Portfolio diversification is one of the easiest and smartest things you can do with your money.

Think about it like this: you would never carry all your cash in one pocket. If that pocket has a hole, you lose everything. The same is true with investing. Portfolio diversification simply means spreading your money across many different places so one bad day does not wipe you out.

This super-long guide uses only tiny words and short sentences so even a child can understand it. By the time you finish reading, you will know exactly how to protect and grow your money.

What Is Portfolio Diversification? (The Easiest Meaning Ever)

What is portfolio diversification?

It is the act of buying many different kinds of things instead of just one thing.

You can buy:

- Stocks (pieces of companies)

- Bonds (loans to companies or governments)

- Gold and silver

- Property or land

- Cash in the bank

- Even a little Bitcoin or other crypto coins

When you own many of these, you have a diversified portfolio.

When you own only one or two, you do not.

A famous saying explains it best:

“Don’t put all your eggs in one basket.”

That old saying is the heart of portfolio diversification.

Why Is Portfolio Diversification Important? Real Stories That Prove It

Why is portfolio diversification important? Because bad things happen to everyone – even big companies.

Story 1 – The Year 2000 Tech Crash

Many people put all their money in internet companies. When the bubble popped, some lost 90 % of their savings in just two years. People who also owned bonds, gold, and normal companies lost only a little.

Story 2 – The 2008 House Crash

People who only owned bank stocks or house companies lost half their money. People who owned food companies, health companies, and bonds did much better.

Story 3 – 2022 (A Very Bad Year)

Stocks fell. Bonds fell. Almost everything fell. But people who owned gold and oil made money that year.

These true stories show the same lesson again and again: portfolio diversification saves you when the world gets crazy.

The Biggest Benefits of Portfolio Diversification (You Will Love These)

Here are the top benefits of portfolio diversification in very easy words:

- You lose way less money when something goes wrong.

- Your money grows more smoothly – no scary big drops.

- You feel calm and happy instead of worried every day.

- You still make good money over many years.

- You are ready for anything – war, high prices, low prices, anything!

- Your family thanks you because their future is safer.

- You look smart to your friends when the market falls and you stay okay.

