If you recently opened your mail and found a check from something called the Fernandez v CoreLogic Qualified Settlement Fund check, you’re not alone. Thousands of people across the United States have received these payments as part of a big class action lawsuit. This case, known as the Fernandez v CoreLogic settlement, started when a man named Marco Fernandez discovered errors on his credit report. CoreLogic Credco, a company that provides credit reports to lenders, wrongly flagged him and many others as possible matches to people on a government watch list. This led to a $58.5 million settlement to make things right for affected consumers. In this article, we’ll break it down simply: what happened, why you might have gotten this check, how to know if it’s real, and what to do next. We’ll also explain terms like qualified settlement fund and OFAC list settlement payment, so everything makes sense.

The Story Behind the Lawsuit

Let’s start at the beginning. Marco A. Fernandez, a Navy veteran and U.S. citizen, applied for a home mortgage in 2020. When he checked his credit report from CoreLogic Credco, he saw a shocking error. The report said he was a “potential match” to someone on the OFAC sanctions list false match – that’s the Office of Foreign Assets Control list, run by the U.S. Treasury. This list names terrorists, drug traffickers, and other serious criminals that whom U.S. companies can’t do business.

The problem? Fernandez shared a similar name with a Mexican narcotics trafficker, but nothing else matched. He had a Social Security number, U.S. citizenship, and no ties to Mexico. CoreLogic used loose rules for matching names, ignoring details like birth dates or addresses. This mistake, called a false OFAC alert credit report, could hurt people’s chances of getting loans, jobs, or even renting homes. Fernandez disputed it, but CoreLogic didn’t fix it properly and broke the rules about sharing information.

Frustrated, Fernandez sued CoreLogic Credco in a California court. He claimed they violated the Fair Credit Reporting Act violation (FCRA), a law that protects consumers from wrong info on credit reports. The case grew into a class action, meaning it covered anyone else harmed the same way. Lawyers from Berger Montague fought for over three years, uncovering that over 700,000 people faced similar issues.

CoreLogic Credco sells credit reports to mortgage lenders, car dealers, and others. They include OFAC reporting and FCRA settlement checks as part of background screening. But their methods led to inaccurate background check reporting, associating innocent folks with criminals. This isn’t just embarrassing – it can block financial opportunities.

How the Case Unfolded

The lawsuit, officially the Fernandez CoreLogic settlement, was filed in San Diego Superior Court and moved to federal court (Case No. 3:20-cv-01262). It accused CoreLogic of not using “reasonable procedures” to ensure accuracy, a key FCRA rule. They also failed to disclose full details when consumers asked.

Court documents show motions to dismiss, discovery fights, and even a pause while waiting for a Supreme Court decision on similar cases. By 2024, both sides agreed to settle. The judge approved it on March 20, 2024, ending the case. This avoided a trial and got money to the victims faster.

Details of the Settlement Agreement

The CoreLogic Credco OFAC settlement totals $58.5 million. This creates a big pot of money, called the settlement fund, to pay class members, lawyers, and costs. Attorneys got $14.625 million for their work – about 25% of the total, which is common in these cases. There’s also money for admin fees and a $5,000 award to Fernandez for leading the charge.

After fees, the net fund is around $40 million, split among class members. Payouts are pro-rata, meaning everyone gets a share based on the total claims. Early estimates suggest $50 to $100 per person, but it depends on how many claim. Some got notices by mail or email, and claims were due by October 12, 2024.

The settlement also forces CoreLogic to improve their matching process. They’ll use stricter checks to avoid future identity mismatch OFAC screening errors.

What Is a Qualified Settlement Fund?

Now, let’s talk about the “qualified settlement fund” part of your check. A qualified settlement fund, CoreLogic, is a special account set up under IRS rules (Section 468B) for class action payouts. It holds the money until it’s ready to distribute.

Why use one? It lets the company (CoreLogic) take a tax deduction right away when they pay into the fund. Then, an administrator handles sending checks. This keeps things organized, especially with 700,000 people involved.

In simple terms:

- The court orders the fund.

- Money goes in from the defendant.

- It earns interest, which can help pay costs.

- Checks go out to claimants.

Your Fernandez v CoreLogic qualified settlement fund check comes from this fund, managed by a neutral party like Angeion Group. It’s not a scam – it’s how big settlements work.

Who qualifies for the Fernandez v CoreLogic qualified settlement fund check?

You might qualify if CoreLogic Credco reported you as a potential OFAC match between July 6, 2015, and December 31, 2022. This often happened during credit checks for loans or jobs.

Common signs you qualify:

- You got a notice letter or email from the class action settlement administrator.

- Your credit report showed an OFAC list class action settlement flag.

