Think about this sad thing. You trust a friend with your money. You worked very hard to get it. Then poof! The money is all gone. This bad dream came true for more than 100 people.

A man named Matthew Jess Thrash did it. He is 49 years old. He lives in Lufkin, Texas. For many years (2012 to 2024), he told big lies. He made fake companies. He promised fast money from sports and marijuana. People gave him their savings. He took more than 9 million dollars. Now the people have nothing. They feel very sad and hurt. This is a story about one bad man who wanted too much money. It is a big warning for all of us. The FBI and the law caught him. In May 2025, he said, “I am guilty.” He committed very bad crimes like cheating and hiding stolen money.

Be careful who you trust with your money. If you invested in his “opportunities”—or know someone who did, you’re not alone. The FBI wants your story to help build a stronger case and fight for your money back.

In this guide, we’ll break it down simply. You’ll learn who Thrash is, how his scams worked, and what to do next. Our goal? To empower you with facts, steps, and hope. Reporting isn’t about blame, it’s about recovery. Let’s start by looking at the man behind the schemes.

Who Is Matthew Jess Thrash?

Matthew Jess Thrash grew up in small-town Texas, in Angelina County, where life moves at a steady pace. He was born around 1976. He grew up in Lufkin, Texas. Lufkin has lots of tall pine trees. People there love high school football. Everyone knows everyone and helps each other.

When he was young, Thrash really liked sports. He coached little kids’ teams. In 2017, the Lufkin Little League team was called the Thundering 13. They did great and went all the way to the World Series. Thrash helped coach them. The whole town was so proud and cheered loudly. He became a big name in Lufkin. People trusted him a lot. A video even surfaced of baseball legend Pete Rose cheering them on, with Thrash nearby. It painted him as a hometown hero, someone who loved the game and gave back.

But beneath that image, Thrash chased bigger dreams. He launched legitimate-sounding companies in the sports world. In 2010, he founded a company. It was called Thrash Sports Management, or TSM for short. He put his own name as the boss and the person who gets the mail.

In 2013, he founded another company. It was called Thrash and Henderson Sports Management. In 2018, he made one more. It was called Harvey & Thrash Sports. These companies were not real work. They were just papers to make people trust him.

He told everyone, “I am a sports agent. I help pro baseball players and football players.” He said he knew big MLB stars. He went to sports parties. He shook hands with famous people like Pete Rose. He smiled a lot and talked loudly. Friends said, “Matt is so fun! He always has a sure-win deal!”

But there is no proof he ever helped any real pro player. No big names. No big money was made the right way. The companies were just on paper. They helped him hide the lies. People in town liked him, so they gave him their money. That is how the scams started.

Why does this matter? Understanding Thrash’s background helps spot red flags in future deals. He wasn’t a Wall Street wolf; he was the guy next door with a smile and a pitch. If his story sounds familiar, it might explain why so many fell for it. Now, let’s dive into the heart of the problem: the schemes themselves.

The Decadelong Fraudulent Investment Schemes: How Thrash Pulled It Off

Thrash’s operation ran like a well-oiled machine, for him, anyway. From January 1, 2012, to November 6, 2024, he tricked people in many places.

Texas. Louisiana, like Shreveport and Lake Charles. Florida, around Tampa. Nevada, Las Vegas. And other states, too. He used phone calls, text messages, and emails to tell his big lies.

In November 2024, the government showed a long paper. It is 19 pages long. That paper says he is guilty of 10 counts of wire fraud and 3 counts of money laundering.

Wire fraud means cheating people over the phone and via the internet. Money laundering means hiding the stolen money. Each count ties to a specific lie that crossed state lines.

Here’s how it worked, step by step:

- The Hook: Fake Sports Management Company Thrash posed as a top sports agent. He promised investors funding for athlete contracts, team sponsorships, or event deals. “Put in $10,000, get 20% returns in months,” he’d say. Victims wired money, thinking they backed real stars. But no contracts existed. Thrash pocketed the cash for gambling and bills.