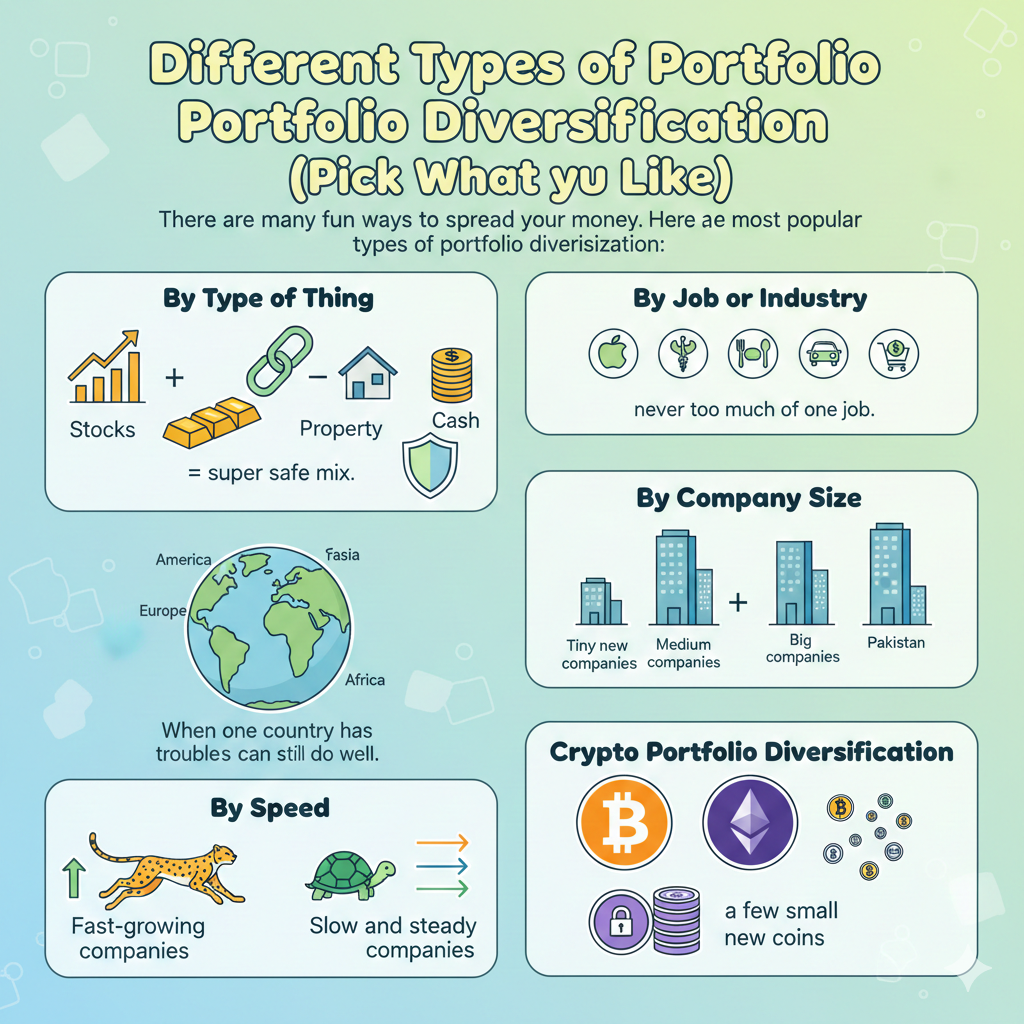

Different Types of Portfolio Diversification (Pick What You Like)

There are many fun ways to spread your money. Here are the most popular types of portfolio diversification:

- By Type of Thing Stocks + Bonds + Gold + Property + Cash = super safe mix.

- By Job or Industry Own tech companies, health companies, food companies, car companies, banks, shops – never too much of one job.

- By Country America + Europe + Asia + Pakistan + Africa. When one country has trouble, the others can still do well.

- By Company Size Big companies + medium companies + tiny new companies.

- By Speed Fast-growing companies + slow and steady companies.

- Crypto Portfolio Diversification Bitcoin + Ethereum + some stable coins + a few small new coins1.

You do not need all of them. Just pick two or three and you are already much safer.

Super Simple Portfolio Diversification Strategies for Real People in 2025

Strategy 1 – The Magic 60/40 Plan (Perfect for Beginners)

- Put 60 % of your money in stocks (use one cheap world-stock fund)

- Put 40 % in bonds (use one cheap bond fund) That’s it! Millions of people use this and sleep very well.

Strategy 2 – The “Buy Only 4 Things” Lazy Plan

Buy these four cheap funds and forget about them for years:

- World stock fund

- Pakistan or emerging market fund

- Bond fund

- Gold fund (just a little) You now own thousands of companies and things all over the planet.

Strategy 3 – The Happy Income Plan (Great if You Want Money Every Month)

Many people love the SCHD dividend portfolio diversification plan:

- Big part in SCHD (a fund that pays you money every three months)

- Some in other dividend funds from around the world

- Some in bonds

- Tiny bit in gold You get paid every month and still stay very safe.

Strategy 4 – The All-Weather Plan (Made by a Billionaire)

- 30 % stocks

- 55 % bonds (some short, some long)

- 7.5 % gold

- 7.5 % oil and food things This plan does well when prices go up, down, or stay the same.

How to Build Your Own Diversified Portfolio – 10 Baby Steps Anyone Can Follow

You do not need to be rich or smart. Just follow these tiny steps to diversify portfolio today:

- Open a free investing account (many banks and apps give them).

- Decide how much money you can invest right now – even 5,000 rupees is fine to start.

- Ask yourself: “How many years until I need this money?”

- More than 10 years → you can have more stocks.

- Less than 5 years → you need more bonds and cash.

- Choose your simple mix (example: 70 % stocks, 30 % bonds).

- Buy one or two cheap world-stock funds (they own thousands of companies for you).

- Buy one cheap bond fund.

- Buy a tiny gold fund (5–10 % is enough).

- Write down your plan on a piece of paper or phone note.

- Check it once every year and fix if one part grew too big.

- Add more money every month – even small amounts grow huge over time.

That’s all! You now have a strong diversified portfolio.

