Saving Strategies For Students help you handle college costs without stress. You learn to track spends, grab deals, and build a small safety net. In 2025, with average college costs at $38,270 per year including living expenses, these tips keep you afloat. Many students juggle tuition, books, and fun on tight budgets, but simple habits change that. Start with one easy step today, like listing your weekly buys, and watch extra cash appear. Feel good knowing you control your money.

Why Saving Strategies For Students Matter in 2025

Saving Strategies For Students are key now because college hits hard on the wallet. Total student debt tops $1.77 trillion in 2025, with average federal loans at $39,075 per borrower, per Federal Reserve data. That’s up 3.23% from last year. Many undergrads face $38,270 yearly costs, including $17,709 tuition and $14,435 living fees. Without plans, small leaks like $5 coffees add $150 monthly. But smart saves build buffers for surprises like laptop breaks.Students often live on $1,500-2,000 monthly from jobs or aid. A Sallie Mae survey shows 62% of families plan college pay, but students cover 10% out-of-pocket. This pushes debt risks—11.3% of federal loans are delinquent. Good strategies cut that by teaching needs over wants. Needs: rent, food. Wants: new clothes. Track to spot $200 waste easy.In the US and UK, costs rise 6.1% yearly for food alone. Yet, 35% of families use 529 plans averaging $6,844 saved. Students can mimic this with apps. Husson University says start budgets early to avoid 20-year loan traps. Peace comes from knowing you save $50 weekly for emergencies.Student money-saving tips like discounts save hundreds. Amazon Prime Student cuts shipping free. Overall, these habits grow wealth—$100 monthly at 25 compounds to $200,000 by 65 at 7% return. No magic, just steady steps.Long-term, they free post-grad dreams. Less debt means faster homes or trips. In 2025, with 19.28 million undergrads, 54% will join with emergency funds. Start small, win big.

Basic Saving Strategies For Students: Build a Budget

Saving Strategies For Students begin with a simple budget. List income: part-time pay, aid, gifts1. The average student earns $500-800 monthly from gigs. Then subtract fixed costs: rent $700, food $300. Use free apps like Mint to track. Review weekly—adjust if over on fun.Budgeting tips for students use 50/30/20: 50% needs, 30% wants, 20% save. For $1,000 income, save $200. Zero-based budgets assign every dollar a job. No leftovers means no waste.Track spends seven days. Note coffee, bus, snacks. Many find $100 leaks. Cut half to save $50 weekly. Saint Leo University tips group buys: food, transport, books.Set goals: $500 emergency fund first. Auto-save $10 paychecks. High-yield accounts earn 4.5% in 2025. This grows $120 yearly free.Share budgets with roommates. Split Netflix, save $5 each. Apps sync for teams. Monthly checks tweak for rises like books.These basics fit dorm life. No fancy tools—just phone notes. Habits form in weeks, easing stress.

