In the world of investing, large organizations need reliable options that track major markets without high fees. The Vanguard institutional index fund institutional plus shares compare stands out as a top choice for those managing big sums. This fund, known as VIIIX mutual fund, follows the S&P 500 index closely. It suits institutional investors like pension funds and endowments. We will look at its features and stack it up against similar Vanguard products.

Understanding the Vanguard Institutional Index Fund

Vanguard has a strong history in low-cost investing. Founded in 1975, it focuses on index funds that mirror market benchmarks. The Vanguard Institutional Index Fund launched in 1997. It aims to match the S&P 500, which includes 500 large U.S. companies.

This fund uses a passive strategy. Managers buy stocks to copy the index exactly. This keeps costs low and tracking tight. For institutional investors, it means steady growth tied to the U.S. economy.

Key facts:

- Inception Date: July 7, 1997

- Benchmark: S&P 500 Index

- Management Style: Passive

- Fund Managers: Michelle Louie, Nick Birkett, Aurélie Denis

The fund holds about 503 stocks. Its top sectors include technology at 34.60%, financials at 13.00%, and communication services at 10.70%. This mix reflects the S&P 500’s focus on large-cap U.S. equities. Vanguard Institutional Index Fund Institutional Plus Shares, VIIIX summary.

Why Choose Institutional Plus Shares?

Institutional Plus Shares are made for big players. They require a high entry point but offer the best deals on fees.

- Minimum Investment Requirement: $100 million. This fits pension fund investment options or endowment fund portfolio needs.

- Expense Ratio: Just 0.02%. This is among the lowest in low-cost index funds.

- Net Assets: Over $338 billion, showing strong trust from large groups.

These shares help when handling huge amounts. Small fee differences add up over time. For example, on $500 million, a 0.01% lower fee saves $50,000 yearly.

Institutional share class perks include no sales loads or 12b-1 fees. This makes it pure for core equity allocation in big plans.

Vanguard Institutional Index Fund Institutional Plus Shares Compare with Admiral Shares

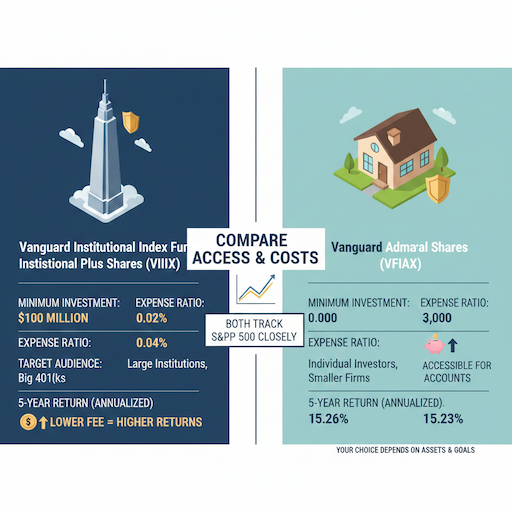

When you Vanguard Institutional Index Fund Institutional Plus Shares compare to Admiral Shares, differences show in access and costs.

Admiral Shares, like VFIAX, also track the S&P 500. But they target smaller investors.

- Expense Ratio: VFIAX has 0.04%, higher than VIIIX’s 0.02%.

- Minimum Investment: Only $3,000 for VFIAX vs. $100 million for VIIIX.

- Performance: Both match the S&P 500 closely. For 5 years ending November 2025, VIIIX returned 15.26% annualized, VFIAX 15.23%.

Why pick VIIIX? If your group meets the minimum, the lower fee boosts returns. Over 10 years, this could mean millions more for a large fund.

Example: A $200 million investment at 0.02% costs $40,000 yearly. At 0.04%, it’s $80,000. Savings go straight to your bottom line.

For retirement plan investment, VIIIX suits big 401(k) sponsors. Admiral works for personal accounts or smaller firms.

