Nvidia CEO Jensen Huang’s frequent stock sales concern investors as the AI leader sees massive growth. Many people watch these moves closely. They wonder if the sales mean trouble ahead for the company’s stock.

Jensen Huang leads Nvidia, a top company in chips for artificial intelligence. His choices get a lot of attention from retail investors, big funds, analysts, and traders. When he sells shares often, it can make people think twice about holding the stock.

This article looks at the facts. We explain why these sales happen and what they mean for you as an investor.

Who Is Jensen Huang?

Jensen Huang started Nvidia in 1993. He is the president and CEO. He was born in Taiwan and moved to the US as a child. He studied at Oregon State University and Stanford University. Both schools gave him honorary degrees for his work.

Huang turned Nvidia from a graphics card maker into the king of AI chips. Under him, Nvidia made big steps, like the invention of the GPU in 1999. This changed gaming, science, and now AI.

Today, Huang is one of the richest people in the world. His net worth is over $140 billion, mostly from Nvidia shares. He often wears a black leather jacket and speaks at big events about the future of tech.

Huang stays very tied to Nvidia. He owns a huge amount of shares directly and through family trusts.

What Are Insider Stock Sales?

Insider stock sales happen when company leaders, like CEOs, sell their own shares. Laws require them to report these to the SEC. You can see them in Form 4 filings.

Many times, sales are part of a Rule 10b5-1 plan. This is a set plan made ahead of time. It lets insiders sell shares on a schedule. The plan helps avoid claims of using secret information to trade.

These plans are common for rich executives. They need cash for taxes, homes, or to spread their money around.

Details of Jensen Huang’s Recent Stock Sales

In 2025, Jensen Huang sold shares many times. All under a Rule 10b5-1 plan he set in March 2025. The plan allows up to 6 million shares sold by year’s end.

Here are some key sales:

- In June 2025, he started with about 100,000 shares for around $15 million.

- In July 2025, sales picked up. One week, he sold 225,000 shares for $37 million. Another time, $36 million worth. The total in July reached over $100 million in some reports.

- August and September saw more. For example, $39 million in one set and $38 million in another.

- October had a smaller sale of about 25,000 shares for $5.19 million.

Overall, by late 2025, Huang sold millions of shares. Values added up to hundreds of millions. But he still owns tens of millions directly. Plus hundreds of millions through trusts.

These sales come as Nvidia stock hit new highs. The company passed $4 trillion in value at times.

For more details on specific sales, check thisCNBC report on a July sale1.

Are nvidia ceo Jensen Huang’s frequent stock sales concern investors?

Many ask: Are Nvidia CEO share sales a red flag for investors?

Not really. Here is why:

- The sales are planned ahead. The Rule 10b5-1 plan was made in March 2025. Long before some big news.

- Huang keeps a huge stake. Even after sales, he owns over 3% of Nvidia through direct and family holdings.

- No link to bad news. Nvidia keeps reporting strong results. Demand for AI chips is very high.

But some worry. Frequent sales can make short-term traders nervous. It might add to stock ups and downs.

How Jensen Huang’s Stock Sales Affect Nvidia Investors

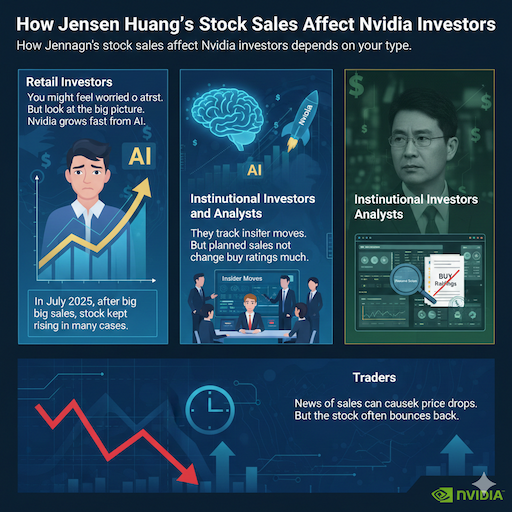

How Jensen Huang’s stock sales affect Nvidia investors depends on your type.