- The Shiny Lie: Fake Sports Store: He told everyone, “I own a big fancy store!” It is in Las Vegas. Inside the huge Mandalay Bay Casino. The store sells very special Pete Rose things. Bats with Pete’s name on them. Balls Pete signed. Rare old jerseys. But it was all fake. There was no store. He never owned it. It was just a big lie to trick people. Investors funded “inventory” or “expansion,” lured by photos and floor plans he faked. One victim got a “stock purchase agreement” promising dividends. Reality? No store. No Rose ties. Thrash never met the Hall of Famer beyond that one video.

- The Green Rush: Illegal Cannabis Dispensary Investment Stock Cannabis was hot—legal in Nevada, booming everywhere. Thrash sold shares in “TK Investments,” a supposed Las Vegas dispensary chain. He sent slick docs: business plans, recorded tours, even fake profit projections. “Invest $50,000, own 5% of a million-dollar pot shop,” he’d promise. From 2016 to 2024, this snagged the most cash. But TK? A front. Thrash had zero ownership in any real dispensary. He used funds to pay early investors, mimicking a Ponzi-style investment scheme to keep suspicion low.

- The Quick Cash: Personal Loans and COVID Scams. Not all were big pitches. Some victims loaned money for “emergencies” or “deals.” Thrash also faked businesses to snag over $60,000 in federal COVID relief, like Paycheck Protection Program (PPP) loans and Economic Injury Disaster Loans (EIDL). These were for struggling firms, but his were ghosts.

The total haul? About $9.17 million from over 100 victims. That’s real money, retirement savings, kids’ college funds, and home down payments. Thrash didn’t build empires. He gambled it away, covered personal debts, and tossed “returns” to a few to silence doubts. When the first report hit in December 2020, the house of cards wobbled. By November 2024, the FBI Lufkin office, Texas DPS, and Lufkin PD had enough for the DOJ fraud indictment.

This wasn’t random. Thrash targeted networks, friends, family referrals, and sports fans. Many got partial payouts early, thinking it was legit. Others? Total wipeout. The FBI investment fraud investigation shows a pattern: lies stacked on lies, all via wire to dodge local cops.

From Indictment to Guilty Plea in the Angelina County Fraud Case

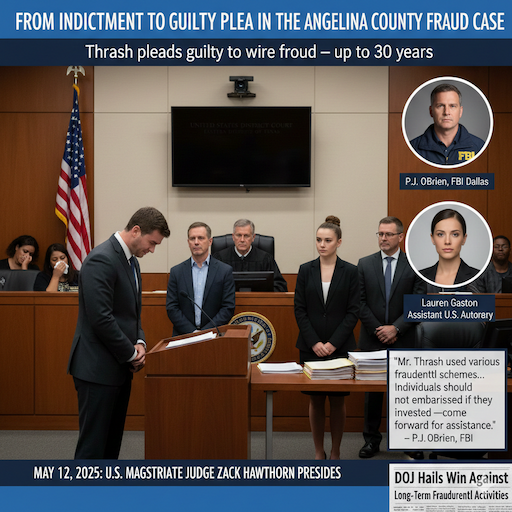

Fast-forward to 2025. On May 12, Thrash stood before U.S. Magistrate Judge Zack Hawthorn in the Eastern District of Texas. He pleaded guilty to two counts of wire fraud. No trial—just a stark admission. The original 13 counts boiled down, but the stakes stayed high: up to 30 years per count, fines, and full restitution.

Why plead? Evidence piled up: bank records, emails, and victim statements. The federal court case Thrash moved quickly post-indictment. Sentencing looms after a U.S. Probation Office review. Assistant U.S. Attorney Lauren Gaston leads the prosecution, backed by the financial crime prosecution team.

