A Printable Budget Worksheet helps you keep track of your cash in a simple way. You can write down what you earn and what you spend. This tool is great for anyone who wants to save more and spend less. Many people use a Printable Budget Worksheet to plan their month. It lets you see where your money goes. With a Printable Budget Worksheet, you stay on top of bills and goals. Start using one today to feel in control.

What Is a Printable Budget Worksheet?

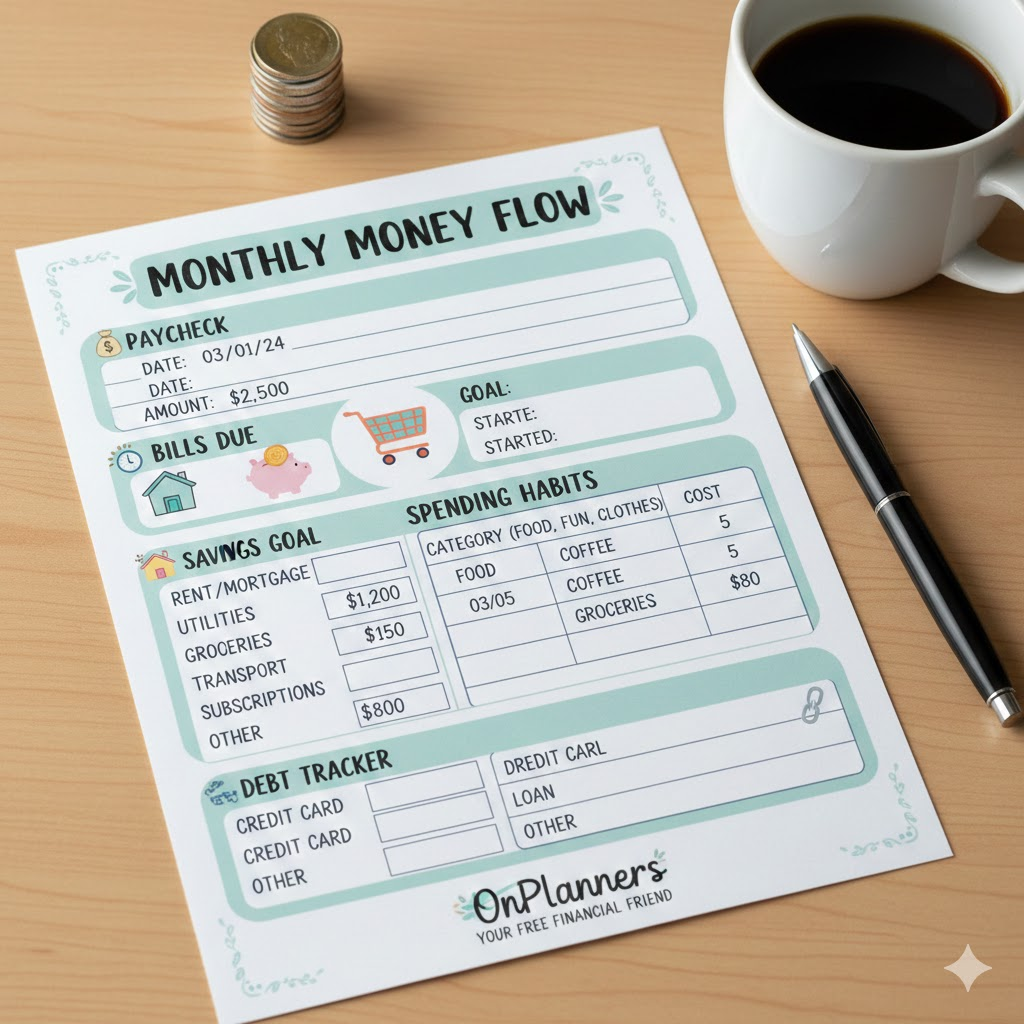

A Printable Budget Worksheet is a paper form you can print at home. It has spots to list your pay, bills, and buys. You fill it in with a pen to see your money flow. This sheet comes in many styles, like for one month or a whole year. Some have boxes for food, rent, and fun stuff. Others track how much you save or owe. People like them because they are easy to get and use right away. No need for apps or tech skills. Just print and start. Sites like OnPlanners offer free ones with fun designs. They help you spot bad spending habits fast. Over time, this leads to better money choices. You can change it to fit your life, like adding spots for kid costs or pet food. It’s a tool that grows with you. Many folks print a new one each month to stay fresh. This keeps your plan up to date. In short, it’s a basic way to handle cash without stress.A Printable Budget Worksheet works for all kinds of people. Students use it to watch small incomes. Families track home costs together. Workers plan for big buys like cars. It shows real numbers, not guesses. This stops overspending surprises. You see if you can afford that trip or gift. Plus, it’s private since it’s on paper. No online risks. Experts say starting with one builds good habits. It teaches you to live within what you make. Over months, you save more for dreams. Think of it as your money map. It guides you to smart choices every day.

