Budgeting On A Low Income can feel hard when bills stack up fast. But it gets easier with a clear plan. You track what comes in and goes out each month. This helps you spot ways to save without big changes. Many folks live this way and still find room for fun. Start small to build good habits. Feel more in control soon. A strong budget turns stress into steps forward.

What Does Budgeting On A Low Income Mean?

Budgeting On A Low Income means you plan your cash with care. Your pay covers basics like food and rent first. Then you look at extras like coffee or trips. The goal is to match what you earn to what you need. No fancy tools required. Just paper or a free app works fine. This way, surprises like car fixes don’t wreck your month. You learn to say no to wants that hurt.People with small paychecks use this to stay afloat. Think of a single mom with a part-time job. She lists her $1,200 monthly take-home pay. Rent takes $800, food $200, and bus fare $50. That leaves little for clothes or fun. But by cutting takeout from $100 to $20, she saves $80. Over time, that adds up for an emergency pot. Experts say start by writing all numbers down. See the full picture right away.This approach fits real life in places like the US or UK. Costs rise, but pay stays flat for many. A 2023 Federal Reserve report shows 54% of adults lack savings for three months of bills. Low earners feel this most. Yet, simple tracking changes that. You prioritize needs over wants. My needs are rent and groceries. I want new shoes or streaming shows. Ask yourself: Do I need this now? If not, wait.Low income budgeting builds skills for life. It teaches patience and smart picks. No shame in starting small. Many succeed by reviewing weekly. Adjust for ups and downs like overtime pay or a sick day. This keeps you steady. Friends share tips too, like swapping clothes instead of buying. It cuts costs and builds ties.In short, Budgeting On A Low Income is about balance. You make your money work harder. Feel proud as you see progress. It’s a tool for peace, not punishment.

Why Budget When Money Is Tight?

Budgeting On A Low Income brings big wins even with little cash. First, it cuts worry. You know bills get paid on time. No late fees eat your next check. Second, it spots leaks. Like $5 daily sodas add $150 a month. Swap for water and save that for gas. Third, it helps build a safety net. Put $10 aside each week for bad days.Stats back this up. Over half of UK homes budget regular and feel calmer, per surveys. In the US, those who track spend 15% less without feeling pinched. This matters when pay barely covers rent. You avoid debt traps like high-fee loans. Instead, you pay down cards slowly but sure.Budget tips for low income start with honesty. List all income: job pay, child support, or odd jobs. Then all outgo: fixed like power bills, and flex like food. Subtract and see the gap. If short, trim wants first. Delay that haircut or movie night. Find free fun like park walks.This method fits families too. A dad with two kids on $2,000 a month plans meals ahead. Batch cook beans and rice to stretch $150 groceries. He skips $20 weekly pizza. That frees cash for school supplies. Kids learn by helping track. It teaches value early.Long-term, money management on low income opens doors. Save for a better job course or small vacation. Feel hope, not stuck. Experts at places like InCharge say small steps lead to big shifts. You deserve that calm.