Quotes from officials cut deep. FBI Dallas Acting Special Agent in Charge P.J. O’Brien said: “Mr. Thrash used various fraudulent schemes… presenting himself as a successful businessman. Individuals should not be embarrassed if they invest—come forward for assistance.” It’s a nod to victims: You’re the heroes here.

This case echoes bigger white-collar crime convictions. I think Bernie Madoff’s $65 billion Ponzi scheme is smaller but no less cruel. The DOJ’s press release on May 13, 2025, hailed it as a win against long-term fraudulent activities.

Victim Stories: Real Lives Hit by the Texas Investment Scam

Numbers tell part of the tale, but faces make it real. Take “John” (name changed), a Shreveport retiree. In 2018, Thrash pitched a memorabilia store stake. John wired $25,000—his nest egg. Early “dividends” came, but then silence. “I thought I was smart,” he shared in a local news interview. “Now, I’m scraping by.”

Or “Sarah” from Tampa. A cannabis fan, she invested $15,000 in 2020 for “dispensary stock.” Thrash sent tour videos; she recruited her brother. Both lost everything. “He seemed so genuine,” she said. These aren’t outliers. The big law paper does not say the names of the people he hurt.

The FBI says he tricked people in many states. Some people lost a little money, thousands of dollars. Some people lost a whole lot, hundreds of thousands of dollars. This kind of trick is not new.

In 2019, the police caught 60 fake money plans just like this. Altogether, those bad plans took 3.25 billion dollars from people. (CNBC told us that number.) Victims skew older, over 50, and middle-class, per IRS data. In Thrash’s web, some got 10-20% back early, fueling the Ponzi-style illusion. Others? Zero. The emotional toll? Anxiety, divorce, and even suicide ideation, as seen in the Adoff cases.

If this rings true, know: The FBI requests victim reports to map the full damage. Your voice counts.

Why Come Forward? Understanding Your Rights in the Fraud Restitution Pro

You might wonder: “I got some money back, am I a victim?” Yes. Partial payouts often hide deeper fraud. The FBI’s public alert for fraud victims stresses: Even small investments or referrals matter. Reporting aids the criminal enterprise investigation and unlocks doors.

Benefits include:

- Restitution Chances: Courts order repayments. In Madoff’s case, victims got 91% back via a $4.2 billion fund (DOJ, 2025). Thrash’s could follow, over $9 million targeted.

- Services: Counseling, tax relief (IRS allows 95% Ponzi loss deductions).

- Justice: Help nail accomplices, like banks that ignored red flags.

- Awareness: Spot scams early, high returns, secrecy, and pressure.

Don’t feel shame. As O’Brien noted, “We encourage you to come forward… to hold him accountable.” Family and friends: Urge your loved ones. Media and public: Share this. The FBI seeks your help to amplify.

Step-by-Step Guide to the FBI Victim Form for Thrash Fraudulent Schemes

Ready to act? The FBI made it easy with a dedicated online form. It’s short, private, and voluntary. No lawyer needed upfront. Here’s how:

- Visit the Portal: Head to the FBI victim information form1.

- Gather Your Info: Jot down basics—no need for perfection.

- Original investment amount and date (e.g., $10,000 in 2015).

- Type of scheme (sports, cannabis, loan).

- Any repayments or refunds requested.

- Docs like emails, texts, agreements (upload if comfy).

- Fill It Out: Answer yes/no on key questions:

- Did you request a refund? (Q6)

- Did Thrash repay the principal? (Q7)

- Got texts/emails? Can you share? (Q9) Indirect? Name others affected.

- Submit Securely: Hit send. FBI Lufkin may follow up—your choice to engage.

- Follow Up: Track via email. If stuck, call FBI Dallas at (972) 559-5601.

Tips: Use a private browser. Save copies. If nervous, start with a trusted advisor. This fuels the investor awareness campaign and FBI outreach to fraud victims in Texas and Louisiana.