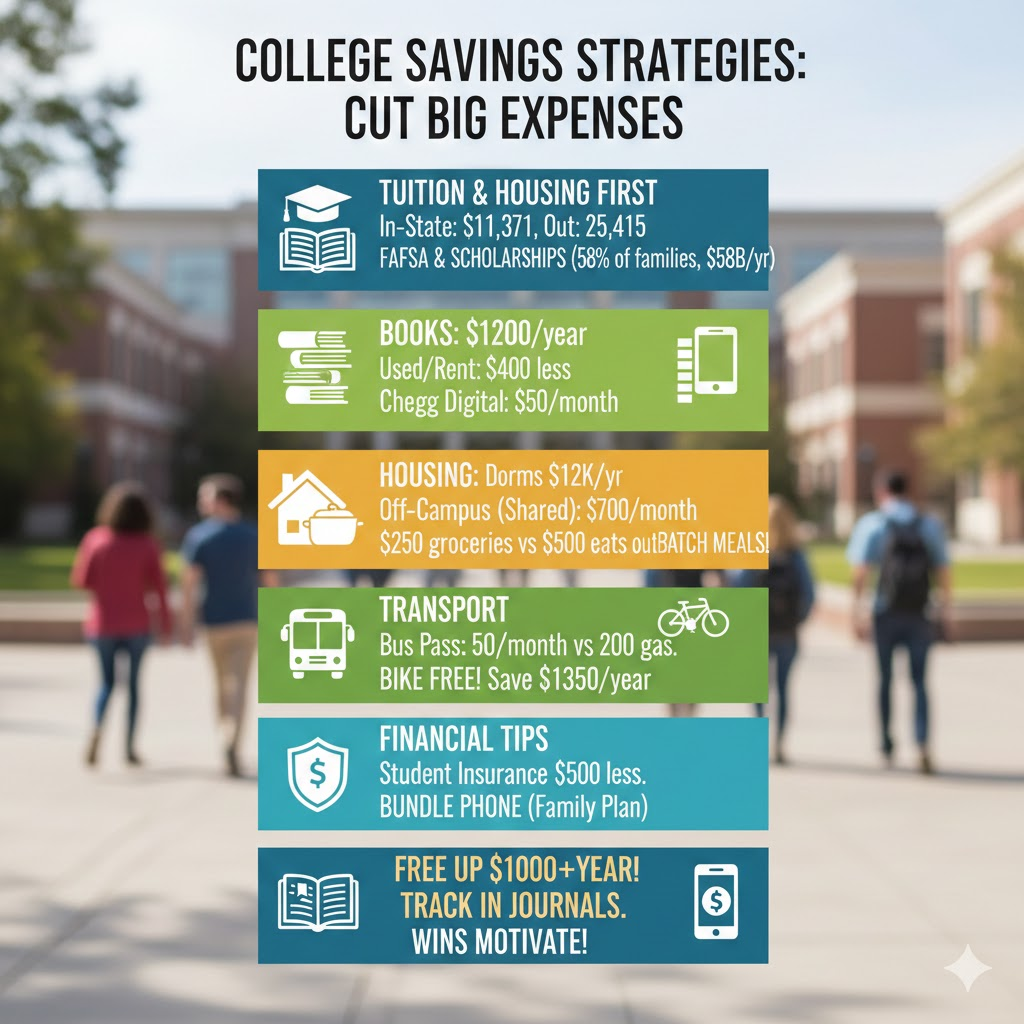

College Savings Strategies: Cut Big Expenses

College savings strategies target tuition and housing first. Average in-state tuition $11,371, out $25,415. Seek aid: FAFSA unlocks grants. 58% of families use scholarships, averaging $58 billion yearly.Books cost $1,200—buy used or rent for $400 less. Apps like Chegg offer digital for $50 monthly. Share with friends.Housing: Dorms average $12,000 yearly. Off-campus shares halve to $700 monthly. Cook home: $250 groceries vs $500 eats out. Batch meals Sunday save time and cash.Transport: Bus passes $50 monthly beat $200 gas. Bike for free. Public options cut $1,350 yearly.Financial tips for students include insurance checks. Student plans save $500. Bundle phone with family.These cuts free $1,000 yearly. Track in journals. Wins motivate more.

Student Money-Saving Tips for Daily Life

Student money-saving tips make everyday cheap. Groceries: Shop Aldi for 20% less. Meal prep rice bowls—$2 each. Avoid campus cafes at $10.Entertainment: Free events via apps. Libraries lend movies. Student IDs get 50% off museums.Clothes: Thrift stores $5 finds. Depop sells old for $20 credit.Utilities: LED bulbs cut power $30 monthly. Unplug chargers.Ways for students to save money use apps like Rakuten for 5% cashback. Stack with sales.Coffee home: $1 vs $5 daily saves $120 yearly. Fun stays—picnics over bars.These habits add $300 monthly. Simple swaps build ease.

Budgeting Tips for Students: Track and Adjust

Budgeting tips for student stress tracking. Use envelopes: Cash for food, gone means stop. Apps alert overspends.Weekly reviews: Sunday tally. Over $20 snacks? Swap fruit.Income boosts: Campus jobs $10 hourly. Tutor for $15.Aid: Pell Grants average $4,000. Apply yearly.Debt watch: Pay cards full to skip 20% interest.How to manage student finances starts here. Tools like Excel free templates.Adjust quarterly for hikes. This keeps control2.

How to Manage Student Finances: Avoid Debt

How to manage student finances means debt smart. Loans average $39,075—pay interest low.Cards: Use for builds, pay full.Aid first: Grants no repay.Student loan management picks income-based plans.Emergency $1,000 fund stops borrows.Track credit free via apps.Habits now free futures.

FAQs About Saving Strategies For Students

What are the best ways for college students to save money?

Best ways for college students to save money start with budgets—list income, cut $50 food by preps. Grab student discounts and deals like 20% Amazon. Sell old books for $100. Gig tutor $15 hours. Auto-save $20 weekly to high-yield. Share rides save $50 gas. Free campus events over paid. These stack $300 monthly. No pain, just smart. Many hit $1,000 funds quickly. Ease grows as habits stick. Start one today—watch3 change.

What easy money-saving tips for students on a tight budget?

Easy money-saving tips for students on tight cash mean thrift clothes $5. Cook beans for $2 meals. The bus passes $30 monthly. Cancel subs $20 free. Library books cost zero. Walking errands save gas. Sell gadgets for $50 easily. Track apps spot leaks. These are free for $150 weekly. Tight turns roomy. Peers save $2,000 yearly. Simple swaps win. Balance fun with free parks. Peace from control.

How to create a student budget and save money?

How to create a student budget and save money use 50/30/20—half needs like $300 rent. Apps like Mint log daily. Review Sundays tweak overs. Set $100 goal pots. Income from $10 jobs adds. Cut coffee $100 yearly. Share housing halves $400. This nets $200 saves. Tools guide newbies. Monthly checks build skill. Funds grow to $500 fast. A secure spot opens.

What practical saving strategies for university students?

Practical saving strategies for university students hunt aid—grants $4,000 average. Used texts $400 less. Meal plans $250 groceries. Discounts 50% of movies. Gig weekends $100. Emergency jars $20 weekly. Track spends notes. These cut $500 yearly. Uni life fits—dorms share. Wins motivate more. Debt drops as saves rise. Habits last post-grad.

How can students save money while in college?

How students can save money while in college batch cooks save $100 food. Free events over $20 nights. Thrift $10 outfits. Bus vs car $150 gas. Sell notes for $50 packs. Budget apps alert. The room shares $300 less rent. These add $400 monthly. College thrills stay—picnics are fun. Peers build $2,400 yearly. Start small, grow steady. The future brightens.

Conclusion: Embrace Saving Strategies For Students for Lasting Wins

Saving Strategies For Students like budgets, discounts, and gigs turn tight cash into freedom. Use budgeting tips for students and college savings strategies to cut debt risks and build buffers in 2025. From meal preps to part-time wins, small acts stack big. You got this—college thrives with smart money. What one tip will you try this week?

References

- Bank of America: Student Banking Spending and Savings – Tools and habits for young students building long-term savings amid rising costs. ↩︎

- Saint Leo University: 8 Proven Money-Saving Strategies for College Students – Tips for first-time budgeters living away from home, emphasizing frugal habits and student perks ↩︎

- Husson University: Money-Saving Tips for Students – Practical advice for undergrads on tight budgets, focusing on daily cuts and avoiding debt. ↩︎