The impact of Uipaths series funding emberslasvegas shape how companies grow in tech. UiPath, a leader in robotic process automation, raised big money in its Series E round. This funding boosted its value and sped up new ideas. It also links to events like investor sessions in Las Vegas. For sites like EmbersLasVegas, which focus on online gaming and esports, these lessons help scale businesses. Investors see how cash drives change in the AI and RPA fields. This article dives into UiPath’s story, its funding effects, and tips for startups.

UiPath started small in Romania in 2005. Founders Daniel Dines and Marius Tirca built software to automate tasks. By 2020, the world had changed with COVID-19. Companies needed fast ways to work. UiPath’s tools helped. The Series E funding came at the right time. It let UiPath grow its team and tech. Now, in 2025, UiPath is public with a market cap of around $10 billion. Its stock rose in 2025 as AI trends grew. This shows funding’s power.

EmbersLasVegas.org shares insights on gaming and betting. It applies UiPath’s funding model to esports. Both fields use tech to expand. UiPath growth strategy teaches how to use money for global reach. This piece covers background, funding details, impacts, and future trends. It helps investors, founders, and tech fans understand strategic moves.

UiPath’s Background and Early Days

UiPath began as a small firm in Bucharest. Daniel Dines worked at Microsoft before starting it. He saw a need for tools that mimic human actions on computers. This is robotic process automation (RPA). RPA saves time on boring jobs like data entry.

In the early years, UiPath focused on building core software. They made it easy for non-coders to use. By 2015, they got their first big funding. Series A brought $1.6 million. This helped hire more people and test the product. UiPath to Host Investor Session at Forward Teched 2024 in Las Vegas

UiPath’s mission: Make every business a software business. They aimed to put automation in everyone’s hands. Early clients were banks and health firms. These needed safe, fast ways to handle data.

Key achievements:

- 2017: Series B funding of $30 million.

- Named in the Forbes AI 50 list.

- Grew users worldwide.

UiPath stood out by adding AI to RPA. This made bots smarter. They could learn from data and make choices. This set them apart from rivals like Automation Anywhere.

The company’s culture stressed innovation. They built a community of developers. Free training helped spread RPA. This grew their market fast.

By 2018, UiPath became a unicorn with $1.1 billion value after Series C. This showed trust from investors. Tech startup funding rounds like these fueled quick growth.

UiPath’s story inspires founders. Start small, solve real problems, and scale with smart cash.

The Series Funding Rounds: A Step-by-Step Climb

UiPath’s funding was built like stairs to success. Each round added more power.

Series A (2015): $1.6 million

Led by Earlybird Venture Capital. Used to polish the product and enter new markets.

Impact: Hired key staff. Built a strong base.

Series B (2017): $30 million

Accel led this. Focused on sales and marketing.

Impact: Expanded to the US and Europe. Grew revenue.

Series C (2018): $153 million

Accel and others. Valuation hit $1.1 billion.

Impact: Added AI features. Acquired startups for tech.

Series D (2019): $568 million

Coatue and others. Valuation $7 billion.

Impact: Boosted R&D. ARR jumped.

Series E (2020): $225 million

Alkeon led. Valuation $10.2 billion.

Impact: Advanced cloud and hyperautomation. Helped during COVID.

Series F (2021): $750 million

Alkeon and Coatue. Valuation $35 billion.

Impact: Prepared for IPO. Global expansion.

Total funding before IPO: Over $1.9 billion.

Each round had a plan. UiPath used money for tech, people, and markets. This shows strategic funding allocation.

For startups, the lesson: Match funding to goals. Don’t spend all at once.

The impact of uipaths series funding emberslasvegas

The impact of uipaths series funding emberslasvegas shows in growth and innovation. The Series E round in 2020 was key. It raised $225 million amid the pandemic. Companies needed automation to work remotely.

UiPath’s ARR grew from $100 million to $400 million in two years. This funding lets them invest in AI and cloud. They launched an end-to-end platform in May 2020.

CEO Daniel Dines said: “This funding allows us to accelerate our platform ambitions.”

The money went to R&D. They built tools for citizen developers. This meant anyone could make bots.

In Las Vegas, UiPath hosted an investor session at FORWARD + TechEd 2024. On October 21, 2024, at the MGM Grand. Executives shared AI visions. A customer panel showed real uses. This tied funding to strategy.

UiPath investor session Las Vegas highlighted growth. It connected investors to the company’s path.

For EmbersLasVegas, a site on esports and betting, this matters. EmbersLasVegas funding impact draws from UiPath. Gaming needs scalable tech like AI for odds or fraud checks.