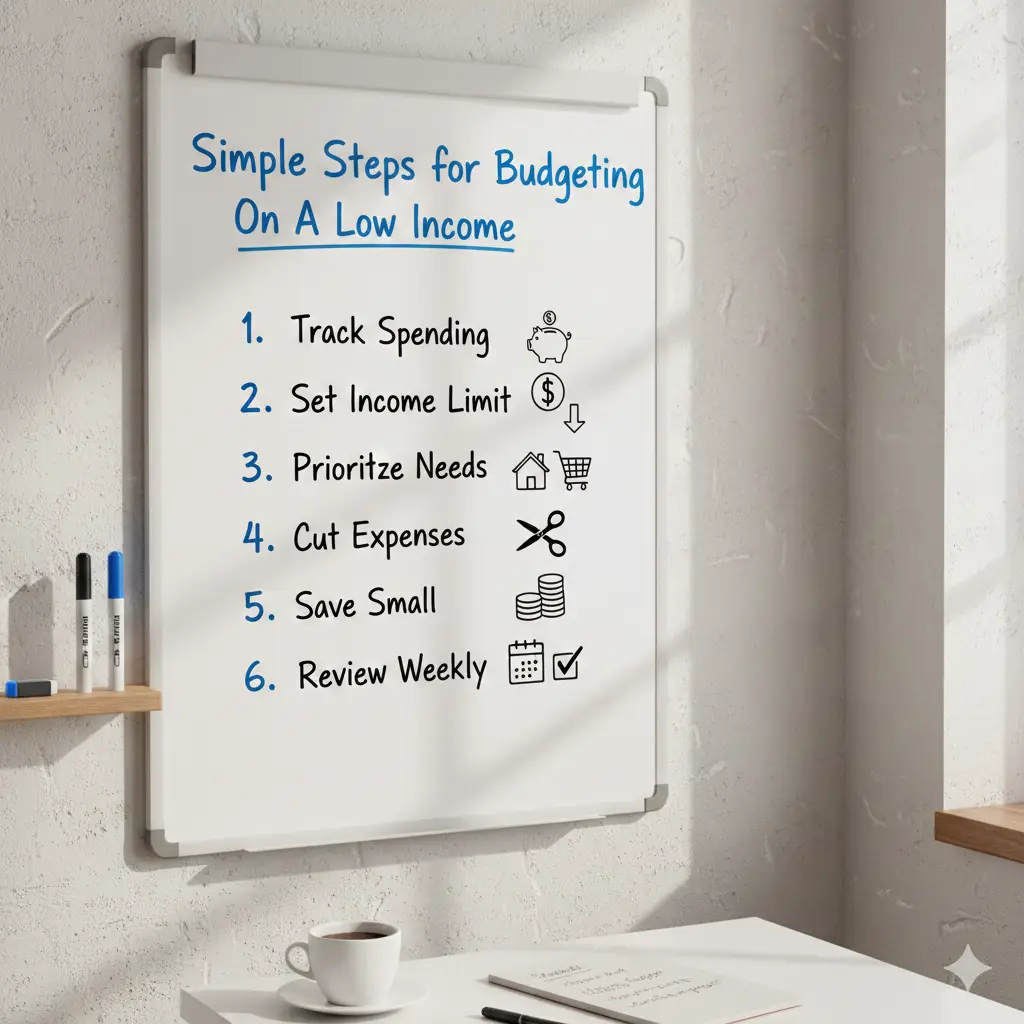

Key Steps to Start Budgeting On A Low Income

Ready to try Budgeting On A Low Income? Follow these easy steps. They take 30 minutes at first. Then check weekly. Use a notebook or free sheet online.First, track your income. Add up after-tax pay from work. Include side cash like babysitting or refunds. Aim for monthly total. If irregular, the average last three months. This gives a true base.Next, list expenses. Split into must-haves and nice-to-haves. Must-haves: rent $700, food $250, bus $60, phone $40. Nice: coffee $30, clothes $50. Use bank apps to see real spends. Tally them up.Subtract expenses from income. Positive? Great, save the extra. Negative? Cut from nice list. Drop one streaming service for free $15. Repeat till balanced.Review each week. Note what you spent on food. Did it hit $250? If it’s over, plan better next time. Adjust for changes like a birthday gift.Build in savings. Even $5 a week goes to an emergency jar. It grows to cover a flat tire. Use apps that round up buys for auto-save.Seek help if needed. Free tools fromMoneyHelper budget planner guide you1. Or chat with community centers.These steps make frugal budgeting simple. You gain control fast. Stick with it for months to see real change.

How to Save Money on a Small Income

Saving feels tough with budgeting with limited income. But tiny moves add up. Start with why: For peace if work slows. Or a fun treat later.First, automate it. Bank $2 per paycheck to savings. It hides before you spend. Apps like Acorns invest change from buys.Second, cut hidden costs. Pack lunch over buying. Brew coffee home. Walk short trips to skip bus fare.Third, use free aid. Food banks stock basics cheap. Government help like SNAP in the US covers groceries. Apply online quick.Fourth, sell stuff. Garage sale old toys. List books on eBay. Turn clutter to cash for your fund.Fifth, goal small. Aim $25 first month. Hit it? Up to $50. Reward with a free park picnic.Sixth, track wins. Notebook notes: “Saved $10 on gas.” This boosts drive.Seventh, learn more. Free classes at libraries on money smarts. Build skills free.Financial planning on low income shines here. You prove small pay can grow. Feel strong2.