- You disputed a false match, and it wasn’t fixed correctly.

If you applied for credit and got denied or delayed due to this, you’re likely in. CoreLogic had to provide a list of affected consumers, so notices went out automatically. If you missed the claim deadline, check the official site for options – sometimes late claims get accepted.

Why Did I Receive a CoreLogic OFAC Settlement Check?

Many ask: why did I receive a CoreLogic ofac settlement check? It’s because your name or details triggered a false positive in CoreLogic’s system. Maybe you share a common name with someone on the list. For example, if your name is John Smith, and there’s a bad guy named Jon Smyth, loose matching could flag you.

This ties to why was I flagged on the OFAC list credit report. OFAC screening aims to stop dealings with sanctioned people, but companies like CoreLogic must do it accurately under FCRA. They didn’t, so the lawsuit happened.

If you got a check without claiming, you’re in the automatic payment group. Others had to file by the deadline. Official settlement website1

Is the Fernandez CoreLogic Settlement Check Legit?

Yes, is the Fernandez CoreLogic settlement check scam or real? It’s real. But scams exist, so verify.

How to check legitimacy:

- Look for the official administrator: Angeion Group.

- Visit is ofaclistsettlement.com legitimate – yes, it’s the real site.

- Call the helpline from the notice (1-888-906-0583).

- Search court records on PACER or CourtListener.

Reddit users in r/legaladvice confirmed it’s legit but noted the site was slow to update. If the check asks for personal info to cash, that’s a red flag – real ones don’t.

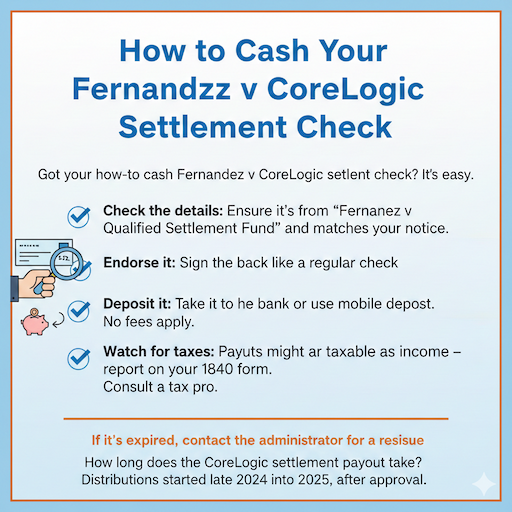

How to Cash Your Fernandez v CoreLogic Settlement Check

Got your how-to cash Fernandez v CoreLogic settlement check? It’s easy.

Steps:

- Check the details: Ensure it’s from “Fernandez v CoreLogic Qualified Settlement Fund” and matches your notice.

- Endorse it: Sign the back like a regular check.

- Deposit it: Take it to your bank or use mobile deposit. No fees apply.

- Watch for taxes: Payouts might be taxable as income – report on your 1040 form. Consult a tax pro.

If it’s expired, contact the administrator for a reissue. How long does the CoreLogic settlement payout take? Distributions started late 2024 into 2025, after approval.

Settlement Amounts: What to Expect

The Fernandez CoreLogic settlement amount per person varies. With $58.5M total and 700k members, after 25% fees and costs, it’s about $57 per person on average. But some get more if they prove extra harm.

Factors affecting your amount:

- If you filed a claim with proof of damage (like a denied loan).

- Total claims filed – fewer claims mean bigger shares.

- Automatic vs. claimed payments.

One user reported getting $50, another $80. It’s not life-changing, but it’s compensation for the hassle.

Understanding OFAC and FCRA in Depth

To grasp why this matters, let’s dive into the laws.

The OFAC list settlement payment relates to the Office of Foreign Assets Control. OFAC enforces sanctions against bad actors. Companies screen against this list, but must be careful.

The Fair Credit Reporting Act (FCRA) requires consumer reporting agency lawsuit companies, like CoreLogi,c to:

- Use accurate info.

- Investigate disputes within 30 days.

- Provide full disclosures.

CoreLogic broke these with sanctions list name matching errors. Similar cases, like against TransUnion, show this is common. In 2021, the Supreme Court limited some FCRA claims, but this settlement pushed through.

Statistics: Each year, millions face credit errors. The FTC says 20% of reports have mistakes. credit report compliance lawsuit cases like this recover billions. Reddit discussion on Fernandez v CoreLogic Credco2

Impact on Consumers

Being flagged wrongly causes real problems. Imagine applying for a car loan and getting rejected over a false OFAC alert credit report. It hurts your score and reputation.

Personal example: A teacher named Maria Lopez got matched to a sanctioned person. She couldn’t rent an apartment until fixed. The settlement gives relief and pushes for better practices.