Real-Life Portfolio Diversification Examples (Copy These If You Want)

Example 1 – Young Person (Age 25)

- 80 % world stocks

- 10 % Pakistan stocks

- 10 % bonds This person can take more risk because they have many years.

Example 2 – Parent Saving for Kids (Age 40)

- 50 % stocks

- 40 % bonds

- 10 % gold and property Safe and steady.

Example 3 – Almost Retired Person (Age 60)

- 30 % stocks

- 50 % bonds

- 20 % cash and gold. Very little chance of big loss.

Example 4 – Crypto Lover

- 40 % Bitcoin

- 30 % Ethereum

- 20 % other good coins

- 10 % stable coins (like digital cash) This is crypto portfolio diversification done righ2t.

How to Measure Diversification in a Portfolio (So Easy!)

You can know if you are doing well in just one minute:

- Do you own at least 3 different kinds of things? Yes = good start.

- Is no single company or country more than 10 % of your money? Yes = great.

- Do some of your things go up when stocks go down? (Like gold or bonds) Yes = perfect.

Or use a free portfolio diversification calculator online. Just type what you own and it gives you a score from 1 to 100.

The Most Common Mistakes (And How to Fix Them Fast)

- Keeping all money in one bank or one company stock → Fix: buy a world fund today.

- Buying 20 different Pakistani companies → Still not safe! Fix: add bonds and gold.

- Forgetting about your money for 10 years without checking → Fix: look once a year.

- Thinking you need lakhs of rupees to start → Wrong! Many apps let you start with 500 rupees.

New and Fun Portfolio Diversification Strategies for 2025 and Beyond

Smart people are now adding these:

- A small slice of Bitcoin and Ethereum (5–10 %)

- Clean energy funds (sun and wind power)

- Water funds (companies that clean and sell water)

- Robot and AI funds

- Health and medicine funds give extra growth and still keep you safe.

Does Portfolio Diversification Still Work in 2025?

Yes – 100 % yes!

Even with all the new technology and fast markets, the basic rule never changes: things do not all move together. Gold still shines when stocks fall. Bonds still pay when companies cut jobs. Different countries still grow at different times.

Every big study in the last 50 years says the same thing: people who use portfolio diversification end up with more money and fewer tears.

Your 2025 Portfolio Diversification Checklist (Print This!)

- I own stocks from many countries

- I own some bonds

- I own a little gold or property

- No single thing is more than 15 % of my money

- I use cheap funds, not expensive ones

- I add money every month

- I check and fix once a year

- I stay calm when others panic

If you can say yes to most of these, you are winning!

FAQs About Portfolio Diversification (Super Easy Answers!)

What is portfolio diversification in very simple words?

Portfolio diversification means never putting all your money in one place. You buy many different things so one bad day does not hurt you too much.

Why is portfolio diversification important for beginners?

Because beginners make the biggest mistakes when they put everything in one stock or one company. Spreading the money keeps you safe while you learn.

Can I start portfolio diversification with very little money?

Yes! Many apps let you start with just 500 or 1,000 rupees. Buy tiny pieces of world funds and you are already diversified.

Is it true that portfolio diversification lowers my profit?

It lowers the super-high profits sometimes, but it also stops super-big losses. Most people end up with more money and less worry.

How many things do I need for a diversified portfolio?

Just 3–5 cheap funds (world stocks, bonds, gold, etc.) give you thousands of companies and things. That is enough for almost everyone.

Conclusion – Your Money Deserves Portfolio Diversification Right Now

Portfolio diversification is not hard. It is not boring. It is the kindest thing you can do for your money and your family.

Just spread it out. Buy a few different things. Check once in a while. Let time do the rest.

You do not need to be rich. You do not need to be old. You just need to start.

Take the first tiny step today and your future self will thank you every single day.

So tell me in the comments: What is the very first new thing you will add to make your money more diversified this week?

References

- Corporate Finance Institute – Diversification guide: Shows with pictures how spreading money cuts big losses – perfect for beginners and families. ↩︎

- Investopedia.com – Diversification page (2025): Uses the famous “eggs in one basket” story and easy charts for everyday people. ↩︎