Benefits of Using a Printable Budget Worksheet

Using a Printable Budget Worksheet brings many good things to your life. First, it helps you see all your money in one place. You write down pay from jobs or side work. Then list bills like rent or power. This shows if you have extra or not enough. It stops you from buying things you can’t pay for. Over time, you cut waste and save cash. For example, you might spot too much spent on eating out. Change that to home meals and watch savings grow. It’s reassuring to know your plan works. Many users feel less worry about money.A Printable Budget Worksheet is flexible for your needs. Make it weekly for quick checks or monthly for big views. Add goals like saving for a house or trip. Track progress each time you fill it. This motivates you to stick with it. It’s great for beginners who fear numbers. The simple layout makes it easy. No hard math needed. Just add and subtract basics. Families use it to teach kids about cash. Couples share one to agree on spends. It builds trust and teamwork. Plus, it’s free from sites like Printabulls. Download, print, and go. No cost to try.This tool boosts your long-term wins. Pay off debts faster by tracking them. See how small changes add up big. Like saving on coffee to fund a fun day. It helps during tough times too. If income drops, adjust fast. Keep essentials covered. Users say it leads to peace of mind. You sleep better knowing bills are paid. Over a year, you might save thousands. It’s a step to financial freedom. Start small and see the change.

Types of Printable Budget Worksheets

There are many kinds of Printable Budget Worksheets to pick from. One type is the monthly budget planner printable. It covers one month with spots for income and costs. List pay at the top. Then groups like food, home, and play. Some have color codes for fun. Another is the household budget worksheet. Great for families. It has lines for all home members’ cash. Track shared bills like food or lights. Add kid costs too. This keeps everyone on the same page.The personal budget template fits one person. Use it if you live alone. Focus on your own earnings and expenses. Simple and quick to fill. Then there’s the weekly budget sheet. Check money each week. Good for tight budgets. See spends day by day. Spot issues fast. The family budget planner is like a household but bigger. Plan for trips or big buys. Include savings goals for all.Don’t forget the expense tracker printable. It logs every buy. No set time like month. Just write as you spend. Pair it with others for full view. The budget planning worksheet helps set up plans. Think ahead for costs. Like holiday gifts or car fixes. All these come free online. Sites likePinterest pin for budget ideas show examples. Pick what matches your life.More types include debt trackers. List what you owe and pay each time. Watch it shrink. Savings trackers too. Fill bars as you save. Fun to see progress. Bill trackers remind you of due dates. Avoid late fees. Mix them for best results. Start with basics and add more. This way, you cover all money parts.

How to Use a Printable Budget Worksheet Effectively

To use a Printable Budget Worksheet, start by printing one that fits you. Get a free Printable Budget Worksheet from trusted sites. Sit down with your pay stubs and bills. Write your total income first. Include all sources like jobs or gifts. Next, list fixed costs. These are things like rent that stay the same. Then add changing ones like food or gas. Guess based on last month. Subtract spending from income. See what’s left for savings.Bold steps to follow1:

- Gather your info: Collect bank statements and receipts.

- Fill in income: Add up all money coming in.

- List expenses: Group them into needs and wants.

- Track daily: Write spends each day to stay accurate.

- Review weekly: Check if you’re on plan.

- Adjust as needed: Change for new costs.

- Set goals: Add spots for saving targets.Do this each month. Over time, it gets easier. Use a pen for clear notes. Keep old sheets to compare. See how you improve. If you overspend, cut back next time. This builds smart habits. Share with family for team effort. It’s simple but powerful.For best use, pick a quiet time weekly. Like Sunday night. Review the week and plan ahead. This keeps you ahead. Use colors to mark groups. Red for bills, green for saves. Makes it easy to see. If new to this, start small. Just track one week first. Build up to a full month. You’ll feel proud as you master it.