Comparing to Vanguard S&P 500 ETF (VOO)

ETFs offer flexibility. Let’s see how vanguard institutional index fund institutional plus shares compare to VOO.

VOO is Vanguard’s ETF version of the S&P 500.

- Expense Ratio: 0.03%, close to VIIIX’s 0.02%.

- Minimum Investment: Just $1, making it open to all.

- Trading: VOO trades like a stock during the day. VIIIX prices once daily.

- Performance: Similar. 5-year return for VOO is 15.21% (market price), vs. VIIIX’s 15.26%.

Key edge for institutions: VIIIX avoids ETF bid-ask spreads. This matters for large trades. No premium or discount risks.

But VOO allows intraday moves. Good for tactical shifts in asset management for institutions.

In the VIIIX vs VFIAX vs VOO comparison, VIIIX wins on cost for qualified buyers. All three track well, with low turnover around 4%.

Performance History and Tracking the S&P 500

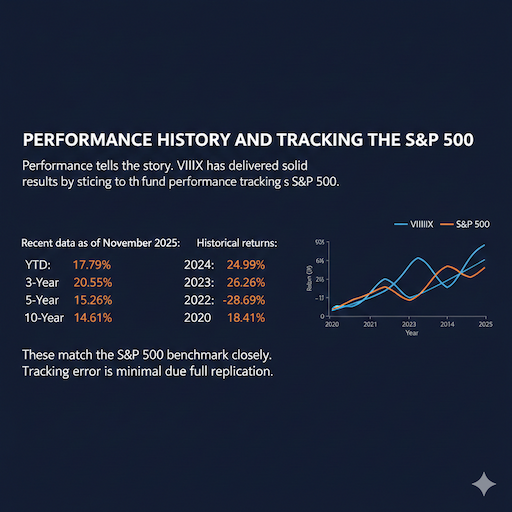

Performance tells the story. VIIIX has delivered solid results by sticking to the fund performance tracking S&P 500.

Recent data as of November 2025:

- YTD: 17.79%

- 1-Year: 14.97%

- 3-Year: 20.55%

- 5-Year: 15.26%

- 10-Year: 14.61%

These match the S&P 500 benchmark closely. Tracking error is minimal due to full replication.

Historical returns:

- 2024: 24.99%

- 2023: 26.26%

- 2022: -18.13%

- 2021: 28.69%

- 2020: 18.41%

Ups and downs follow the market. In bull years like 2021, it gained big. In 2022’s bear, it lost but recovered.

Compared to category averages, VIIIX outperforms. 5-year return beats Large Blend funds at 11.78%.

For an institutional investment fund, this reliability helps plan long-term.

Risk and Volatility Measures

Investing involves risk. VIIIX has a beta of 1.00, moving with the market.

- R-Squared: 1.00, perfect index fit.

- Risk Level: 4 out of 5 (more risk, more reward).

- Sector Focus: Heavy in tech (35%), which can swing.

But diversification across 500 stocks lowers company-specific risk.

Tips for managing:

- Pair with bonds for balance.

- Review allocations yearly.

- Use for core holdings in passive index fund strategies.

Reassuringly, low turnover (4%) cuts tax hits in taxable accounts.

Portfolio Composition and Top Holdings

Inside VIIIX, holdings mirror the S&P 500.

Top 10 holdings as of November 2025:

| Rank | Company Name | Percentage of the Fund |

| 1 | NVIDIA Corp. | 7.39% |

| 2 | Apple Inc. | 7.08% |

| 3 | Microsoft Corp. | 6.26% |

| 4 | Amazon.com Inc. | 3.87% |

| 5 | Broadcom Inc. | 3.24% |

| 6 | Alphabet Inc. Class A | About 3% |

| 7 | Alphabet Inc. Class C | About 2.5% |

| 8 | Meta Platforms Inc. | About 2.4% |

| 9 | Tesla Inc. | About 2% |

| 10 | Berkshire Hathaway Inc. Class B | About 1.6% |

These make up over 27% of the fund. Focus on growth stocks drives returns.