UiPath’s funding boosted valuation. From $7 billion in 2019 to $10.2 billion post-Series E. This attracted more talent.

In RPA, it pushed competitors. The market grew. Forrester said automation mitigates risks.

Stats:

- RPA market: $9.91 billion in 2025, to $24 billion by 2029.

- UiPath’s economic impact: $7 billion in 2021 to $55 billion by 2025.

This funding created jobs. UiPath is hiring globally. R&D hubs in many countries. Enterprise automation investment like this drives change. UiPath acquired AI firms. This added smart features.

For the secondary audience, technology enthusiasts & professionals in AI/RPA, see how funding fuels trends. EmbersLasVegas applies this to gaming. Use funds for blockchain or live betting tech. Overall, Series funding turned UiPath into a leader. It shows cash as a tool for vision.

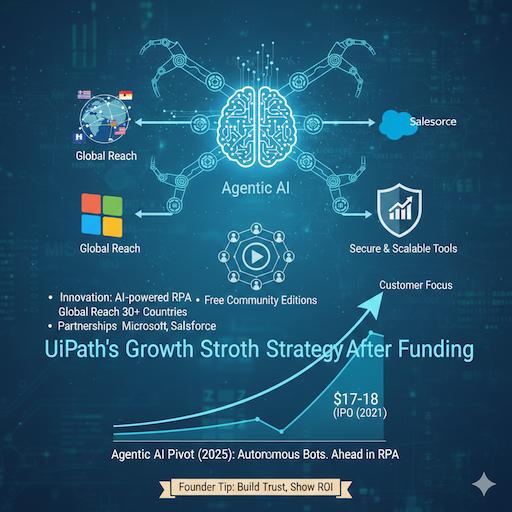

UiPath’s Growth Strategy After Funding

UiPath used funding to grow smart. They focused on key areas.

- Innovation: Added AI to RPA. Bots now handle complex tasks.

- Global Reach: Offices in over 30 countries. Clients in 100+.

- Partnerships: Worked with Microsoft and Salesforce.

- Customer Focus: Built secure, scalable tools.

UiPath growth strategy included free community editions. This grew users fast. Post-Series E, they prepped for IPO. In 2021, they went public. Raised $1.3 billion.

But the stock fell after. From $56 IPO to lows. In 2025, it rebounds to $17-18. Focus on agentic AI helps. UiPath IPO preparation used funding lessons. They scaled ops first.

For founders, tip: Build trust with investors. Show a clear ROI. In 2025, UiPath pivots to AI agents. These are smart bots that decide alone. This strategy keeps them ahead in the RPA industry trends.

Robotic Process Automation Funding Trends

Robotic process automation (RPA) funding booms. In 2025, AI drives it.

Trends:

- AI integration: GenAI makes RPA smarter.

- Cloud-native: Easy to deploy.

- Industry-specific: For health, finance, and gaming. The market grows from $35 billion in 2026 to $247 billion by 2035.

Venture capital in AI hits records. 53% of VC in H1 2025 to AI. UiPath’s rounds set examples. Big valuations attract more cash. AI automation investment focuses on agents. These automate whole processes.

For analysts, watch funding trends in robotic process automation industry. EmbersLasVegas sees this in gaming. AI for personalized bets. Investors look for scalable tech. UiPath shows how.

Enterprise Automation Investment and Scaling

Enterprise automation investment changes businesses. UiPath leads.

They help firms automate back-office work. Saves time and money.

Examples:

- Banks: Automate loans.

- Health: Process claims.

- Gaming: Handle user data.

Corporate technology scaling needs funding. UiPath used it for the cloud.

In 2025, security is key. UiPath adds features for safe AI. Enterprise software expansion grows with RPA. For EmbersLasVegas, scale servers for live events.

UiPath’s Investor Session Insights at Forward Teched 2024

UiPath investor session insights at Forward Teched 2024 shared big ideas. Held in Las Vegas, October 2024. Focused on AI transformation.

Executives talked Business Automation Platform. It mixes robots, people, and AI. The customer panel showed success stories. This session linked past funding to the future.

Investor relations event built trust. For EmbersLasVegas, events like this engage users. Lessons: Share vision openly.

The Role of Series E Funding in UiPath’s Global Expansion

The role of Series E funding in UiPath’s global expansion was huge. Raised $225 million in 2020. Used for worldwide growth. Opened hubs in Asia, Europe, Americas. Clients grew to thousands. Series E fundraising impact: ARR over $400 million. Prepared for $35 billion valuation later. For startups, expand step by step. How UiPath’s Series E funding impacts automation startups: Sets the bar high.

EmbersLasVegas Analysis of UiPath Funding Impact

EmbersLasVegas analysis of UiPath funding impact applies to gaming.