Lessons from the Matthew Jess Thrash Sports Investment Scam Details

Thrash’s playbook teaches us all. Fraudulent sports investment promises? Too good? Pause. Here’s how to protect yourself:

- Red Flags:

- Unsolicited pitches via email/text.

- “Guaranteed” high returns (over 10-15% yearly).

- Pressure: “Act now or miss out.”

- Vague details—no verifiable docs.

- Smart Checks:

- Verify the business: Search the Texas Secretary of State or the SEC Edgar database.

- Ask for audited financials.

- Consult a fiduciary advisor (fee-only, not commission-based).

- Report suspicions to FTC at ReportFraud.ftc.gov2.

Did Thrash run aPonzi cannabis business scam3? Yes—fake ownership in real shops. Who were the victims of the Thrash fraud operation? Everyday folks like you, from retirees to young pros.

Financial Deception and Misrepresentation in America

Thrash fits a trend. U.S. investment fraud costs $3-5 billion yearly (FINRA). Ponzi schemes alone hit 60 cases in 2019, per the SEC. Money laundering and wire fraud hide it all. Thrash laundered via repayments.

Multi-state fraud operations like his thrive on borders. DOJ fights back: In 2024, they recovered $158 million for Madoff victims alone. Your report strengthens that.

Matthew Jess Thrash Indicted for Decade-long Fraudulent Investment Scheme

Navigating this feels overwhelming, but paths exist. Post-guilty plea, sentencing decides restitution. Victims get priority claims. Steps tofile a claim for Thrash investment losses4:

- Submit FBI Form: As above—key to being “official.”

- Track Sentencing: Watch Eastern District of Texas docket (PACER.gov, fee-based5).

- Join Civil Suits: If class actions form, lawyers notify.

- Tax Help: Claim losses on IRS Form 4684—up to 95% deductible.

- Seek Counseling: Victim services via DOJ at (202) 514-2000.

Texas man guilty in decade-long fraud scheme? Thrash’s plea confirms it. What charges did Matthew Jess Thrash receive? Wire fraud core, laundering add-ons. News updates on Thrash federal fraud conviction: Plea in May 2025; sentencing soon.

How to check if I’m a victim of Thrash investment schemes? Review old emails for “TSM,” “TK Investments,” or Pete Rose mentions. Invested 2012-2024? Dig deeper.

Investment Fraud Victims Seeking Restitution in Thrash Case

Success stories inspire. In the $44 million Weinstein Ponzi (2025), victims got full restitution orders. Thrash’s $9 million pot? Recoverable via seized assets, gambling wins traced, per indictment.

DOJ releases statement on Thrash wire fraud case: “Justice for victims drives us.” You’re part of that.

FAQs

Who is Matthew Jess Thrash?

He is a 49-year-old man from Lufkin, Texas. He acted nicely and like a sports hero. But he told big lies and took people’s money.

What bad things did he do?

He tricked more than 100 people. He took their money with fake stories about sports and marijuana shops. He stole more than 9 million dollars.

How much money did he steal?

More than 9 million dollars. That is 9,170,124 dollars. From 2012 to 2024.

When did he say “I am guilty”?

In May 2025. On May 12, 2025, he told the judge, “I did it.” He said he is guilty of wire fraud.

Did he lie about sports?

Yes! He said, “I help pro players. Give me money.” But it was all fake. No real players. No real help.

Conclusion

Matthew Jess Thrash, indicted for decades-long fraudulent investment schemes, marks a turning point. From fake sports dreams to phantom pot profits, his 12-year run ends with accountability. Over 100 victims lost $9.17 million, but reporting builds restitution bridges. The FBI’s form isn’t just paperwork; it’s power. Direct investors, partial payers, families, whistleblowers: All welcome. Media and public: Spread the word for wider reach.

You’ve read the facts, seen the steps. Recovery starts with one click. Remember, shame belongs to the scammer, not you. Justice isn’t instant, but it’s possible,91% in Madoff proves it.