Asset allocation: 99.47% U.S. stocks, tiny foreign slice.

For large-cap U.S. equities, this setup captures market leaders.

Costs and Fees Breakdown

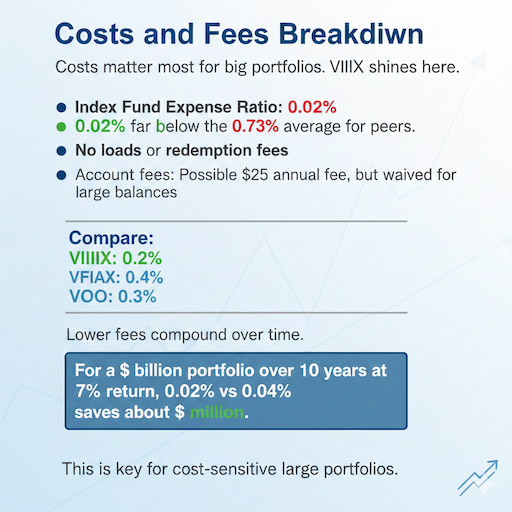

Costs matter most for big portfolios. VIIIX shines here.

- Index Fund Expense Ratio: 0.02%, far below the 0.73% average for peers.

- No loads or redemption fees.

- Account fees: Possible $25 annual fee, but waived for large balances.

Compare:

- VIIIX: 0.02%

- VFIAX: 0.04%

- VOO: 0.03%

Lower fees compound over time. For a $1 billion portfolio over 10 years at 7% return, 0.02% vs 0.04% saves about $2 million.

This is key for cost-sensitive large portfolios.

Minimum Investment and Eligibility

To access Institutional Plus Shares, you need scale.

- Initial Minimum: $100 million.

- Additional: $1.

This targets defined-benefit pension plans, 403(b) plan administrators, and hedge funds.

If under, consider Admiral or ETF versions.

How to qualify:

- Check your organization’s assets.

- Contact Vanguard for setup.

- Ensure compliance with plan rules.

Many registered investment advisors (RIAs) pool client funds to meet this. VIIIX-Vanguard Institutional Index Fund Institutional Plus Shares.

How to Invest in Vanguard VIIIX Fund

Getting started is simple for eligible groups.

Steps:

- Assess Fit: Confirm you meet the fund minimum investment requirement.

- Open Account: Use Vanguard’s institutional portal.

- Fund Transfer: Wire or transfer assets.

- Monitor: Track via NAV, currently around $559.

For how to invest in Vanguard VIIIX fund, consult a fiduciary advisor.

Tips:

- Integrate into retirement plan fund selection.

- Use for core equity allocation.

- Rebalance quarterly.

Benefits for Institutional Investors

Institutional investors gain a lot from VIIIX.

- Low-Cost S&P 500 Fund for Institutional Investors: Minimizes drag on returns.

- Passive Mutual Funds for Large Institutional Portfolios: Easy to manage.

- Vanguard S&P 500 Fund Expense Ratio Comparison: Beats most rivals.

Examples:

- A pension fund allocates 40% to U.S. equities via VIIIX for steady growth.

- An endowment uses it as a benchmark holder.

Reassuring: Vanguard’s scale ensures liquidity for big trades.

Tax Considerations and Distributions

Taxes affect net returns. VIIIX is efficient.

- Quarterly dividends: Around $1.50-$1.65 per share.

- Capital gains: Low due to passive style.

- Recent: December 2025 dividend $1.58, with gains.

For tax-exempt entities like pensions, this is ideal.

Advice:

- Track distributions for reporting.

- Consider in tax-deferred plans.

Market Outlook and Future Prospects

The S&P 500 has averaged 10% annual returns historically. With U.S. growth, VIIIX should follow.

Factors:

- Tech boom drives gains.

- Inflation and rates add volatility.