EmbersLasVegas.org covers online gambling, esports.

UiPath’s model: Use funding for tech upgrades.

In gaming: AI for fraud, real-time odds.

EmbersLasVegas funding impact: Scale esports platforms.

Partnerships like UiPath’s with big firms.

Strategic investment effects on enterprise automation platforms help gaming too.

How Venture Capital Drives AI and RPA Innovation

How venture capital drives AI and RPA innovation: Provides fuel.

In 2025, $37 billion was spent on genAI.

UiPath got billions. Used for AI bots.

Trends: Agentic AI, self-healing systems.

Venture capital in AI: 3.2x growth from 2024.

For founders: Pitch strong visions.

Technology innovation funding creates jobs, new tools.

UiPath IPO preparation: Used cash for compliance, marketing. UiPath Raises $225 Million Series E Funding Round

UiPath’s Series E Funding and Technology Growth

Case study: UiPath’s Series E funding and technology growth.

In 2020, amid COVID, funding helped pivot.

Developed hyperautomation: End-to-end tools.

Acquired AI startups.

Impact: Faster digital change.

For EmbersLasVegas: Fund VR betting tech.

Stats: ROI up to 300% long-term.

Lessons from UiPath Funding for Business Scaling

Lessons from UiPath funding for business scaling.

- Align with vision: Use cash for core goals.

- Build trust: Show growth to investors.

- Innovate: Add AI early.

- Expand global: Localize products.

- Collaborate: Partner big.

Lessons and frameworks for applying funding strategies across industries.

For gaming: Startup ecosystem growth.

Empower teams. UiPath did with citizen devs.

Network: Use events like the Las Vegas session.

Technology Company Valuation After Funding

Technology company valuation soars with funding.

UiPath: From $1 billion to $35 billion.

Factors: Revenue growth, market size.

In 2025, AI boosts vals.

Automation software investment: High returns.

For investors: Look at ARR.

RPA Industry Trends in 2025

RPA industry trends evolve.

- GenAI-assisted: Smarter bots.

- Cloud SaaS: Easy access.

- Accelerators for sectors.

Market CAGR is high.

Technology innovation funding supports.

EmbersLasVegas: AI in esports. The Impact of UiPath’s Series Funding EmbersLasVegas

How UiPath’s Series E Funding Impacts Automation Startups

How UiPath’s Series E funding impacts automation startups: Inspires.

Shows path to scale.

Series E fundraising impact: Preps for big leagues.

Startups copy: Focus R&D.

Strategic Funding Allocation Tips

Strategic funding allocation: Key to success.

UiPath: 1/3 R&D, 1/3 sales, 1/3 ops.

Tips:

- Budget clear.

- Track ROI.

- Adjust fast.

For tech startup founders & business strategists.

Investor and Venture Capitalist Perspectives

Investors love UiPath’s story.

Abhi Arun from Alkeon: “Automation is imperative.”

Venture capital in AI: Seeks disruptors.

Look for teams, tech, and market.

Investors & venture capitalists: Fund scalable ideas.

FAQs

What is the impact of UiPath’s series funding EmbersLasVegas?

UiPath’s big funding rounds have grown its automation tools a lot. Sites like EmbersLasVegas1, a gaming blog, learn from this to get faster and smarter. It shows how money helps tech spread to fun places like betting and esports.

How did UiPath’s Series E funding affect its valuation?

In 2020, UiPath got $225 million in Series E funding. This made its value jump to $10.2 billion right away. The cash helped it grow around the world and add new tech.

What are the key RPA trends in 2025?

In 2025, RPA mixes with AI to make smart agents that think and act. Cloud tools and easy-to-use apps help businesses run better. UiPath leads with safe ways to mix people, robots, and AI.

How can startups apply UiPath’s funding strategy?

Startups should use money to build new ideas and grow fast, as UiPath did. Match cash to big goals, like better tech and more customers. This way, they stay strong and attract more helpers.

What role does Las Vegas play in UiPath’s story?

Las Vegas hosts UiPath’s big events like FORWARD and FUSION for investors. They share plans and show new automation tricks there. It helps connect with people and grow the company’s fame.

Conclusion

The impact of uipaths series funding emberslasvegas transformed UiPath to transform into a global leader. From Series E’s $225 million,2 it fueled AI innovations, market growth, and IPO prep. Lessons include strategic allocation, global expansion, and partnerships. For EmbersLasVegas, it means applying these to esports and betting tech. In 2025, RPA and AI trends promise more opportunities. Investors and founders can use this blueprint for success.

What funding strategies will you apply to your business3?