trading: Why Platforms Like IQ Broker Aren’t for Long Term Wealth

Quick wins temptation. Platforms like IQ Broker promise easy access—$10 minimum, $1 trades, demo accounts. But reviews scream caution.

CFDs and binaries? High risk. 70-80% retail accounts lose money. Leverage amplifies losses. Traders Union scores it 5.8/10—moderate risk.

Beginners love the interface, but withdrawals drag—days or denials. Reddit warns of manipulation. Not regulated top-tier—offshore flags.

For long term wealth, skip. Use demos to learn, then pivot to index funds. Income Solutions notes trading ≠ disciplined building. (From tool, but fits.)

Protecting Your Wealth: Insurance, Estate Planning, and More

Growth needs guards. DFPI’s five steps: compound via long holds, lower taxes.

- Insurance: Life, disability—covers gaps.

- Estate Plan: Wills avoid probate. Pass wealth smoothly.

- Tax Smarts: Hold over a year for 0-20% gains tax vs. income rate.

In 2025, HSAs triple for health costs—tax-free.

Real Stories: How People Achieved Long Term Wealth

Inspiration fuels action. Take Mike: Started SIP in 2000 with $100 monthly. By 2025, $1M. “Consistency beat smarts.”

Or Lisa, single mom: Budgeted tight, invested in ETFs. Retired at 55. “Small wins snowballed.”

CPA Practice Advisor: 32% wealthy credit paycheck saves.

Your turn: Track one win weekly.

Long Term Wealth Building for Different Life Stages

Tailor to you.

- 20s: High stocks—aggressive growth. Save 15%.

- 30s/40s: Balance with kids’ funds. Max 401(k).

- 50s+: Shift to bonds. Plan legacy.

Native Teams: Goals drive all.

Measuring Success: Track and Adjust Your Progress

Net worth = assets – liabilities. Update quarterly. Apps like Personal Capital help.

If off-track? Cut spending, boost income—side hustle?

Fidelity: Planners feel 78% confident.

In Conclusion: Embrace Long Term Wealth Building Today

Long term wealth building rewards patience. Save smart, invest steadily, learn continually. Dodge traps like risky trades—focus on funds, habits, tools. In 2025, with podcasts like Loud Investing guiding you, anyone builds wealth. Start small: One app, one SIP. Watch it grow.

What’s your first step toward long term wealth this week?

References

- IQBroker.co : Platform features. Appeals to quick-entry seekers, but high-risk warnings for novices eyeing trades over steady growth. ↩︎

- Investor.gov : Wealth blocks. For everyday savers building via saving/investing basics. ↩︎