- Retail Investors: You might feel worried at first. But look at the big picture. Nvidia grows fast from AI.

- Institutional Investors and Analysts: They track insider moves. But planned sales do not change buy ratings much.

- Traders: News of sales can cause quick price drops. But the stock often bounces back.

In July 2025, after big sales, stock kept rising in many cases.

See thisYahoo Finance article on a sale for context2.

What Is a Rule 10b5-1 Plan?

A Rule 10b5-1 plan is a tool for insiders.

Here is how it works in simple steps:

- The insider sets the plan when they have no secret info.

- They pick amounts, prices, and dates ahead.

- A broker handles the sales auto.

- This protects from insider trading charges.

Huang uses this for all his 2025 sales. It shows the moves are not based on bad future views.

Tracking Nvidia CEO’s scheduled stock sales is easy. Look at SEC filings online.

Analysis of Nvidia Insider Trading Activity by CEO

Analysis of Nvidia insider trading activity by CEO shows a pattern.

Huang sells regularly under plans. In past years, he sold over $700 million in one plan.

Why?

- Diversify wealth. His money is mostly in Nvidia.

- Pay taxes or personal needs.

- Common for tech CEOs.

Compared to others, like Google or Microsoft CEOs, they do the same. No sign of worry from Huang. He talks bullishly about AI.

Jensen Huang Sells Millions of Nvidia Shares: Investor Reaction

Jensen Huang sells millions of Nvidia shares: investor reaction is mixed. Some media headlines scare people. But most analysts stay positive. The stock price did not crash from sales. Nvidia hit records in 2025.

One report fromInvesting.com on an October sale3.

Impact of Frequent Executive Stock Sales on Nvidia Stock Price

The impact of frequent executive stock sales on Nvidia stock price is small.

Sales add supply, but Nvidia’s demand is huge.

Volatility comes more from earnings or AI news.

Nvidia stock volatility due to CEO insider selling is low. Planned sales do not surprise much.

Nvidia Leadership Stock Sales News 2025

Nvidia leadership stock sales news July 2025 and later focused on the plan.

News in July highlighted $37 million in sales. But the stock rose anyway.

Other executives sell too, like the CFO.

Should Investors Worry About Nvidia CEO Selling Shares?

Should investors worry about Nvidia CEO selling shares?

No, not much.

Here are tips:

- Check if sales are planned.

- Look at the remaining ownership.

- Focus on company results.

Nvidia has huge backlogs for chips. CEO says demand is “off the charts.”

Why Insider Sales Happen Often

Executives like Huang get most wealth from stock. As the company grows, they sell some to:

- Buy homes or give to charity.

- Reduce risk if all money is in one stock.

- Family plan.

It is smart money management.

FAQs

Why does Jensen Huang sell stock so often?

Jensen Huang sells Nvidia stock often because he follows a pre-set plan called a 10b5-1 plan. This plan lets him sell shares at set times and amounts, no matter what, for personal reasons like paying taxes or diversifying his money. It helps him take some cash out safely without looking like he knows secret bad news.

Do these sales mean Nvidia stock will fall?

No, these sales do not mean the stock will fall. In 2025, Nvidia’s stock went up a lot even though Huang sold many shares. The price depends more on how well the company does, like selling lots of AI chips, not just one person’s sales.

Is this insider trading?

No, these sales are not insider trading. The pre-set plan (10b5-1) is made ahead of time when he does not know secret company news. This rule protects him and makes sure the sales are fair and legal.

How much does Huang own now?

Jensen Huang still owns tens of millions of Nvidia shares directly. He also has trusts and other ways that hold billions of dollars worth of Nvidia stock. Even after selling some, he remains one of the biggest owners and is very rich from the company.

Conclusion

Nvidia CEO Jensen Huang’s frequent stock sales concern investors at first glance. But the facts show these are scheduled moves under a Rule 10b5-1 plan. They do not signal lack of faith in Nvidia.

Huang keeps massive ownership. Nvidia leads AI with strong demand ahead.

Should investors worry about Nvidia CEO selling shares? For most long-term holders, no. Focus on the company’s bright future.