Tips for Better Budgeting with Printable Worksheets

Here are tips to make your Printable Budget Worksheet work best. First, be honest with numbers. Don’t guess how low you spend. Track real costs for a week first. This gives true data. Set real goals too. Like save $50 a month, not $500 if it’s hard. Build up slowly. Use the savings tracker part often. Fill it as you add cash. See it grow to stay motivated.Break costs into small groups. Like food: groceries, eating out, snacks. This shows where to cut. Pair with a bill tracker printable for due dates. Pay on time to save fees. Review at month end. Ask what went well or not. Change for next time. Involve family if shared. Talk about the plan together.Use finance tracker tools with it. Log all in one book. Keep it handy like in the fridge. Write spends right away. Don’t wait. This stops forgetting. Celebrate wins. Like treat yourself small when you hit a goal. But stay on budget. Over time, this leads to big savings. Feel secure with money.More tips: Update for life changes. A new job means new income. Baby means new costs. Adjust fast. Learn from others. Read stories online. But make it your own. Simple is best. Don’t overfill sheets. Focus on key parts2. This keeps it fun, not work.

Common Mistakes to Avoid When Using a Printable Budget Worksheet

Avoid these errors with your Printable Budget Worksheet. Don’t forget small spends. Like coffee or apps. They add up. Track all. Don’t guess numbers. Use real data from banks. This keeps it true. Skip reviewing often. Check weekly, not just monthly. Catch issues early.Don’t set hard goals. Start easy to build wins. Avoid ignoring fun money. Budget some for joy. Or you’ll quit. Don’t share if family. Talk to agree. This stops fights. Update for seasons. Holidays cost more. Plan ahead.Last, don’t give up fast. The first month is hard. Keep going. It gets better. Use it as tool, not a rule. Flex when needed. This way, it helps long term.

FAQs About Printable Budget Worksheets

What makes a Printable Budget Worksheet better than apps?

A Printable Budget Worksheet is simple and offline. You don’t need power or a net. Just paper and pen. It gives privacy too. No data online. Many like the feel of writing. It helps focus without phone pings. Plus, it’s free to print many times. Change as you like. For beginners, it’s less scary than tech. You see all at once on one page. This aids quick checks. Over time, it builds hand habits for money. Families use it together easily. No logins needed.

How do I start with a free Printable Budget Worksheet?

Pick a free Printable Budget Worksheet online. Download from good sites. Print on home paper. Gather your pay and bill info. Fill income first. List costs next. Subtract to see left over. Set a save goal. Track daily spends. Review each week. Adjust if off plan. Do this monthly. It takes little time once set. Use the basic one if it’s new. Add details later. This starts your money control.

Can a Printable Budget Worksheet help with debt?

Yes, a Printable Budget Worksheet aids debt pay. List all you owe first. Track pay to each. See progress monthly. Cut spending to free cash. Use extra for debt. Pick small ones first for wins. Or high rate ones to save interest. Write goals like pay off cards by year end. Check off as done. This motivates. Pair with a debt repayment tracker. Log every pay. Watch the total drop. Over time, debt goes away. Feel free.

Is a monthly budget planner printable good for families?

A monthly budget planner printable works well for families. It has spots for all incomes. List home costs like food and school. Share with all to agree. Teach kids too. Add fun goals like trips. Track together weekly. This builds a team. See where money leaks. Fix as a group. It’s easy to print something new each month. Change for needs like baby or move. Keep peace with a clear plan.

What if I need a simple Printable Budget Worksheet for beginners?

For new users, a simple Printable Budget Worksheet is best. It has a few boxes. Income at top, costs below. No hard parts. Fill in the basics first. Track one week to learn. Add more as comfy. Use free ones online. Print and try. No risk. Build habits slowly. See wins fast. These boosts keep going.

Conclusion: Take Control Today with a Printable Budget Worksheet

In sum, a Printable Budget Worksheet is a key tool for smart money use. It helps track, save, and plan easily. From free Printable Budget Worksheet to budget planning worksheet, options fit all. Use them to cut debt and hit goals. Start simple and grow. You’ll see big changes. Feel secure and free. What goal will you set first with your Printable Budget Worksheet3?

References

- Pinterest Budget Worksheet Pin – Visual inspiration for free printable budget sheets. ↩︎

- OnPlanners Free Printable Budget Templates – Source for various budget template downloads and ideas. ↩︎

- Printabulls Finance Printables – Provides free budgeting worksheets and trackers for personal and family use. ↩︎