For long term, it’s a solid bet.

Case Studies: Real-World Use

Consider a large university endowment. They shifted $150 million to VIIIX in 2020. By 2025, it grew to over $250 million, thanks to 18%+ annual returns.

A corporate pension fund saved $100,000 yearly in fees vs. active funds.

These show practical wins.

Alternatives to VIIIX

If VIIIX doesn’t fit, options include:

- BlackRock’s iShares Core S&P 500 ETF (IVV): 0.03% expense.

- State Street’s SPDR S&P 500 ETF (SPY): 0.09% expense.

But Vanguard’s low fees and service stand out.

Potential Drawbacks

No fund is perfect.

- High minimum excludes small groups.

- Market risk: Falls with S&P 500.

- No active management for outperformance.

Mitigate with diversification.

Strategies for Using VIIIX in Portfolios

Build around it.

- Core: 50-70% in U.S. equities.

- Satellite: Add international or bonds.

- Rebalance: Keep weights steady.

This approach reassures steady growth. Vanguard Institutional Index Instl Pl (VIIIX) Stock Price, News, Quote & History.

Integrating with Other Vanguard Funds

Pair VIIIX with bond funds like Vanguard Total Bond Market for balance.

This creates a diversified mix.

Long-Term Wealth Building

Over decades, compounding in low-fee funds like VIIIX builds wealth. A $100 million investment at 7% net return doubles in 10 years.

Focus on patience.

Expert Tips for Maximizing Returns

- Minimize Fees: Always choose the lowest share class you qualify for.

- Diversify: Don’t put all in one fund.

- Monitor Economy: Watch Fed rates impacting stocks.

- Use Tools: Vanguard’s calculators for projections.

These steps help navigate markets.

FAQs

What are the VIIIX Mutual Fund Minimum Investment Requirements?

The VIIIX fund needs a big first investment of $100 million. After that, you can add even just $1 more anytime. This makes it perfect only for very large investors like big companies or funds.

Vanguard Institutional Index Fund Performance History?

VIIIX has done really well for many years. It copies the S&P 500 almost exactly, so it grows just like the big U.S. companies. Over the last 5 years, it has often given returns of more than 15% each year on average.

Best Low-Cost S&P 500 Fund for Institutional Investors?

VIIIX is one of the very best choices for big investors. Its fee is super low at only 0.02%, which means you keep almost all the money it earns. This low cost helps big groups save a lot over time.

Low-Cost Large-Cap Index Funds for Retirement Plans?

VIIIX is a top pick for really big retirement plans. It tracks the biggest U.S. companies with almost no extra costs. This helps workers’ retirement money grow more because fees stay tiny.

Institutional Plus Shares for Pension Fund Allocation?

Yes, the Institutional Plus Shares (VIIIX) are great for pension funds. They let big pension plans put lots of money into safe, low-cost U.S. stocks. The huge minimum fits perfectly with how much pension funds usually invest.

Passive Mutual Funds for Large Institutional Portfolios?

VIIIX is a favorite passive fund for very large investors. It just follows the S&P 500 without trying to pick winners, so it stays simple and cheap. Big portfolios love it because it gives steady growth with almost no fees.

Conclusion

In summary, the Vanguard institutional index fund institutional plus shares compare favorably to Admiral Shares and ETFs due to its ultra-low 0.02% expense ratio and tight S&P 500 tracking1. It’s a smart pick for institutional investors seeking efficient core equity allocation in large-cap U.S. equities. With a strong performance history and minimal costs, it supports pension fund investment options and endowment fund portfolio goals.

What are your thoughts on using the VIIIX mutual fund in your portfolio—does it fit your strategy2?

References

- For current quotes and historical data, visit Vanguard Institutional Index Instl Pl (VIIIX) Stock Price, News, Quote & History. ↩︎

- Check fund summary and performance at Vanguard Institutional Index Fund Institutional Plus Shares, VIIIX summary. ↩︎