The receipt of the list settlement letter from CoreLogic means you’re eligible. Don’t ignore it – claim your share.

The Role of Class Action Lawsuits

Class actions like this pool small claims into a big impact. Without them, individuals couldn’t afford to sue giants like CoreLogic.

Benefits:

- Holds companies accountable.

- Provides payouts without individual lawsuits.

- Improves industry standards.

Critics say lawyers get too much, but here, the $14M fee reflects years of work.

Similar Cases and Lessons Learned

This isn’t the only CoreLogic consumer credit lawsuit. In 2023, they settled another FCRA case for $5.7M over background checks.

Lessons:

- Check your credit reports yearly (free at AnnualCreditReport.com).

- Dispute errors promptly.

- Know your FCRA rights.

If flagged, ask for proof and demand removal.

Tips for Handling Credit Report Errors

Prevent future issues with these steps:

- Monitor reports: Pull from Equifax, Experian, TransUnion.

- Spot flags: Look for OFAC or sanctions notes.

- Dispute fast: Write to the agency with evidence.

- Seek help: Use CFPB.gov for complaints.

- Freeze credit: If worried about identity theft.

Bold action fixes most errors within months.

The Settlement Distribution Process

The settlement distribution process works like this:

- Fund setup after approval.

- Claims reviewed.

- Checks mailed or direct deposit.

Admins like Angeion handle it, ensuring fairness. If you moved, update your address.

Broader Insights on Consumer Rights

Consumer rights under FCRA protect against inaccurate background check reporting. Companies must verify data. This case highlights credit report compliance lawsuit needs.

In Tier 1 countries like the US, UK, and Canada, similar laws exist (like GDPR in Europe). If you’re in a Tier 2 country but affected (e.g., US expat), you might still qualify.

Potential Tax Implications

Settlement money is often taxable. The IRS sees it as income unless for physical injury. Report it, but deduct any related expenses. Use Form 1099-MISC if over $600.

Tip: Save records for audits.

How This Settlement Changes the Industry

CoreLogic now uses better matching, reducing identity mismatch OFAC screening. Other agencies follow suit, fearing lawsuits.

Industry stats: FCRA cases rose 15% in 2024, per Consumer Reports.

Personal Stories from Class Members

While names are private, forums like Reddit share tales. One user said: “I got flagged buying a house – settlement check helped cover fees.” Another: “Thought it was spam, but cashed $65.”

These show real impact. Berger Montague case summary3

Avoiding Scams Related to Settlements

Scammers mimic the Fernandez CoreLogic settlement check scam or a real one. They call asking for bank info. Hang up – real admins don’t do that.

Protect yourself:

- Never pay to claim.

- Verify via official channels.

- Report to FTC.

The Future of Credit Reporting

With AI, matching improves, but human errors persist. Lawsuits like this push tech fixes.

FAQs

What is a qualified settlement fund check from CoreLogic?

A qualified settlement fund check is your payout from the big class action lawsuit against CoreLogic. It comes from a special tax-safe fund set up just to hold and send money to people in the case. This keeps things fair and safe for everyone who gets paid.

CoreLogic OFAC list settlement payment explanation?

This payment helps fix harm from CoreLogic wrongly saying you might be on the OFAC list. The OFAC list is for bad people, like terrorists or drug dealers, so that companies cannot work with them. The money says sorry for the wrong flag on your credit report that could hurt loans or jobs.

Who qualifies for the Fernandez v CoreLogic settlement?

People qualify if CoreLogic wrongly flags them as a possible match to someone on the OFAC list. This covers reports from around 2015 to recent years, like 2022 or later in some cases. Over 700,000 people may get help from this big court case.

Fernandez, CoreLogic settlement check legit?

Yes, the check is real and comes from a real court-approved class action. The case is Fernandez v. CoreLogic Credco, LLC, and lawyers from Berger Montague won it. Check the official site at ofaclistsettlement.com or call the court if you are not sure.

How much is the payout?

Most people get between about $47 and $1,000, depending on the class they fit in. Many checks are around $50 to $500, but the exact amount changes with how many claims. The whole settlement is $58.5 million to help lots of people.

Conclusion

In summary, the Fernandez v CoreLogic qualified settlement fund check is a legitimate payout from a landmark $58.5 million settlement addressing Fair Credit Reporting Act violations by CoreLogic Credco. It compensates over 700,000 consumers for OFAC sanctions list false match errors that caused unnecessary stress and financial hurdles. If you received one, verify it, cash it safely, and check your credit to prevent future issues. This case reminds us to stay vigilant about our financial data.

Have you received a similar check or faced credit errors? Share your experience in the comments – it could help others!

References