Paycheck to Paycheck Budgeting Made Easy

Many live paycheck to paycheck budgeting. It means the next check pays the last bills. But a plan breaks that cycle.Map your cycle. Payday Friday? List due dates after. Pay rent first from check.Buffer small. Keep $20 in a jar for surprises. Builds to more over time.Average variable costs. Gas last month $80? Budget that. Adjust if prices drop.Use envelopes. Cash for food in one. When gone, stop till next pay.Side cash counts. Gig app rides add to the main pot. Track separate.Review end of month. What worked? Tweak for the next cycle.This paycheck to paycheck budgeting turns into a rush to rhythm. You breathe easier.

Building an Emergency Fund on Low Income

An emergency fund on low income shields from shocks. Start with a $500 goal. Then three months basics.Save first from pay. Like tax refund goes straight in.Cut one wants. Skip latte twice a week. That’s $10 saved.High-yield accounts earn extra. Free at many banks.Track growth. App shows bar fill up. Motivating sight.Use for true needs only. Flat tire yes, new shoes no.Rebuild if used. Back to habit quick.This fund brings sleep-easy nights. Key to Budgeting On A Low Income.

FAQs About Budgeting On A Low Income

How do I start Budgeting On A Low Income if I’m overwhelmed?

Take one step today for Budgeting On A Low Income. Grab paper and list last week’s expenses. No judgment, just facts. Then note your main income. Use a free app like Mint to auto-track. Set one goal: Cut $10 from food this week. Review Sunday. This builds ease. Many feel lost at first but gain speed. Free help from templates. Talk to a friend who budgets. Small wins stack up. You got this, one day at a time.

What are simple budget tips for low income families?

Budget tips for low income shine for homes with kids. Plan meals with cheap proteins like beans. Shop sales for diapers. Use school free lunches. Track shared costs in one sheet. Involve kids in picks to teach value. Save $5 weekly in a jar for family fun. Check TSB low income budget tips for UK ideas. Adjust for your spot. This keeps harmony. Families report less fights over money. Peace grows from shared plans.

Can I build savings with low income?

Yes, building savings with a low income works slow but sure. Start $1 a day in a jar. Move to the bank monthly. Cut one sub to free $15. Use cashback apps on groceries. Side gigs like surveys add bits. Track in notebook: “Added $20 today.” Hit $100? Celebrate free. Experts say consistency beats big jumps. Your fund grows to cover doc visits. Feel secure step by step.

How to track expenses for low income budgeting?

For low income budgeting, track daily simple. Use phone notes for buys. Or app photos receipts. Group: Food, bills, fun. Weekly tally totals. See over $20 on snacks? Swap fruit. Bank alerts ping big spends. Free tools like Make It Visible budgeting learn to show how. This catches leaks fast. Habits form in weeks. You master your flow.

What if my income changes often?

Budgeting with limited income handles ups and downs. The average last three pays for base. Buffer 10% for low weeks. Gig cash goes half to fun, half save. Adjust monthly: More in, save extra. Less in, cut wants. Use community aid for gaps. This keeps steady. Many freelancers thrive this way. Adapt and win.

Conclusion: Take Charge of Your Budget on a Low Income

Budgeting On A Low Income empowers you to stretch every dollar3. From tracking basics to small saves, these steps build strength. Use low income budgeting tools and tips to cut stress and grow hope. You deserve financial calm. What one tip will you try this week?

References

- TSB: How to Budget on a Low Income – Tips and free planners for UK households on tight budgets, emphasizing small habits. ↩︎

- Make It Visible: Budgeting On A Low Income – UK-focused guide with tools for tracking income and finding hidden savings. ↩︎

- InCharge: How to Budget Money on a Low Income – Practical steps and resources for US low-income earners facing debt and essentials. ↩︎